Should You Use National Aerospace Fasteners' (TPE:3004) Statutory Earnings To Analyse It?

It might be old fashioned, but we really like to invest in companies that make a profit, each and every year. However, sometimes companies receive a one-off boost (or reduction) to their profit, and it's not always clear whether statutory profits are a good guide, going forward. Today we'll focus on whether this year's statutory profits are a good guide to understanding National Aerospace Fasteners (TPE:3004).

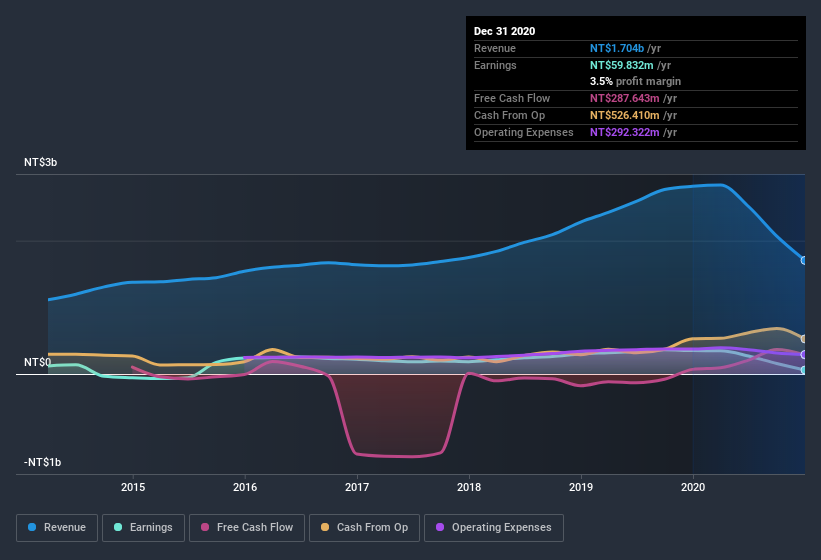

While National Aerospace Fasteners was able to generate revenue of NT$1.70b in the last twelve months, we think its profit result of NT$59.8m was more important. Below, you can see that both its revenue and its profit have fallen over the last three years.

See our latest analysis for National Aerospace Fasteners

Of course, it is only sensible to look beyond the statutory profits and question how well those numbers represent the sustainable earnings power of the business. This article, will discuss how a tax benefit impacted National Aerospace Fasteners' most recent profit results. Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of National Aerospace Fasteners.

An Unusual Tax Situation

We can see that National Aerospace Fasteners received a tax benefit of NT$8.8m. It's always a bit noteworthy when a company is paid by the tax man, rather than paying the tax man. We're sure the company was pleased with its tax benefit. However, the devil in the detail is that these kind of benefits only impact in the year they are booked, and are often one-off in nature. In the likely event the tax benefit is not repeated, we'd expect to see its statutory profit levels drop, at least in the absence of strong growth. While we think it's good that the company has booked a tax benefit, it does mean that there's every chance the statutory profit will come in a lot higher than it would be if the income was adjusted for one-off factors.

Our Take On National Aerospace Fasteners' Profit Performance

As we have already discussed National Aerospace Fasteners reported that it received a tax benefit, rather than paying tax, in the last year. As a result we don't think its profit result, which includes that tax-boost, is a good guide to its sustainable profit levels. Because of this, we think that it may be that National Aerospace Fasteners' statutory profits are better than its underlying earnings power. In further bad news, its earnings per share decreased in the last year. At the end of the day, it's essential to consider more than just the factors above, if you want to understand the company properly. So while earnings quality is important, it's equally important to consider the risks facing National Aerospace Fasteners at this point in time. Be aware that National Aerospace Fasteners is showing 4 warning signs in our investment analysis and 1 of those doesn't sit too well with us...

Today we've zoomed in on a single data point to better understand the nature of National Aerospace Fasteners' profit. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

If you’re looking to trade National Aerospace Fasteners, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if National Aerospace Fasteners might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TWSE:3004

National Aerospace Fasteners

Engages in the manufacture, processing, agency, and trading of various types of fasteners and construction parts and related components of aircraft and automobiles in Taiwan and internationally.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives