As global markets navigate a period of cautious optimism following the Federal Reserve's recent rate cuts and mixed economic signals, investors are closely watching how these developments impact various sectors. Amidst this backdrop, dividend stocks continue to attract attention for their potential to provide steady income streams in uncertain times. A good dividend stock often combines a strong track record of consistent payouts with solid fundamentals, making them appealing options for those seeking stability in today's fluctuating market environment.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.38% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.15% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.74% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.06% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.54% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.36% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.87% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.48% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.84% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.22% | ★★★★★★ |

Click here to see the full list of 1937 stocks from our Top Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

Huangshan NovelLtd (SZSE:002014)

Simply Wall St Dividend Rating: ★★★★★★

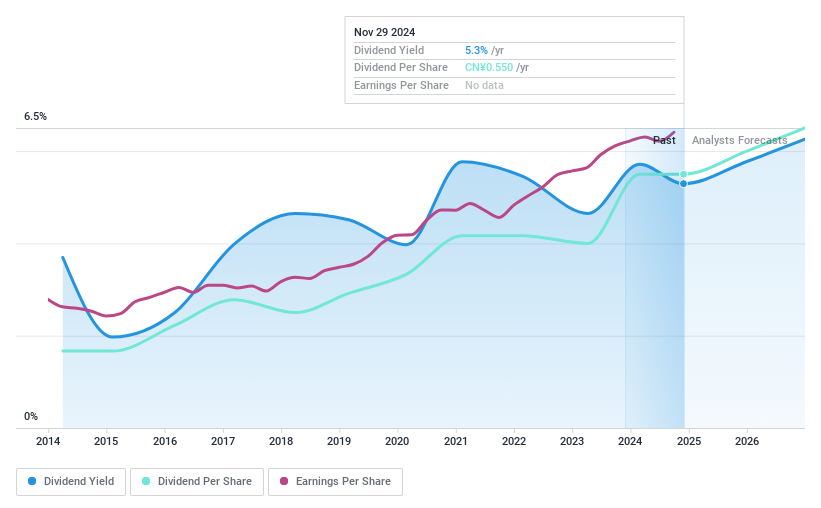

Overview: Huangshan Novel Co., Ltd specializes in the manufacturing and sale of packaging materials both in China and internationally, with a market capitalization of CN¥6.47 billion.

Operations: Huangshan Novel Co., Ltd generates its revenue through the production and distribution of packaging materials across domestic and international markets.

Dividend Yield: 5.2%

Huangshan Novel Ltd. offers a compelling dividend profile, with a payout ratio of 79.7% covered by earnings and a cash payout ratio of 65.1%, ensuring sustainability. Trading at 14.7% below its estimated fair value, it provides good value for investors seeking dividends. The company has maintained reliable and growing dividends over the past decade, with a current yield of 5.2%, placing it in the top quartile among Chinese dividend payers (2.15%). Recent earnings growth supports continued dividend stability and attractiveness for income-focused investors.

- Dive into the specifics of Huangshan NovelLtd here with our thorough dividend report.

- Our valuation report unveils the possibility Huangshan NovelLtd's shares may be trading at a discount.

Toa Road (TSE:1882)

Simply Wall St Dividend Rating: ★★★★★☆

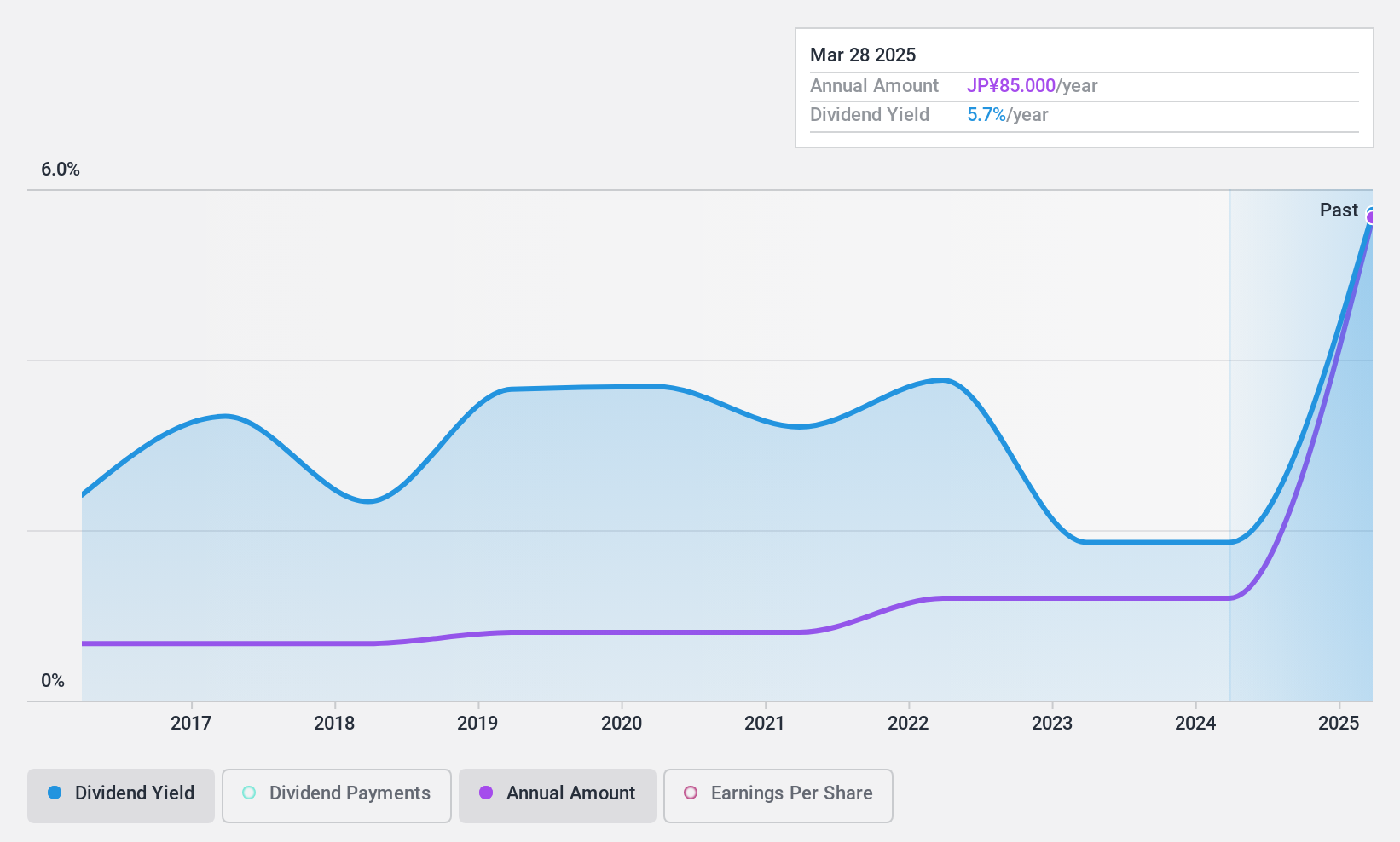

Overview: Toa Road Corporation operates in the civil engineering sector in Japan with a market capitalization of ¥59.89 billion.

Operations: Toa Road Corporation generates revenue through its Construction Business, which contributes ¥72.66 billion, and its Manufacturing and Sales, Environmental Business, Etc., which adds ¥49.52 billion.

Dividend Yield: 4%

Toa Road's dividend yield of 3.97% ranks in the top 25% of JP market payers, though it's not covered by free cash flows, raising sustainability concerns. Despite this, dividends have been stable and growing over the past decade with a payout ratio of 50.3%, indicating coverage by earnings. However, high non-cash earnings suggest caution for investors prioritizing dividend reliability and growth potential amidst modest earnings growth of 3.4% annually over five years.

- Take a closer look at Toa Road's potential here in our dividend report.

- In light of our recent valuation report, it seems possible that Toa Road is trading beyond its estimated value.

Eurocharm Holdings (TWSE:5288)

Simply Wall St Dividend Rating: ★★★★☆☆

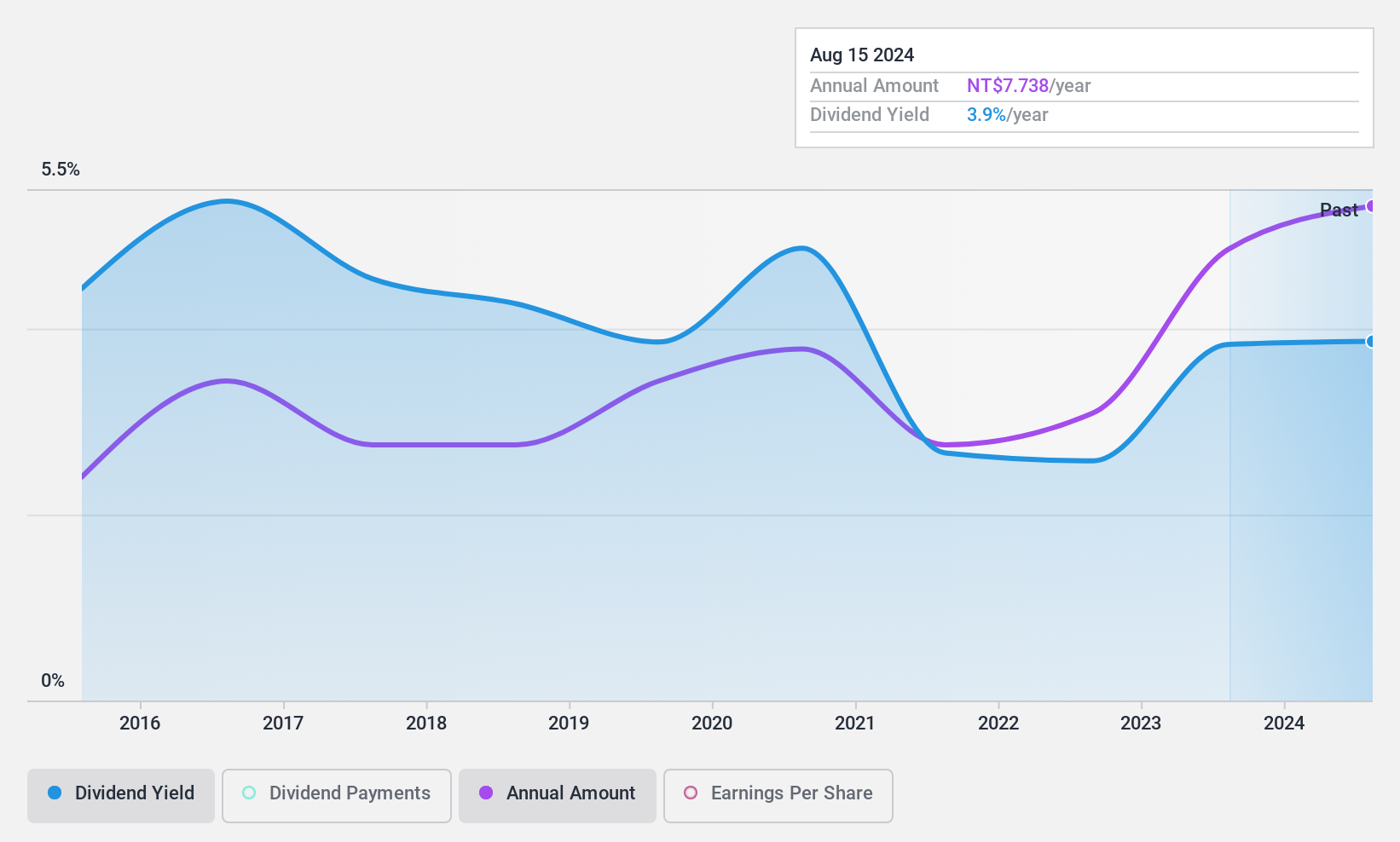

Overview: Eurocharm Holdings Co., Ltd. manufactures and sells motorcycle and auto equipment parts, medical equipment, and machine parts in Taiwan, Vietnam, and internationally, with a market cap of NT$13.15 billion.

Operations: Eurocharm Holdings Co., Ltd. generates revenue of NT$7.31 billion from its operations in manufacturing and selling automobile, locomotive parts, and medical equipment.

Dividend Yield: 3.9%

Eurocharm Holdings' dividend yield of 3.93% is below the top 25% in the TW market, yet its payout ratio of 50.1% suggests dividends are covered by earnings. Despite a volatile and unreliable dividend history over the past decade, recent payments have been supported by cash flows with a low cash payout ratio of 33.8%. Earnings growth at 16.1% annually over five years indicates potential for future stability, though past shareholder dilution warrants caution.

- Get an in-depth perspective on Eurocharm Holdings' performance by reading our dividend report here.

- Upon reviewing our latest valuation report, Eurocharm Holdings' share price might be too pessimistic.

Taking Advantage

- Get an in-depth perspective on all 1937 Top Dividend Stocks by using our screener here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Huangshan NovelLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002014

Huangshan NovelLtd

Manufactures and sells packaging materials in China and internationally.

6 star dividend payer with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives