As global markets continue to navigate the complexities of rising inflation and shifting trade policies, U.S. stock indexes are climbing toward record highs, with growth stocks leading the charge. In this environment, companies with high insider ownership can be particularly appealing as they often signal strong internal confidence and alignment with shareholder interests.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 17.3% | 22.8% |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Propel Holdings (TSX:PRL) | 36.5% | 38.7% |

| CD Projekt (WSE:CDR) | 29.7% | 39.4% |

| On Holding (NYSE:ONON) | 19.1% | 29.7% |

| Kingstone Companies (NasdaqCM:KINS) | 20.8% | 24.9% |

| Pharma Mar (BME:PHM) | 11.9% | 45.4% |

| Elliptic Laboratories (OB:ELABS) | 26.8% | 121.1% |

| Plenti Group (ASX:PLT) | 12.7% | 120.1% |

| Findi (ASX:FND) | 35.8% | 111.4% |

Below we spotlight a couple of our favorites from our exclusive screener.

Jiangsu Canlon Building Materials (SZSE:300715)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Jiangsu Canlon Building Materials Co., Ltd. (SZSE:300715) operates in the building materials sector with a market capitalization of CN¥2.97 billion.

Operations: Jiangsu Canlon Building Materials Co., Ltd. generates its revenue from various segments within the building materials industry.

Insider Ownership: 26%

Jiangsu Canlon Building Materials is expected to see substantial earnings growth of 115.74% annually over the next three years, with revenue growth forecasted at 16.7% per year, outpacing the Chinese market average. Despite a low future return on equity and unsustainable dividend coverage, it trades at a good value compared to peers. Recent acquisition activity includes a CNY 370 million stake purchase by Suzhou Silicon Optoelectronics Technology Co., Ltd., indicating strong insider interest.

- Delve into the full analysis future growth report here for a deeper understanding of Jiangsu Canlon Building Materials.

- In light of our recent valuation report, it seems possible that Jiangsu Canlon Building Materials is trading behind its estimated value.

Nan Juen International (TPEX:6584)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Nan Juen International Co., Ltd. is involved in the research, development, manufacture, and trading of steel ball bearing slides across the United States, Asia, Europe, Africa, and other international markets with a market cap of NT$9.56 billion.

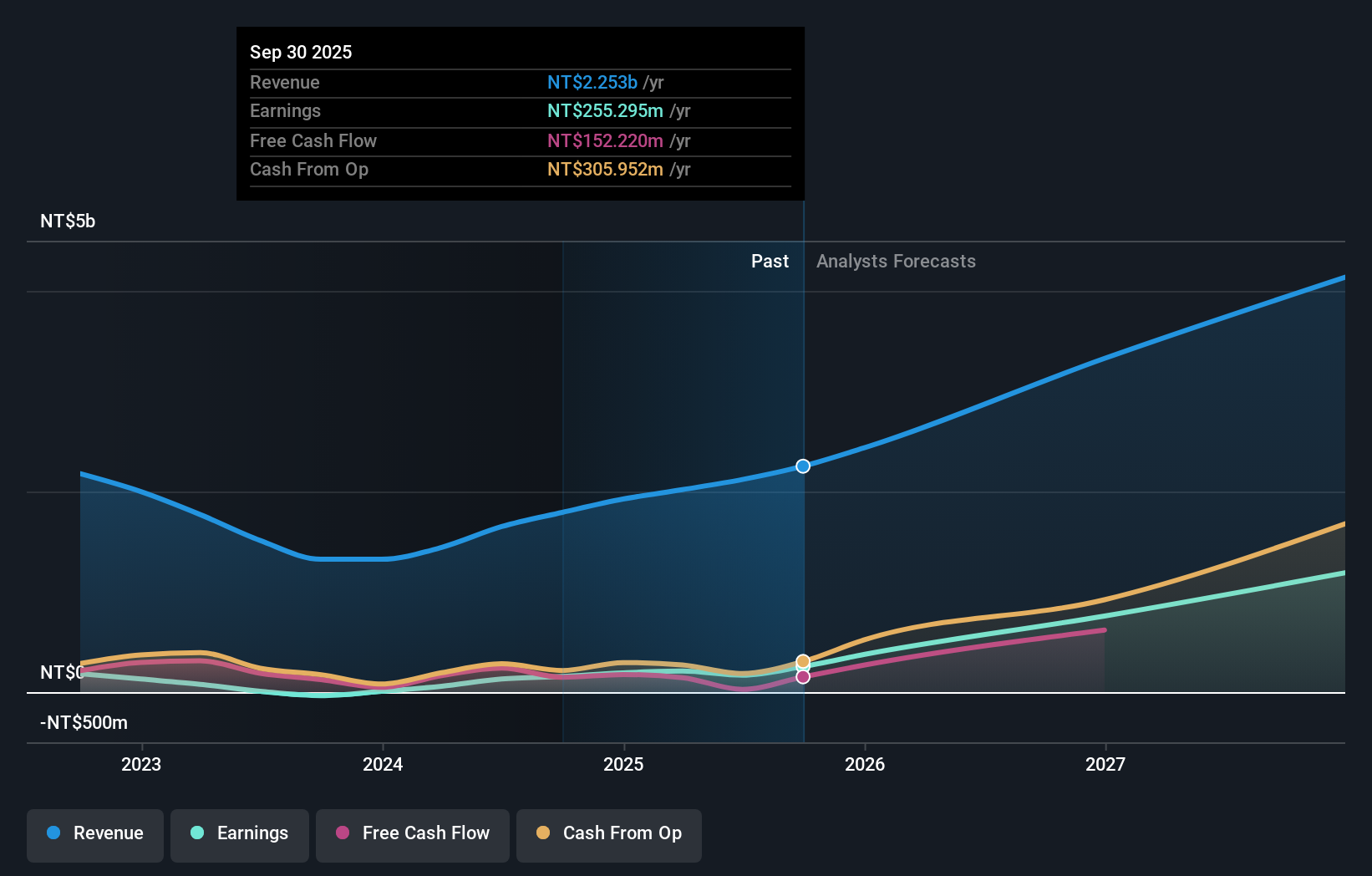

Operations: The company's revenue is primarily derived from the manufacture and sale of steel ball rails, amounting to NT$1.79 billion.

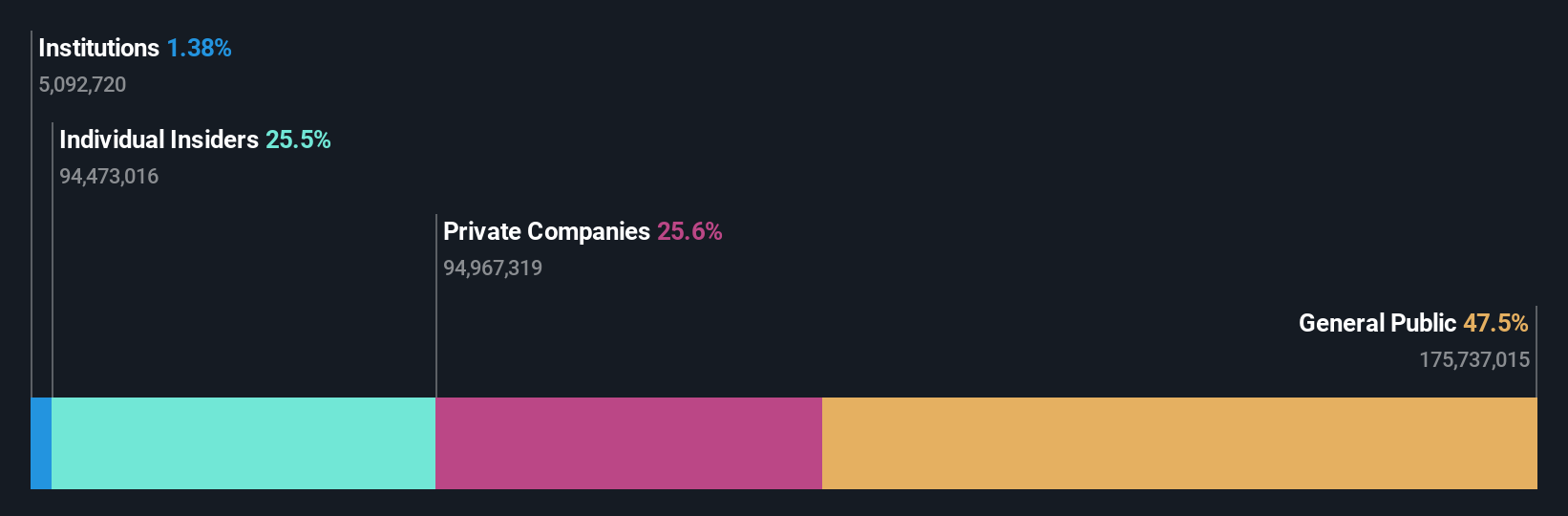

Insider Ownership: 19.7%

Nan Juen International anticipates robust earnings growth of 105% annually, surpassing the Taiwan market average. Revenue is projected to increase by 39.4% per year, significantly outpacing the market. Despite trading at 39.1% below estimated fair value, its debt coverage by operating cash flow remains inadequate. Recent leadership changes see Chairman Chin-Lan Lee also assuming the CEO role to support organizational growth from February 2025, aligning with strategic objectives for operational expansion.

- Unlock comprehensive insights into our analysis of Nan Juen International stock in this growth report.

- According our valuation report, there's an indication that Nan Juen International's share price might be on the cheaper side.

Kinik (TWSE:1560)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Kinik Company, with a market cap of NT$40.39 billion, produces and sells various abrasives, cutting tools, and reclaimed wafers in Taiwan and internationally.

Operations: The company generates revenue from two main segments: The Electronics Sector, contributing NT$3.39 billion, and The Traditional Sectors, also contributing NT$3.39 billion.

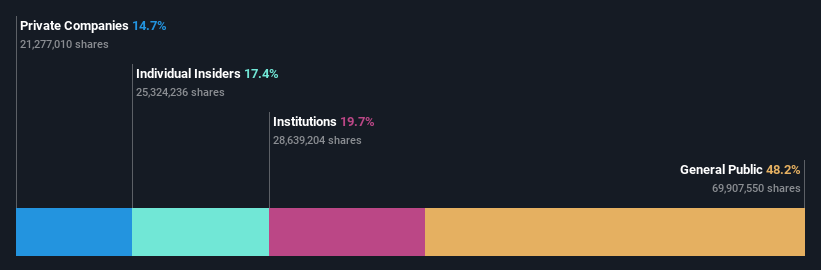

Insider Ownership: 15.9%

Kinik exhibits strong growth potential with earnings expected to grow significantly at 35.4% annually, outpacing the Taiwan market. Revenue is also set to rise faster than the market average, although below 20% per year. The stock trades at a substantial discount of 63.4% below its estimated fair value, suggesting potential upside. Recent events include an earnings call on November 29, 2024, but no substantial insider trading activity has been reported in the past three months.

- Click to explore a detailed breakdown of our findings in Kinik's earnings growth report.

- Our valuation report here indicates Kinik may be undervalued.

Where To Now?

- Take a closer look at our Fast Growing Companies With High Insider Ownership list of 1463 companies by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300715

Jiangsu Canlon Building Materials

Jiangsu Canlon Building Materials Co., Ltd.

Reasonable growth potential and fair value.

Market Insights

Community Narratives