- Taiwan

- /

- Auto Components

- /

- TWSE:2497

After Leaping 31% E-Lead Electronic Co., Ltd. (TWSE:2497) Shares Are Not Flying Under The Radar

E-Lead Electronic Co., Ltd. (TWSE:2497) shareholders would be excited to see that the share price has had a great month, posting a 31% gain and recovering from prior weakness. The bad news is that even after the stocks recovery in the last 30 days, shareholders are still underwater by about 3.0% over the last year.

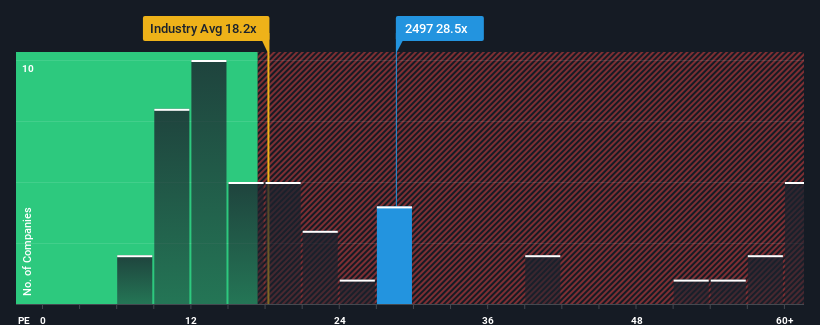

Since its price has surged higher, given around half the companies in Taiwan have price-to-earnings ratios (or "P/E's") below 21x, you may consider E-Lead Electronic as a stock to potentially avoid with its 28.5x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's as high as it is.

For example, consider that E-Lead Electronic's financial performance has been pretty ordinary lately as earnings growth is non-existent. It might be that many are expecting an improvement to the uninspiring earnings performance over the coming period, which has kept the P/E from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for E-Lead Electronic

Is There Enough Growth For E-Lead Electronic?

E-Lead Electronic's P/E ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the market.

If we review the last year of earnings, the company posted a result that saw barely any deviation from a year ago. Still, the latest three year period has seen an excellent 3,416% overall rise in EPS, in spite of its uninspiring short-term performance. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 24% shows it's noticeably more attractive on an annualised basis.

With this information, we can see why E-Lead Electronic is trading at such a high P/E compared to the market. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the bourse.

The Bottom Line On E-Lead Electronic's P/E

E-Lead Electronic's P/E is getting right up there since its shares have risen strongly. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that E-Lead Electronic maintains its high P/E on the strength of its recent three-year growth being higher than the wider market forecast, as expected. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. If recent medium-term earnings trends continue, it's hard to see the share price falling strongly in the near future under these circumstances.

A lot of potential risks can sit within a company's balance sheet. Our free balance sheet analysis for E-Lead Electronic with six simple checks will allow you to discover any risks that could be an issue.

If these risks are making you reconsider your opinion on E-Lead Electronic, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if E-Lead Electronic might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:2497

E-Lead Electronic

Designs and manufactures electronics devices for automotive industry in Taiwan and internationally.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives