What Percentage Of Zhong Yang Technology Co., Ltd. (TPE:6668) Shares Do Insiders Own?

A look at the shareholders of Zhong Yang Technology Co., Ltd. (TPE:6668) can tell us which group is most powerful. Institutions often own shares in more established companies, while it's not unusual to see insiders own a fair bit of smaller companies. I quite like to see at least a little bit of insider ownership. As Charlie Munger said 'Show me the incentive and I will show you the outcome.

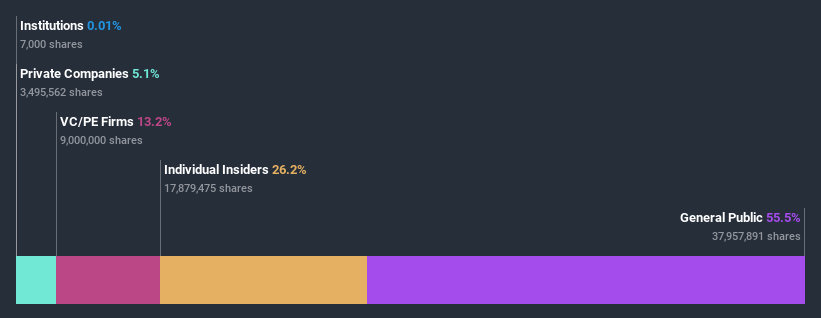

With a market capitalization of NT$4.1b, Zhong Yang Technology is a small cap stock, so it might not be well known by many institutional investors. Our analysis of the ownership of the company, below, shows that institutions don't own shares in the company. Let's take a closer look to see what the different types of shareholders can tell us about Zhong Yang Technology.

Check out our latest analysis for Zhong Yang Technology

What Does The Lack Of Institutional Ownership Tell Us About Zhong Yang Technology?

Institutional investors often avoid companies that are too small, too illiquid or too risky for their tastes. But it's unusual to see larger companies without any institutional investors.

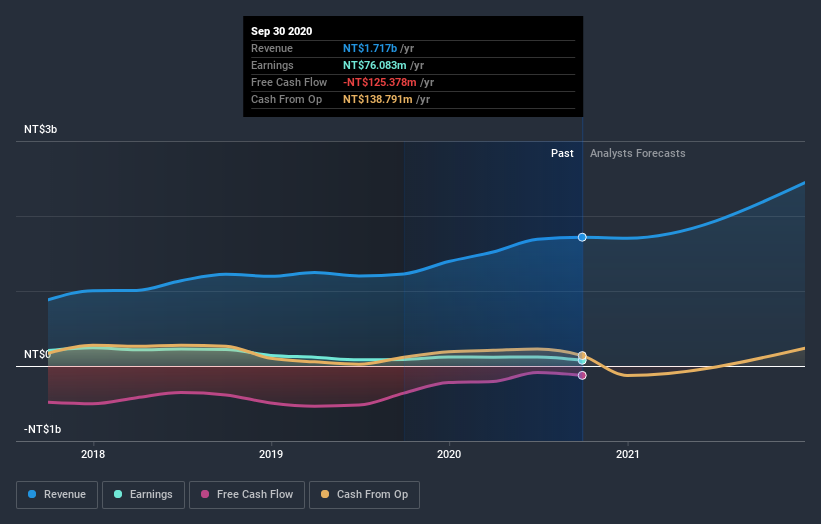

There are multiple explanations for why institutions don't own a stock. The most common is that the company is too small relative to funds under management, so the institution does not bother to look closely at the company. On the other hand, it's always possible that professional investors are avoiding a company because they don't think it's the best place for their money. Institutional investors may not find the historic growth of the business impressive, or there might be other factors at play. You can see the past revenue performance of Zhong Yang Technology, for yourself, below.

Zhong Yang Technology is not owned by hedge funds. With a 16% stake, CEO Jung-Chou Lee is the largest shareholder. In comparison, the second and third largest shareholders hold about 13% and 10% of the stock. Interestingly, the third-largest shareholder, Cheng-Tien Cheng is also a Chairman of the Board, again, indicating strong insider ownership amongst the company's top shareholders.

On studying our ownership data, we found that 8 of the top shareholders collectively own less than 50% of the share register, implying that no single individual has a majority interest.

While it makes sense to study institutional ownership data for a company, it also makes sense to study analyst sentiments to know which way the wind is blowing. While there is some analyst coverage, the company is probably not widely covered. So it could gain more attention, down the track.

Insider Ownership Of Zhong Yang Technology

The definition of company insiders can be subjective and does vary between jurisdictions. Our data reflects individual insiders, capturing board members at the very least. The company management answer to the board and the latter should represent the interests of shareholders. Notably, sometimes top-level managers are on the board themselves.

Most consider insider ownership a positive because it can indicate the board is well aligned with other shareholders. However, on some occasions too much power is concentrated within this group.

Our most recent data indicates that insiders own a reasonable proportion of Zhong Yang Technology Co., Ltd.. It has a market capitalization of just NT$4.1b, and insiders have NT$1.1b worth of shares in their own names. It is great to see insiders so invested in the business. It might be worth checking if those insiders have been buying recently.

General Public Ownership

The general public -- mostly retail investors -- own 56% of Zhong Yang Technology. This size of ownership gives retail investors collective power. They can and probably do influence decisions on executive compensation, dividend policies and proposed business acquisitions.

Private Equity Ownership

With an ownership of 13%, private equity firms are in a position to play a role in shaping corporate strategy with a focus on value creation. Some investors might be encouraged by this, since private equity are sometimes able to encourage strategies that help the market see the value in the company. Alternatively, those holders might be exiting the investment after taking it public.

Private Company Ownership

Our data indicates that Private Companies hold 5.1%, of the company's shares. It might be worth looking deeper into this. If related parties, such as insiders, have an interest in one of these private companies, that should be disclosed in the annual report. Private companies may also have a strategic interest in the company.

Next Steps:

It's always worth thinking about the different groups who own shares in a company. But to understand Zhong Yang Technology better, we need to consider many other factors. For instance, we've identified 3 warning signs for Zhong Yang Technology (2 shouldn't be ignored) that you should be aware of.

If you are like me, you may want to think about whether this company will grow or shrink. Luckily, you can check this free report showing analyst forecasts for its future.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

If you decide to trade Zhong Yang Technology, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Zhong Yang TechnologyLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TWSE:6668

Zhong Yang TechnologyLtd

Zhong Yang Technology Co., Ltd., together with its subsidiaries, engages in the research, development, manufacture, and sale of optical lens molds in Taiwan, China, Korea, and internationally.

Slight with mediocre balance sheet.

Market Insights

Community Narratives