Is Waffer Technology (TPE:6235) Weighed On By Its Debt Load?

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. Importantly, Waffer Technology Corporation (TPE:6235) does carry debt. But the more important question is: how much risk is that debt creating?

Why Does Debt Bring Risk?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

See our latest analysis for Waffer Technology

How Much Debt Does Waffer Technology Carry?

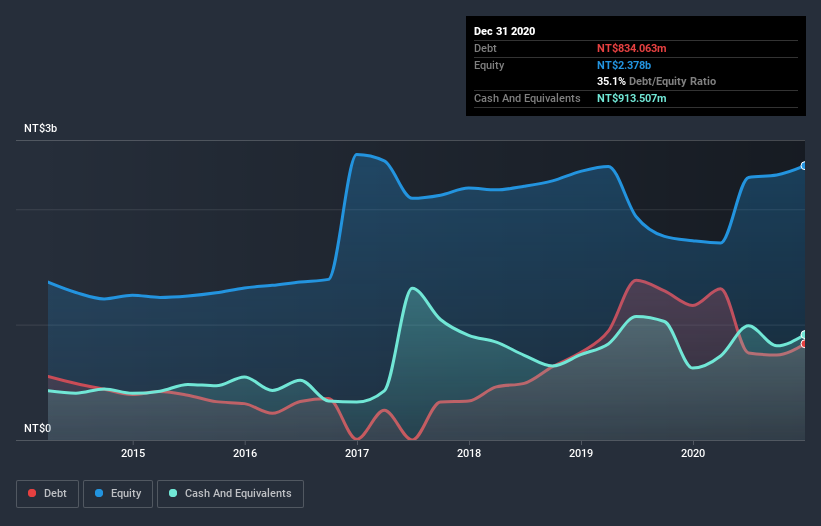

You can click the graphic below for the historical numbers, but it shows that Waffer Technology had NT$834.1m of debt in December 2020, down from NT$1.17b, one year before. But on the other hand it also has NT$913.5m in cash, leading to a NT$79.4m net cash position.

How Strong Is Waffer Technology's Balance Sheet?

According to the last reported balance sheet, Waffer Technology had liabilities of NT$1.97b due within 12 months, and liabilities of NT$112.9m due beyond 12 months. Offsetting these obligations, it had cash of NT$913.5m as well as receivables valued at NT$842.0m due within 12 months. So it has liabilities totalling NT$326.7m more than its cash and near-term receivables, combined.

Given Waffer Technology has a market capitalization of NT$3.51b, it's hard to believe these liabilities pose much threat. Having said that, it's clear that we should continue to monitor its balance sheet, lest it change for the worse. While it does have liabilities worth noting, Waffer Technology also has more cash than debt, so we're pretty confident it can manage its debt safely. The balance sheet is clearly the area to focus on when you are analysing debt. But you can't view debt in total isolation; since Waffer Technology will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Over 12 months, Waffer Technology made a loss at the EBIT level, and saw its revenue drop to NT$2.0b, which is a fall of 8.6%. We would much prefer see growth.

So How Risky Is Waffer Technology?

While Waffer Technology lost money on an earnings before interest and tax (EBIT) level, it actually booked a paper profit of NT$650m. So taking that on face value, and considering the cash, we don't think its very risky in the near term. With revenue growth uninspiring, we'd really need to see some positive EBIT before mustering much enthusiasm for this business. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. Case in point: We've spotted 2 warning signs for Waffer Technology you should be aware of, and 1 of them is a bit concerning.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

When trading Waffer Technology or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

If you're looking to trade Waffer Technology, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Waffer Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TWSE:6235

Waffer Technology

Engages in the production and sale of magnesium aluminum alloy molded products in the Mainland of China, Taiwan, the United States, and internationally.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives