Did You Participate In Any Of Taiwan Cooperative Financial Holding's (TPE:5880) Fantastic 112% Return ?

If you want to compound wealth in the stock market, you can do so by buying an index fund. But in our experience, buying the right stocks can give your wealth a significant boost. For example, the Taiwan Cooperative Financial Holding Co., Ltd. (TPE:5880) share price is 76% higher than it was five years ago, which is more than the market average. In stark contrast, the stock price has actually fallen 0.7% in the last year.

Check out our latest analysis for Taiwan Cooperative Financial Holding

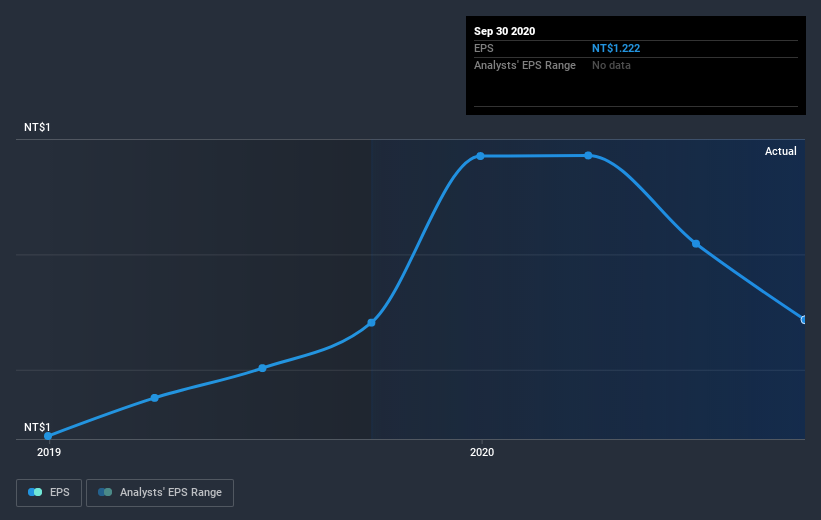

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Over half a decade, Taiwan Cooperative Financial Holding managed to grow its earnings per share at 5.0% a year. This EPS growth is lower than the 12% average annual increase in the share price. This suggests that market participants hold the company in higher regard, these days. And that's hardly shocking given the track record of growth.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. As it happens, Taiwan Cooperative Financial Holding's TSR for the last 5 years was 112%, which exceeds the share price return mentioned earlier. This is largely a result of its dividend payments!

A Different Perspective

Taiwan Cooperative Financial Holding shareholders gained a total return of 3.3% during the year. But that was short of the market average. On the bright side, the longer term returns (running at about 16% a year, over half a decade) look better. It may well be that this is a business worth popping on the watching, given the continuing positive reception, over time, from the market. It's always interesting to track share price performance over the longer term. But to understand Taiwan Cooperative Financial Holding better, we need to consider many other factors. To that end, you should learn about the 2 warning signs we've spotted with Taiwan Cooperative Financial Holding (including 1 which is doesn't sit too well with us) .

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on TW exchanges.

If you decide to trade Taiwan Cooperative Financial Holding, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Taiwan Cooperative Financial Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About TWSE:5880

Taiwan Cooperative Financial Holding

Provides commercial banking, insurance, securities, bills finance, venture capital, asset management, and investment trust services in Taiwan.

Flawless balance sheet with acceptable track record.