- Taiwan

- /

- Electrical

- /

- TPEX:3226

Does Topower's (GTSM:3226) Share Price Gain of 23% Match Its Business Performance?

We believe investing is smart because history shows that stock markets go higher in the long term. But not every stock you buy will perform as well as the overall market. Unfortunately for shareholders, while the Topower Co., Ltd. (GTSM:3226) share price is up 23% in the last year, that falls short of the market return. However, the longer term returns haven't been so impressive, with the stock up just 11% in the last three years.

See our latest analysis for Topower

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Over the last twelve months, Topower actually shrank its EPS by 13%.

So we don't think that investors are paying too much attention to EPS. Indeed, when EPS is declining but the share price is up, it often means the market is considering other factors.

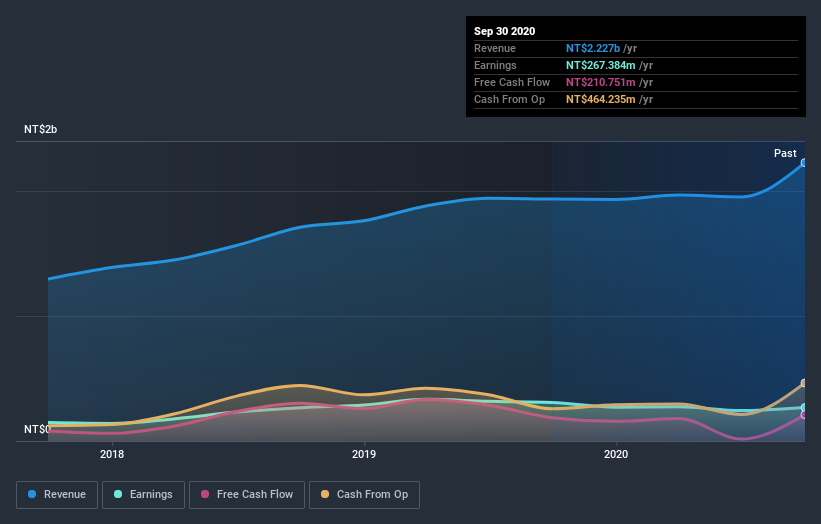

Absent any improvement, we don't think a thirst for dividends is pushing up the Topower's share price. Rather, we'd posit that the revenue increase of 15% might be more meaningful. Revenue growth often does precede earnings growth, so some investors might be willing to forgo profits today because they have their eyes fixed firmly on the future.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

This free interactive report on Topower's balance sheet strength is a great place to start, if you want to investigate the stock further.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. In the case of Topower, it has a TSR of 30% for the last year. That exceeds its share price return that we previously mentioned. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

Topower shareholders are up 30% for the year (even including dividends). But that was short of the market average. On the bright side, that's still a gain, and it's actually better than the average return of 1.1% over half a decade This suggests the company might be improving over time. It's always interesting to track share price performance over the longer term. But to understand Topower better, we need to consider many other factors. Take risks, for example - Topower has 1 warning sign we think you should be aware of.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on TW exchanges.

When trading Topower or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TPEX:3226

LFA

Manufactures and sells automotive components, electronic components, and power supplies in Taiwan.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives