TBI MOTION Technology (TPE:4540) Shareholders Will Want The ROCE Trajectory To Continue

What are the early trends we should look for to identify a stock that could multiply in value over the long term? One common approach is to try and find a company with returns on capital employed (ROCE) that are increasing, in conjunction with a growing amount of capital employed. This shows us that it's a compounding machine, able to continually reinvest its earnings back into the business and generate higher returns. So when we looked at TBI MOTION Technology (TPE:4540) and its trend of ROCE, we really liked what we saw.

Understanding Return On Capital Employed (ROCE)

Just to clarify if you're unsure, ROCE is a metric for evaluating how much pre-tax income (in percentage terms) a company earns on the capital invested in its business. The formula for this calculation on TBI MOTION Technology is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.036 = NT$186m ÷ (NT$6.1b - NT$1.0b) (Based on the trailing twelve months to December 2020).

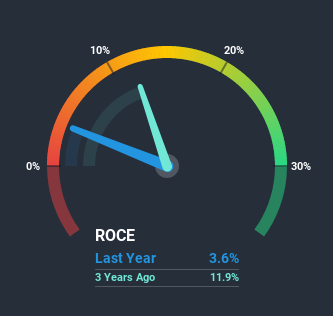

Thus, TBI MOTION Technology has an ROCE of 3.6%. In absolute terms, that's a low return and it also under-performs the Machinery industry average of 9.4%.

See our latest analysis for TBI MOTION Technology

Above you can see how the current ROCE for TBI MOTION Technology compares to its prior returns on capital, but there's only so much you can tell from the past. If you'd like to see what analysts are forecasting going forward, you should check out our free report for TBI MOTION Technology.

What Does the ROCE Trend For TBI MOTION Technology Tell Us?

While in absolute terms it isn't a high ROCE, it's promising to see that it has been moving in the right direction. Over the last five years, returns on capital employed have risen substantially to 3.6%. Basically the business is earning more per dollar of capital invested and in addition to that, 148% more capital is being employed now too. The increasing returns on a growing amount of capital is common amongst multi-baggers and that's why we're impressed.

On a related note, the company's ratio of current liabilities to total assets has decreased to 17%, which basically reduces it's funding from the likes of short-term creditors or suppliers. This tells us that TBI MOTION Technology has grown its returns without a reliance on increasing their current liabilities, which we're very happy with.

The Bottom Line On TBI MOTION Technology's ROCE

To sum it up, TBI MOTION Technology has proven it can reinvest in the business and generate higher returns on that capital employed, which is terrific. And with the stock having performed exceptionally well over the last five years, these patterns are being accounted for by investors. With that being said, we still think the promising fundamentals mean the company deserves some further due diligence.

Like most companies, TBI MOTION Technology does come with some risks, and we've found 1 warning sign that you should be aware of.

While TBI MOTION Technology isn't earning the highest return, check out this free list of companies that are earning high returns on equity with solid balance sheets.

When trading TBI MOTION Technology or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Tbi Motion Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TWSE:4540

Tbi Motion Technology

Engages in the manufacture and sale of linear motion products for automation industry in Taiwan, rest of Asia, Europe, and internationally.

Fair value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives