- China

- /

- Consumer Durables

- /

- SZSE:002668

Undiscovered Gems And 2 Other Small Caps With Promising Potential

Reviewed by Simply Wall St

In a global market environment where U.S. stock indexes are climbing toward record highs and inflation data is fueling expectations for prolonged higher interest rates, small-cap stocks have been lagging behind larger indices like the S&P 500. Despite this underperformance, the current climate presents an intriguing opportunity to explore small-cap companies that may be undervalued or overlooked, offering promising potential for growth as economic conditions evolve. Identifying such undiscovered gems often involves looking for strong fundamentals and innovative business models that can thrive even amid broader market uncertainties.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Marítima de Inversiones | NA | 82.67% | 21.14% | ★★★★★★ |

| SHL Consolidated Bhd | NA | 16.14% | 19.01% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 7.47% | -26.86% | ★★★★★★ |

| Teekay | NA | -3.71% | 60.91% | ★★★★★★ |

| Aesler Grup Internasional | NA | -17.61% | -40.21% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 11.69% | 30.36% | ★★★★★☆ |

| Steamships Trading | 33.60% | 4.17% | 3.90% | ★★★★★☆ |

| Reitar Logtech Holdings | 31.39% | 231.46% | 41.38% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Guangdong TCL Smart Home Appliances (SZSE:002668)

Simply Wall St Value Rating: ★★★★★★

Overview: Guangdong TCL Smart Home Appliances Co., Ltd. operates in the smart home appliances sector and has a market cap of CN¥13.48 billion.

Operations: Guangdong TCL Smart Home Appliances generates revenue primarily through its smart home appliances sector.

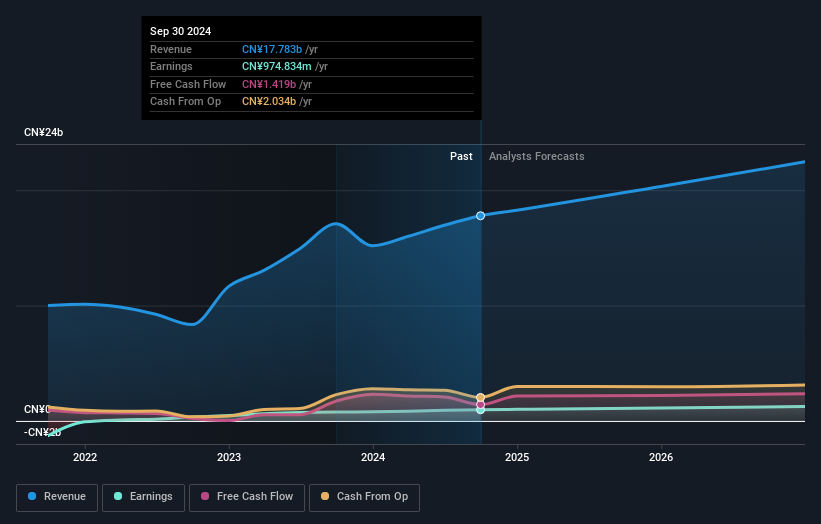

TCL Smart Home Appliances, a small-cap player in the consumer durables sector, has been making waves with its robust financial health. The company boasts a debt-to-equity ratio that has impressively dropped from 101.9% to 29.4% over five years, indicating prudent financial management. Trading at 61.7% below estimated fair value suggests potential undervaluation compared to peers and industry standards. Furthermore, TCL's earnings growth of 26.1% last year outpaced the industry's -1.9%, showcasing its competitive edge and high-quality earnings profile which is likely appealing for those eyeing promising opportunities in this space.

Beijing Jingneng Thermal (SZSE:002893)

Simply Wall St Value Rating: ★★★★★☆

Overview: Beijing Jingneng Thermal Co., Ltd. operates in the heating sector within China and has a market capitalization of CN¥2.81 billion.

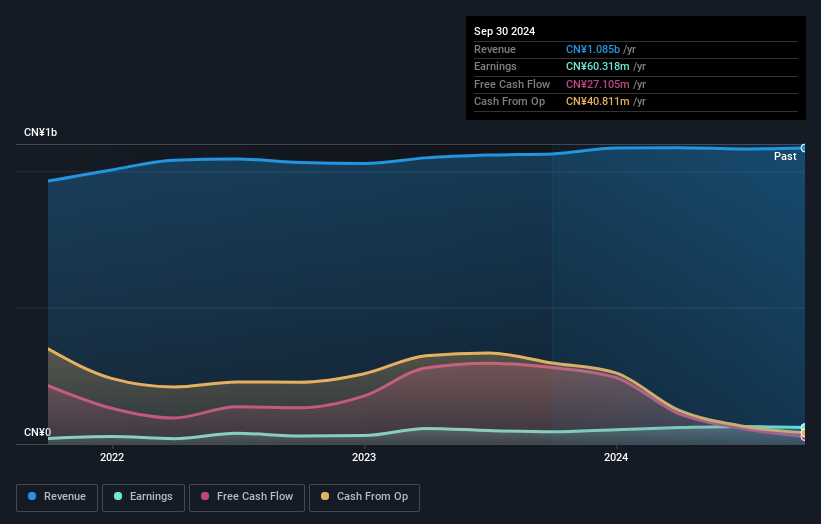

Operations: The primary revenue stream for Beijing Jingneng Thermal comes from its heat production and supply segment, generating CN¥1.09 billion. The company's financial performance includes a net profit margin trend worth noting, though specific figures are not provided here.

Beijing Jingneng Thermal, a smaller player in the energy sector, showcases impressive financial health with high-quality earnings and a significant reduction in its debt to equity ratio from 97.7% to 34.5% over five years. The company has more cash than total debt, indicating strong liquidity. Interest payments are comfortably covered by EBIT at 11.4 times, suggesting solid profitability management. Earnings growth of 34.5% outpaces the machinery industry's -0.06%, highlighting competitive performance within its sector context. Recent developments include an extraordinary shareholders meeting addressing audit and transaction measures, potentially influencing future governance and operational strategies.

- Navigate through the intricacies of Beijing Jingneng Thermal with our comprehensive health report here.

Assess Beijing Jingneng Thermal's past performance with our detailed historical performance reports.

GFC (TPEX:4506)

Simply Wall St Value Rating: ★★★★★☆

Overview: GFC. LTD., along with its subsidiaries, is involved in the manufacturing and sale of elevators, escalators, and generators in Taiwan with a market capitalization of NT$19.21 billion.

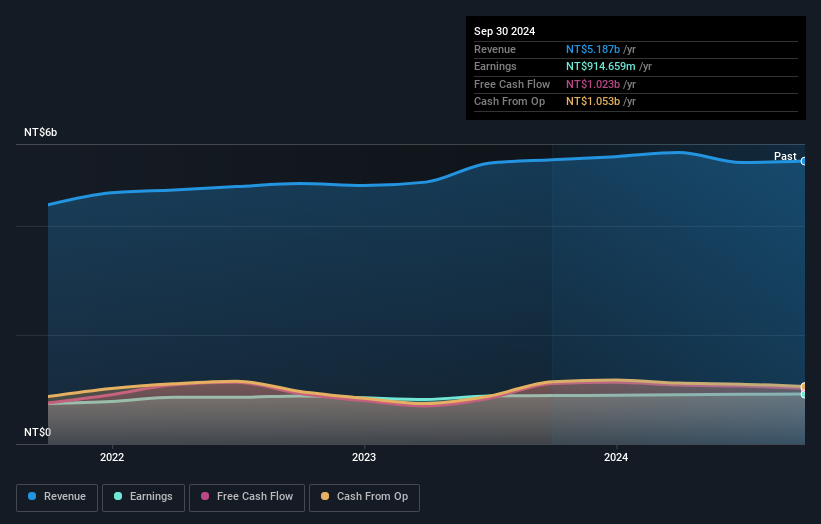

Operations: GFC generates revenue primarily from its Sales Department, including contributions from Shanghai Chong You Industrial Co., Ltd. and its subsidiaries, amounting to NT$2.97 billion, followed by the Maintenance Department at NT$2.34 billion.

GFC, a relatively small player in its industry, showcases a promising profile with earnings growing at 6.9% annually over the past five years. Despite this growth, its recent annual increase of 3.1% lagged behind the Machinery industry's 14.6%. The company boasts high-quality past earnings and maintains an appropriate debt level with more cash than total debt, reflecting financial prudence. Its price-to-earnings ratio of 21x is slightly below the TW market average of 21.3x, indicating potential value for investors seeking opportunities in smaller companies. GFC's active participation in events like TPEx & KGI Taiwan Corporate Day suggests ongoing efforts to engage with stakeholders and enhance visibility within its sector.

- Delve into the full analysis health report here for a deeper understanding of GFC.

Explore historical data to track GFC's performance over time in our Past section.

Seize The Opportunity

- Reveal the 4725 hidden gems among our Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002668

Guangdong TCL Smart Home Appliances

Guangdong TCL Smart Home Appliances Co., Ltd.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives