Warren Buffett famously said, 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. As with many other companies TECO Electric & Machinery Co., Ltd. (TPE:1504) makes use of debt. But should shareholders be worried about its use of debt?

When Is Debt Dangerous?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we think about a company's use of debt, we first look at cash and debt together.

View our latest analysis for TECO Electric & Machinery

What Is TECO Electric & Machinery's Net Debt?

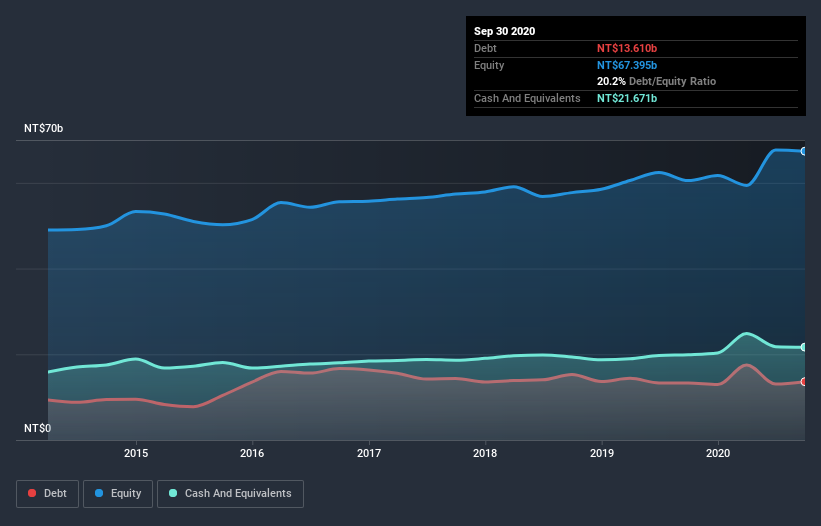

The chart below, which you can click on for greater detail, shows that TECO Electric & Machinery had NT$13.6b in debt in September 2020; about the same as the year before. However, it does have NT$21.7b in cash offsetting this, leading to net cash of NT$8.06b.

How Healthy Is TECO Electric & Machinery's Balance Sheet?

The latest balance sheet data shows that TECO Electric & Machinery had liabilities of NT$19.2b due within a year, and liabilities of NT$19.5b falling due after that. Offsetting this, it had NT$21.7b in cash and NT$11.3b in receivables that were due within 12 months. So its liabilities total NT$5.70b more than the combination of its cash and short-term receivables.

Since publicly traded TECO Electric & Machinery shares are worth a total of NT$57.9b, it seems unlikely that this level of liabilities would be a major threat. Having said that, it's clear that we should continue to monitor its balance sheet, lest it change for the worse. Despite its noteworthy liabilities, TECO Electric & Machinery boasts net cash, so it's fair to say it does not have a heavy debt load!

On the other hand, TECO Electric & Machinery's EBIT dived 10%, over the last year. We think hat kind of performance, if repeated frequently, could well lead to difficulties for the stock. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately the future profitability of the business will decide if TECO Electric & Machinery can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. While TECO Electric & Machinery has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. Over the last three years, TECO Electric & Machinery actually produced more free cash flow than EBIT. That sort of strong cash generation warms our hearts like a puppy in a bumblebee suit.

Summing up

We could understand if investors are concerned about TECO Electric & Machinery's liabilities, but we can be reassured by the fact it has has net cash of NT$8.06b. The cherry on top was that in converted 105% of that EBIT to free cash flow, bringing in NT$4.5b. So we don't have any problem with TECO Electric & Machinery's use of debt. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. Take risks, for example - TECO Electric & Machinery has 2 warning signs we think you should be aware of.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

When trading TECO Electric & Machinery or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if TECO Electric & Machinery might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TWSE:1504

TECO Electric & Machinery

Manufactures, installs, wholesales, and retails electronic and telecommunications equipment, office equipment, and home appliances in Taiwan, the United States, China, and internationally.

Flawless balance sheet and undervalued.