- Taiwan

- /

- Construction

- /

- TPEX:6122

3 Reliable Dividend Stocks Offering Up To 6.1% Yield

Reviewed by Simply Wall St

As global markets experience broad-based gains, with U.S. indexes nearing record highs and positive sentiment fueled by strong labor market reports, investors are increasingly seeking stability amid geopolitical uncertainties and fluctuating economic conditions. In such an environment, dividend stocks can offer a reliable income stream, making them an attractive option for those looking to balance growth potential with steady returns.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.78% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.47% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.20% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.61% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.58% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.30% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.41% | ★★★★★★ |

| James Latham (AIM:LTHM) | 6.06% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.30% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.88% | ★★★★★★ |

Click here to see the full list of 1958 stocks from our Top Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

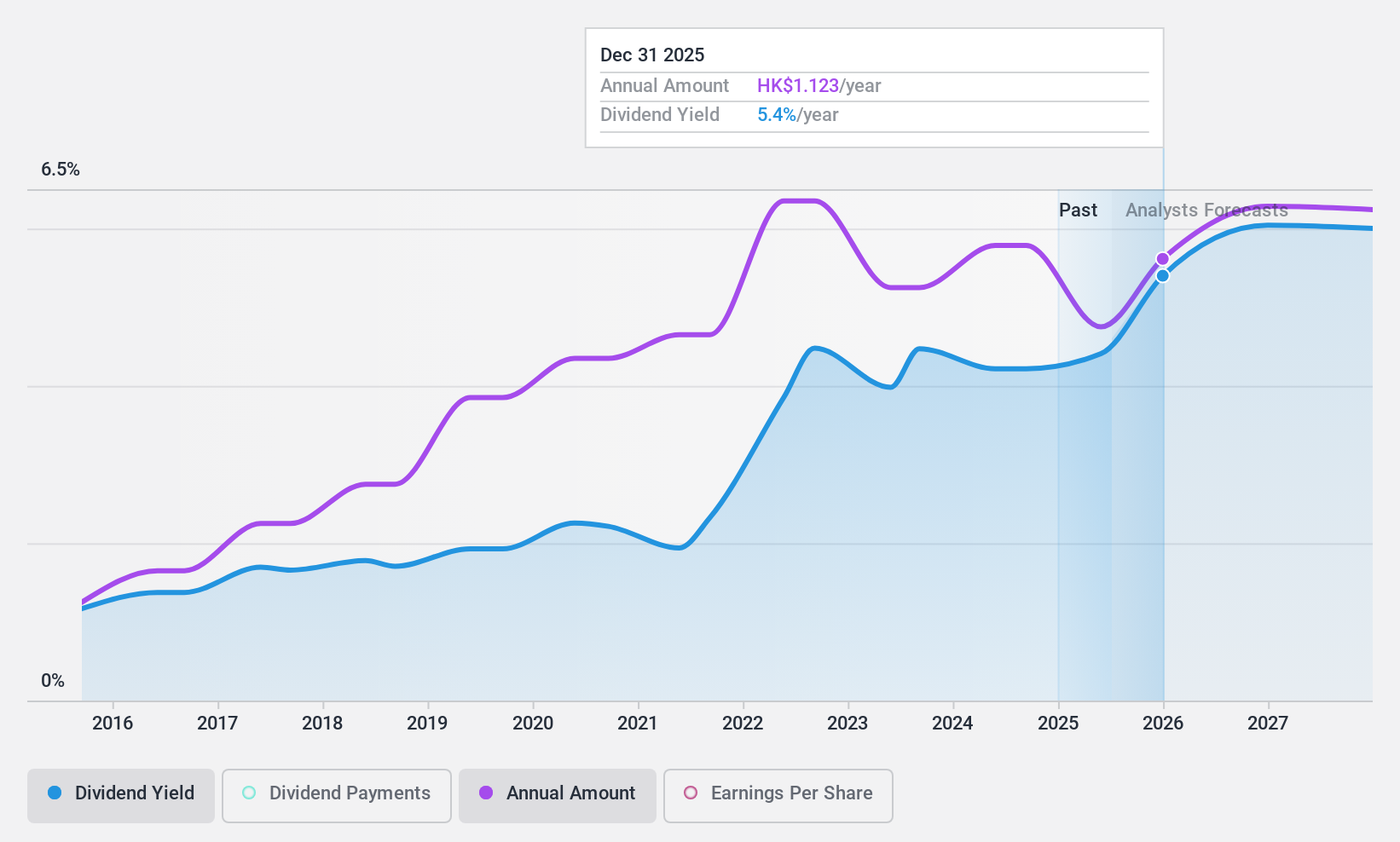

China Resources Gas Group (SEHK:1193)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: China Resources Gas Group Limited is an investment holding company involved in the sale of natural and liquefied gas and the connection of gas pipelines, with a market cap of approximately HK$67.57 billion.

Operations: China Resources Gas Group Limited generates revenue from several segments, including HK$87.31 billion from the sale and distribution of gas fuel and related products (excluding gas stations), HK$9.65 billion from gas connection services, HK$4.34 billion from comprehensive services, HK$3.23 billion from gas stations, and HK$0.44 billion from design and construction services.

Dividend Yield: 4%

China Resources Gas Group's dividend yield of 3.96% is low compared to the top dividend payers in Hong Kong. Despite a reasonable payout ratio of 55.5% and cash payout ratio of 61.6%, dividends have been unstable over the past decade, with volatility noted in annual payments. However, recent announcements show an interim dividend increase to HK$0.25 per share for mid-2024, indicating potential growth in their dividend strategy amidst stable earnings coverage.

- Dive into the specifics of China Resources Gas Group here with our thorough dividend report.

- Insights from our recent valuation report point to the potential undervaluation of China Resources Gas Group shares in the market.

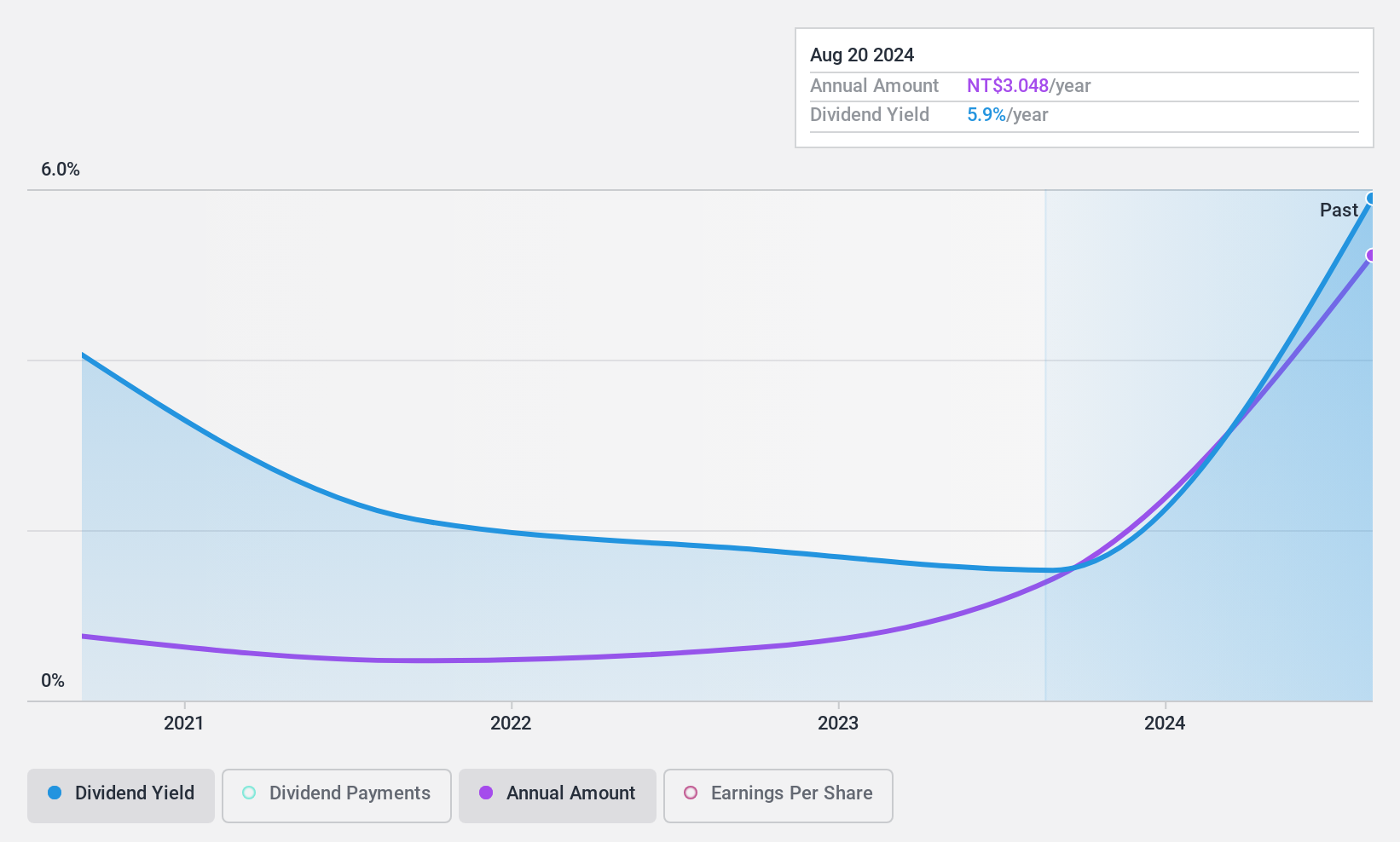

King Polytechnic Engineering (TPEX:6122)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: King Polytechnic Engineering Co., Ltd. is an integrated engineering and construction company operating in Taiwan and internationally, with a market cap of NT$3.89 billion.

Operations: King Polytechnic Engineering Co., Ltd. generates its revenue through its integrated engineering and construction activities both in Taiwan and on an international scale.

Dividend Yield: 6.1%

King Polytechnic Engineering's dividend yield of 6.13% ranks in the top 25% of Taiwan's market, but its dividend history is less than a decade old and has been volatile, with annual drops over 20%. Despite this, dividends are covered by earnings and cash flows with payout ratios of 58.4% and 62.6%, respectively. The company's P/E ratio of 9.5x suggests good value compared to the market average, supported by a recent earnings growth of TWD 268.58 million for nine months in 2024.

- Click here to discover the nuances of King Polytechnic Engineering with our detailed analytical dividend report.

- Our comprehensive valuation report raises the possibility that King Polytechnic Engineering is priced higher than what may be justified by its financials.

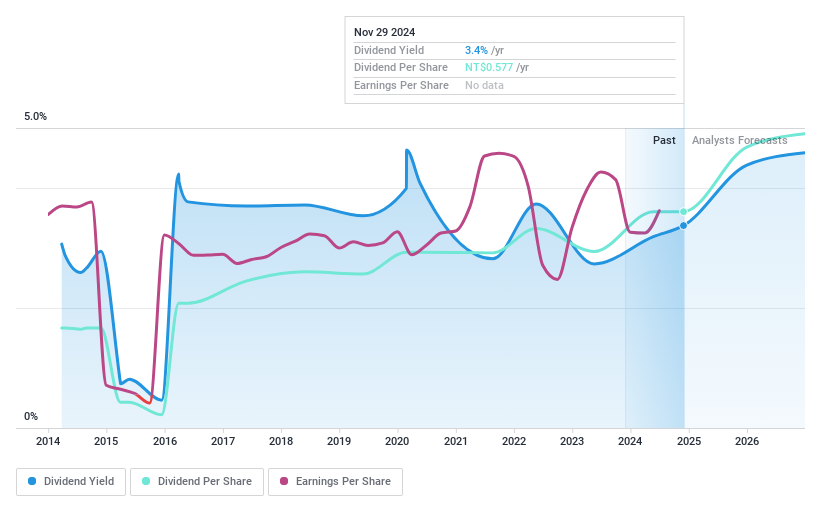

Taishin Financial Holding (TWSE:2887)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Taishin Financial Holding Co., Ltd. operates in Taiwan and internationally, offering a range of financial products and services through its subsidiaries, with a market cap of NT$244.22 billion.

Operations: Taishin Financial Holding Co., Ltd.'s revenue is primarily derived from Taishin Life (NT$21.87 billion), Taishin Bank's Personal Finance Business Headquarters (NT$29.46 billion), Corporate Financial Business Headquarters (NT$15.57 billion), and Taishin Securities Merger (NT$5.55 billion).

Dividend Yield: 3.3%

Taishin Financial Holding's dividends are covered by earnings with a payout ratio of 52.3%, though they have been volatile over the past decade. The dividend yield is relatively low at 3.33% compared to Taiwan's top payers. Despite trading below its estimated fair value, shareholder dilution has occurred recently, and dividend reliability remains a concern due to an unstable track record, despite some growth in payouts over ten years.

- Delve into the full analysis dividend report here for a deeper understanding of Taishin Financial Holding.

- Insights from our recent valuation report point to the potential overvaluation of Taishin Financial Holding shares in the market.

Key Takeaways

- Discover the full array of 1958 Top Dividend Stocks right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade King Polytechnic Engineering, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if King Polytechnic Engineering might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:6122

King Polytechnic Engineering

Operates as an integrated engineering and construction company in Taiwan and internationally.

Excellent balance sheet and fair value.

Market Insights

Community Narratives