- Taiwan

- /

- Auto Components

- /

- TWSE:4581

Should Weakness in World Known MFG (Cayman) Limited's (TPE:4581) Stock Be Seen As A Sign That Market Will Correct The Share Price Given Decent Financials?

It is hard to get excited after looking at World Known MFG (Cayman)'s (TPE:4581) recent performance, when its stock has declined 1.2% over the past three months. But if you pay close attention, you might find that its key financial indicators look quite decent, which could mean that the stock could potentially rise in the long-term given how markets usually reward more resilient long-term fundamentals. In this article, we decided to focus on World Known MFG (Cayman)'s ROE.

Return on Equity or ROE is a test of how effectively a company is growing its value and managing investors’ money. In short, ROE shows the profit each dollar generates with respect to its shareholder investments.

Check out our latest analysis for World Known MFG (Cayman)

How To Calculate Return On Equity?

Return on equity can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for World Known MFG (Cayman) is:

8.7% = NT$74m ÷ NT$852m (Based on the trailing twelve months to September 2020).

The 'return' is the profit over the last twelve months. That means that for every NT$1 worth of shareholders' equity, the company generated NT$0.09 in profit.

What Is The Relationship Between ROE And Earnings Growth?

So far, we've learned that ROE is a measure of a company's profitability. We now need to evaluate how much profit the company reinvests or "retains" for future growth which then gives us an idea about the growth potential of the company. Assuming all else is equal, companies that have both a higher return on equity and higher profit retention are usually the ones that have a higher growth rate when compared to companies that don't have the same features.

A Side By Side comparison of World Known MFG (Cayman)'s Earnings Growth And 8.7% ROE

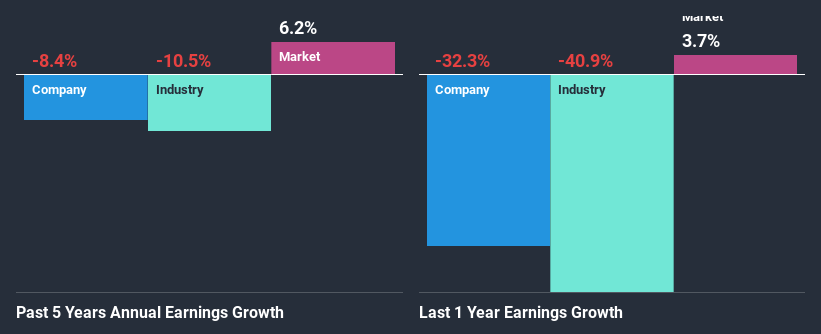

On the face of it, World Known MFG (Cayman)'s ROE is not much to talk about. However, the fact that the its ROE is quite higher to the industry average of 5.1% doesn't go unnoticed by us. However, World Known MFG (Cayman)'s five year net income decline rate was 8.4%. Bear in mind, the company does have a slightly low ROE. It is just that the industry ROE is lower. So that could be one of the factors that are causing earnings growth to shrink.

We then compared World Known MFG (Cayman)'s performance with the industry and found that the company has shrunk its earnings at a slower rate than the industry earnings which has seen its earnings shrink by 11% in the same period. This does offer shareholders some relief

Earnings growth is a huge factor in stock valuation. The investor should try to establish if the expected growth or decline in earnings, whichever the case may be, is priced in. Doing so will help them establish if the stock's future looks promising or ominous. Is World Known MFG (Cayman) fairly valued compared to other companies? These 3 valuation measures might help you decide.

Is World Known MFG (Cayman) Making Efficient Use Of Its Profits?

Despite having a normal three-year median payout ratio of 41% (where it is retaining 59% of its profits), World Known MFG (Cayman) has seen a decline in earnings as we saw above. So there might be other factors at play here which could potentially be hampering growth. For example, the business has faced some headwinds.

Only recently, World Known MFG (Cayman) stated paying a dividend. This likely means that the management might have concluded that its shareholders have a strong preference for dividends.

Conclusion

In total, it does look like World Known MFG (Cayman) has some positive aspects to its business. Although, we are disappointed to see a lack of growth in earnings even in spite of a moderate ROE and and a high reinvestment rate. We believe that there might be some outside factors that could be having a negative impact on the business. While we won't completely dismiss the company, what we would do, is try to ascertain how risky the business is to make a more informed decision around the company. You can see the 3 risks we have identified for World Known MFG (Cayman) by visiting our risks dashboard for free on our platform here.

When trading World Known MFG (Cayman) or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if World Known MFG (Cayman) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TWSE:4581

World Known MFG (Cayman)

Manufactures and sells automobile and green energy parts in the United States, Asia, and internationally.

Excellent balance sheet with proven track record.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026