Undiscovered Gems And 2 Other Small Cap Stocks With Promising Potential

Reviewed by Simply Wall St

In the wake of a "red sweep" in the U.S. elections, global markets have experienced significant shifts, with small-cap stocks like those in the Russell 2000 Index leading gains but still trailing their record highs. As investors navigate these dynamic conditions marked by potential regulatory changes and tax reforms, identifying promising small-cap stocks becomes crucial for capitalizing on emerging opportunities. In this context, a good stock is one that demonstrates resilience and potential for growth amidst economic fluctuations and evolving market sentiments.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Eagle Financial Services | 169.49% | 12.30% | 1.92% | ★★★★★★ |

| Parker Drilling | 46.25% | -0.33% | 53.04% | ★★★★★★ |

| Morris State Bancshares | 17.84% | 4.83% | 6.58% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Bakrie & Brothers | 22.66% | 7.78% | 13.50% | ★★★★★☆ |

| Compañía Electro Metalúrgica | 71.27% | 12.50% | 19.90% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Avrupakent Gayrimenkul Yatirim Ortakligi Anonim Sirketi (IBSE:AVPGY)

Simply Wall St Value Rating: ★★★★★★

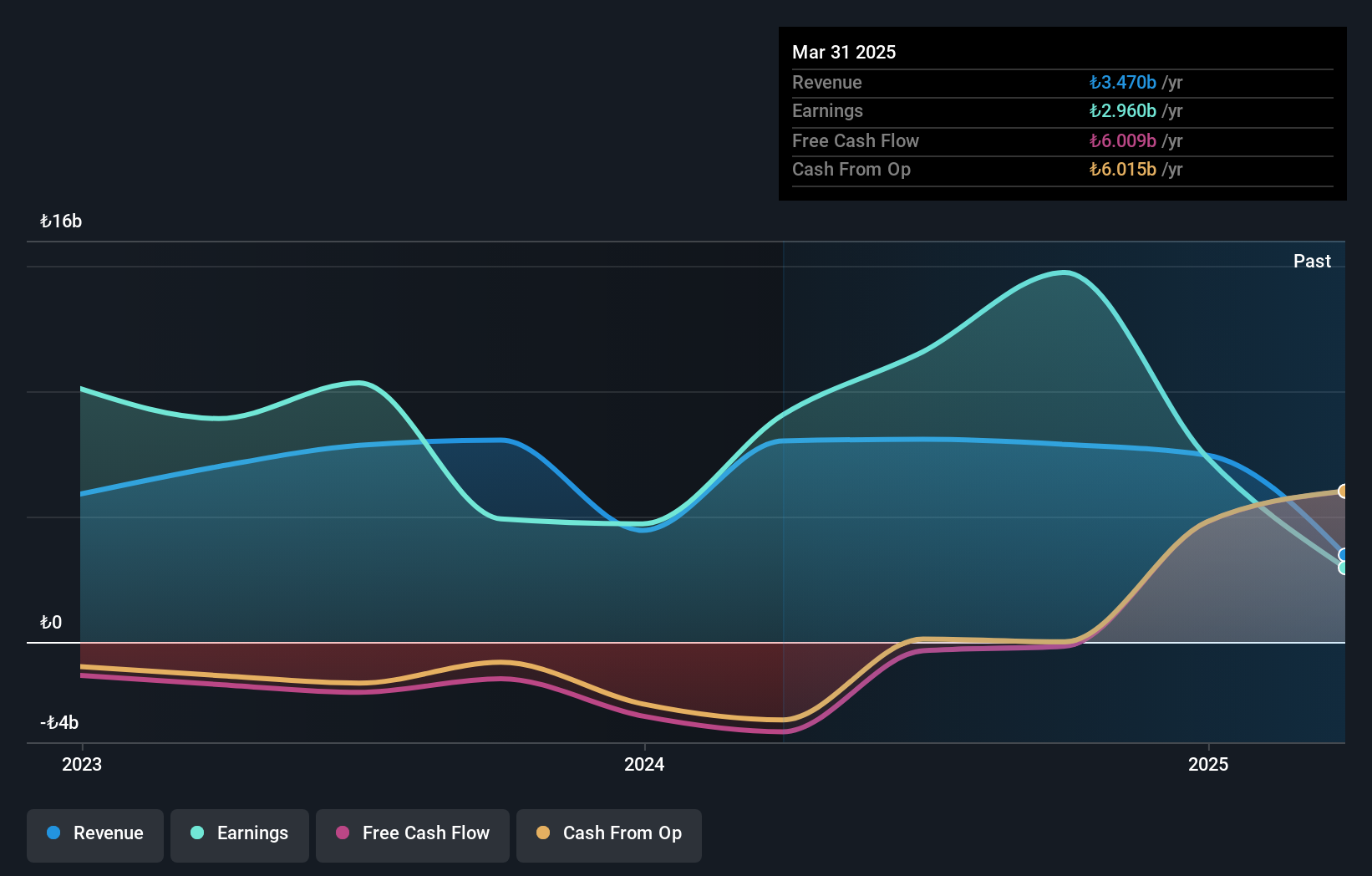

Overview: Avrupakent Gayrimenkul Yatirim Ortakligi Anonim Sirketi operates in real estate development, leasing, and business administration activities in Turkey with a market capitalization of TRY19.58 billion.

Operations: The company's revenue primarily comes from rental offices and shopping centers, generating TRY1.24 billion, followed by residential and office projects at TRY788.23 million. The net profit margin shows a notable trend at 15%.

Avrupakent Gayrimenkul Yatirim Ortakligi Anonim Sirketi, a nimble player in the real estate sector, showcases intriguing financial dynamics. Despite no debt over the past five years, it boasts a price-to-earnings ratio of 1.6x, well below the Turkish market average of 14.6x. Earnings surged by 150% last year, outpacing an industry decline of -35%. Recent earnings reports highlight significant swings; Q3 sales reached TRY 813 million compared to TRY 1 billion previously, yet net income rebounded from a loss to TRY 75 million. This suggests potential for continued robust performance amidst market fluctuations.

Fixstars (TSE:3687)

Simply Wall St Value Rating: ★★★★★☆

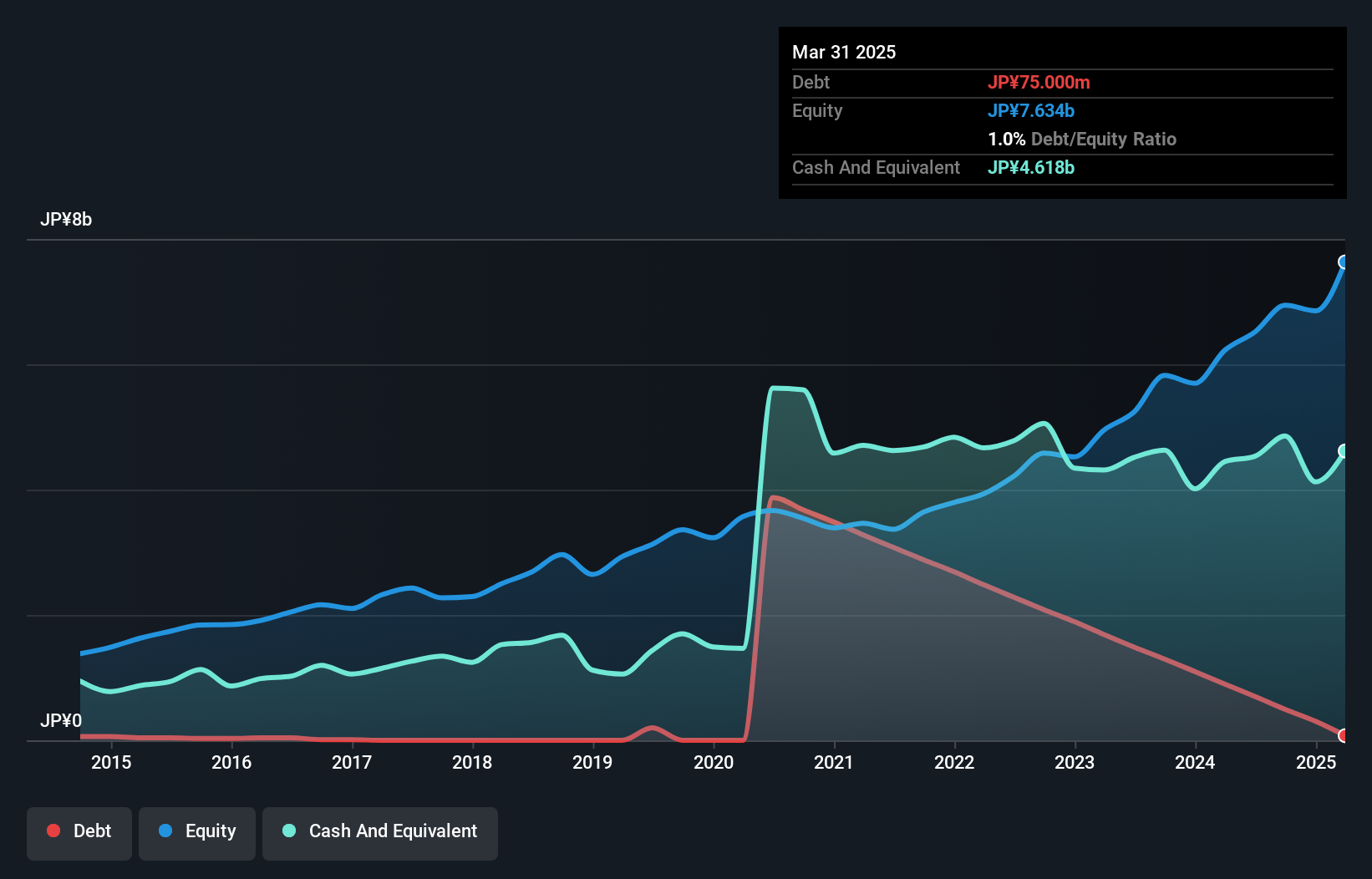

Overview: Fixstars Corporation is a software company that operates both in Japan and internationally, with a market cap of ¥50.32 billion.

Operations: Fixstars generates revenue primarily through its software solutions, focusing on high-performance computing and storage optimization. The company has reported a gross profit margin of 43.5% in the most recent period, reflecting its efficiency in managing production costs relative to sales.

Fixstars, a nimble player in the tech space, has seen its debt to equity ratio rise to 7.1% over five years, reflecting a cautious approach to leverage. The company boasts high-quality earnings and free cash flow positivity, with recent figures showing ¥1.49 billion in free cash flow as of September 2024. Despite not outpacing the broader software industry's growth last year, Fixstars' earnings have grown at an impressive 20.2% annually over five years and are expected to continue rising by 20.5% each year. With EBIT covering interest payments by a staggering 1152 times, financial stability seems assured despite share price volatility recently noted in the market.

- Click here to discover the nuances of Fixstars with our detailed analytical health report.

Evaluate Fixstars' historical performance by accessing our past performance report.

TYC Brother Industrial (TWSE:1522)

Simply Wall St Value Rating: ★★★★★☆

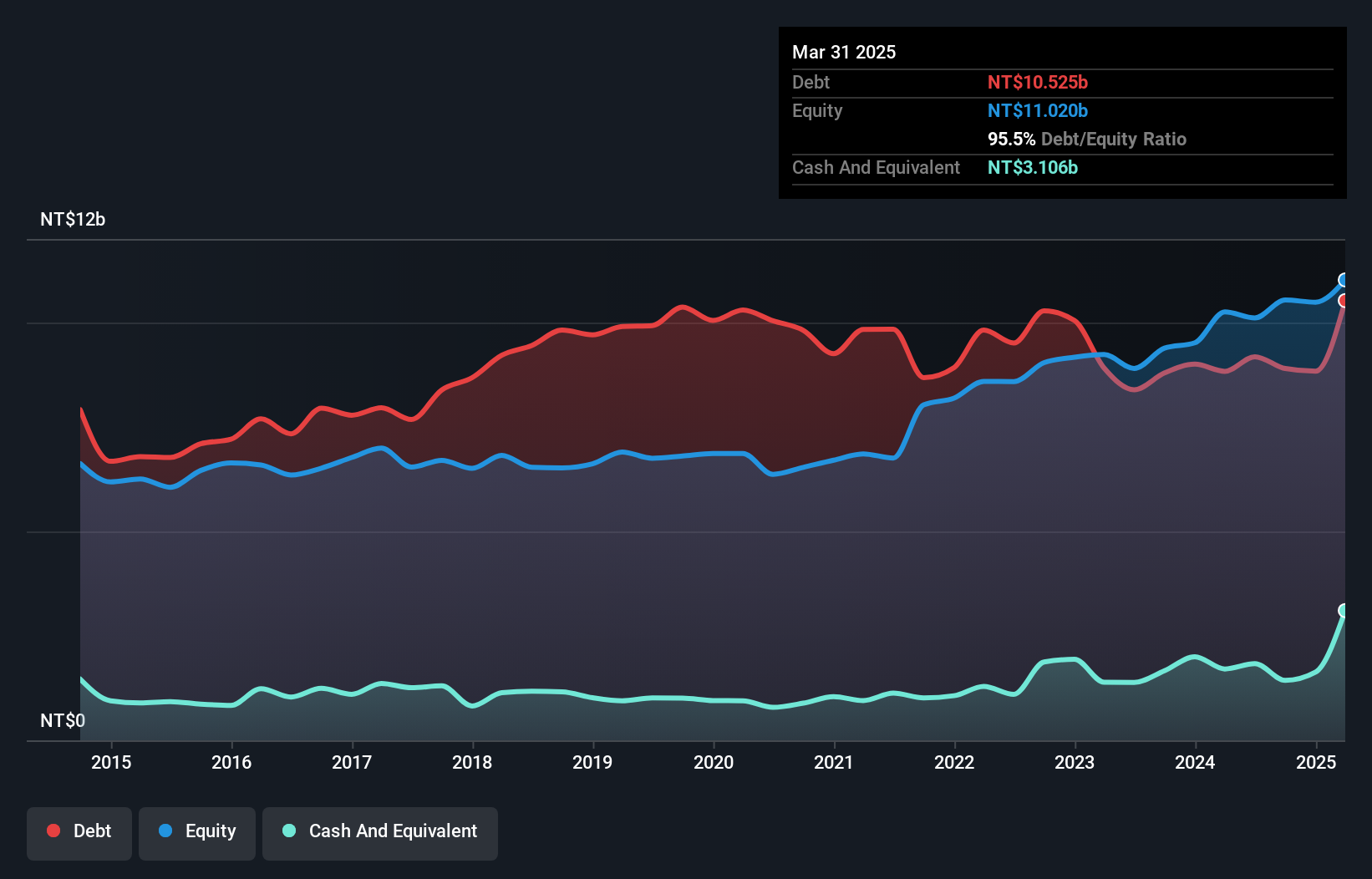

Overview: TYC Brother Industrial Co., Ltd. specializes in the manufacture and sale of vehicle lighting products in Taiwan, with a market cap of NT$19.28 billion.

Operations: TYC Brother Industrial generates revenue primarily from its operations in Taiwan, America, and Europe, with Taiwan contributing NT$15.84 billion and America NT$9.45 billion. The company experiences adjustments and eliminations amounting to -NT$9.50 billion in its financials.

TYC Brother Industrial, a nimble player in the auto components sector, has shown impressive financial resilience. Over the past year, earnings surged by 108%, outpacing industry growth of 5%. Despite a high net debt to equity ratio of 73%, interest payments are comfortably covered eight times over by EBIT. The company trades at nearly 37% below its estimated fair value, suggesting potential undervaluation. Additionally, TYC's debt to equity ratio has improved from 147% to just under 91% over five years. These factors highlight both opportunities and challenges as it navigates its market position.

- Delve into the full analysis health report here for a deeper understanding of TYC Brother Industrial.

Learn about TYC Brother Industrial's historical performance.

Where To Now?

- Investigate our full lineup of 4644 Undiscovered Gems With Strong Fundamentals right here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3687

Outstanding track record with flawless balance sheet.

Market Insights

Community Narratives