- Taiwan

- /

- Electrical

- /

- TWSE:1513

3 Asian Dividend Stocks Yielding Up To 8.7%

Reviewed by Simply Wall St

As global markets navigate a landscape marked by easing trade tensions and mixed economic signals, investors are increasingly turning their attention to the potential of dividend stocks in Asia. In this context, identifying stocks with robust dividend yields can offer a measure of stability and income generation amidst economic fluctuations.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 4.92% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.43% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.85% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.55% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 4.19% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.17% | ★★★★★★ |

| E J Holdings (TSE:2153) | 4.97% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.49% | ★★★★★★ |

| Soliton Systems K.K (TSE:3040) | 4.12% | ★★★★★★ |

| Japan Excellent (TSE:8987) | 4.39% | ★★★★★★ |

Click here to see the full list of 1226 stocks from our Top Asian Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

Datang Environment Industry Group (SEHK:1272)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Datang Environment Industry Group Co., Ltd. (SEHK:1272) operates in the environmental protection sector, focusing on services like flue gas desulfurization and denitrification, with a market cap of approximately HK$3.68 billion.

Operations: Datang Environment Industry Group Co., Ltd. generates revenue from Renewable Energy Engineering (CN¥252.26 million) and Environmental Protection and Energy Conservation Solutions (CN¥5.50 billion).

Dividend Yield: 8.8%

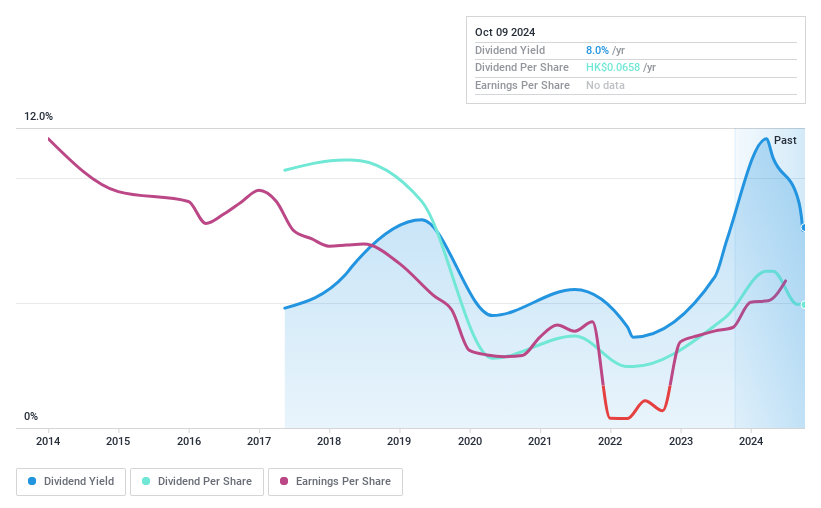

Datang Environment Industry Group's dividend payments, though well-covered by earnings (43.8% payout ratio) and cash flows (22.1% cash payout ratio), have been volatile over the past 8 years, with a recent proposed final dividend of RMB 0.051 per share for 2024. Despite an unstable track record, its current yield is attractive within Hong Kong’s top quartile at 8.77%. The company reported modest earnings growth of CNY 549.06 million for 2024, up from CNY 522.38 million in the previous year.

- Take a closer look at Datang Environment Industry Group's potential here in our dividend report.

- The valuation report we've compiled suggests that Datang Environment Industry Group's current price could be quite moderate.

Man Wah Holdings (SEHK:1999)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Man Wah Holdings Limited is an investment holding company involved in the manufacture, wholesale, trading, and distribution of sofas and ancillary products across China, Europe, Vietnam, Mexico, and internationally with a market cap of HK$16.83 billion.

Operations: Man Wah Holdings Limited generates revenue primarily from its Sofa and Ancillary Products segment, which accounts for HK$12.30 billion, followed by Bedding and Ancillary Products at HK$2.71 billion, and the Home Group Business contributing HK$747.24 million.

Dividend Yield: 6.9%

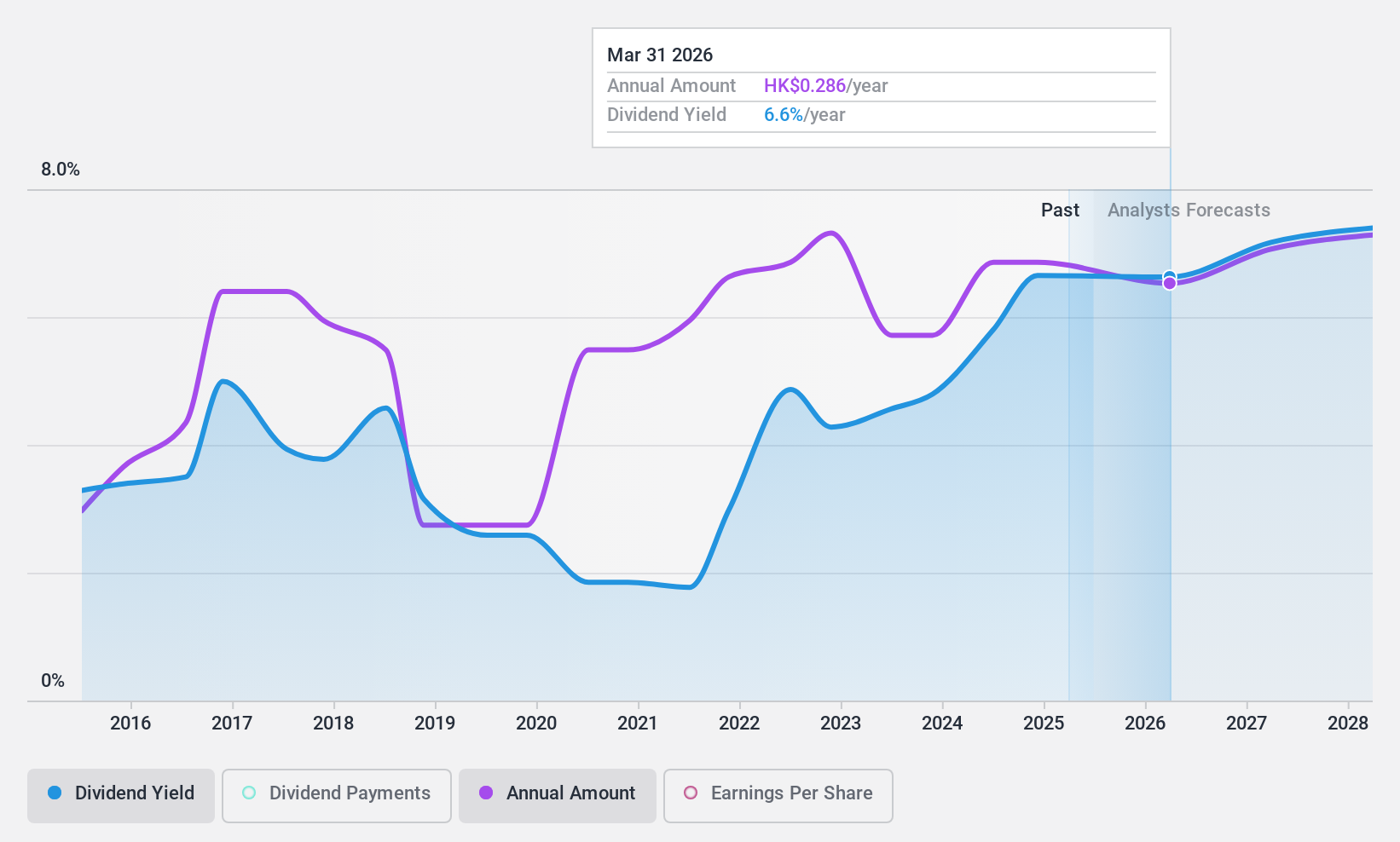

Man Wah Holdings offers a mixed dividend profile, with dividends covered by both earnings (50.5% payout ratio) and cash flows (61.9% cash payout ratio). However, its dividend yield of 6.91% is below the top 25% in Hong Kong. Despite recent earnings growth of 17.7%, the company has an unstable dividend history with past volatility and unreliability in payments, though dividends have increased over the last decade while trading significantly below estimated fair value.

- Click here to discover the nuances of Man Wah Holdings with our detailed analytical dividend report.

- Our valuation report unveils the possibility Man Wah Holdings' shares may be trading at a discount.

Chung-Hsin Electric and Machinery Manufacturing (TWSE:1513)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Chung-Hsin Electric and Machinery Manufacturing Corp. operates in the electrical and machinery manufacturing sector, with a market cap of NT$66.95 billion.

Operations: Chung-Hsin Electric and Machinery Manufacturing Corp.'s revenue is primarily derived from its Motor Energy Business at NT$19.29 billion, followed by its Service Business at NT$5.11 billion, and Engineering and Other segments at NT$3.04 billion.

Dividend Yield: 3.4%

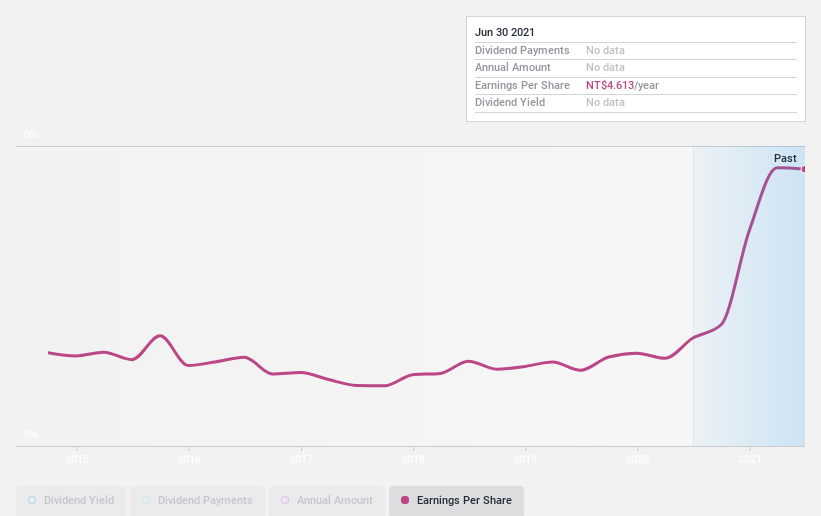

Chung-Hsin Electric and Machinery Manufacturing provides a stable dividend profile, with dividends covered by earnings (62.7% payout ratio) and cash flows (69.9% cash payout ratio). The recent increase to TWD 4.60 per share highlights its commitment to returning value to shareholders, despite a yield of 3.39% being below Taiwan's top quartile payers. Earnings surged significantly last year, enhancing dividend sustainability, though the company carries substantial debt and trades below estimated fair value.

- Click to explore a detailed breakdown of our findings in Chung-Hsin Electric and Machinery Manufacturing's dividend report.

- Our comprehensive valuation report raises the possibility that Chung-Hsin Electric and Machinery Manufacturing is priced lower than what may be justified by its financials.

Taking Advantage

- Investigate our full lineup of 1226 Top Asian Dividend Stocks right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Chung-Hsin Electric and Machinery Manufacturing, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:1513

Chung-Hsin Electric and Machinery Manufacturing

Chung-Hsin Electric and Machinery Manufacturing Corp.

Very undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives