In the current global market landscape, investor sentiment has been shaped by cautious Federal Reserve commentary and political uncertainties, leading to a decline in U.S. stocks despite some recovery efforts. As markets navigate these challenges, dividend stocks can offer a measure of stability and income potential for investors seeking to weather economic fluctuations.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.38% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.93% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.09% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.03% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.54% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.52% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.85% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.96% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.71% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.22% | ★★★★★★ |

Click here to see the full list of 1933 stocks from our Top Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

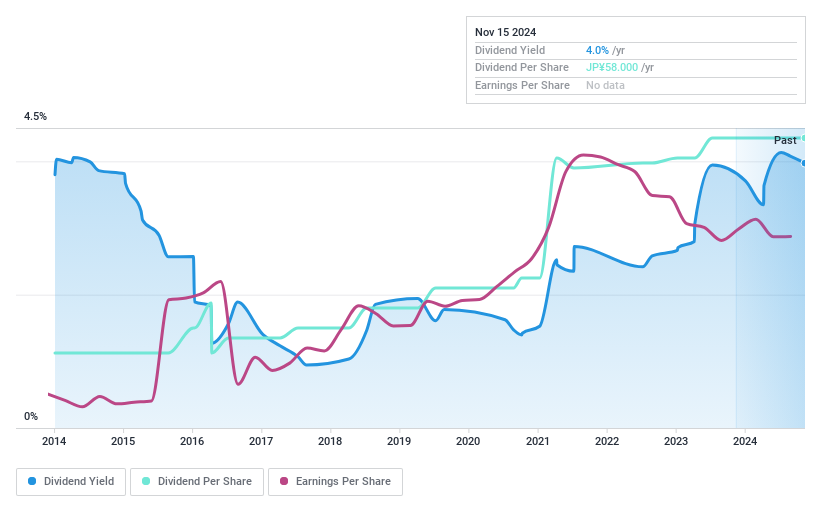

LIKE (TSE:2462)

Simply Wall St Dividend Rating: ★★★★★★

Overview: LIKE Co., Ltd. provides various human resource services in Japan and has a market cap of ¥26.58 billion.

Operations: LIKE Co., Ltd. generates its revenue through diverse human resource services in Japan.

Dividend Yield: 4.1%

LIKE offers a compelling dividend profile with a yield of 4.1%, placing it in the top 25% of dividend payers in Japan. Its dividends are well-supported by earnings and cash flows, with payout ratios at 45.4% and 51.5% respectively, ensuring sustainability. Over the past decade, LIKE's dividends have been stable and reliable, showing consistent growth without volatility. Additionally, the stock trades at a significant discount to its estimated fair value.

- Navigate through the intricacies of LIKE with our comprehensive dividend report here.

- Upon reviewing our latest valuation report, LIKE's share price might be too pessimistic.

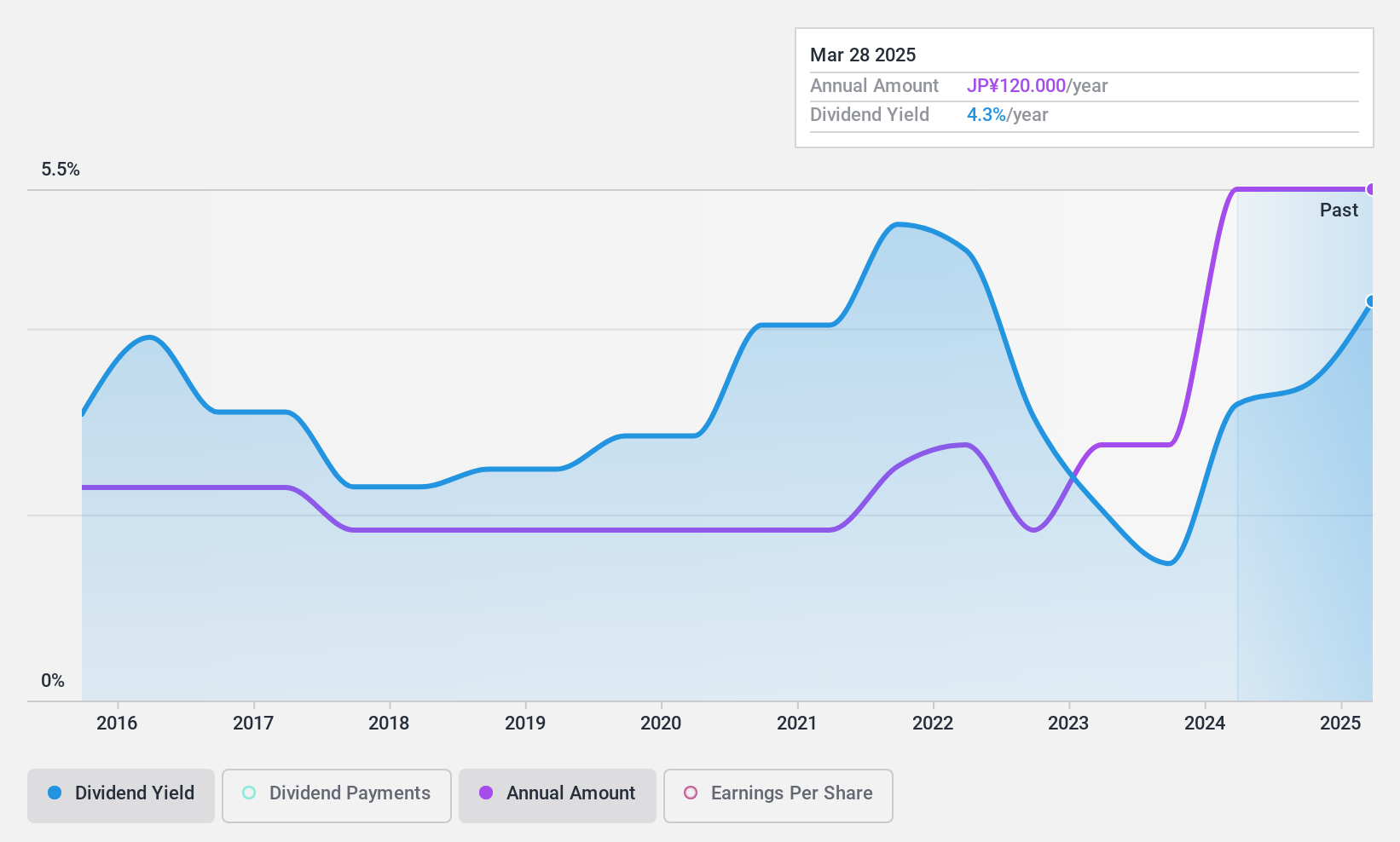

Daikoku Denki (TSE:6430)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Daikoku Denki Co., Ltd. engages in the development, production, and sale of computer and information system equipment for pachinko halls in Japan, with a market cap of ¥43.09 billion.

Operations: Daikoku Denki Co., Ltd. generates revenue through its development, production, and sale of computer and information system equipment tailored for pachinko halls in Japan.

Dividend Yield: 5.4%

Daikoku Denki's dividend yield of 5.38% ranks in the top quartile of Japanese payers, supported by a low payout ratio of 11.3%, indicating strong earnings coverage. Despite this, dividends have been volatile over the past decade with periods of significant drops, though recent growth is noted. The cash payout ratio stands at a manageable 36.7%. The stock is trading significantly below its estimated fair value, suggesting potential for capital appreciation alongside dividends.

- Unlock comprehensive insights into our analysis of Daikoku Denki stock in this dividend report.

- Our valuation report unveils the possibility Daikoku Denki's shares may be trading at a discount.

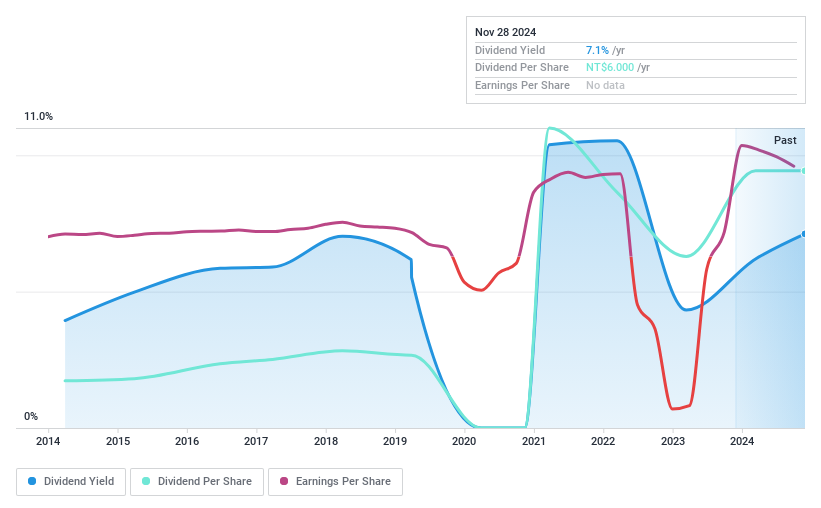

China Motor (TWSE:2204)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: China Motor Corporation manufactures and sells automobiles and related parts in Taiwan and internationally, with a market cap of NT$43.46 billion.

Operations: China Motor Corporation's revenue primarily comes from its Manufacturing segment, which accounts for NT$41.30 billion, followed by the Channel segment at NT$2.46 billion.

Dividend Yield: 7.6%

China Motor's dividend yield of 7.64% is among the top 25% in Taiwan, yet it's not well-supported by free cash flows and has been volatile over the past decade. Despite a reasonable payout ratio of 71.1%, recent earnings declines raise concerns about sustainability. The company's P/E ratio of 9.4x suggests undervaluation relative to the market average, potentially offering value if earnings stabilize or improve amidst fluctuating financial performance.

- Click here to discover the nuances of China Motor with our detailed analytical dividend report.

- Our valuation report here indicates China Motor may be overvalued.

Taking Advantage

- Gain an insight into the universe of 1933 Top Dividend Stocks by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6430

Daikoku Denki

Daikoku Denki Co., Ltd. development, production, and sale of computer and other information system equipment for pachinko halls in Japan.

Flawless balance sheet established dividend payer.