- South Korea

- /

- Capital Markets

- /

- KOSDAQ:A064850

Undiscovered Gems These 3 Hidden Small Caps Offer Unique Opportunities

Reviewed by Simply Wall St

With the recent Federal Reserve rate cut and a broad rally in U.S. stocks, small-cap indexes like the Russell 2000 have shown notable performance despite still being below their all-time highs. This market environment presents an opportune moment to explore lesser-known small-cap stocks that offer unique growth potential. In this context, identifying promising small-cap stocks involves looking for companies with strong fundamentals, innovative business models, and the ability to capitalize on current economic trends.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Soliton Systems K.K | 0.58% | 5.04% | 16.76% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Nofoth Food Products | NA | 14.41% | 31.88% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Amana Cooperative Insurance | NA | -1.95% | 20.64% | ★★★★★★ |

| Marusan Securities | 5.33% | 1.01% | 10.00% | ★★★★★☆ |

| Central Cooperative Bank AD | 4.88% | 4.12% | 8.95% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Holcim (Liban)L (BDB:HOLC)

Simply Wall St Value Rating: ★★★★★☆

Overview: Holcim (Liban) S.A.L. is a cement company involved in the production, export, and sale of cement and related products in Lebanon, with a market cap of $1.37 billion.

Operations: Holcim (Liban) S.A.L. generates revenue primarily from the production, export, and sale of cement and related products in Lebanon. The company has a market cap of $1.37 billion.

Holcim (Liban) has shown remarkable growth, with earnings surging by 800.2% in the past year, outpacing the Basic Materials industry's 9.4%. Its debt to equity ratio increased from 27.3% to 119% over five years, yet it holds more cash than total debt, indicating financial robustness. With EBIT covering interest payments 3.7 times over and high non-cash earnings contributing to profitability, Holcim stands out despite its highly illiquid shares and recent shareholder meetings highlighting ongoing corporate activities in Lebanon.

- Dive into the specifics of Holcim (Liban)L here with our thorough health report.

Evaluate Holcim (Liban)L's historical performance by accessing our past performance report.

FnGuide (KOSDAQ:A064850)

Simply Wall St Value Rating: ★★★★☆☆

Overview: FnGuide Inc. provides online-based financial information services and has a market cap of ₩336 billion.

Operations: The company generates revenue primarily from its online financial information services, amounting to ₩31.33 billion.

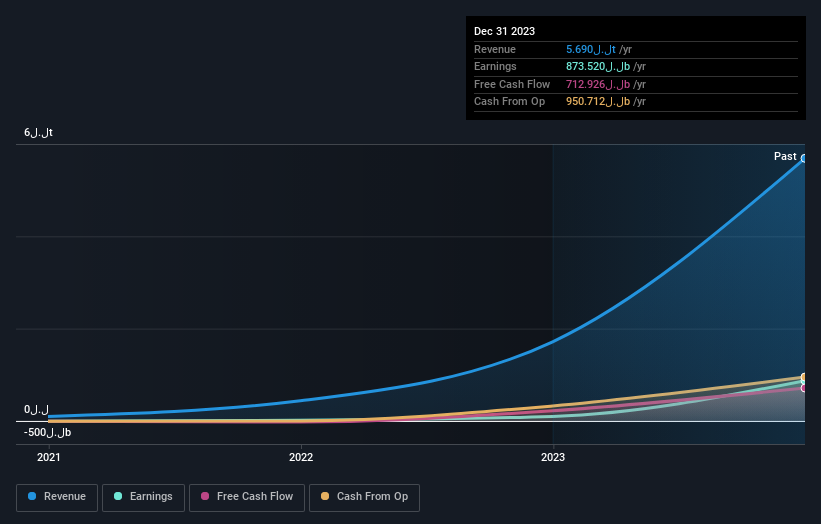

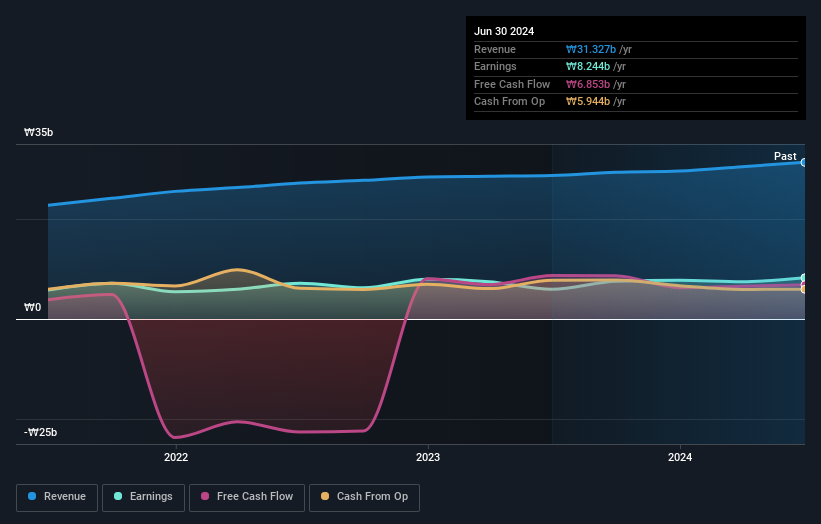

FnGuide, a small cap in the financial sector, has shown impressive earnings growth of 38.8% over the past year, outpacing its industry average of 21.5%. The company’s net debt to equity ratio stands at a satisfactory 10.3%, indicating prudent financial management. A significant one-off gain of ₩2.5B has boosted its recent financial results, while interest payments are well covered by EBIT at 20.6x coverage. Despite high share price volatility recently, FnGuide remains profitable and free cash flow positive with ₩6.85B as of June 2024.

King's Town Bank (TWSE:2809)

Simply Wall St Value Rating: ★★★★★★

Overview: King's Town Bank Co., Ltd. operates in Taiwan, offering a range of banking products and services, with a market cap of NT$62.67 billion.

Operations: King's Town Bank generates revenue primarily from branch sales (NT$7.97 billion) and financial market activities (NT$2.98 billion).

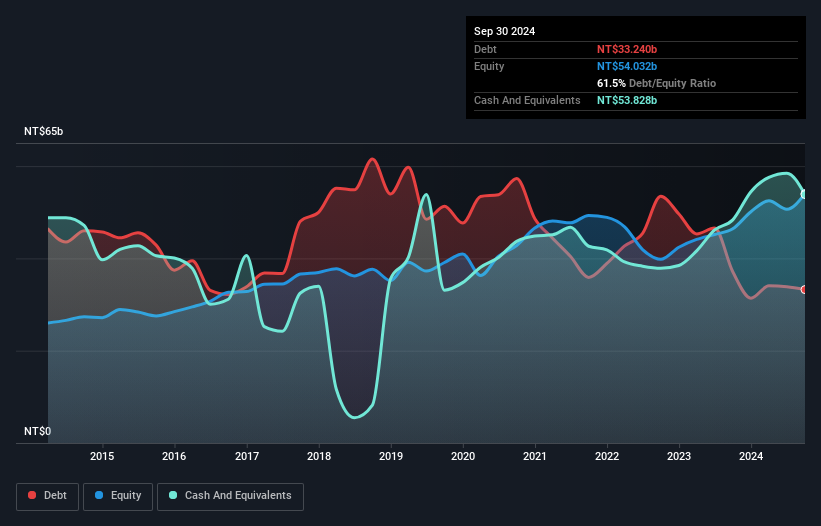

King's Town Bank, with total assets of NT$387.2B and equity of NT$50.7B, has seen earnings growth of 91.1% in the past year, outperforming the industry average of 2.8%. Total deposits stand at NT$293.9B while loans are NT$223.4B. The bank holds a sufficient allowance for bad loans at 7618%, with bad loans currently at 0%. Trading at nearly 35% below estimated fair value, it also benefits from primarily low-risk funding sources (87%).

- Click here to discover the nuances of King's Town Bank with our detailed analytical health report.

Explore historical data to track King's Town Bank's performance over time in our Past section.

Taking Advantage

- Reveal the 4843 hidden gems among our Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A064850

Adequate balance sheet second-rate dividend payer.