- China

- /

- Real Estate

- /

- SZSE:000534

February 2025's Stocks Estimated To Be Trading Below Their Fair Value

Reviewed by Simply Wall St

As global markets navigate a landscape marked by tariff uncertainties and mixed economic signals, investors are keeping a close eye on potential opportunities amid fluctuating indices. With U.S. job growth falling short of expectations and manufacturing activity showing signs of recovery, the search for stocks trading below their fair value becomes particularly relevant in this environment. Identifying undervalued stocks can be crucial for investors looking to capitalize on discrepancies between current market prices and intrinsic values, especially when broader market conditions present both challenges and opportunities.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| National World (LSE:NWOR) | £0.225 | £0.45 | 49.9% |

| Geo Holdings (TSE:2681) | ¥1773.00 | ¥3508.29 | 49.5% |

| TCI (TPEX:8436) | NT$119.00 | NT$237.17 | 49.8% |

| Decisive Dividend (TSXV:DE) | CA$6.05 | CA$12.03 | 49.7% |

| APAC Realty (SGX:CLN) | SGD0.455 | SGD0.91 | 49.7% |

| Fine Foods & Pharmaceuticals N.T.M (BIT:FF) | €6.66 | €13.31 | 50% |

| Coastal Financial (NasdaqGS:CCB) | US$86.45 | US$172.68 | 49.9% |

| Prodways Group (ENXTPA:PWG) | €0.584 | €1.16 | 49.4% |

| Pantoro (ASX:PNR) | A$0.135 | A$0.27 | 49.5% |

| Believe (ENXTPA:BLV) | €14.48 | €28.83 | 49.8% |

Let's take a closer look at a couple of our picks from the screened companies.

Wedge IndustrialLtd (SZSE:000534)

Overview: Wedge Industrial Co., Ltd., along with its subsidiaries, focuses on the research and development, production, and sale of micro-ecological live bacteria products and superalloys in China, with a market cap of CN¥7.12 billion.

Operations: The company generates revenue through the development, production, and sale of micro-ecological live bacteria products and superalloys within China.

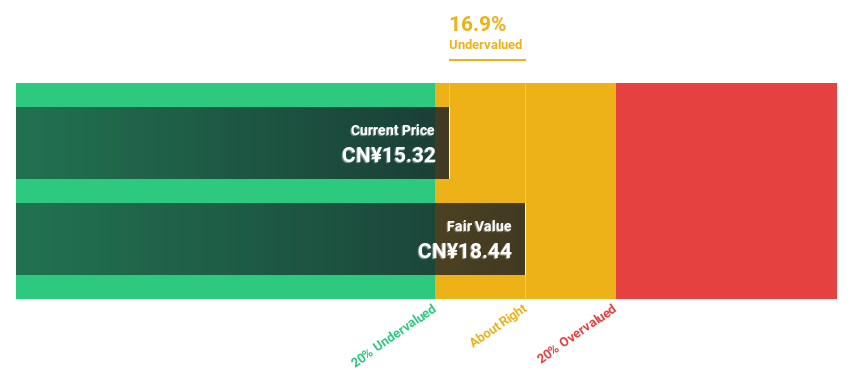

Estimated Discount To Fair Value: 16.9%

Wedge Industrial Ltd. is trading at CN¥15.32, below its estimated fair value of CN¥18.43, suggesting it may be undervalued based on cash flows. The company's earnings grew by 50% over the past year and are forecast to grow significantly at 35.48% annually, outpacing the market average of 25.5%. However, its dividend yield of 0.78% is not well covered by free cash flows, and debt coverage by operating cash flow remains a concern.

- The growth report we've compiled suggests that Wedge IndustrialLtd's future prospects could be on the up.

- Delve into the full analysis health report here for a deeper understanding of Wedge IndustrialLtd.

SEIKOH GIKEN (TSE:6834)

Overview: SEIKOH GIKEN Co., Ltd. designs, manufactures, and sells optical components, lenses, and radio over fiber products in Japan and internationally, with a market cap of ¥46.05 billion.

Operations: The company's revenue segments include Optical Products Related at ¥8.23 billion and Precision Machine Related at ¥8.78 billion.

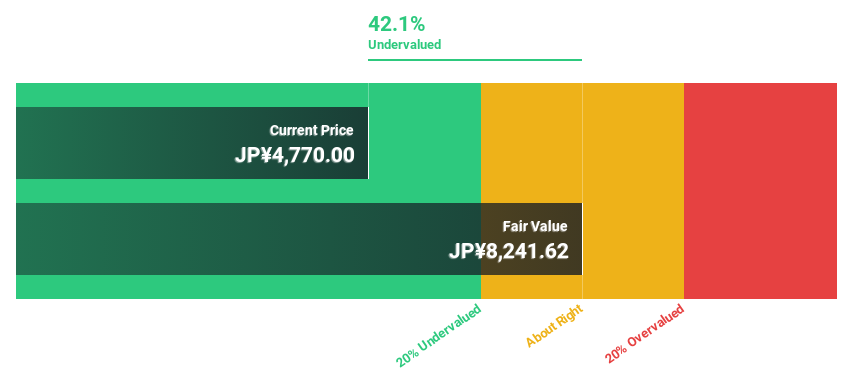

Estimated Discount To Fair Value: 38.3%

SEIKOH GIKEN is trading at ¥5,170, significantly below its estimated fair value of ¥8,381.7, highlighting potential undervaluation based on cash flows. The company's earnings grew by 67.8% last year and are expected to grow at 25.1% annually, surpassing the Japanese market average of 7.7%. Despite recent share price volatility and a completed buyback program worth ¥1,315 million for capital efficiency enhancement, SEIKOH GIKEN remains attractively valued.

- In light of our recent growth report, it seems possible that SEIKOH GIKEN's financial performance will exceed current levels.

- Unlock comprehensive insights into our analysis of SEIKOH GIKEN stock in this financial health report.

Shihlin Electric & Engineering (TWSE:1503)

Overview: Shihlin Electric & Engineering Corp. is a company that manufactures and sells heavy electrical equipment, electrical machinery, and automotive equipment in Taiwan, Mainland China, Vietnam, and internationally, with a market cap of NT$89.35 billion.

Operations: The company's revenue segments consist of NT$23.12 billion from Power Distribution, NT$5.96 billion from Vehicle Parts, and NT$3.44 billion from Automation Equipment and Spare Parts Department.

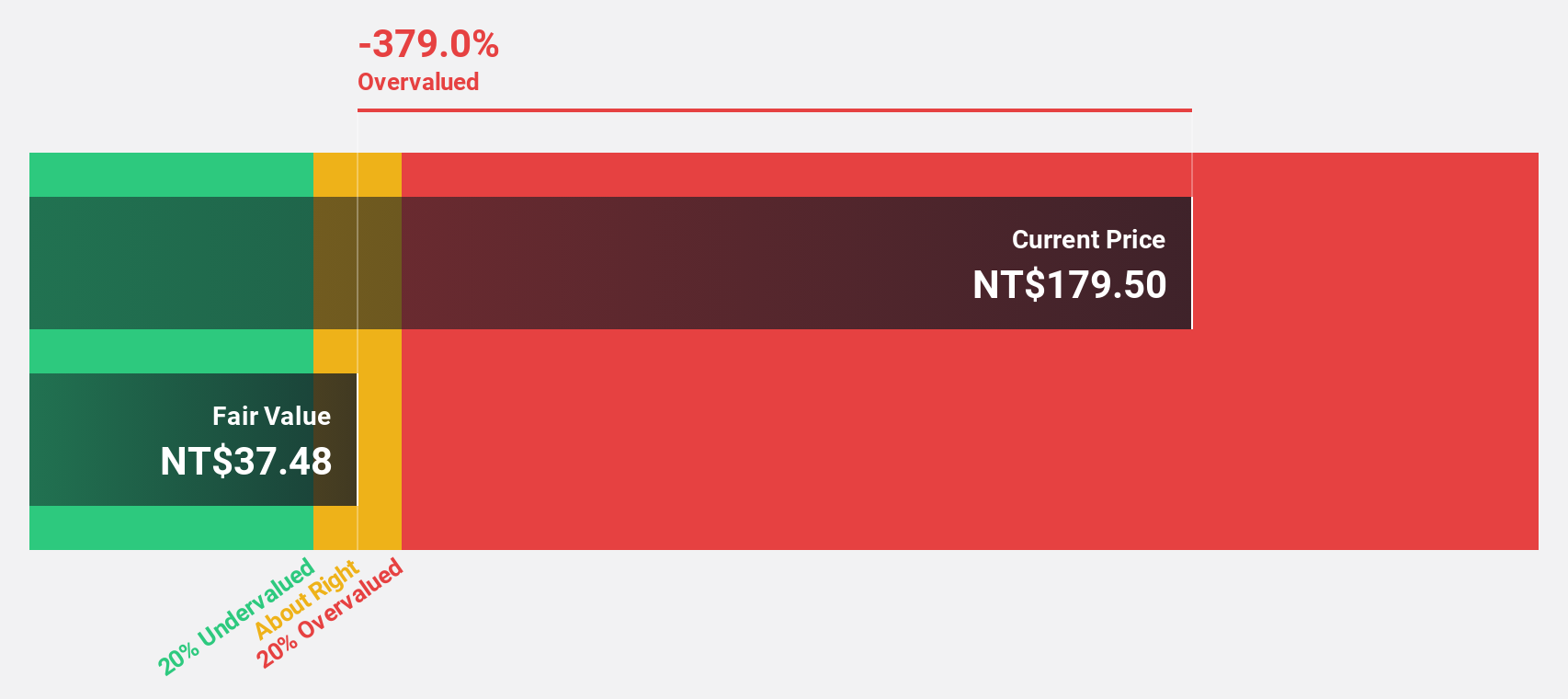

Estimated Discount To Fair Value: 48.2%

Shihlin Electric & Engineering is trading at NT$178.5, considerably below its estimated fair value of NT$344.33, suggesting undervaluation based on cash flows. The company reported third-quarter revenue of TWD 8.06 billion, up from TWD 7.7 billion last year, with net income rising to TWD 702.4 million from TWD 669.38 million a year ago. Earnings are projected to grow significantly at 34.9% annually, outpacing the Taiwan market's average growth rate.

- According our earnings growth report, there's an indication that Shihlin Electric & Engineering might be ready to expand.

- Dive into the specifics of Shihlin Electric & Engineering here with our thorough financial health report.

Seize The Opportunity

- Unlock our comprehensive list of 900 Undervalued Stocks Based On Cash Flows by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wedge IndustrialLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:000534

Wedge IndustrialLtd

Engages in the research and development, production, and sale of micro-ecological live bacteria products, superalloys, and related products in China.

Exceptional growth potential with proven track record.

Market Insights

Community Narratives