The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We can see that Chien Kuo Construction Co., Ltd. (TPE:5515) does use debt in its business. But is this debt a concern to shareholders?

What Risk Does Debt Bring?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first step when considering a company's debt levels is to consider its cash and debt together.

See our latest analysis for Chien Kuo Construction

What Is Chien Kuo Construction's Net Debt?

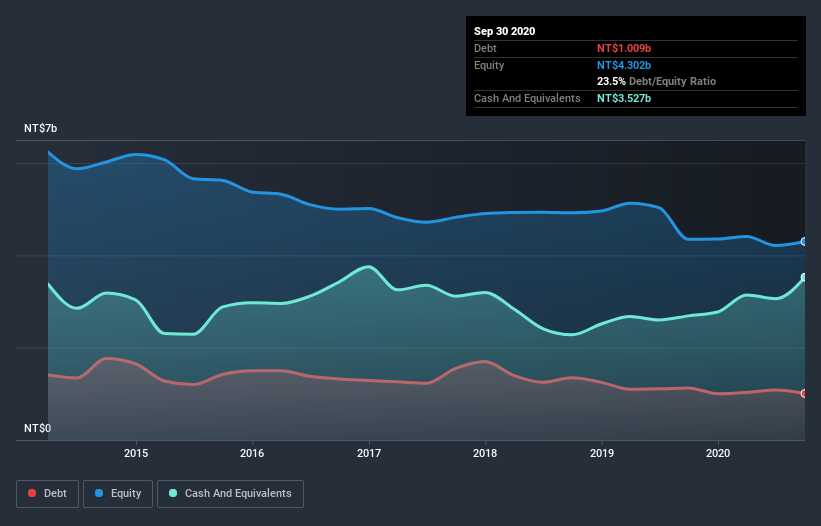

As you can see below, Chien Kuo Construction had NT$1.01b of debt at September 2020, down from NT$1.13b a year prior. But it also has NT$3.53b in cash to offset that, meaning it has NT$2.52b net cash.

How Healthy Is Chien Kuo Construction's Balance Sheet?

According to the last reported balance sheet, Chien Kuo Construction had liabilities of NT$3.39b due within 12 months, and liabilities of NT$1.20b due beyond 12 months. On the other hand, it had cash of NT$3.53b and NT$3.23b worth of receivables due within a year. So it actually has NT$2.16b more liquid assets than total liabilities.

This luscious liquidity implies that Chien Kuo Construction's balance sheet is sturdy like a giant sequoia tree. Having regard to this fact, we think its balance sheet is as strong as an ox. Succinctly put, Chien Kuo Construction boasts net cash, so it's fair to say it does not have a heavy debt load!

Even more impressive was the fact that Chien Kuo Construction grew its EBIT by 282% over twelve months. That boost will make it even easier to pay down debt going forward. When analysing debt levels, the balance sheet is the obvious place to start. But it is Chien Kuo Construction's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. Chien Kuo Construction may have net cash on the balance sheet, but it is still interesting to look at how well the business converts its earnings before interest and tax (EBIT) to free cash flow, because that will influence both its need for, and its capacity to manage debt. Over the last three years, Chien Kuo Construction actually produced more free cash flow than EBIT. That sort of strong cash generation warms our hearts like a puppy in a bumblebee suit.

Summing up

While we empathize with investors who find debt concerning, you should keep in mind that Chien Kuo Construction has net cash of NT$2.52b, as well as more liquid assets than liabilities. The cherry on top was that in converted 203% of that EBIT to free cash flow, bringing in NT$1.1b. The bottom line is that Chien Kuo Construction's use of debt is absolutely fine. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. These risks can be hard to spot. Every company has them, and we've spotted 1 warning sign for Chien Kuo Construction you should know about.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

If you decide to trade Chien Kuo Construction, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TWSE:5515

Chien Kuo Construction

Engages in the construction business in Taiwan and China.

Flawless balance sheet 6 star dividend payer.

Market Insights

Community Narratives