There's no doubt that money can be made by owning shares of unprofitable businesses. For example, although software-as-a-service business Salesforce.com lost money for years while it grew recurring revenue, if you held shares since 2005, you'd have done very well indeed. Having said that, unprofitable companies are risky because they could potentially burn through all their cash and become distressed.

So, the natural question for Amita Technologies (GTSM:5233) shareholders is whether they should be concerned by its rate of cash burn. In this article, we define cash burn as its annual (negative) free cash flow, which is the amount of money a company spends each year to fund its growth. First, we'll determine its cash runway by comparing its cash burn with its cash reserves.

See our latest analysis for Amita Technologies

Does Amita Technologies Have A Long Cash Runway?

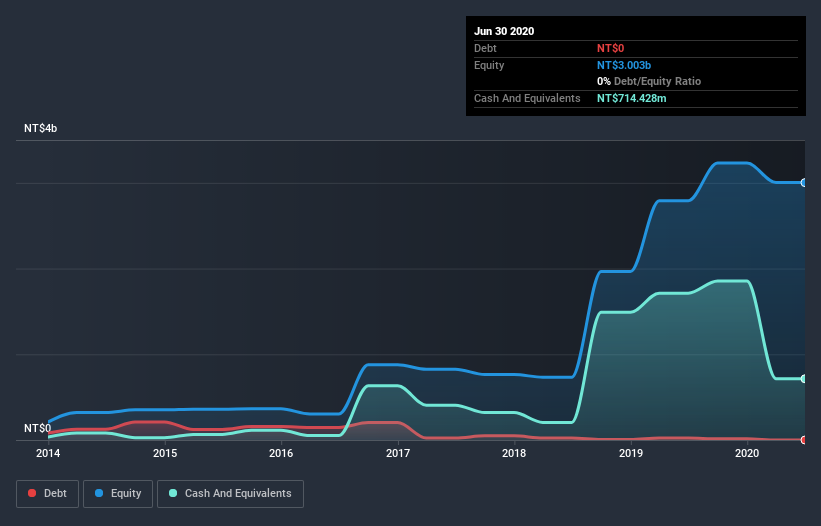

A company's cash runway is the amount of time it would take to burn through its cash reserves at its current cash burn rate. In June 2020, Amita Technologies had NT$714m in cash, and was debt-free. In the last year, its cash burn was NT$1.3b. So it had a cash runway of approximately 7 months from June 2020. To be frank, this kind of short runway puts us on edge, as it indicates the company must reduce its cash burn significantly, or else raise cash imminently. However, if we extrapolate the company's recent cash burn trend, then it would have a longer cash run way. The image below shows how its cash balance has been changing over the last few years.

How Well Is Amita Technologies Growing?

Notably, Amita Technologies actually ramped up its cash burn very hard and fast in the last year, by 133%, signifying heavy investment in the business. That does give us pause, and we can't take much solace in the operating revenue growth of 11% in the same time frame. Taken together, we think these growth metrics are a little worrying. Of course, we've only taken a quick look at the stock's growth metrics, here. You can take a look at how Amita Technologies has developed its business over time by checking this visualization of its revenue and earnings history.

How Hard Would It Be For Amita Technologies To Raise More Cash For Growth?

Since Amita Technologies has been boosting its cash burn, the market will likely be considering how it can raise more cash if need be. Companies can raise capital through either debt or equity. Many companies end up issuing new shares to fund future growth. By comparing a company's annual cash burn to its total market capitalisation, we can estimate roughly how many shares it would have to issue in order to run the company for another year (at the same burn rate).

Since it has a market capitalisation of NT$3.0b, Amita Technologies' NT$1.3b in cash burn equates to about 42% of its market value. From this perspective, it seems that the company spent a huge amount relative to its market value, and we'd be very wary of a painful capital raising.

How Risky Is Amita Technologies' Cash Burn Situation?

On this analysis of Amita Technologies' cash burn, we think its revenue growth was reassuring, while its increasing cash burn has us a bit worried. Considering all the measures mentioned in this report, we reckon that its cash burn is fairly risky, and if we held shares we'd be watching like a hawk for any deterioration. Separately, we looked at different risks affecting the company and spotted 3 warning signs for Amita Technologies (of which 1 is a bit unpleasant!) you should know about.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies, and this list of stocks growth stocks (according to analyst forecasts)

If you’re looking to trade Amita Technologies, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

If you're looking to trade Amita Technologies, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About TPEX:5233

Amita Technologies

Manufactures and sells lithium-ion polymer batteries in Taiwan.

Slight and slightly overvalued.

Market Insights

Community Narratives