- Japan

- /

- Gas Utilities

- /

- TSE:9543

Dividend Stocks To Consider In November 2024

Reviewed by Simply Wall St

As global markets show signs of recovery with U.S. indexes approaching record highs and a strong labor market boosting sentiment, investors are increasingly looking for stable options amid geopolitical uncertainties and fluctuating economic policies. Dividend stocks often provide a reliable income stream, making them an attractive consideration for those seeking to balance growth potential with risk mitigation in today's dynamic market environment.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.54% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.96% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.28% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 6.72% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.50% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.37% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.80% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.58% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.39% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.79% | ★★★★★★ |

Click here to see the full list of 1950 stocks from our Top Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

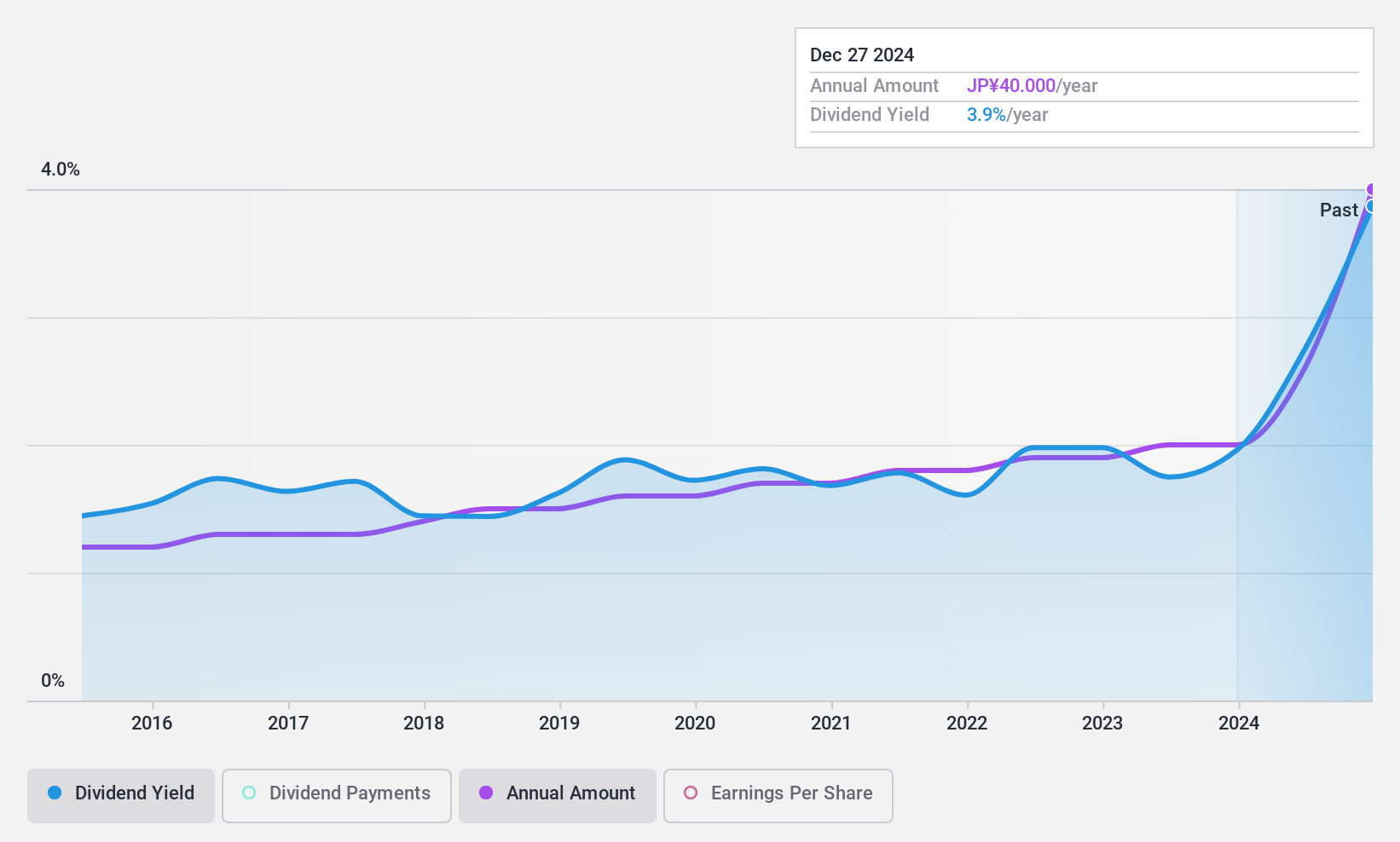

Shizuoka Gas (TSE:9543)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Shizuoka Gas Co., Ltd. is a Japanese company engaged in the production, supply, and sale of city gas, with a market cap of approximately ¥78.12 billion.

Operations: Shizuoka Gas Co., Ltd. generates revenue primarily through the production, supply, and sale of city gas in Japan.

Dividend Yield: 3.9%

Shizuoka Gas offers a stable dividend profile with a payout ratio of 28.9%, ensuring dividends are well covered by earnings and cash flows (52% cash payout ratio). The company's dividends have been reliable and growing over the past decade, yielding 3.85%, placing it in the top quartile of Japanese dividend payers. Despite recent profit margin declines, Shizuoka Gas trades at a significant discount to its estimated fair value, suggesting potential value for investors seeking income stability.

- Dive into the specifics of Shizuoka Gas here with our thorough dividend report.

- Upon reviewing our latest valuation report, Shizuoka Gas' share price might be too pessimistic.

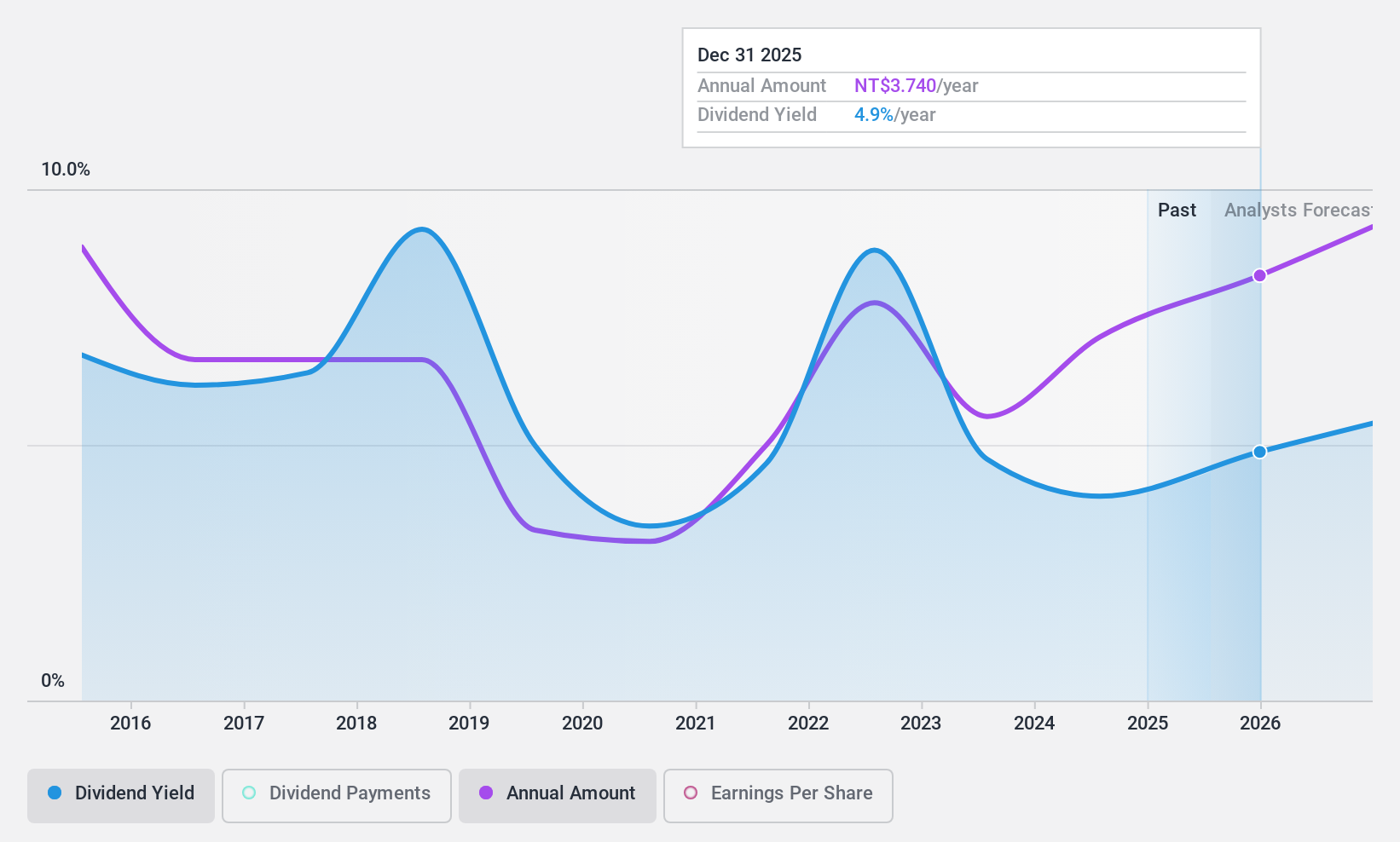

Everlight Electronics (TWSE:2393)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Everlight Electronics Co., Ltd. manufactures and sells light-emitting diodes (LEDs) in Taiwan, the rest of Asia, the United States, and internationally, with a market cap of approximately NT$34.98 billion.

Operations: Everlight Electronics Co., Ltd. generates revenue through the production and distribution of LEDs across Taiwan, other parts of Asia, the United States, and various international markets.

Dividend Yield: 4.1%

Everlight Electronics' dividend payments, while increasing over the past decade, have been volatile with a history of significant annual drops. Despite this instability, dividends are covered by both earnings and cash flows with payout ratios of 62.9% and 57.2%, respectively. Recent earnings growth of 76.5% supports dividend sustainability. The stock trades at a favorable price-to-earnings ratio of 15.5x compared to the TW market average, offering relative value despite its lower-than-top-tier yield of 4.06%.

- Click here to discover the nuances of Everlight Electronics with our detailed analytical dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Everlight Electronics shares in the market.

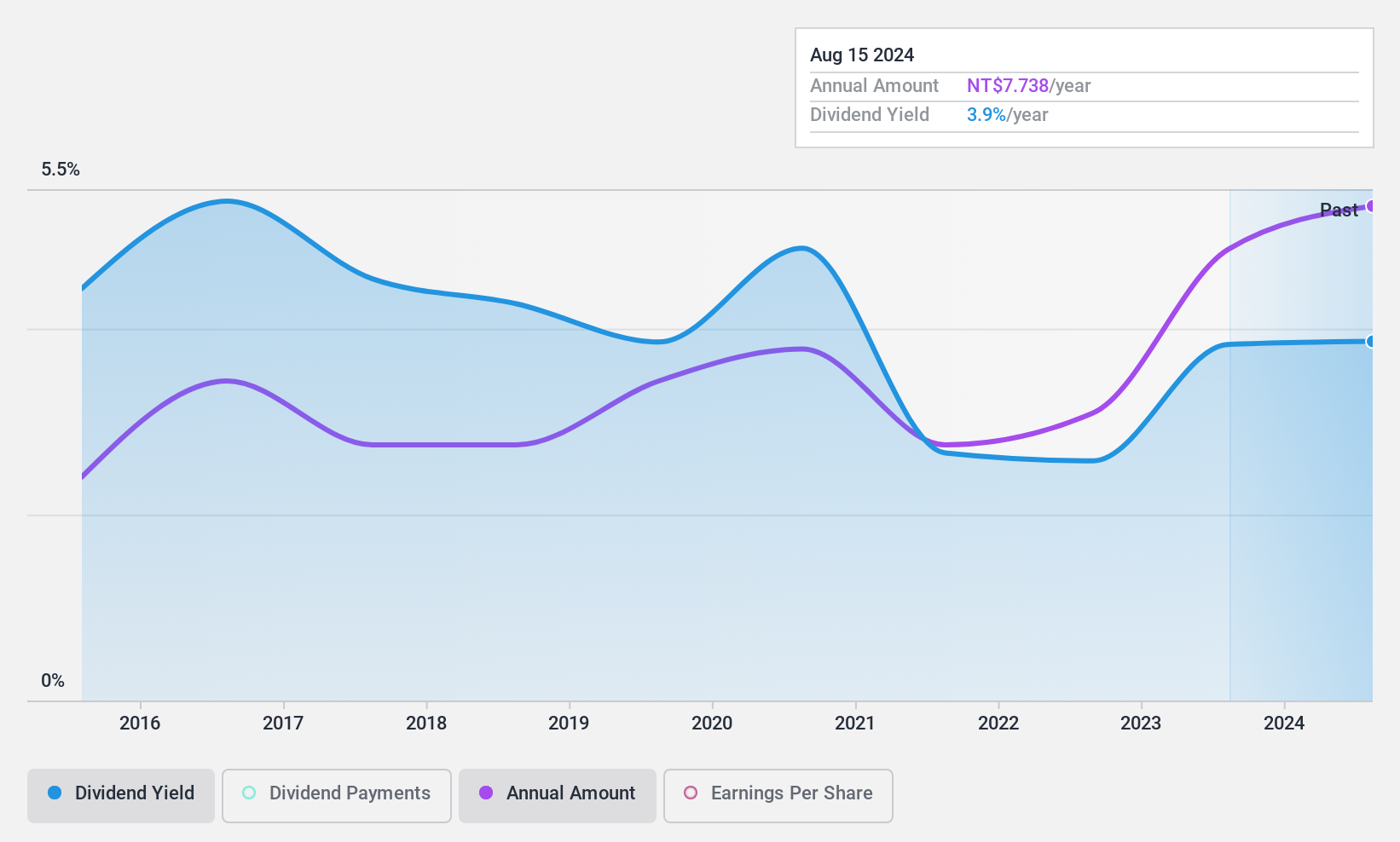

Eurocharm Holdings (TWSE:5288)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Eurocharm Holdings Co., Ltd. manufactures and sells motorcycle and auto equipment parts, medical equipment, and machine parts in Taiwan, Vietnam, and internationally with a market cap of approximately NT$13.29 billion.

Operations: Eurocharm Holdings Co., Ltd. generates NT$7.31 billion in revenue from its manufacturing and sales of automobile, locomotive parts, and medical equipment.

Dividend Yield: 3.9%

Eurocharm Holdings has shown a stable earnings growth of 16.1% annually over the past five years, supporting its dividend sustainability with a payout ratio of 50.1%. Despite this, its dividend yield is lower than top-tier payers in Taiwan at 3.95%, and it has an unstable track record with volatile payments over the past decade. Recent Q3 results indicate steady sales but declining net income, which may impact future dividend reliability despite adequate cash flow coverage at a 33.8% payout ratio.

- Navigate through the intricacies of Eurocharm Holdings with our comprehensive dividend report here.

- Our valuation report unveils the possibility Eurocharm Holdings' shares may be trading at a discount.

Where To Now?

- Unlock more gems! Our Top Dividend Stocks screener has unearthed 1947 more companies for you to explore.Click here to unveil our expertly curated list of 1950 Top Dividend Stocks.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9543

Excellent balance sheet established dividend payer.