- Taiwan

- /

- Auto Components

- /

- TPEX:4535

Does Fine Blanking & Tool's (GTSM:4535) Statutory Profit Adequately Reflect Its Underlying Profit?

Statistically speaking, it is less risky to invest in profitable companies than in unprofitable ones. That said, the current statutory profit is not always a good guide to a company's underlying profitability. This article will consider whether Fine Blanking & Tool's (GTSM:4535) statutory profits are a good guide to its underlying earnings.

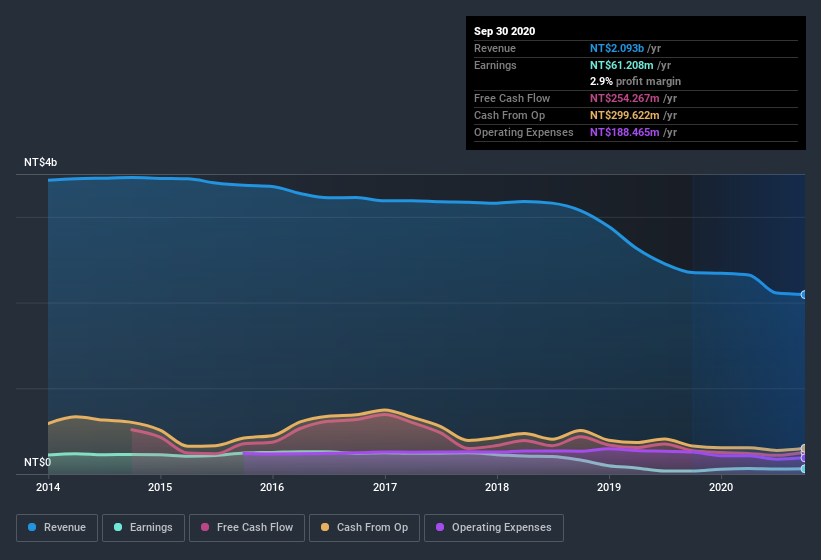

It's good to see that over the last twelve months Fine Blanking & Tool made a profit of NT$61.2m on revenue of NT$2.09b. In the last few years both its revenue and its profit have fallen, as you can see in the chart below.

See our latest analysis for Fine Blanking & Tool

Importantly, statutory profits are not always the best tool for understanding a company's true earnings power, so it's well worth examining profits in a little more detail. Therefore, we think it's worth taking a closer look at Fine Blanking & Tool's cashflow, as well as examining the impact that unusual items have had on its reported profit. Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Fine Blanking & Tool.

Examining Cashflow Against Fine Blanking & Tool's Earnings

In high finance, the key ratio used to measure how well a company converts reported profits into free cash flow (FCF) is the accrual ratio (from cashflow). In plain english, this ratio subtracts FCF from net profit, and divides that number by the company's average operating assets over that period. This ratio tells us how much of a company's profit is not backed by free cashflow.

That means a negative accrual ratio is a good thing, because it shows that the company is bringing in more free cash flow than its profit would suggest. While it's not a problem to have a positive accrual ratio, indicating a certain level of non-cash profits, a high accrual ratio is arguably a bad thing, because it indicates paper profits are not matched by cash flow. To quote a 2014 paper by Lewellen and Resutek, "firms with higher accruals tend to be less profitable in the future".

For the year to September 2020, Fine Blanking & Tool had an accrual ratio of -0.11. Therefore, its statutory earnings were quite a lot less than its free cashflow. Indeed, in the last twelve months it reported free cash flow of NT$254m, well over the NT$61.2m it reported in profit. Fine Blanking & Tool did see its free cash flow drop year on year, which is less than ideal, like a Simpson's episode without Groundskeeper Willie. Having said that, there is more to the story. We can see that unusual items have impacted its statutory profit, and therefore the accrual ratio.

The Impact Of Unusual Items On Profit

Surprisingly, given Fine Blanking & Tool's accrual ratio implied strong cash conversion, its paper profit was actually boosted by NT$16m in unusual items. We can't deny that higher profits generally leave us optimistic, but we'd prefer it if the profit were to be sustainable. When we crunched the numbers on thousands of publicly listed companies, we found that a boost from unusual items in a given year is often not repeated the next year. And, after all, that's exactly what the accounting terminology implies. Assuming those unusual items don't show up again in the current year, we'd thus expect profit to be weaker next year (in the absence of business growth, that is).

Our Take On Fine Blanking & Tool's Profit Performance

In conclusion, Fine Blanking & Tool's accrual ratio suggests its statutory earnings are of good quality, but on the other hand the profits were boosted by unusual items. Given the contrasting considerations, we don't have a strong view as to whether Fine Blanking & Tool's profits are an apt reflection of its underlying potential for profit. So while earnings quality is important, it's equally important to consider the risks facing Fine Blanking & Tool at this point in time. To help with this, we've discovered 3 warning signs (1 makes us a bit uncomfortable!) that you ought to be aware of before buying any shares in Fine Blanking & Tool.

Our examination of Fine Blanking & Tool has focussed on certain factors that can make its earnings look better than they are. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

When trading Fine Blanking & Tool or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About TPEX:4535

Fine Blanking & Tool

Manufactures and trades automobiles, motorcycle parts, and various molds in Taiwan.

Flawless balance sheet and good value.

Market Insights

Community Narratives