As global markets experience broad-based gains with U.S. indexes approaching record highs, investors are keeping a close eye on the Federal Reserve's upcoming decisions regarding interest rate cuts. Amidst this backdrop of economic optimism and geopolitical uncertainties, dividend stocks continue to attract attention for their potential to provide steady income and stability in volatile times.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.34% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.55% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 3.97% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.29% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 6.64% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.40% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.97% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.42% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.87% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.86% | ★★★★★★ |

Click here to see the full list of 1982 stocks from our Top Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

Bank of Hangzhou (SHSE:600926)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bank of Hangzhou Co., Ltd. offers a range of banking products and services to individuals, corporate clients, and small and micro businesses in China, with a market cap of approximately CN¥84.05 billion.

Operations: Bank of Hangzhou Co., Ltd. generates revenue through its diverse banking services tailored for individual customers, corporate entities, and small to micro-sized enterprises in China.

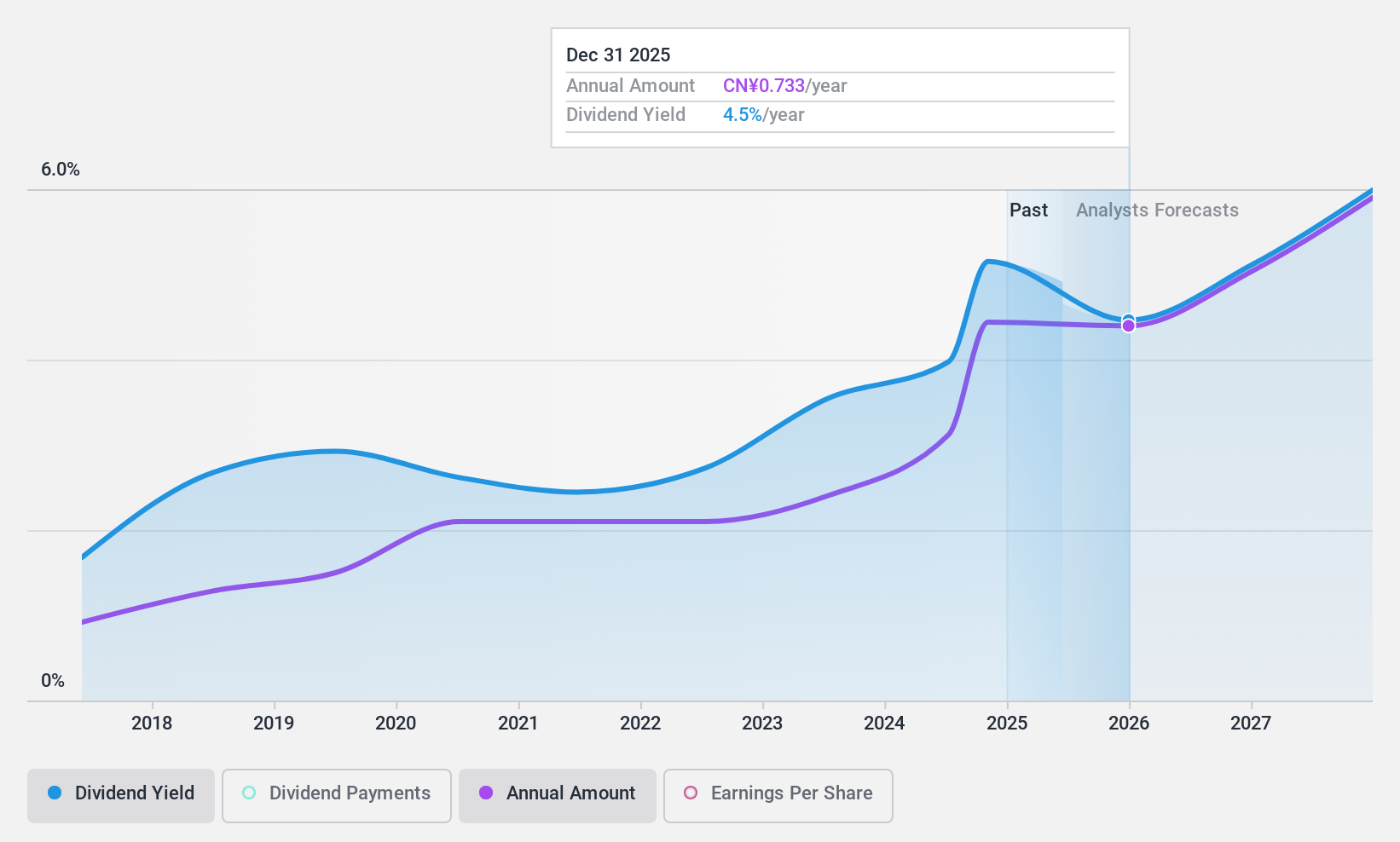

Dividend Yield: 5.3%

Bank of Hangzhou's dividend yield of 5.28% ranks in the top 25% among CN market dividend payers. With a payout ratio of 33.1%, dividends are well covered by earnings, ensuring sustainability and reliability despite being paid for less than a decade. Earnings grew by 19.5% over the past year, with future growth forecasted at 15.45% annually, supporting continued dividend payments and potential increases over time. Recent earnings reports show strong financial performance with net income rising to CNY 13.87 billion for the first nine months of 2024 from CNY 11.69 billion a year ago, indicating robust profitability that underpins its dividend strategy.

- Click here and access our complete dividend analysis report to understand the dynamics of Bank of Hangzhou.

- Upon reviewing our latest valuation report, Bank of Hangzhou's share price might be too pessimistic.

GFC (TPEX:4506)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: GFC. LTD., along with its subsidiaries, manufactures and sells elevators, escalators, and generators in Taiwan, with a market capitalization of NT$18.23 billion.

Operations: GFC. LTD.'s revenue is derived from the manufacturing and sale of elevators, escalators, and generators in Taiwan.

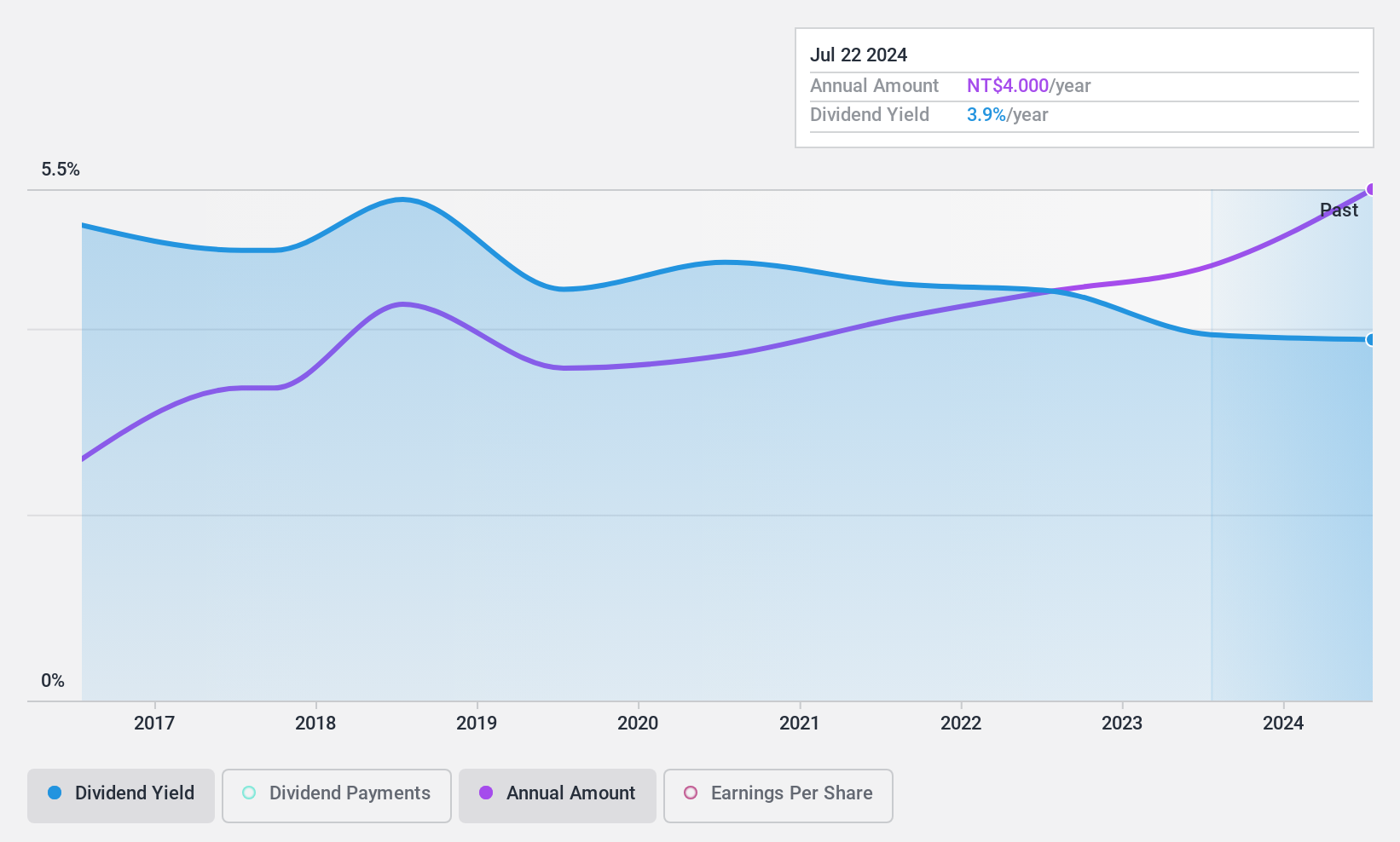

Dividend Yield: 3.9%

GFC's dividend yield of 3.88% is below the top tier of TW market payers, yet it maintains reliability and stability over the past decade. With a payout ratio of 77.4%, dividends are well-covered by earnings and cash flows, indicating sustainability. Recent earnings show modest growth with net income rising to TWD 246.65 million for Q3 2024 from TWD 243.01 million a year ago, supporting its consistent dividend strategy amidst stable financial performance.

- Click to explore a detailed breakdown of our findings in GFC's dividend report.

- The analysis detailed in our GFC valuation report hints at an inflated share price compared to its estimated value.

Aichi (TSE:6345)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Aichi Corporation manufactures and sells mechanized vehicles for industries such as electric utilities, telecommunications, construction, cargo handling, shipbuilding, and rail worldwide with a market cap of ¥90.07 billion.

Operations: Aichi Corporation's revenue is primarily derived from its Special Purpose Vehicle segment, which generated ¥44.84 billion, and the Parts and Repair segment, contributing ¥11.76 billion.

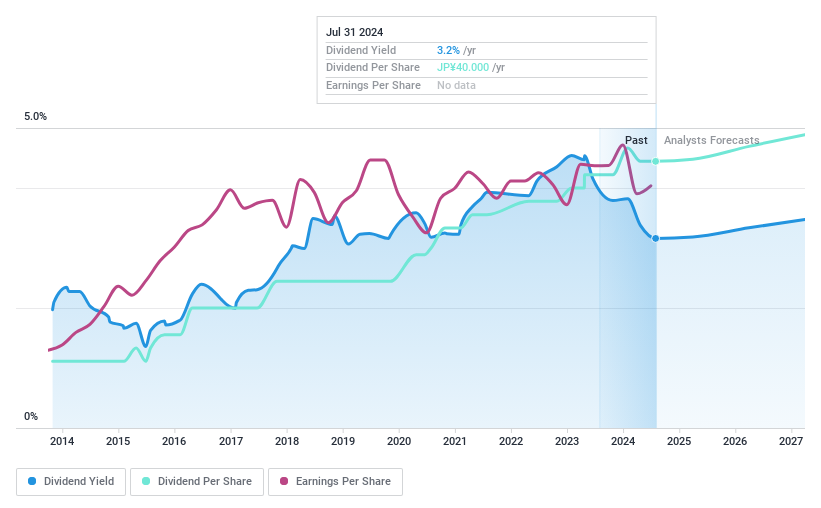

Dividend Yield: 3.3%

Aichi's dividend yield of 3.31% is below Japan's top-tier payers, with a payout ratio of 28.8% indicating dividends are well-covered by earnings and cash flows. Despite past volatility and unreliability, recent increases to JPY 20 per share suggest growth potential. The company reported half-year net income of JPY 2.22 billion, supporting its dividend strategy amidst improving financial results and an estimated undervaluation of the stock by over half its fair value.

- Dive into the specifics of Aichi here with our thorough dividend report.

- In light of our recent valuation report, it seems possible that Aichi is trading beyond its estimated value.

Turning Ideas Into Actions

- Explore the 1982 names from our Top Dividend Stocks screener here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6345

Aichi

Manufactures and sells mechanized vehicles for electric utilities, telecommunications, construction, cargo handling, shipbuilding, and rail industries worldwide.

Flawless balance sheet average dividend payer.