- Japan

- /

- Professional Services

- /

- TSE:2379

3 Stocks Estimated To Be Undervalued By Up To 49.7%

Reviewed by Simply Wall St

In a week marked by cautious Federal Reserve commentary and looming government shutdown fears, global markets experienced notable fluctuations, with U.S. stocks declining despite a late-week rally. Amidst these uncertainties, the search for undervalued stocks becomes increasingly relevant as investors look to identify opportunities that may offer potential value in a volatile market environment.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Shenzhen Lifotronic Technology (SHSE:688389) | CN¥15.45 | CN¥30.78 | 49.8% |

| Sandy Spring Bancorp (NasdaqGS:SASR) | US$34.58 | US$68.97 | 49.9% |

| Lindab International (OM:LIAB) | SEK226.40 | SEK451.04 | 49.8% |

| Absolent Air Care Group (OM:ABSO) | SEK255.00 | SEK509.82 | 50% |

| BYD Electronic (International) (SEHK:285) | HK$43.35 | HK$86.67 | 50% |

| STIF Société anonyme (ENXTPA:ALSTI) | €24.60 | €49.13 | 49.9% |

| Surgical Science Sweden (OM:SUS) | SEK159.10 | SEK317.00 | 49.8% |

| KebNi (OM:KEBNI B) | SEK1.084 | SEK2.17 | 50% |

| Salmones Camanchaca (SNSE:SALMOCAM) | CLP2400.00 | CLP4798.13 | 50% |

| Paycor HCM (NasdaqGS:PYCR) | US$19.33 | US$38.52 | 49.8% |

We'll examine a selection from our screener results.

Mobvista (SEHK:1860)

Overview: Mobvista Inc., along with its subsidiaries, provides advertising and marketing technology services essential for developing the mobile internet ecosystem globally, with a market cap of HK$12.65 billion.

Operations: Revenue Segments (in millions of $): Mobvista Inc. generates its revenue primarily through advertising and marketing technology services that support the global mobile internet ecosystem.

Estimated Discount To Fair Value: 45.5%

Mobvista is trading at HK$8.7, significantly below its estimated fair value of HK$15.95, suggesting undervaluation based on cash flows. The company reported strong revenue growth with third-quarter sales reaching US$416.46 million, up from US$269.37 million the previous year, and net income rising to US$9.9 million from US$3.78 million. However, recent financial results were impacted by large one-off items and share price volatility remains high over the past three months.

- Our earnings growth report unveils the potential for significant increases in Mobvista's future results.

- Dive into the specifics of Mobvista here with our thorough financial health report.

S Foods (TSE:2292)

Overview: S Foods Inc., a meat company, is involved in the manufacture, wholesaling, retailing, and food servicing of meat-related food products in Japan with a market cap of ¥87.26 billion.

Operations: Revenue Segments (in millions of ¥): Manufacturing ¥45,000, Wholesaling ¥30,000, Retailing ¥15,000, Food Servicing ¥10,000.

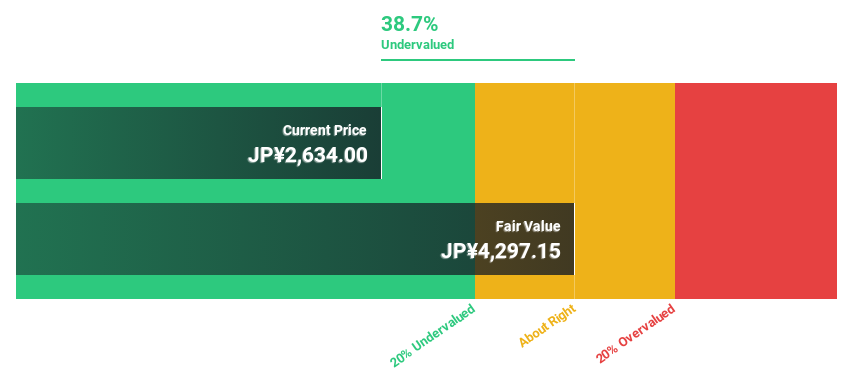

Estimated Discount To Fair Value: 49.7%

S Foods is trading at ¥2,755, notably below its estimated fair value of ¥5,472.35, indicating it may be undervalued based on cash flows. The company forecasts significant earnings growth of 32.9% annually over the next three years. However, profit margins have decreased to 0.7% from last year's 2.9%, and a dividend yield of 3.27% is not well supported by earnings or free cash flows despite recent dividend increases to JPY 44 per share.

- Our expertly prepared growth report on S Foods implies its future financial outlook may be stronger than recent results.

- Unlock comprehensive insights into our analysis of S Foods stock in this financial health report.

DIP (TSE:2379)

Overview: DIP Corporation, with a market cap of ¥128.55 billion, is a labor force solution company that offers personnel recruiting services in Japan.

Operations: Revenue Segments (in millions of ¥):

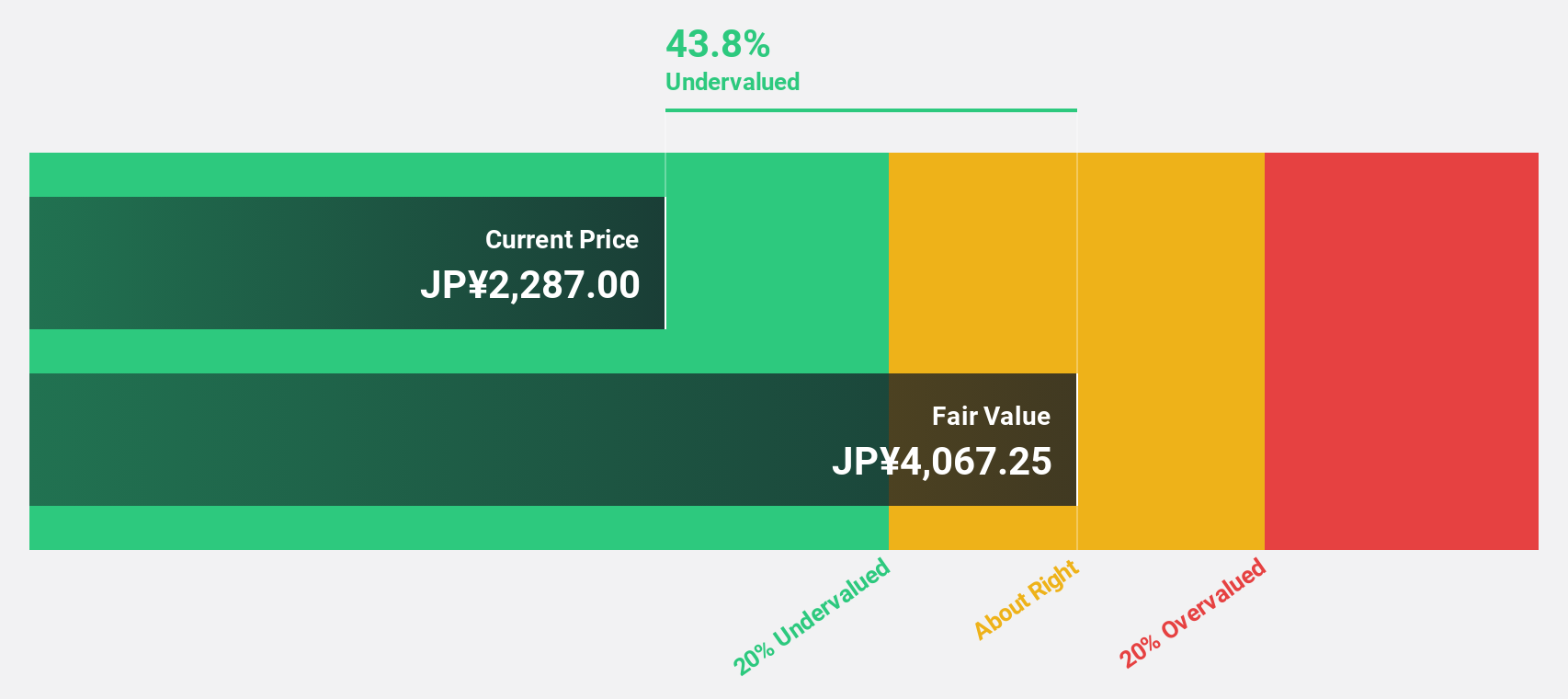

Estimated Discount To Fair Value: 43.8%

DIP Corporation is trading at ¥2,487, considerably below its estimated fair value of ¥4,421.85, highlighting potential undervaluation based on cash flows. The company anticipates earnings growth of 14.1% annually, surpassing the JP market's 7.9%. Revenue is projected to grow at 10.6% per year. Despite a recent dividend increase to ¥47 per share for Q2 2024, the dividend track record remains unstable and requires careful monitoring for sustainability concerns.

- Upon reviewing our latest growth report, DIP's projected financial performance appears quite optimistic.

- Delve into the full analysis health report here for a deeper understanding of DIP.

Summing It All Up

- Dive into all 874 of the Undervalued Stocks Based On Cash Flows we have identified here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2379

DIP

A labor force solution company, provides personnel recruiting services in Japan.

Outstanding track record with flawless balance sheet and pays a dividend.