As Asian markets navigate a complex landscape marked by global economic uncertainties and shifting trade dynamics, investors are increasingly turning their attention to dividend stocks as a source of steady income. In this environment, identifying strong dividend-paying companies can offer a measure of stability and potential yield, making them an appealing option for those looking to balance risk with reliable returns.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 4.93% | ★★★★★★ |

| Soliton Systems K.K (TSE:3040) | 3.69% | ★★★★★★ |

| SAN Holdings (TSE:9628) | 3.80% | ★★★★★★ |

| NCD (TSE:4783) | 4.29% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 3.85% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.95% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.44% | ★★★★★★ |

| Daicel (TSE:4202) | 4.32% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.65% | ★★★★★★ |

| Binggrae (KOSE:A005180) | 4.63% | ★★★★★★ |

Click here to see the full list of 1011 stocks from our Top Asian Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

First Tractor (SEHK:38)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: First Tractor Company Limited is involved in the manufacturing and sale of agricultural and power machinery, with a market cap of HK$13.54 billion.

Operations: First Tractor Company Limited generates its revenue primarily through the manufacturing and sale of agricultural and power machinery.

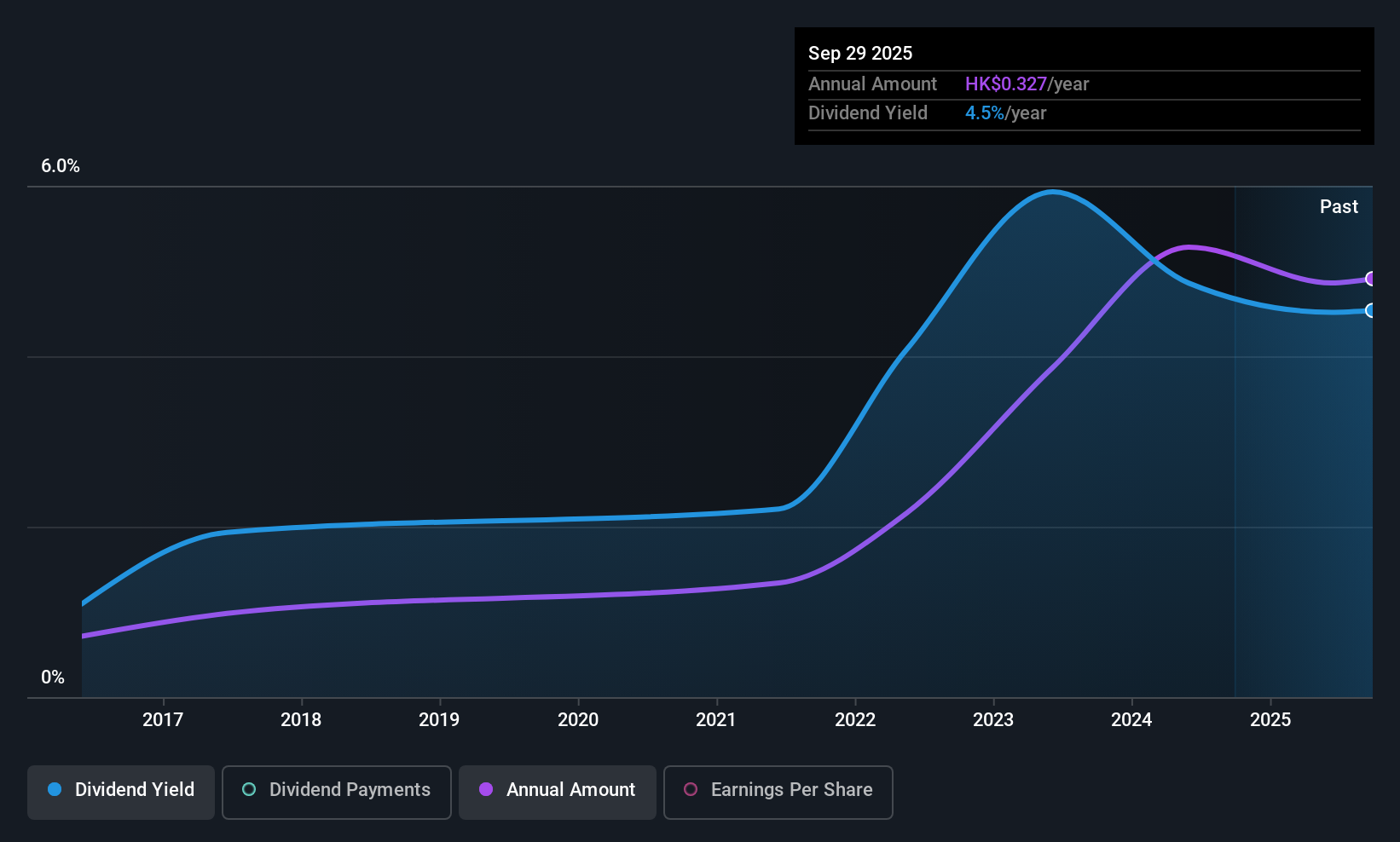

Dividend Yield: 4.3%

First Tractor's dividend payments have been volatile over the past decade, with frequent fluctuations exceeding 20%. Despite this instability, recent dividends are covered by both earnings and cash flows, with payout ratios at 52.6% and 55.4%, respectively. The company trades at a relatively low price-to-earnings ratio of 10x compared to the Hong Kong market average of 12.3x, suggesting good value relative to peers. An interim ordinary dividend was recently affirmed for FY2025.

- Click to explore a detailed breakdown of our findings in First Tractor's dividend report.

- Upon reviewing our latest valuation report, First Tractor's share price might be too pessimistic.

Lenovo Group (SEHK:992)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Lenovo Group Limited is an investment holding company that develops, manufactures, and markets technology products and services with a market cap of HK$143.52 billion.

Operations: Lenovo Group Limited generates revenue through its development, manufacturing, and marketing of technology products and services.

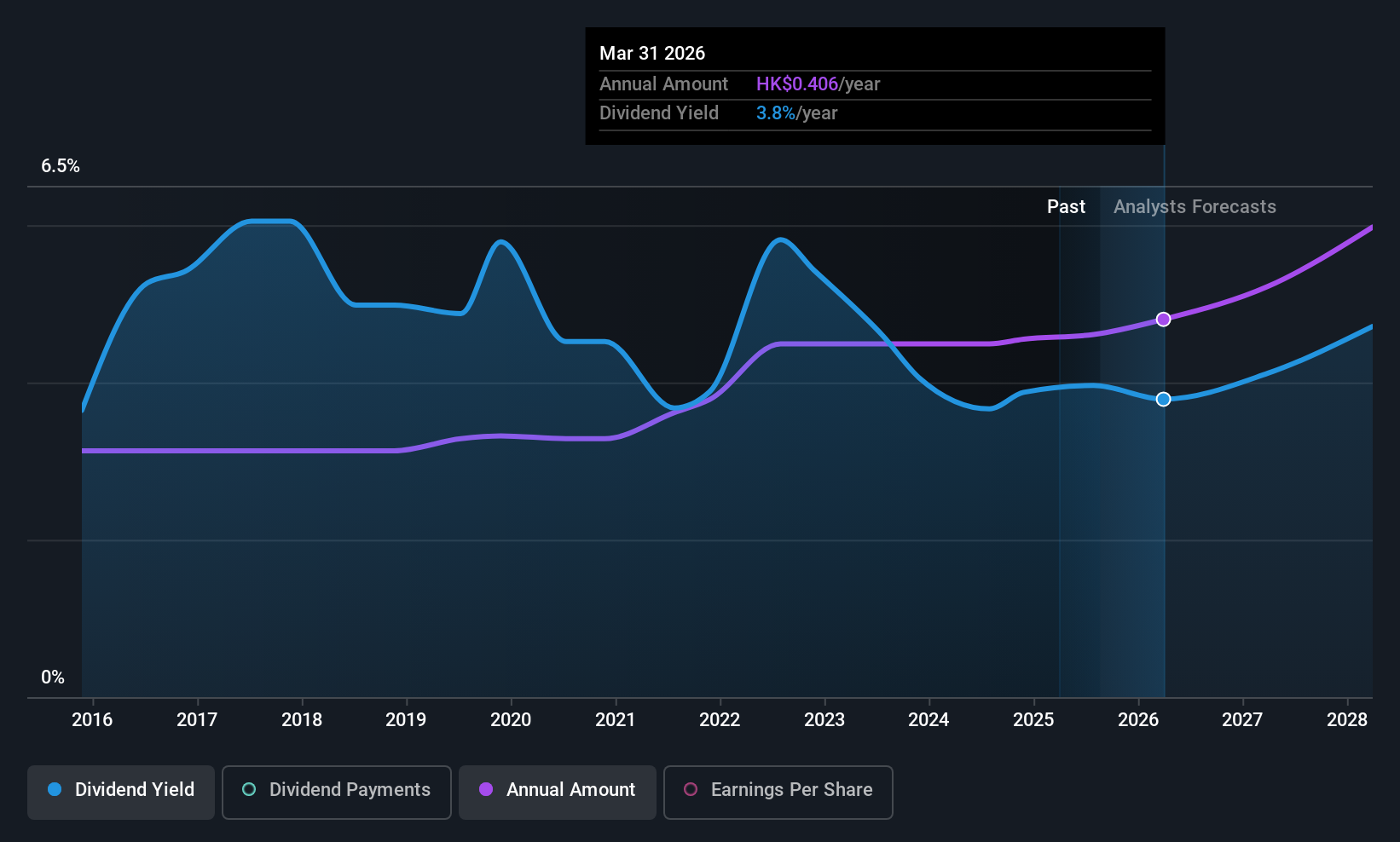

Dividend Yield: 3.3%

Lenovo's dividend yield of 3.34% is below the top tier in Hong Kong, and while dividends have grown steadily over the past decade, they are not well-covered by free cash flows. The payout ratio stands at a manageable 37.3%, indicating earnings coverage, yet the lack of free cash flow raises sustainability concerns. Recent earnings growth and strategic AI initiatives may support future profitability, but current dividend sustainability remains uncertain without improved cash flow management.

- Click here to discover the nuances of Lenovo Group with our detailed analytical dividend report.

- The analysis detailed in our Lenovo Group valuation report hints at an deflated share price compared to its estimated value.

Value Valves (TPEX:4580)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Value Valves Co., Ltd. specializes in the research, development, design, manufacture, inspection, and marketing of valves in Taiwan and has a market cap of NT$4.07 billion.

Operations: Value Valves Co., Ltd. generates its revenue primarily through the design, production, and sale of valves in Taiwan.

Dividend Yield: 5.8%

Value Valves' dividend yield of 5.84% ranks in the top 25% of Taiwan's market, supported by a cash payout ratio of 64.8%. However, its six-year history shows volatility with payments sometimes dropping over 20%, indicating unreliability. Despite trading at a discount to estimated fair value, recent earnings have declined significantly with net income falling to TWD 68.21 million from TWD 109.88 million year-on-year, raising concerns about future dividend stability and sustainability.

- Get an in-depth perspective on Value Valves' performance by reading our dividend report here.

- Our expertly prepared valuation report Value Valves implies its share price may be lower than expected.

Where To Now?

- Take a closer look at our Top Asian Dividend Stocks list of 1011 companies by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:4580

Value Valves

Engages in the research, development, design, manufacture, inspection, and marketing of valves in Taiwan.

Flawless balance sheet, good value and pays a dividend.

Market Insights

Community Narratives