- Taiwan

- /

- Electrical

- /

- TWSE:1503

Maire Leads These 3 Estimated Undervalued Stocks Offering Potential Value

Reviewed by Simply Wall St

As global markets continue to reach record highs, driven by positive sentiment from domestic policy shifts and geopolitical developments, investors are increasingly on the lookout for potential value in an environment marked by robust trading activity. Identifying undervalued stocks amidst these conditions requires a keen eye for those companies that may offer intrinsic value not yet recognized by the broader market, such as Maire and two other promising contenders.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Shandong Bailong Chuangyuan Bio-Tech (SHSE:605016) | CN¥16.64 | CN¥33.16 | 49.8% |

| Pan African Resources (AIM:PAF) | £0.3735 | £0.75 | 49.9% |

| Sudarshan Chemical Industries (BSE:506655) | ₹1116.10 | ₹2222.42 | 49.8% |

| Iguatemi (BOVESPA:IGTI3) | R$2.25 | R$4.49 | 49.8% |

| Elekta (OM:EKTA B) | SEK61.50 | SEK122.95 | 50% |

| Adtraction Group (OM:ADTR) | SEK38.40 | SEK76.45 | 49.8% |

| Pluk Phak Praw Rak Mae (SET:OKJ) | THB15.50 | THB30.86 | 49.8% |

| Privia Health Group (NasdaqGS:PRVA) | US$21.66 | US$43.17 | 49.8% |

| Sands China (SEHK:1928) | HK$20.40 | HK$40.58 | 49.7% |

| Energy One (ASX:EOL) | A$5.40 | A$10.52 | 48.7% |

Underneath we present a selection of stocks filtered out by our screen.

Maire (BIT:MAIRE)

Overview: Maire S.p.A. develops and implements solutions for the energy transition, with a market cap of €2.37 billion.

Operations: The company's revenue is primarily derived from Integrated E&C Solutions, generating €4.98 billion, and Sustainable Technology Solutions, contributing €321.47 million.

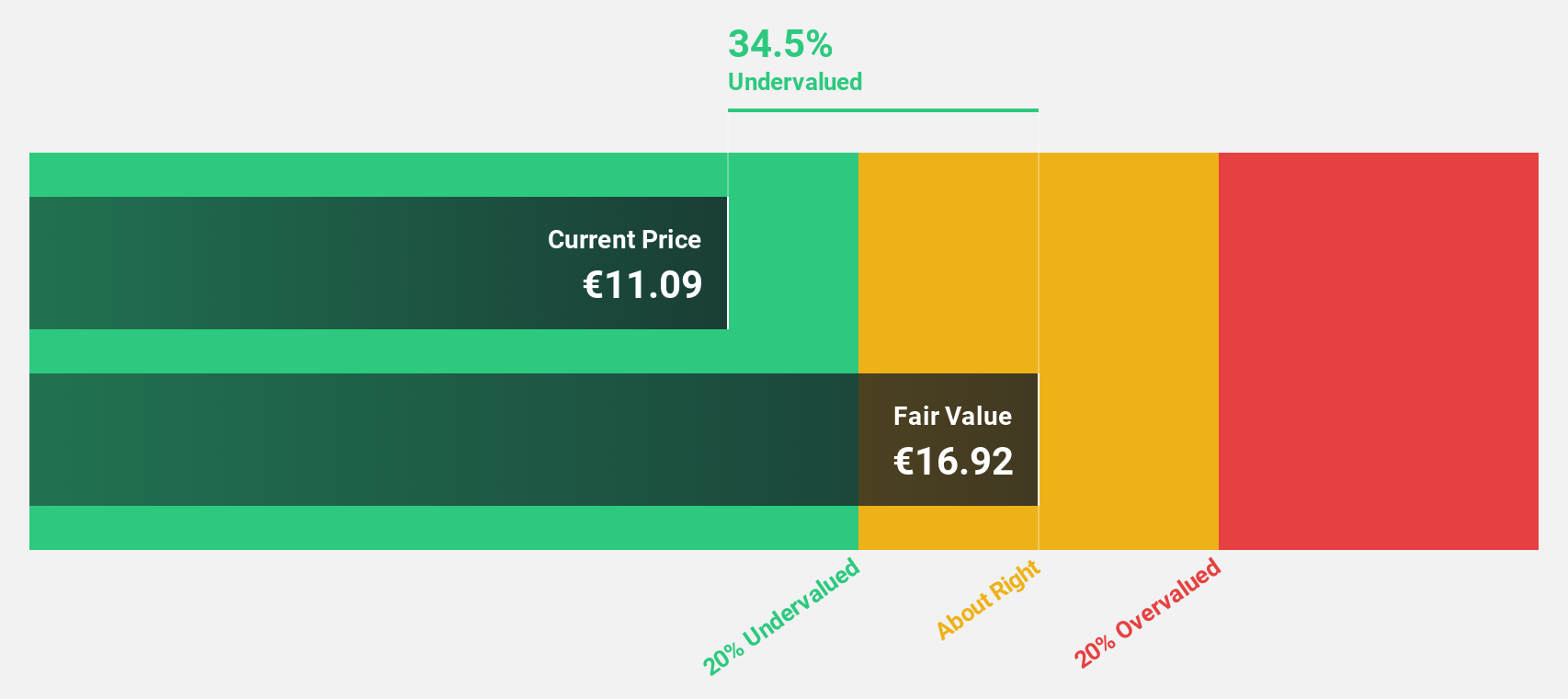

Estimated Discount To Fair Value: 45%

Maire S.p.A. is trading at €7.26, significantly below its estimated fair value of €13.21, indicating it may be undervalued based on cash flows. The company reported strong earnings growth of 62.7% over the past year and forecasts suggest continued revenue growth at 10.9% annually, outpacing the Italian market average of 4%. Despite an unstable dividend track record, Maire's high return on equity forecast and good relative value compared to peers enhance its investment appeal.

- Insights from our recent growth report point to a promising forecast for Maire's business outlook.

- Delve into the full analysis health report here for a deeper understanding of Maire.

Shihlin Electric & Engineering (TWSE:1503)

Overview: Shihlin Electric & Engineering Corp. manufactures and sells heavy electrical equipment, electrical machinery, electrical automotive equipment, and related parts in Taiwan, Mainland China, Vietnam, and internationally, with a market cap of NT$107.06 billion.

Operations: The company's revenue segments include NT$5.96 billion from vehicle parts, NT$23.12 billion from power distribution, and NT$3.44 billion from automation equipment and spare parts.

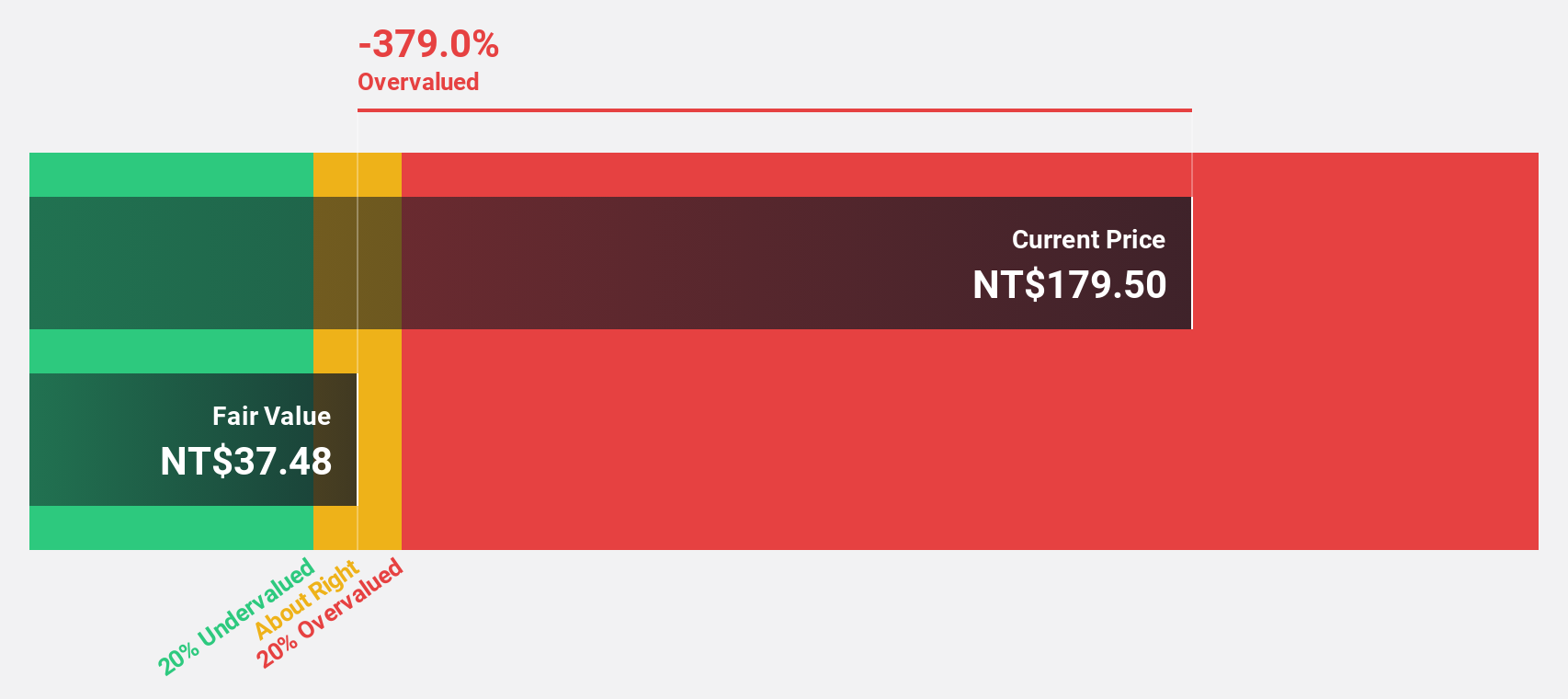

Estimated Discount To Fair Value: 41.5%

Shihlin Electric & Engineering is trading at NT$205.5, well below its estimated fair value of NT$351.5, highlighting potential undervaluation based on cash flows. The company's earnings grew by 23.9% last year and are expected to grow significantly over the next three years, outpacing the Taiwanese market average. Recent third-quarter results show improved revenue and net income compared to the previous year, reinforcing its strong financial performance despite recent executive changes.

- The analysis detailed in our Shihlin Electric & Engineering growth report hints at robust future financial performance.

- Navigate through the intricacies of Shihlin Electric & Engineering with our comprehensive financial health report here.

DO & CO (WBAG:DOC)

Overview: DO & CO Aktiengesellschaft offers catering services across Austria, Turkey, Great Britain, the United States, Spain, Germany, and internationally with a market cap of €1.81 billion.

Operations: The company's revenue segments consist of Airline Catering at TRY 60.89 billion, International Event Catering at TRY 12.10 billion, and Restaurants, Lounges & Hotels at TRY 5.98 billion.

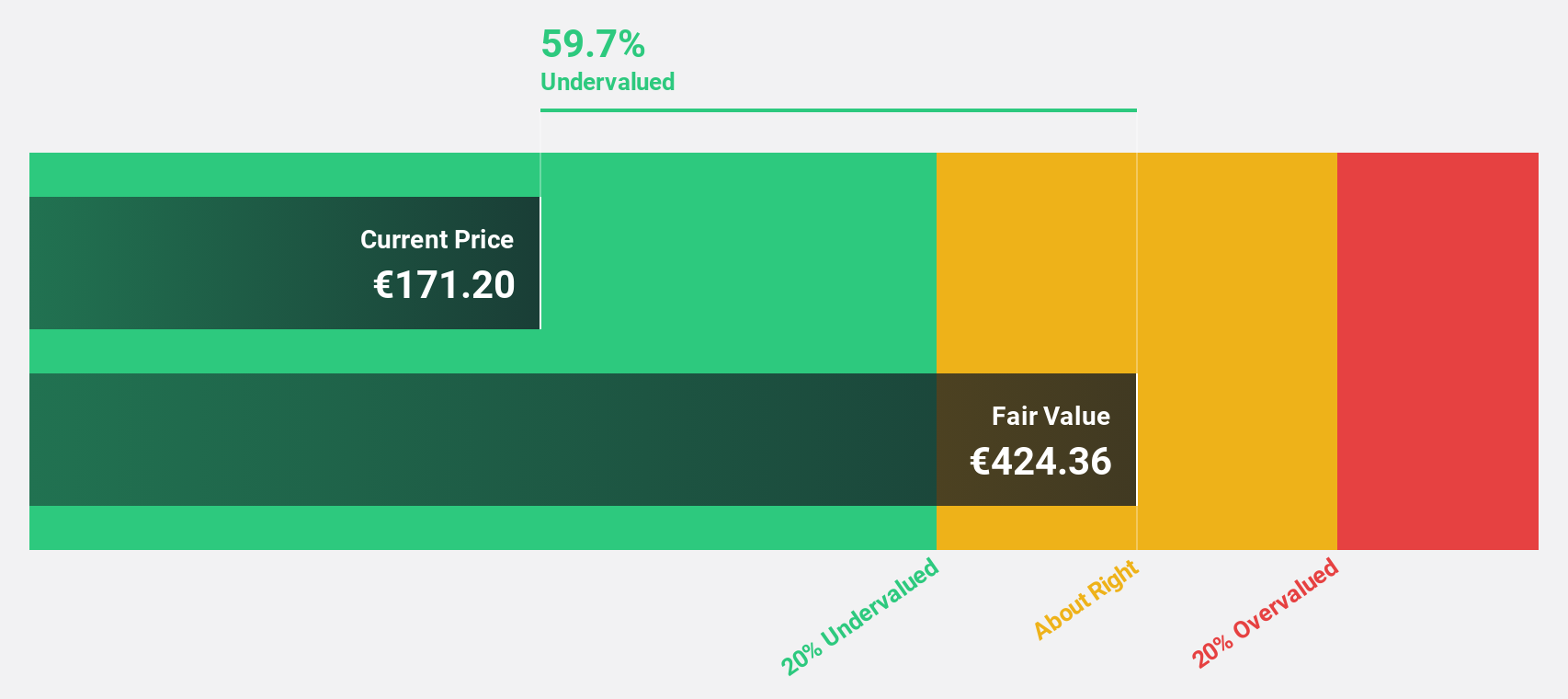

Estimated Discount To Fair Value: 47.7%

DO & CO, trading at €165, is significantly undervalued with a fair value estimate of €315.56. The company's earnings grew by 48.7% last year and are projected to increase at 17.3% annually, surpassing the Austrian market's growth rate. Despite recent shareholder dilution and share price volatility, DO & CO reported strong second-quarter results with sales rising to TRY 22,113 million from TRY 18,281.67 million and net income increasing to TRY 977.27 million from TRY 764.08 million year-on-year.

- Our expertly prepared growth report on DO & CO implies its future financial outlook may be stronger than recent results.

- Click to explore a detailed breakdown of our findings in DO & CO's balance sheet health report.

Turning Ideas Into Actions

- Click through to start exploring the rest of the 888 Undervalued Stocks Based On Cash Flows now.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:1503

Shihlin Electric & Engineering

Manufactures and sells of heavy electrical equipment, electrical machinery, electrical automotive equipment, and related parts in Taiwan, Mainland China, Vietnam, and internationally.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives