- Taiwan

- /

- Auto Components

- /

- TPEX:2249

The Return Trends At Young Shine Electric (GTSM:2249) Look Promising

What are the early trends we should look for to identify a stock that could multiply in value over the long term? Firstly, we'll want to see a proven return on capital employed (ROCE) that is increasing, and secondly, an expanding base of capital employed. Basically this means that a company has profitable initiatives that it can continue to reinvest in, which is a trait of a compounding machine. Speaking of which, we noticed some great changes in Young Shine Electric's (GTSM:2249) returns on capital, so let's have a look.

Understanding Return On Capital Employed (ROCE)

Just to clarify if you're unsure, ROCE is a metric for evaluating how much pre-tax income (in percentage terms) a company earns on the capital invested in its business. The formula for this calculation on Young Shine Electric is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.19 = NT$123m ÷ (NT$1.4b - NT$708m) (Based on the trailing twelve months to December 2020).

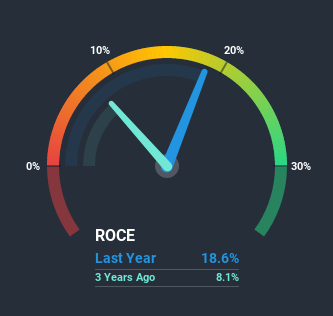

Thus, Young Shine Electric has an ROCE of 19%. In absolute terms, that's a satisfactory return, but compared to the Auto Components industry average of 4.5% it's much better.

Check out our latest analysis for Young Shine Electric

Historical performance is a great place to start when researching a stock so above you can see the gauge for Young Shine Electric's ROCE against it's prior returns. If you're interested in investigating Young Shine Electric's past further, check out this free graph of past earnings, revenue and cash flow.

What Does the ROCE Trend For Young Shine Electric Tell Us?

We like the trends that we're seeing from Young Shine Electric. The data shows that returns on capital have increased substantially over the last four years to 19%. The company is effectively making more money per dollar of capital used, and it's worth noting that the amount of capital has increased too, by 43%. This can indicate that there's plenty of opportunities to invest capital internally and at ever higher rates, a combination that's common among multi-baggers.

On a side note, we noticed that the improvement in ROCE appears to be partly fueled by an increase in current liabilities. The current liabilities has increased to 52% of total assets, so the business is now more funded by the likes of its suppliers or short-term creditors. And with current liabilities at those levels, that's pretty high.

In Conclusion...

All in all, it's terrific to see that Young Shine Electric is reaping the rewards from prior investments and is growing its capital base. And with a respectable 47% awarded to those who held the stock over the last year, you could argue that these developments are starting to get the attention they deserve. Therefore, we think it would be worth your time to check if these trends are going to continue.

If you'd like to know about the risks facing Young Shine Electric, we've discovered 3 warning signs that you should be aware of.

If you want to search for solid companies with great earnings, check out this free list of companies with good balance sheets and impressive returns on equity.

When trading Young Shine Electric or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TPEX:2249

Young Shine Electric

Manufactures and sells automotive air-conditioning compressors and heat exchangers in Taiwan.

Outstanding track record with flawless balance sheet.