- South Korea

- /

- Machinery

- /

- KOSE:A100090

3 Stocks Including SK oceanplantLtd That Might Be Valued Below Their Estimated Worth

Reviewed by Simply Wall St

As global markets continue to navigate the complexities of rising inflation and fluctuating interest rates, U.S. stock indexes have been climbing toward record highs, with growth stocks outperforming their value counterparts. In this environment, identifying undervalued stocks can be a strategic move for investors seeking opportunities that might be overlooked by the broader market.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Provident Financial Services (NYSE:PFS) | US$18.48 | US$36.92 | 49.9% |

| Smurfit Westrock (NYSE:SW) | US$55.32 | US$110.32 | 49.9% |

| América Móvil. de (BMV:AMX B) | MX$14.90 | MX$29.71 | 49.9% |

| Power Wind Health Industry (TWSE:8462) | NT$111.00 | NT$221.07 | 49.8% |

| Guangdong Fenghua Advanced Technology (Holding) (SZSE:000636) | CN¥15.07 | CN¥30.02 | 49.8% |

| Com2uS (KOSDAQ:A078340) | ₩48300.00 | ₩96047.78 | 49.7% |

| F-Secure Oyj (HLSE:FSECURE) | €1.706 | €3.41 | 49.9% |

| Likewise Group (AIM:LIKE) | £0.185 | £0.37 | 49.8% |

| EKINOPS (ENXTPA:EKI) | €3.285 | €6.57 | 50% |

| Hindustan Foods (BSE:519126) | ₹572.85 | ₹1143.64 | 49.9% |

Let's uncover some gems from our specialized screener.

SK oceanplantLtd (KOSE:A100090)

Overview: SK oceanplant Co., Ltd. operates in South Korea, focusing on the manufacturing of steel and stainless steel pipes, hull blocks, and shipbuilding equipment with a market capitalization of approximately ₩903.92 billion.

Operations: The company's revenue is derived primarily from its Shipbuilding/Marine segment, which generated ₩847.12 million, and its Steel Pipe Division, contributing ₩20.86 million.

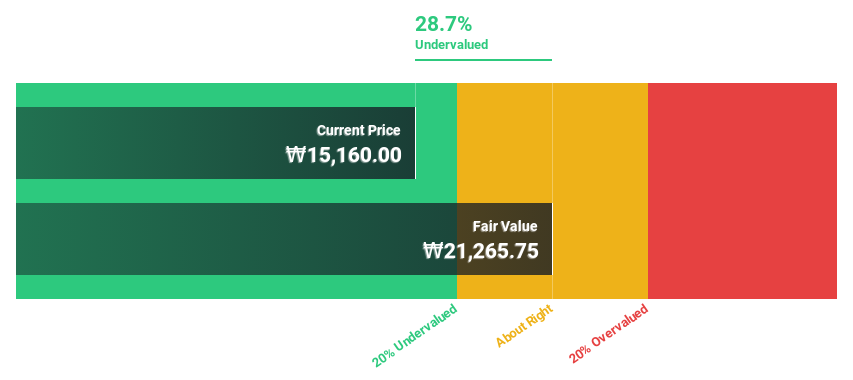

Estimated Discount To Fair Value: 27.9%

SK oceanplant Ltd. is trading at ₩15,270, significantly below its estimated fair value of ₩21,186.67, making it undervalued based on cash flows. Despite a decrease in profit margins from 5.4% to 3.6%, earnings are forecast to grow at 29.77% annually over the next three years—outpacing the Korean market's average growth rate of 26%. However, the return on equity is projected to remain low at 8% in three years.

- According our earnings growth report, there's an indication that SK oceanplantLtd might be ready to expand.

- Click to explore a detailed breakdown of our findings in SK oceanplantLtd's balance sheet health report.

Suzhou West Deane New Power ElectricLtd (SHSE:603312)

Overview: Suzhou West Deane New Power Electric Co., Ltd. is an engineering and manufacturing company that supplies laminated bus bar products globally, with a market capitalization of CN¥5.90 billion.

Operations: The company's revenue is primarily derived from its Electrical Machinery and Equipment Manufacturing segment, which generated CN¥1.90 billion.

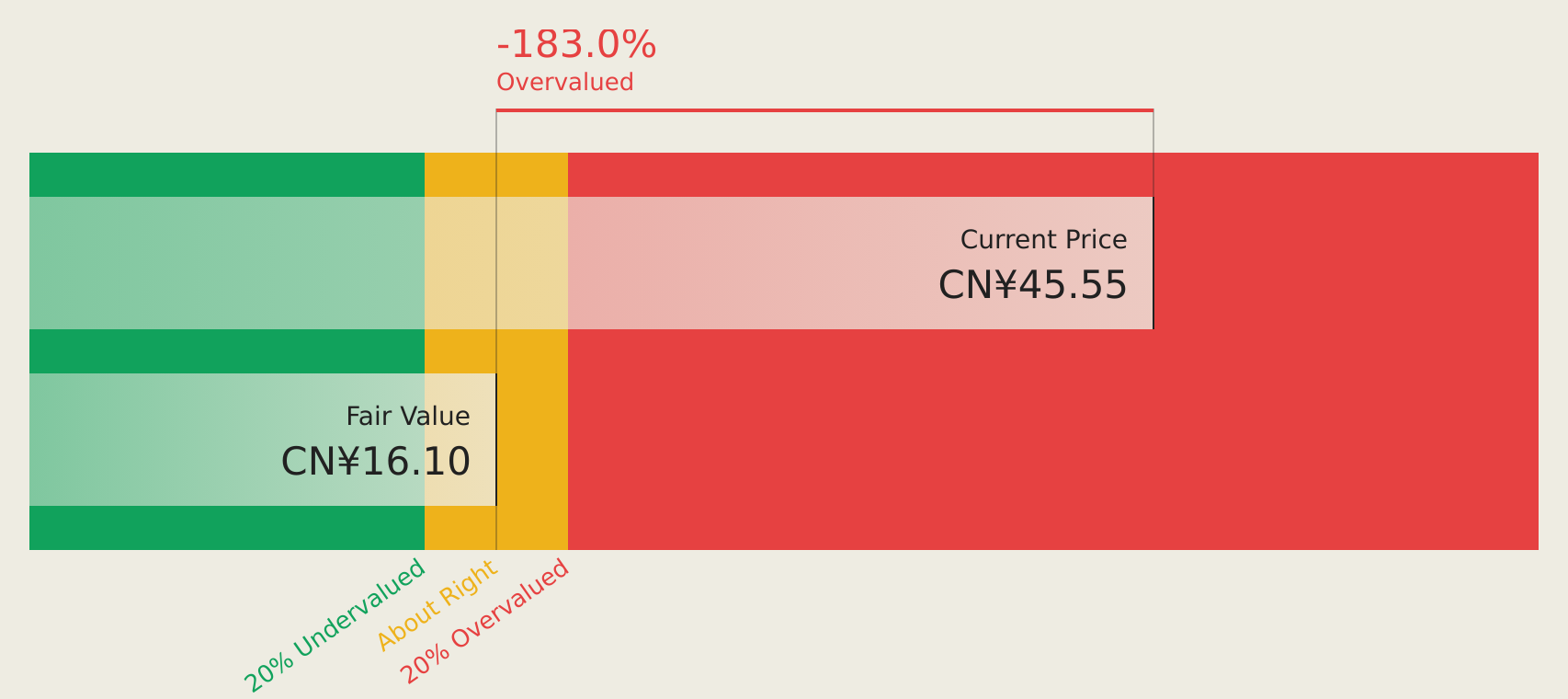

Estimated Discount To Fair Value: 32.5%

Suzhou West Deane New Power Electric Ltd. is trading at CN¥37.42, significantly below its estimated fair value of CN¥55.4, presenting an undervaluation based on cash flows. Earnings are projected to grow 33.39% annually, surpassing the Chinese market's average growth rate of 25%. However, the return on equity is expected to remain modest at 16.4% in three years, and its dividend yield of 1.74% lacks coverage by free cash flows.

- Our comprehensive growth report raises the possibility that Suzhou West Deane New Power ElectricLtd is poised for substantial financial growth.

- Navigate through the intricacies of Suzhou West Deane New Power ElectricLtd with our comprehensive financial health report here.

Nan Juen International (TPEX:6584)

Overview: Nan Juen International Co., Ltd. operates in the research, development, manufacture, and trading of steel ball bearing slides across various global markets with a market capitalization of NT$10.09 billion.

Operations: The company's revenue is primarily derived from the manufacture and sale of steel ball rails, amounting to NT$1.79 billion.

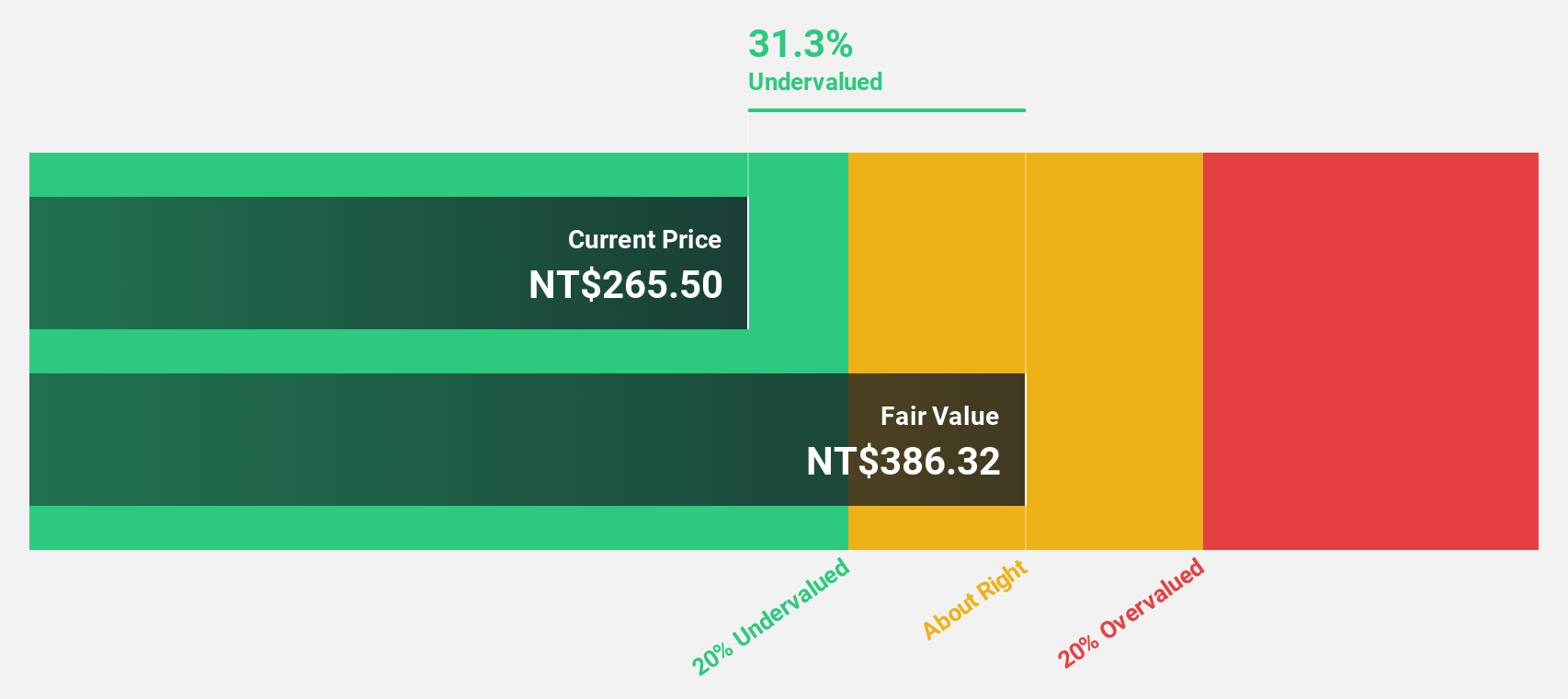

Estimated Discount To Fair Value: 36.7%

Nan Juen International is trading at NT$153, notably below its estimated fair value of NT$241.56, highlighting potential undervaluation based on cash flows. Revenue and earnings are forecasted to grow significantly at 39.4% and 105% annually, respectively, outpacing the Taiwanese market's growth rates. Despite this strong growth outlook, the company's debt coverage by operating cash flow remains a concern. Recent leadership changes may support strategic alignment with growth objectives.

- The analysis detailed in our Nan Juen International growth report hints at robust future financial performance.

- Dive into the specifics of Nan Juen International here with our thorough financial health report.

Where To Now?

- Unlock more gems! Our Undervalued Stocks Based On Cash Flows screener has unearthed 924 more companies for you to explore.Click here to unveil our expertly curated list of 927 Undervalued Stocks Based On Cash Flows.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A100090

SK oceanplantLtd

Engages in manufacturing of steel and stainless steel pipe, hull block, and shipbuilding equipment in South Korea.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives