- Taiwan

- /

- Electrical

- /

- TWSE:1513

3 Asian Stocks Estimated To Be Trading At Up To 18.4% Below Intrinsic Value

Reviewed by Simply Wall St

As global markets navigate through a period of uncertainty with mixed economic signals, Asian stock markets have shown resilience, particularly in the face of challenges such as fluctuating interest rates and evolving trade policies. In this context, identifying undervalued stocks becomes crucial for investors seeking opportunities amidst market fluctuations; these stocks are often characterized by strong fundamentals and potential for growth relative to their current market price.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Tibet GaoZheng Explosive (SZSE:002827) | CN¥38.57 | CN¥76.69 | 49.7% |

| Teikoku Sen-i (TSE:3302) | ¥3380.00 | ¥6752.89 | 49.9% |

| SRE Holdings (TSE:2980) | ¥3205.00 | ¥6371.11 | 49.7% |

| Sheng Siong Group (SGX:OV8) | SGD2.15 | SGD4.29 | 49.8% |

| Samyang Foods (KOSE:A003230) | ₩1509000.00 | ₩3006664.22 | 49.8% |

| Malee Group (SET:MALEE) | THB5.55 | THB11.01 | 49.6% |

| Kuraray (TSE:3405) | ¥1762.50 | ¥3479.49 | 49.3% |

| Guangdong Marubi Biotechnology (SHSE:603983) | CN¥39.80 | CN¥79.42 | 49.9% |

| Devsisters (KOSDAQ:A194480) | ₩48200.00 | ₩95869.93 | 49.7% |

| Bloomberry Resorts (PSE:BLOOM) | ₱3.87 | ₱7.66 | 49.5% |

We'll examine a selection from our screener results.

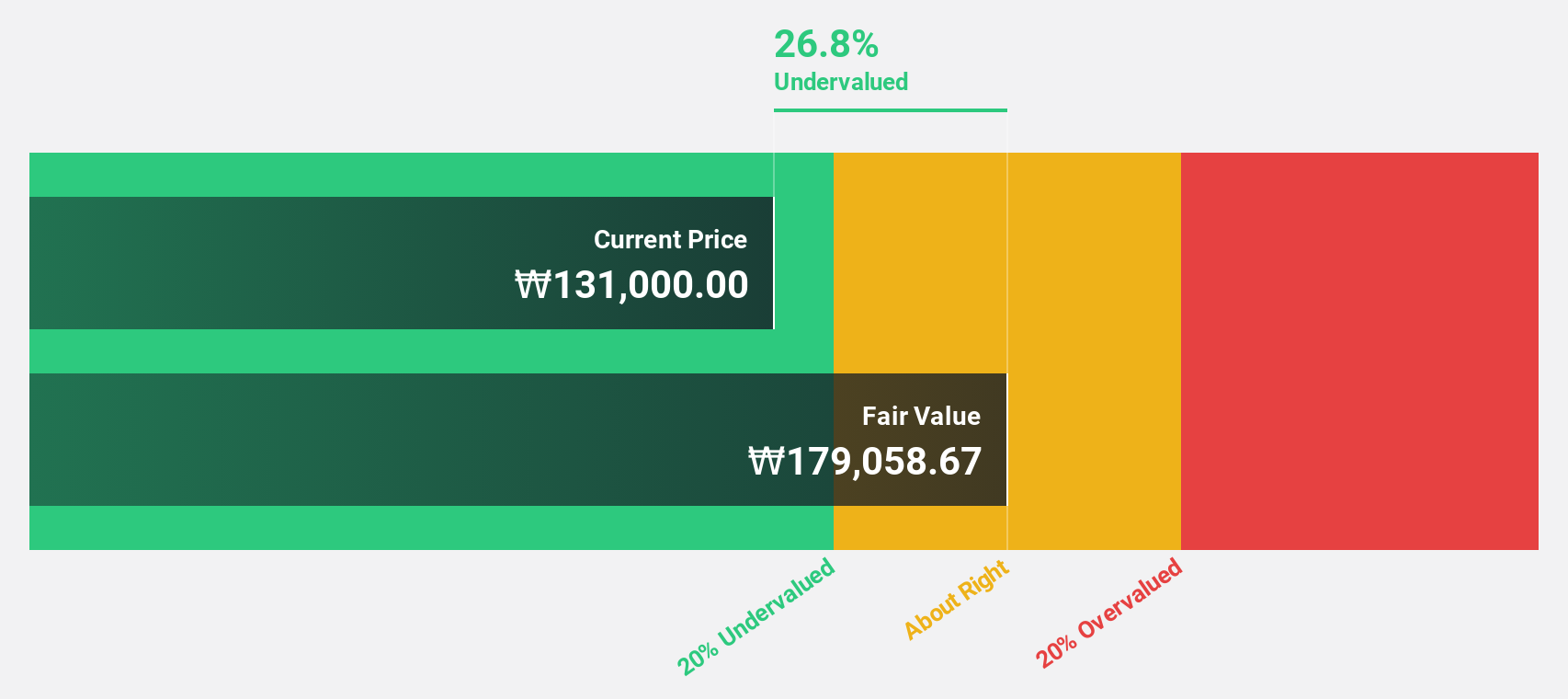

APR (KOSE:A278470)

Overview: APR Co., Ltd. manufactures and sells cosmetic products for men and women, with a market cap of ₩9.54 trillion.

Operations: The company's revenue segments include Cosmetics at ₩1.25 billion, Coordination at -₩285.69 million, and Apparel Fashion at ₩43.61 million.

Estimated Discount To Fair Value: 17.7%

APR Co., Ltd. is trading at ₩255,000, which is 17.7% below its estimated fair value of ₩309,694.35, indicating potential undervaluation based on cash flows. Despite a highly volatile share price recently, the company's earnings and revenue are forecast to grow significantly faster than the market at 34.6% and 30.5% per year respectively. However, its dividend yield of 2.82% lacks coverage by free cash flows—a point for cautious consideration.

- According our earnings growth report, there's an indication that APR might be ready to expand.

- Click here and access our complete balance sheet health report to understand the dynamics of APR.

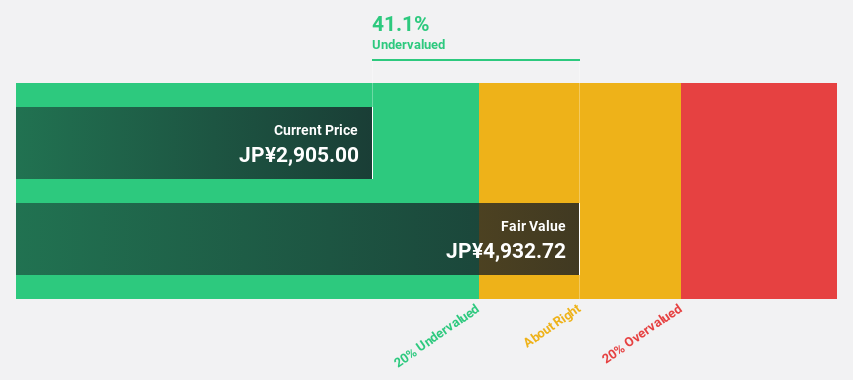

DMG Mori (TSE:6141)

Overview: DMG Mori Co., Ltd. is a global manufacturer and seller of machine tools, with a market cap of ¥431.69 billion.

Operations: The company's revenue is primarily derived from Machine Tools, which account for ¥596.67 billion, and Industrial Service, contributing ¥220.62 billion.

Estimated Discount To Fair Value: 18.4%

DMG Mori is trading at ¥3,045, below its estimated fair value of ¥3,730.82, highlighting potential undervaluation based on cash flows. Despite a recent dip in profit margins from 5.7% to 1.9%, earnings are forecast to grow significantly at 40.74% annually over the next three years—outpacing the JP market's growth rate of 8.1%. However, its dividend yield of 3.61% is not well covered by earnings or free cash flows, warranting caution.

- Insights from our recent growth report point to a promising forecast for DMG Mori's business outlook.

- Delve into the full analysis health report here for a deeper understanding of DMG Mori.

Chung-Hsin Electric and Machinery Manufacturing (TWSE:1513)

Overview: Chung-Hsin Electric and Machinery Manufacturing Corp. operates in the electrical and machinery manufacturing industry, with a market cap of NT$78.56 billion.

Operations: The company's revenue is primarily derived from the Motor Energy Business at NT$19.71 billion, followed by the Service Business at NT$5.32 billion and Engineering and Other at NT$3.44 billion.

Estimated Discount To Fair Value: 10.4%

Chung-Hsin Electric and Machinery Manufacturing is trading at NT$159, below its estimated fair value of NT$177.53, indicating potential undervaluation based on cash flows. Recent earnings showed a modest increase in net income to TWD 941.39 million for Q2 2025 from TWD 897.07 million the previous year. With forecasted annual earnings growth of 24.21%, outpacing the TW market's growth rate, it offers good relative value compared to peers and industry standards.

- Upon reviewing our latest growth report, Chung-Hsin Electric and Machinery Manufacturing's projected financial performance appears quite optimistic.

- Click to explore a detailed breakdown of our findings in Chung-Hsin Electric and Machinery Manufacturing's balance sheet health report.

Next Steps

- Navigate through the entire inventory of 282 Undervalued Asian Stocks Based On Cash Flows here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:1513

Chung-Hsin Electric and Machinery Manufacturing

Chung-Hsin Electric and Machinery Manufacturing Corp.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives