Buima Group Inc.'s (GTSM:5543) Price Is Out Of Tune With Earnings

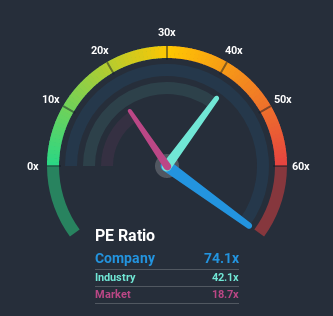

Buima Group Inc.'s (GTSM:5543) price-to-earnings (or "P/E") ratio of 74.1x might make it look like a strong sell right now compared to the market in Taiwan, where around half of the companies have P/E ratios below 18x and even P/E's below 13x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

Earnings have risen firmly for Buima Group recently, which is pleasing to see. One possibility is that the P/E is high because investors think this respectable earnings growth will be enough to outperform the broader market in the near future. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

See our latest analysis for Buima Group

Does Growth Match The High P/E?

There's an inherent assumption that a company should far outperform the market for P/E ratios like Buima Group's to be considered reasonable.

If we review the last year of earnings growth, the company posted a terrific increase of 28%. However, the latest three year period hasn't been as great in aggregate as it didn't manage to provide any growth at all. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 24% shows it's noticeably less attractive on an annualised basis.

With this information, we find it concerning that Buima Group is trading at a P/E higher than the market. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with recent growth rates.

What We Can Learn From Buima Group's P/E?

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Buima Group currently trades on a much higher than expected P/E since its recent three-year growth is lower than the wider market forecast. When we see weak earnings with slower than market growth, we suspect the share price is at risk of declining, sending the high P/E lower. Unless the recent medium-term conditions improve markedly, it's very challenging to accept these prices as being reasonable.

You should always think about risks. Case in point, we've spotted 3 warning signs for Buima Group you should be aware of, and 2 of them are concerning.

Of course, you might also be able to find a better stock than Buima Group. So you may wish to see this free collection of other companies that sit on P/E's below 20x and have grown earnings strongly.

If you’re looking to trade Buima Group, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Buima Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About TPEX:5543

Buima Group

Manufactures and sells residential metal ceilings, metal partitions, and T-grids for suspended ceilings in Mainland China, Taiwan, and internationally.

Slight and slightly overvalued.