- Japan

- /

- Specialty Stores

- /

- TSE:8219

Discovering Three Hidden Gems with Promising Potential

Reviewed by Simply Wall St

In the wake of a significant rally in U.S. stocks driven by expectations of lower corporate taxes and deregulation following recent political developments, small-cap indices like the Russell 2000 have shown notable gains, reflecting renewed investor optimism. As market dynamics shift, identifying stocks with strong fundamentals and growth potential becomes crucial for investors seeking to capitalize on emerging opportunities amidst these evolving economic conditions.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Marítima de Inversiones | NA | 86.64% | 24.51% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| MAPFRE Middlesea | NA | 14.56% | 1.77% | ★★★★★☆ |

| Steamships Trading | 33.60% | 4.17% | 3.90% | ★★★★★☆ |

| La Positiva Seguros y Reaseguros | 0.20% | 7.84% | 27.00% | ★★★★☆☆ |

| BOSQAR d.d | 94.35% | 39.99% | 23.94% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Jiangsu Ankura Intelligent Power (SZSE:300617)

Simply Wall St Value Rating: ★★★★★★

Overview: Jiangsu Ankura Intelligent Power Co., Ltd. operates in the electric equipment industry and has a market capitalization of approximately CN¥4.71 billion.

Operations: Ankura Intelligent Power generates revenue primarily from its electric equipment segment, amounting to CN¥948.17 million. The company's financial performance is influenced by the costs associated with this segment, impacting overall profitability.

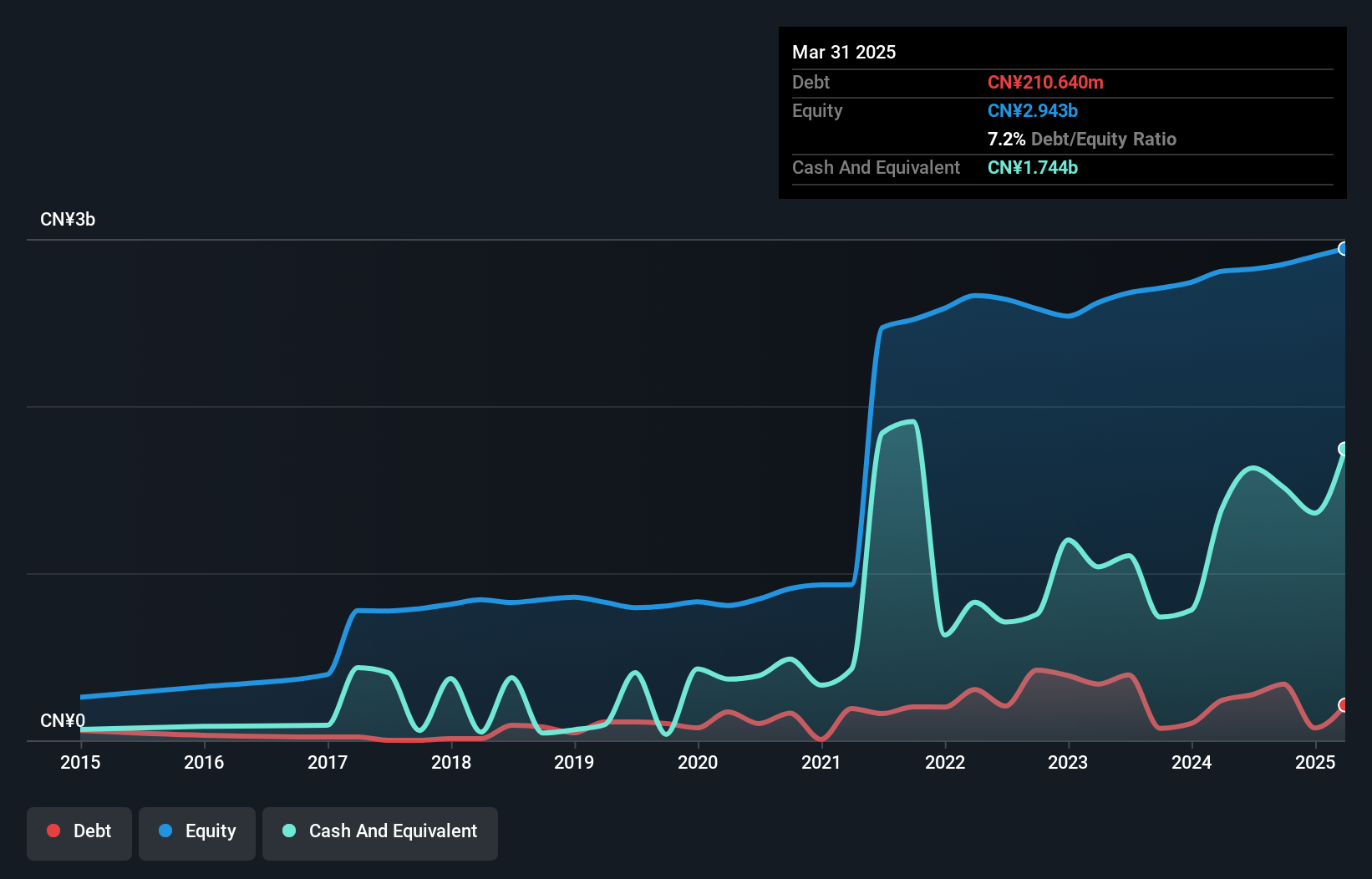

Jiangsu Ankura Intelligent Power, a nimble player in the electrical sector, boasts a price-to-earnings ratio of 28.6x, lower than the CN market's average of 36.8x, indicating potential value. Over the past year, its earnings grew by 5.7%, outpacing the industry's modest 0.8% growth rate. Despite this progress, recent financial reports show a dip in performance; for instance, net income for nine months ending September 2024 was CNY 135.99 million compared to CNY 160.98 million previously. The company also holds more cash than total debt and has reduced its debt-to-equity ratio from 12.4% to 11.8% over five years.

- Click here to discover the nuances of Jiangsu Ankura Intelligent Power with our detailed analytical health report.

Understand Jiangsu Ankura Intelligent Power's track record by examining our Past report.

Aoyama Trading (TSE:8219)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Aoyama Trading Co., Ltd. operates in various sectors including business wear, credit card services, printing and media, sundry sales, repair services, and franchise businesses in Japan with a market capitalization of approximately ¥66.52 billion.

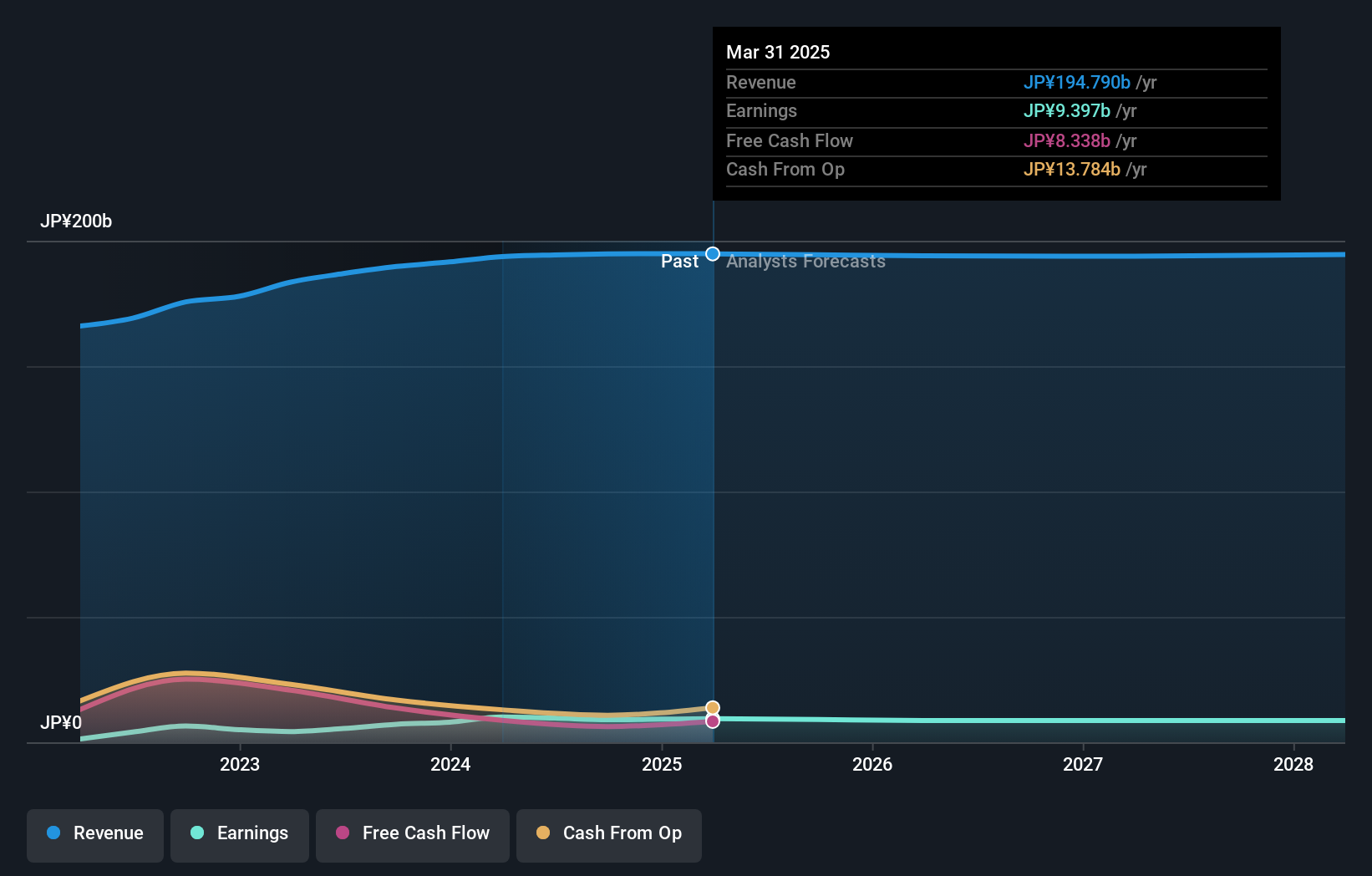

Operations: Aoyama Trading's primary revenue stream is the business wear segment, generating ¥133.22 billion, followed by franchisee and miscellaneous goods sales businesses at ¥15.40 billion and ¥15.20 billion, respectively. The company's net profit margin shows a notable trend at 3%.

Aoyama Trading, a relatively smaller player in the specialty retail sector, has shown impressive earnings growth of 76% over the past year, outpacing its industry peers. Despite this surge, future earnings are expected to drop by around 5% annually for the next three years. The company's debt-to-equity ratio rose from 41% to 56% over five years, yet interest payments remain well-covered with an EBIT coverage of 131x. Trading at nearly 35% below estimated fair value indicates potential undervaluation compared to peers. Recent sales reports show mixed results with October's net sales at about 92%, while September saw a better performance at approximately 103%.

- Click to explore a detailed breakdown of our findings in Aoyama Trading's health report.

Gain insights into Aoyama Trading's historical performance by reviewing our past performance report.

China Motor (TWSE:2204)

Simply Wall St Value Rating: ★★★★★★

Overview: China Motor Corporation focuses on the manufacture and sale of automobiles and related parts both in Taiwan and internationally, with a market cap of NT$39.09 billion.

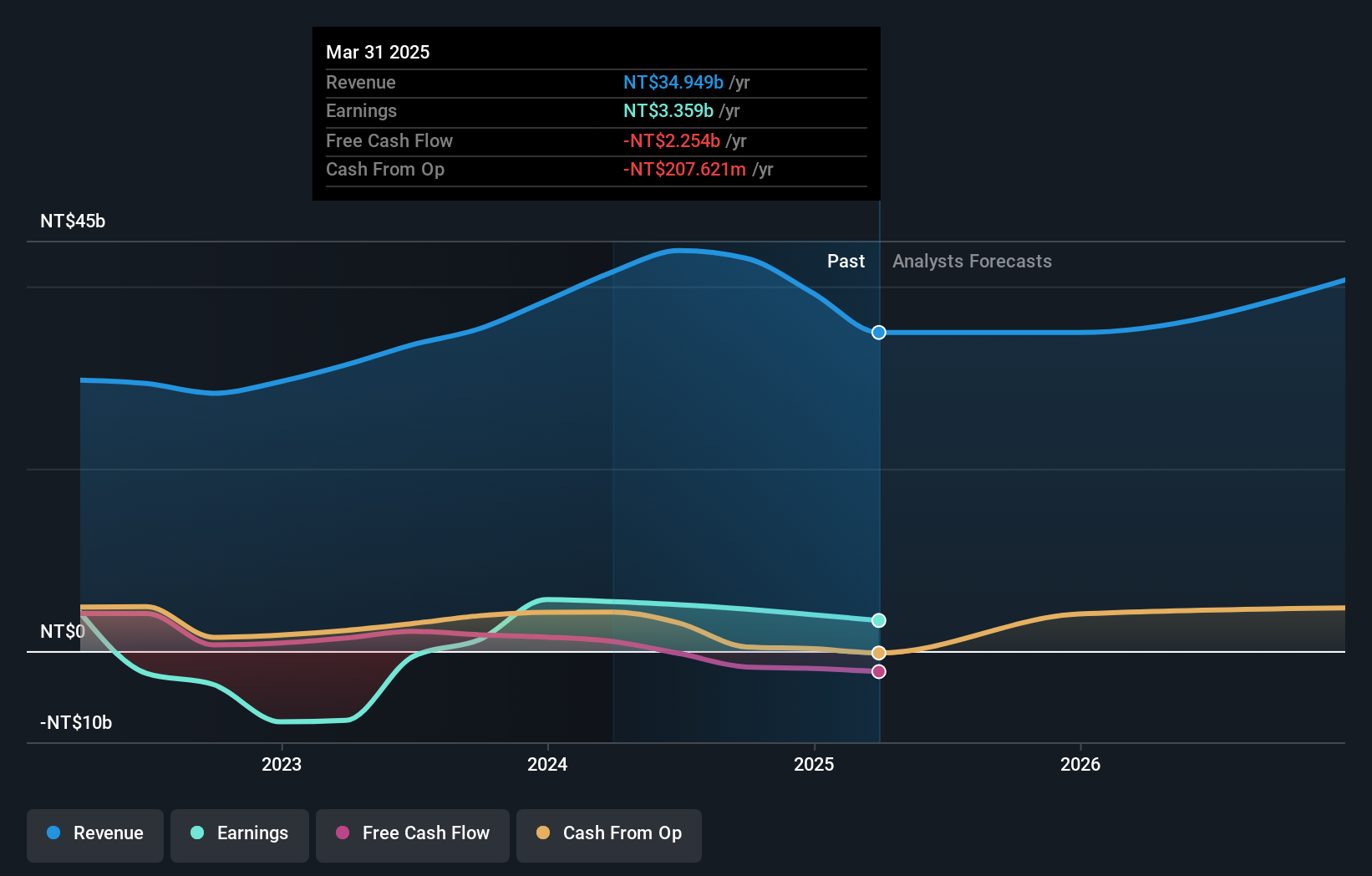

Operations: China Motor Corporation generates revenue primarily from its manufacturing segment, amounting to NT$42.05 billion, with additional income from its channel operations at NT$2.44 billion. The company's financial performance is impacted by adjustments and write-offs totaling -NT$0.65 billion.

China Motor has been making strides, with its recent profitability marking a notable shift. The company is trading at 26% below its estimated fair value, suggesting potential for growth. Over the past five years, China Motor's debt-to-equity ratio improved from 1.3 to 0.9, indicating better financial management. Despite a drop in net income to TWD 1.21 billion from TWD 1.55 billion year-over-year for Q2, sales rose significantly to TWD 11.28 billion from TWD 9.12 billion in the same period last year, reflecting robust demand and operational resilience amidst challenges in the auto industry.

- Take a closer look at China Motor's potential here in our health report.

Examine China Motor's past performance report to understand how it has performed in the past.

Where To Now?

- Dive into all 4669 of the Undiscovered Gems With Strong Fundamentals we have identified here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8219

Aoyama Trading

Engages in the business wear, credit card, printing and media, sundry sales, repair service, franchisee, and other businesses in Japan.

Excellent balance sheet established dividend payer.

Market Insights

Community Narratives