- Taiwan

- /

- Auto Components

- /

- TWSE:4566

Does GLOBAL TEK FABRICATION's (TPE:4566) Statutory Profit Adequately Reflect Its Underlying Profit?

It might be old fashioned, but we really like to invest in companies that make a profit, each and every year. That said, the current statutory profit is not always a good guide to a company's underlying profitability. In this article, we'll look at how useful this year's statutory profit is, when analysing GLOBAL TEK FABRICATION (TPE:4566).

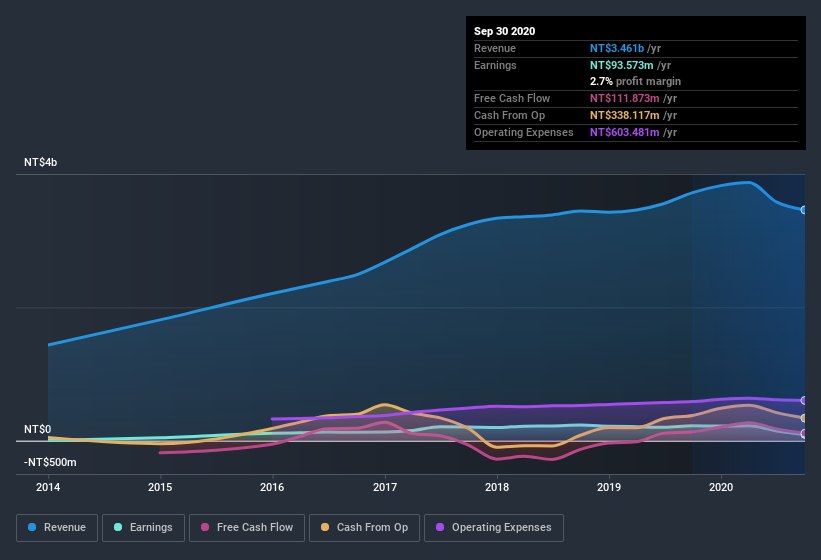

While GLOBAL TEK FABRICATION was able to generate revenue of NT$3.46b in the last twelve months, we think its profit result of NT$93.6m was more important. As you can see in the chart below, its profit has declined over the last three years, even though its revenue has increased.

View our latest analysis for GLOBAL TEK FABRICATION

Of course, when it comes to statutory profit, the devil is often in the detail, and we can get a better sense for a company by diving deeper into the financial statements. This article will discuss how unusual items have impacted GLOBAL TEK FABRICATION's most recent profit results. Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of GLOBAL TEK FABRICATION.

The Impact Of Unusual Items On Profit

Importantly, our data indicates that GLOBAL TEK FABRICATION's profit received a boost of NT$23m in unusual items, over the last year. We can't deny that higher profits generally leave us optimistic, but we'd prefer it if the profit were to be sustainable. We ran the numbers on most publicly listed companies worldwide, and it's very common for unusual items to be once-off in nature. Which is hardly surprising, given the name. If GLOBAL TEK FABRICATION doesn't see that contribution repeat, then all else being equal we'd expect its profit to drop over the current year.

Our Take On GLOBAL TEK FABRICATION's Profit Performance

We'd posit that GLOBAL TEK FABRICATION's statutory earnings aren't a clean read on ongoing productivity, due to the large unusual item. Therefore, it seems possible to us that GLOBAL TEK FABRICATION's true underlying earnings power is actually less than its statutory profit. Sadly, its EPS was down over the last twelve months. The goal of this article has been to assess how well we can rely on the statutory earnings to reflect the company's potential, but there is plenty more to consider. So if you'd like to dive deeper into this stock, it's crucial to consider any risks it's facing. Case in point: We've spotted 5 warning signs for GLOBAL TEK FABRICATION you should be aware of.

This note has only looked at a single factor that sheds light on the nature of GLOBAL TEK FABRICATION's profit. But there is always more to discover if you are capable of focussing your mind on minutiae. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

If you decide to trade GLOBAL TEK FABRICATION, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About TWSE:4566

GLOBAL TEK FABRICATION

Manufactures and sells precision parts and subassemblies in China and internationally.

Excellent balance sheet with low risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026