Shareholders of Rexon IndustrialLtd (TPE:1515) Must Be Delighted With Their 713% Total Return

Long term investing can be life changing when you buy and hold the truly great businesses. While not every stock performs well, when investors win, they can win big. Don't believe it? Then look at the Rexon Industrial Corp.,Ltd (TPE:1515) share price. It's 603% higher than it was five years ago. If that doesn't get you thinking about long term investing, we don't know what will. In the last week shares have slid back 5.2%.

Anyone who held for that rewarding ride would probably be keen to talk about it.

View our latest analysis for Rexon IndustrialLtd

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

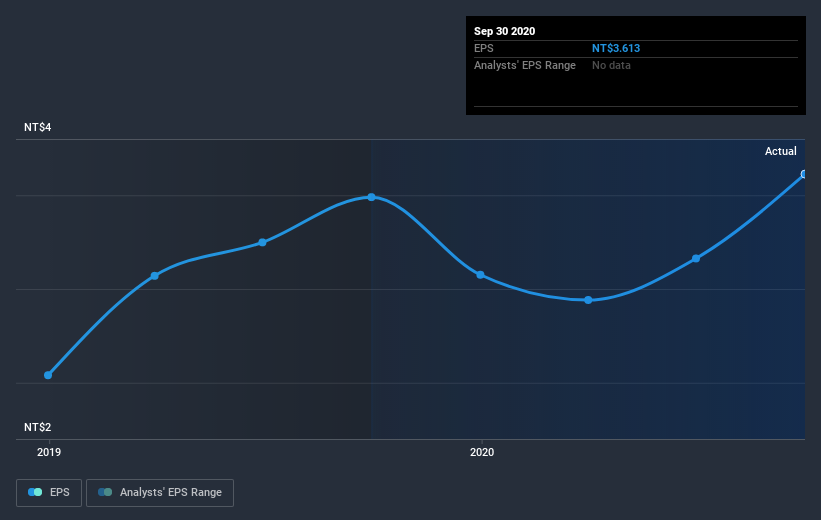

Over half a decade, Rexon IndustrialLtd managed to grow its earnings per share at 26% a year. This EPS growth is slower than the share price growth of 48% per year, over the same period. So it's fair to assume the market has a higher opinion of the business than it did five years ago. That's not necessarily surprising considering the five-year track record of earnings growth.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here.

What about the Total Shareholder Return (TSR)?

Investors should note that there's a difference between Rexon IndustrialLtd's total shareholder return (TSR) and its share price change, which we've covered above. The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Dividends have been really beneficial for Rexon IndustrialLtd shareholders, and that cash payout contributed to why its TSR of 713%, over the last 5 years, is better than the share price return.

A Different Perspective

Rexon IndustrialLtd shareholders are up 7.2% for the year. But that return falls short of the market. It's probably a good sign that the company has an even better long term track record, having provided shareholders with an annual TSR of 52% over five years. It's quite possible the business continues to execute with prowess, even as the share price gains are slowing. Before deciding if you like the current share price, check how Rexon IndustrialLtd scores on these 3 valuation metrics.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on TW exchanges.

If you’re looking to trade Rexon IndustrialLtd, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TWSE:1515

Rexon IndustrialLtd

Manufactures and sells drills, woodworking tools, and fitness equipment in Taiwan, the United States, Europe, the rest of Asia, and internationally.

Excellent balance sheet slight.

Similar Companies

Market Insights

Community Narratives