- Taiwan

- /

- Construction

- /

- TWSE:1472

Why Investors Shouldn't Be Surprised By Triocean Industrial Corporation Co., Ltd.'s (TWSE:1472) 28% Share Price Surge

The Triocean Industrial Corporation Co., Ltd. (TWSE:1472) share price has done very well over the last month, posting an excellent gain of 28%. The annual gain comes to 154% following the latest surge, making investors sit up and take notice.

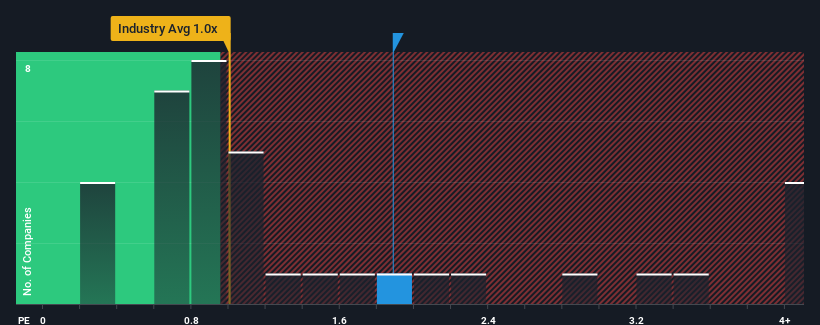

Since its price has surged higher, you could be forgiven for thinking Triocean Industrial Corporation is a stock not worth researching with a price-to-sales ratios (or "P/S") of 1.9x, considering almost half the companies in Taiwan's Construction industry have P/S ratios below 1x. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Triocean Industrial Corporation

What Does Triocean Industrial Corporation's Recent Performance Look Like?

Triocean Industrial Corporation certainly has been doing a great job lately as it's been growing its revenue at a really rapid pace. It seems that many are expecting the strong revenue performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Triocean Industrial Corporation will help you shine a light on its historical performance.Is There Enough Revenue Growth Forecasted For Triocean Industrial Corporation?

There's an inherent assumption that a company should outperform the industry for P/S ratios like Triocean Industrial Corporation's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 102% gain to the company's top line. This great performance means it was also able to deliver immense revenue growth over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

When compared to the industry's one-year growth forecast of 17%, the most recent medium-term revenue trajectory is noticeably more alluring

With this information, we can see why Triocean Industrial Corporation is trading at such a high P/S compared to the industry. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the wider industry.

What We Can Learn From Triocean Industrial Corporation's P/S?

Triocean Industrial Corporation shares have taken a big step in a northerly direction, but its P/S is elevated as a result. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

It's no surprise that Triocean Industrial Corporation can support its high P/S given the strong revenue growth its experienced over the last three-year is superior to the current industry outlook. Right now shareholders are comfortable with the P/S as they are quite confident revenue aren't under threat. If recent medium-term revenue trends continue, it's hard to see the share price falling strongly in the near future under these circumstances.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Triocean Industrial Corporation (1 is a bit unpleasant!) that you need to be mindful of.

If these risks are making you reconsider your opinion on Triocean Industrial Corporation, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Triocean Industrial Corporation might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:1472

Triocean Industrial Corporation

Engages in the construction business in Taiwan.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives