Undiscovered Gems Including 3 Promising Stocks With Strong Potential

Reviewed by Simply Wall St

In recent weeks, the global markets have been characterized by a mix of economic indicators and monetary policy adjustments, with major indices like the Russell 2000 underperforming against their larger-cap counterparts. As smaller-cap stocks navigate these challenging conditions, investors are increasingly on the lookout for undiscovered gems—companies that exhibit strong fundamentals and resilience in a fluctuating market environment.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Cresco | 6.62% | 8.15% | 9.94% | ★★★★★★ |

| DoshishaLtd | NA | 2.43% | 2.36% | ★★★★★★ |

| NOROO PAINT & COATINGS | 12.38% | 4.96% | 8.97% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| ITOCHU-SHOKUHIN | NA | 0.74% | 13.97% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Wan Hwa Enterprise | NA | -7.43% | -7.24% | ★★★★★★ |

| First Copper Technology | 17.03% | 3.07% | 19.66% | ★★★★★★ |

| New Asia Construction & Development | 65.89% | 5.34% | 12.05% | ★★★★★☆ |

| Nippon Sharyo | 59.09% | -1.22% | -12.92% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Guomai Technologies (SZSE:002093)

Simply Wall St Value Rating: ★★★★★★

Overview: Guomai Technologies, Inc. is a Chinese company that offers internet of things technology services, consulting and design services, science park operation and development services, as well as education services, with a market cap of CN¥7.97 billion.

Operations: Guomai Technologies generates revenue primarily from its internet of things technology services, consulting and design services, science park operations and development, and education services. The company's net profit margin reflects the efficiency of its operations in converting revenue into actual profit.

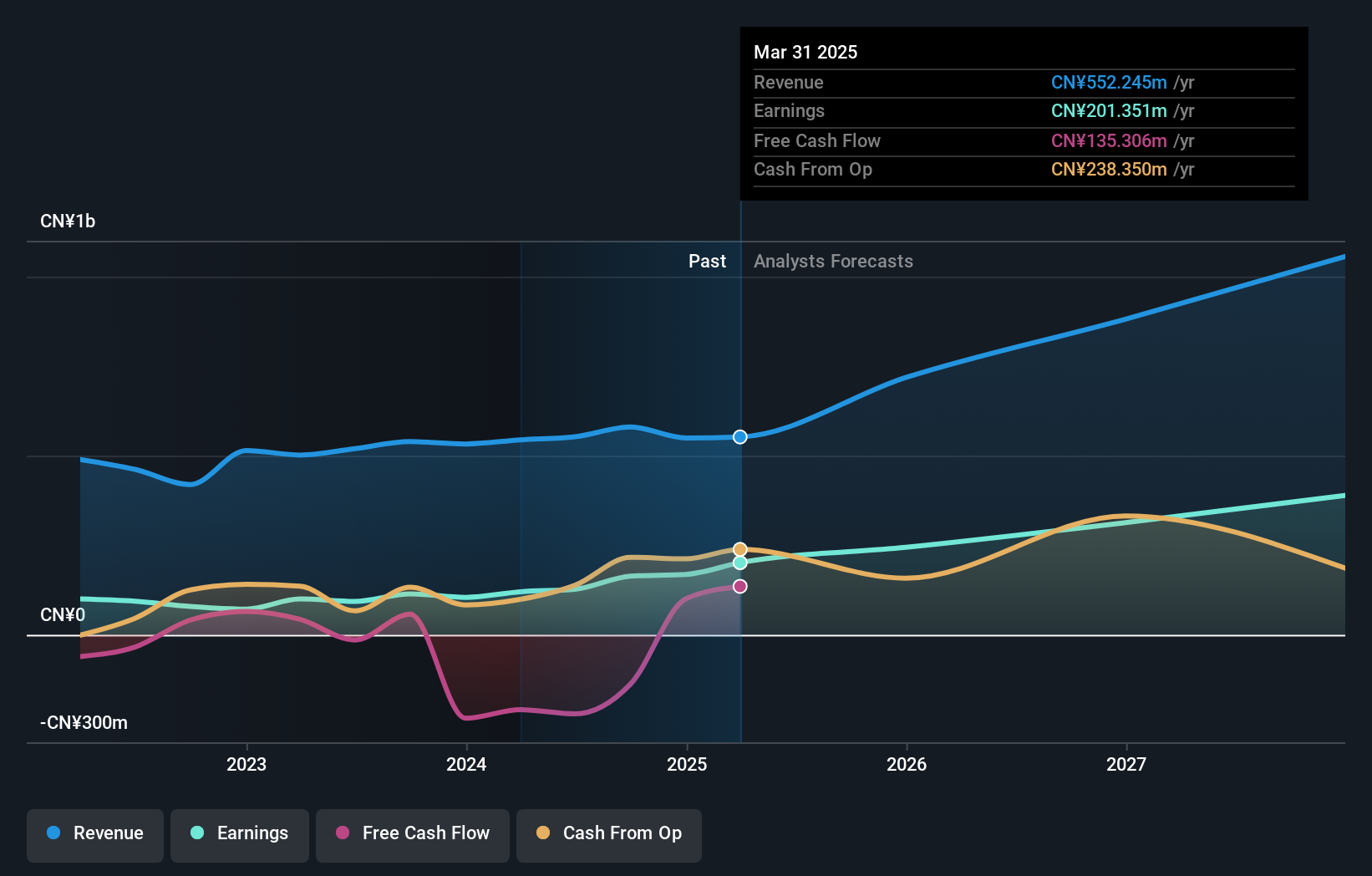

Guomai Technologies, a smaller player in the IT sector, has shown impressive earnings growth of 43.7% over the past year, outpacing the industry average of -8.1%. The company has improved its financial health by reducing its debt-to-equity ratio from 10.2 to 5.5 over five years and currently holds more cash than total debt, indicating sound fiscal management. Although a significant one-off gain of CN¥78M impacted recent results, Guomai's price-to-earnings ratio of 48.6x suggests it offers better value compared to the industry average of 80.4x, hinting at potential for future growth despite not yet achieving positive free cash flow status.

- Dive into the specifics of Guomai Technologies here with our thorough health report.

Examine Guomai Technologies' past performance report to understand how it has performed in the past.

Guangdong Kingstrong Technology (SZSE:300629)

Simply Wall St Value Rating: ★★★★★☆

Overview: Guangdong Kingstrong Technology Co., Ltd. operates in the technology sector with a market cap of CN¥51.84 billion.

Operations: The company generates revenue primarily through its technology-related segments. With a market cap of CN¥51.84 billion, it focuses on leveraging its technological expertise to drive financial performance.

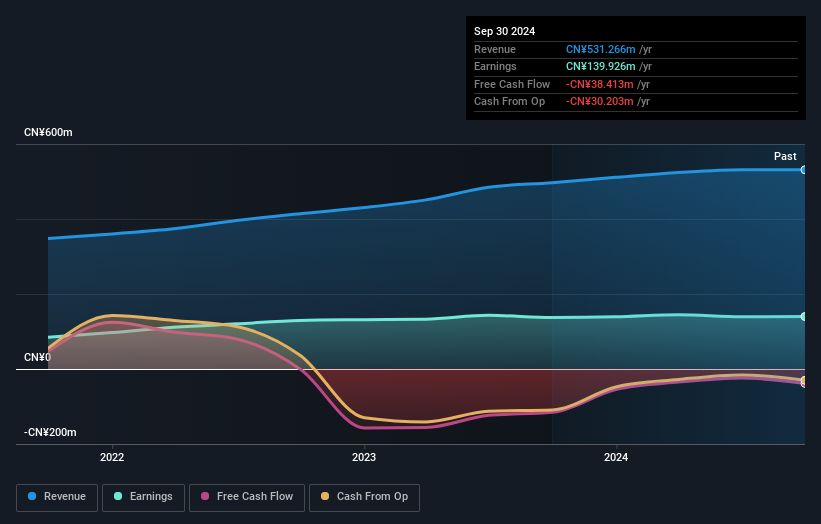

Kingstrong Technology, a small player in the tech space, has shown resilience with earnings growth of 1.7% over the past year, outpacing the building industry's -8% performance. The company's debt situation has improved significantly over five years, with its debt-to-equity ratio dropping from 38.4% to just 3.2%. This reduction is complemented by strong interest coverage at 35 times EBIT, indicating robust financial health despite negative free cash flow figures recently reported. High-quality past earnings further underscore its potential as an undiscovered gem in its sector, suggesting a stable foundation for future endeavors.

Syntec Technology (TPEX:7750)

Simply Wall St Value Rating: ★★★★★☆

Overview: Syntec Technology Co., Ltd. manufactures PC-based digital controllers specializing in machine tools and has a market capitalization of NT$34.43 billion.

Operations: Syntec Technology generates revenue primarily from the Machinery & Industrial Equipment segment, amounting to NT$10.29 billion.

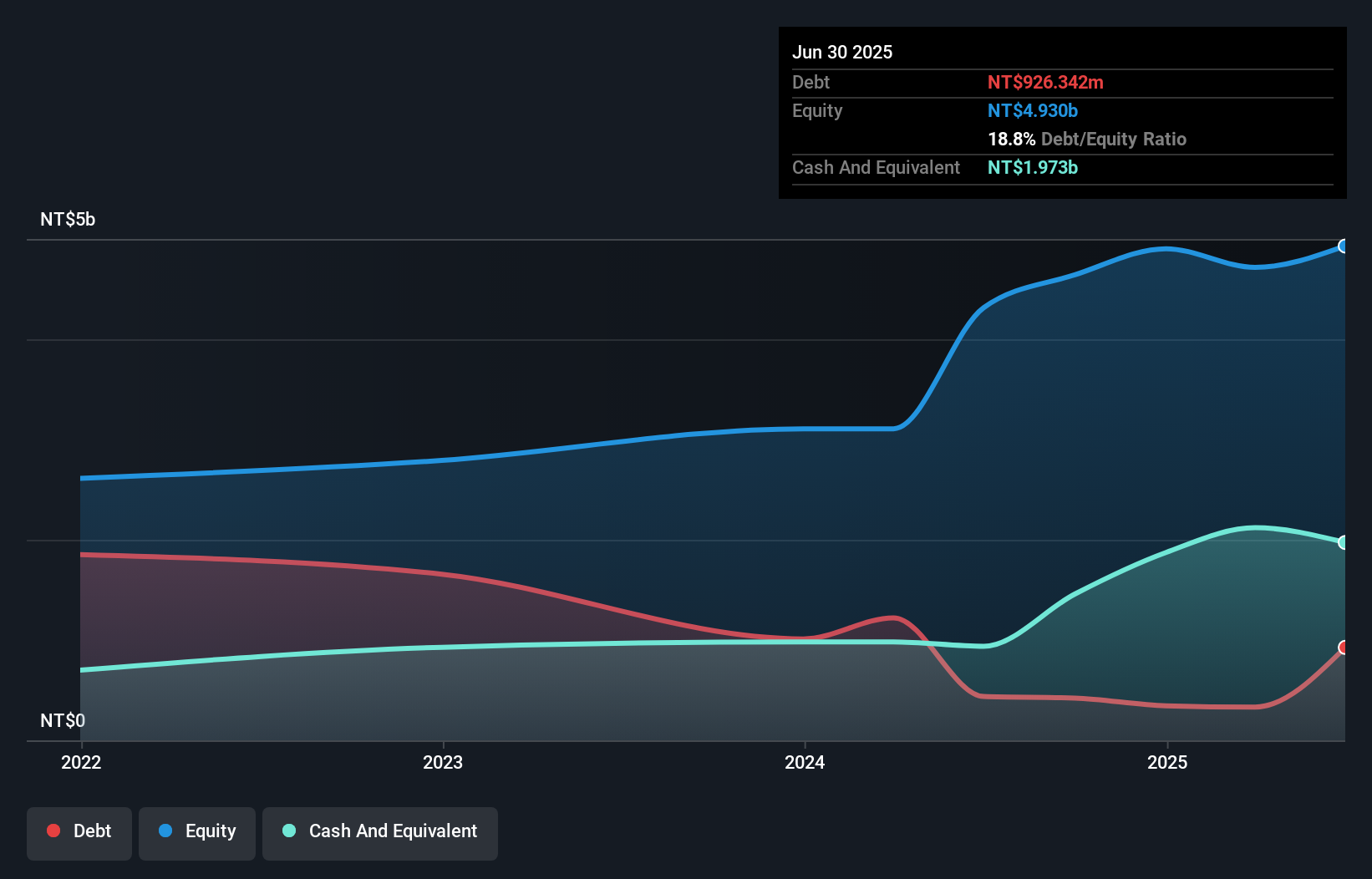

Syntec Technology, a promising player in the tech sector, has shown impressive growth with earnings up 106% over the past year, outpacing its industry peers. The company's recent inclusion in the S&P Global BMI Index underscores its rising prominence. For Q3 2024, sales reached TWD 2.5 billion from TWD 1.79 billion a year prior, while net income climbed to TWD 280 million from TWD 132 million. With interest payments well covered by EBIT at an impressive rate of nearly 200 times and trading slightly below estimated fair value, Syntec's financial health appears robust and attractive for potential investors.

- Click here to discover the nuances of Syntec Technology with our detailed analytical health report.

Understand Syntec Technology's track record by examining our Past report.

Make It Happen

- Explore the 4724 names from our Undiscovered Gems With Strong Fundamentals screener here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:7750

Syntec Technology

Manufactures PC-based digital controllers that specializes in machine tools.

Excellent balance sheet with proven track record.

Market Insights

Community Narratives