In a week marked by cautious Federal Reserve commentary and looming government shutdown fears, global markets have experienced volatility, with U.S. stocks declining despite some recovery efforts. Amidst this backdrop of economic uncertainty and fluctuating interest rate expectations, dividend stocks can offer investors a measure of stability through consistent income streams.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.23% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.28% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.78% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.11% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.28% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.53% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.34% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 3.90% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.28% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.22% | ★★★★★★ |

Click here to see the full list of 1957 stocks from our Top Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

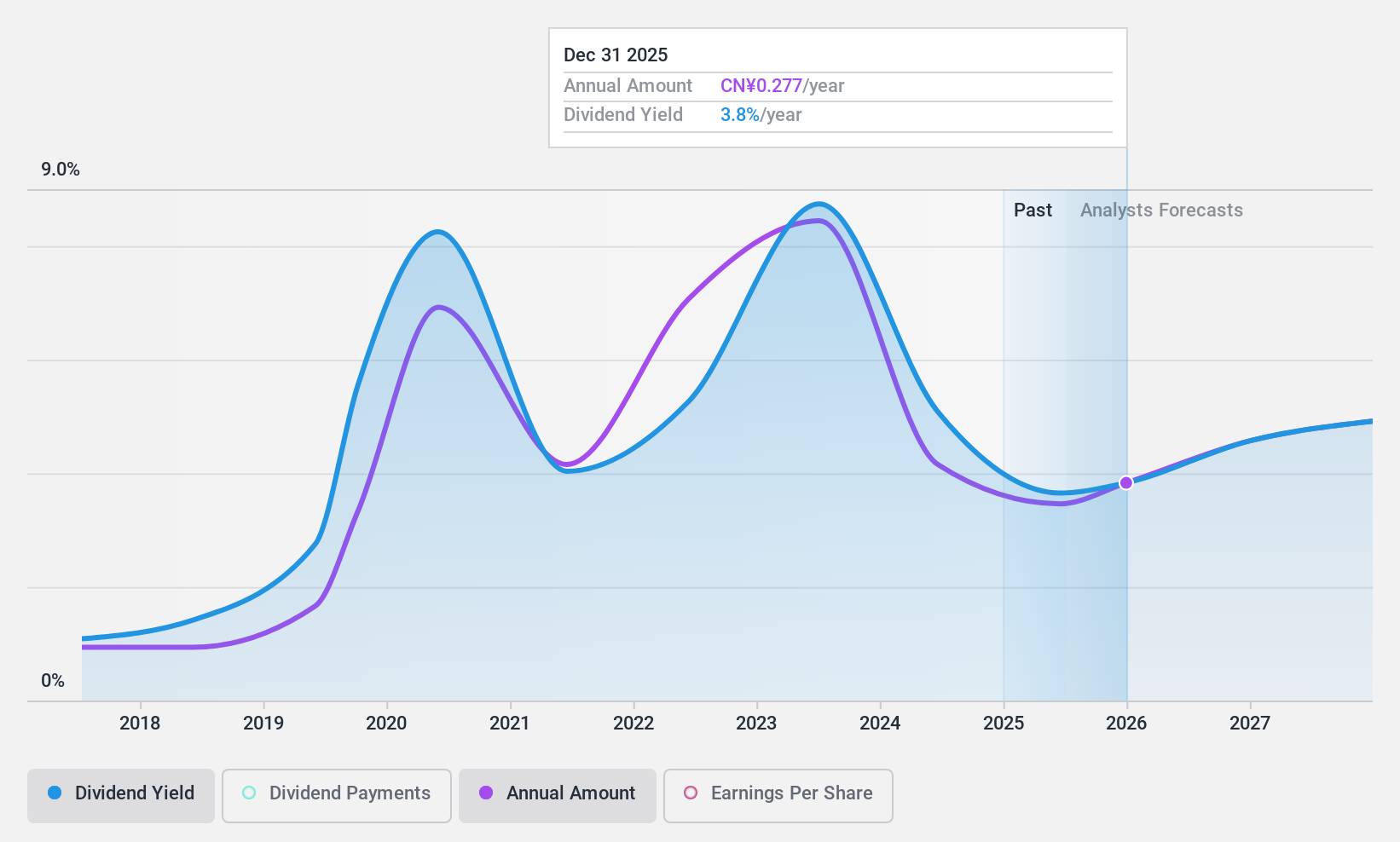

Xiamen Xiangyu (SHSE:600057)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Xiamen Xiangyu Co., Ltd. offers supply chain services in the People's Republic of China and has a market cap of CN¥14.28 billion.

Operations: Xiamen Xiangyu Co., Ltd. generates its revenue primarily through its supply chain services in the People's Republic of China.

Dividend Yield: 4.8%

Xiamen Xiangyu's dividend payments are well covered by cash flows, with a low cash payout ratio of 23.8%, and earnings, with a payout ratio of 70.1%. However, the company's dividend history is less than ten years old and marked by volatility, including annual drops over 20%. Despite this instability, the dividend yield is in the top 25% within the Chinese market. Recent financial results showed declining revenue and net income compared to last year.

- Click here and access our complete dividend analysis report to understand the dynamics of Xiamen Xiangyu.

- Our valuation report unveils the possibility Xiamen Xiangyu's shares may be trading at a discount.

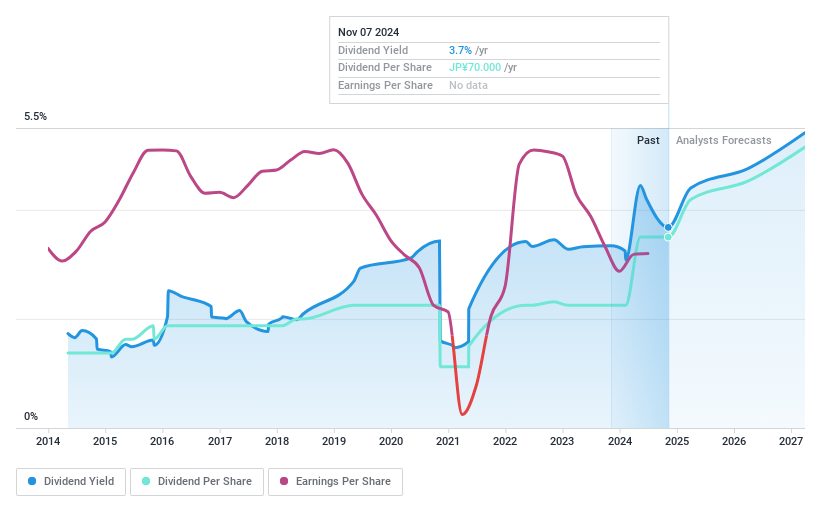

Nippon Shokubai (TSE:4114)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Nippon Shokubai Co., Ltd. manufactures and sells various chemical products both in Japan and internationally, with a market cap of ¥285.73 billion.

Operations: Nippon Shokubai Co., Ltd.'s revenue primarily comes from its Materials segment, generating ¥307.46 billion, and its Solutions segment, contributing ¥116.56 billion.

Dividend Yield: 5.7%

Nippon Shokubai's dividend payments have been stable and reliable over the past decade, with a yield in the top 25% of JP market payers. However, its high payout ratio of 90.4% suggests dividends are not well covered by earnings, though cash flows offer better coverage at 67.4%. The company has engaged in significant share buybacks this year but also diluted shareholders recently. Dividend forecasts were revised during a November board meeting.

- Dive into the specifics of Nippon Shokubai here with our thorough dividend report.

- Our expertly prepared valuation report Nippon Shokubai implies its share price may be too high.

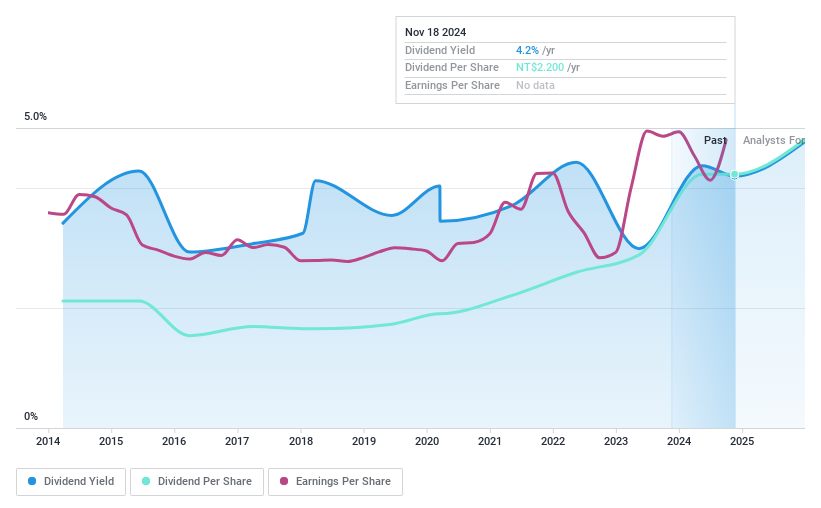

TECO Electric & Machinery (TWSE:1504)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: TECO Electric & Machinery Co., Ltd. is involved in the manufacturing, installation, wholesale, and retail of electronic and telecommunications equipment, office equipment, and home appliances across Taiwan, the United States, China, and globally with a market cap of NT$111.37 billion.

Operations: TECO Electric & Machinery Co., Ltd. generates revenue primarily from its Electromechanical Systems segment at NT$47.24 billion, followed by Intelligent Life at NT$16.26 billion and Smart Energy at NT$11.53 billion.

Dividend Yield: 4.2%

TECO Electric & Machinery's dividend payments are covered by earnings and cash flows, with payout ratios of 81.9% and 82.4%, respectively, though they have been volatile over the past decade. The company's dividend yield of 4.17% is below the top quartile in Taiwan's market. Recent executive changes include a new Vice Chairman and CFO, potentially impacting future financial strategies. Despite challenges in sales, net income has increased significantly year-over-year for Q3 2024.

- Navigate through the intricacies of TECO Electric & Machinery with our comprehensive dividend report here.

- Upon reviewing our latest valuation report, TECO Electric & Machinery's share price might be too pessimistic.

Seize The Opportunity

- Unlock more gems! Our Top Dividend Stocks screener has unearthed 1954 more companies for you to explore.Click here to unveil our expertly curated list of 1957 Top Dividend Stocks.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nippon Shokubai might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4114

Nippon Shokubai

Engages in the manufacture and sale of various chemical products in Japan and internationally.

Flawless balance sheet 6 star dividend payer.

Similar Companies

Market Insights

Community Narratives