Xin Chio Global Co., Ltd. (GTSM:3171) announced strong profits, but the stock was stagnant. Our analysis suggests that this might be because shareholders have noticed some concerning underlying factors.

View our latest analysis for Xin Chio Global

One essential aspect of assessing earnings quality is to look at how much a company is diluting shareholders. Xin Chio Global expanded the number of shares on issue by 14% over the last year. Therefore, each share now receives a smaller portion of profit. To talk about net income, without noticing earnings per share, is to be distracted by the big numbers while ignoring the smaller numbers that talk to per share value. Check out Xin Chio Global's historical EPS growth by clicking on this link.

A Look At The Impact Of Xin Chio Global's Dilution on Its Earnings Per Share (EPS).

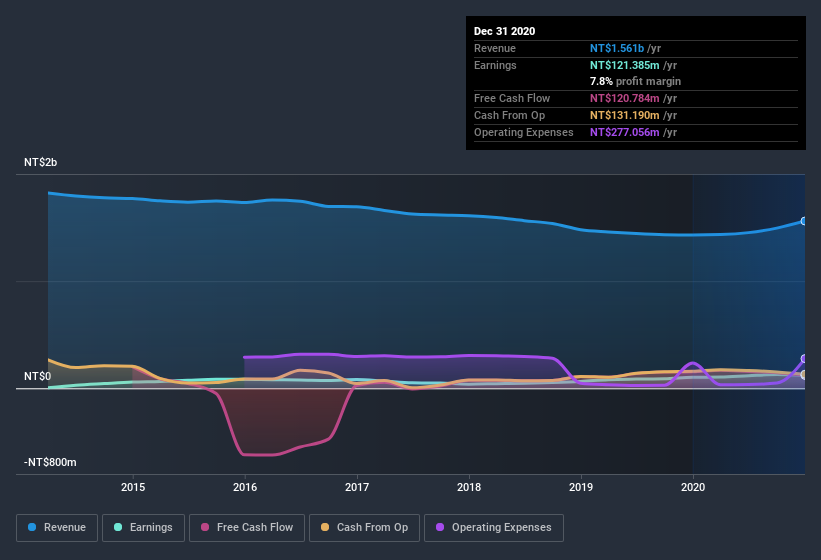

Xin Chio Global has improved its profit over the last three years, with an annualized gain of 213% in that time. And in the last year the company managed to bump profit up by 18%. But in comparison, EPS only increased by 22% over the same period. Therefore, the dilution is having a noteworthy influence on shareholder returns.

In the long term, earnings per share growth should beget share price growth. So Xin Chio Global shareholders will want to see that EPS figure continue to increase. But on the other hand, we'd be far less excited to learn profit (but not EPS) was improving. For the ordinary retail shareholder, EPS is a great measure to check your hypothetical "share" of the company's profit.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Xin Chio Global.

Our Take On Xin Chio Global's Profit Performance

Each Xin Chio Global share now gets a meaningfully smaller slice of its overall profit, due to dilution of existing shareholders. Therefore, it seems possible to us that Xin Chio Global's true underlying earnings power is actually less than its statutory profit. But the good news is that its EPS growth over the last three years has been very impressive. The goal of this article has been to assess how well we can rely on the statutory earnings to reflect the company's potential, but there is plenty more to consider. With this in mind, we wouldn't consider investing in a stock unless we had a thorough understanding of the risks. In terms of investment risks, we've identified 3 warning signs with Xin Chio Global, and understanding them should be part of your investment process.

Today we've zoomed in on a single data point to better understand the nature of Xin Chio Global's profit. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

When trading Xin Chio Global or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TPEX:3171

Yem Chio Distribution

Engages in the sale, import, and export of packaging materials in Taiwan, China, and internationally.

Flawless balance sheet with proven track record and pays a dividend.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.