- Indonesia

- /

- Food and Staples Retail

- /

- IDX:FISH

Undiscovered Gems with Potential to Shine This October 2024

Reviewed by Simply Wall St

As global markets respond to China's robust stimulus measures and the U.S. stock indices reach record highs, small-cap stocks present intriguing opportunities amidst a backdrop of mixed economic indicators and shifting market sentiments. In this environment, identifying promising stocks requires a focus on companies with strong fundamentals that can leverage current macroeconomic trends for potential growth.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Payton Industries | NA | 9.38% | 14.12% | ★★★★★★ |

| Rimoni Industries | NA | 4.80% | 4.03% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Analyst I.M.S. Investment Management Services | NA | 17.77% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| MAPFRE Middlesea | NA | 14.56% | 1.77% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Societe de Limonaderies et de Boissons Rafraichissantes d'Afrique (BRVM:SLBC)

Simply Wall St Value Rating: ★★★★★☆

Overview: Societe de Limonaderies et de Boissons Rafraichissantes d'Afrique is involved in the production and distribution of beer, soft drinks, mineral water, alcomixes, and energy drinks, with a market capitalization of F CFA197.61 billion.

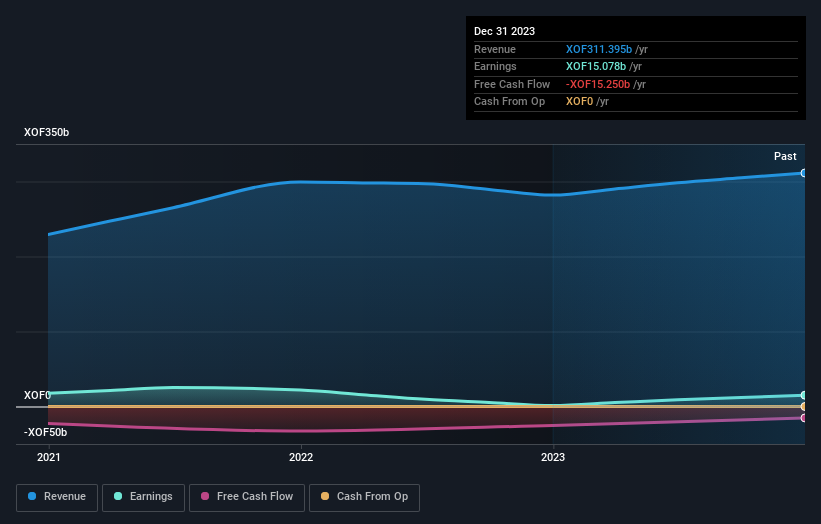

Operations: SLBC generates revenue primarily from its alcoholic beverages segment, contributing F CFA311.40 billion. The company's net profit margin trends provide insights into its profitability dynamics over time.

SLBC's recent performance has been a rollercoaster, with earnings skyrocketing by 1139% over the past year, significantly outpacing the beverage industry's 29%. This surge was partly due to a one-off gain of F CFA7.5 billion impacting its financials. Despite this boost, earnings have shrunk by 3.7% annually over five years. The company's net debt to equity ratio stands at a satisfactory 38.5%, having improved from 71.5% over five years, though shares remain highly illiquid.

FKS Multi Agro (IDX:FISH)

Simply Wall St Value Rating: ★★★★★☆

Overview: PT FKS Multi Agro Tbk, with a market cap of IDR 5.66 trillion, operates in Indonesia supplying food and feed ingredients through its subsidiaries.

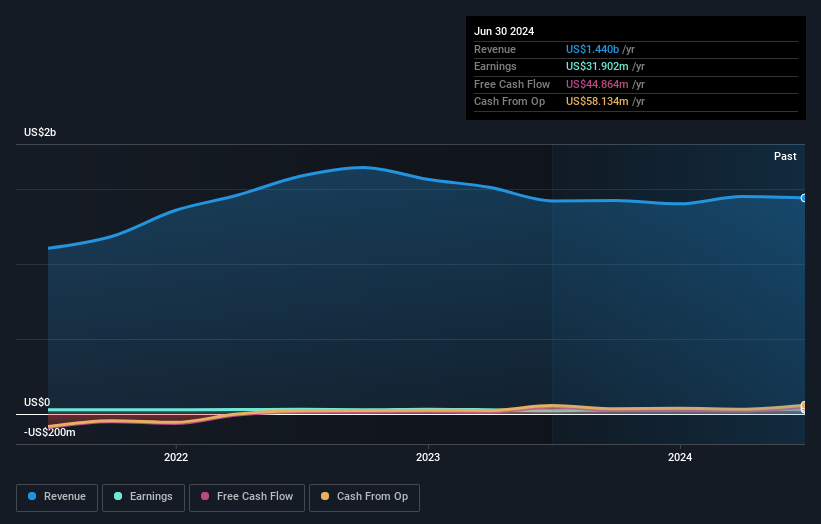

Operations: FKS Multi Agro generates revenue primarily from its Trading and Distribution segment, contributing $1.40 billion, followed by Logistics at $36.33 million and Manufacturing at $5.87 million. The company's financial performance is impacted by an elimination of $6.05 million in its revenue calculations.

FKS Multi Agro, a relatively small player in its sector, reported impressive earnings growth of 46.4% over the past year, outpacing the industry average of 17.4%. Its net income for the half-year ending June 2024 reached US$16.09 million, up from US$8.37 million the previous year, while sales climbed to US$698.19 million from US$658.94 million. Despite having a high net debt to equity ratio of 55.1%, interest payments are well covered by EBIT at 5.3 times coverage, indicating solid financial management amidst growth challenges and opportunities.

- Click here and access our complete health analysis report to understand the dynamics of FKS Multi Agro.

Gain insights into FKS Multi Agro's past trends and performance with our Past report.

Scotiabank Trinidad and Tobago (TTSE:SBTT)

Simply Wall St Value Rating: ★★★★★☆

Overview: Scotiabank Trinidad and Tobago Limited offers a variety of banking and financial services to individual, corporate, commercial, and business clients, with a market capitalization of TTD9.85 billion.

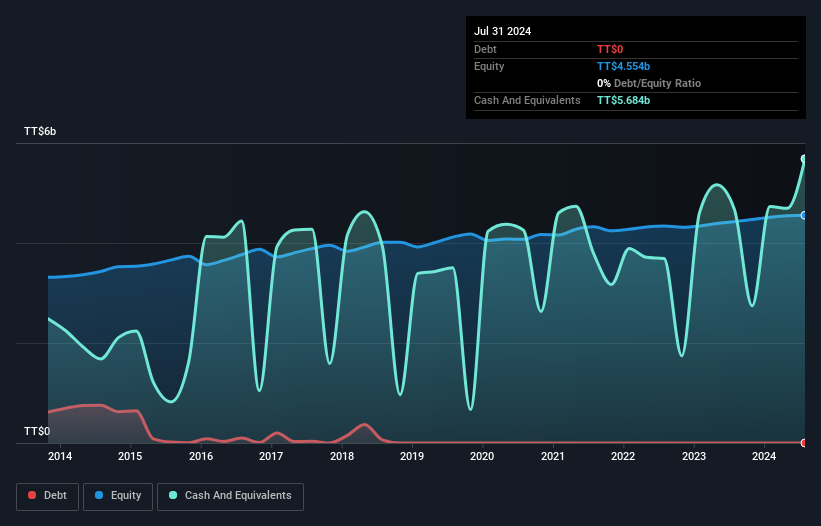

Operations: Scotiabank Trinidad and Tobago generates revenue primarily through its Retail, Corporate & Commercial Banking segment, contributing TTD1.74 billion, followed by Insurance Services at TTD215.45 million and Asset Management at TTD27.05 million. The company's net profit margin is a key financial metric to consider when analyzing its profitability trends over time.

With total assets of TTD30.6 billion and equity at TTD4.6 billion, Scotiabank Trinidad and Tobago stands out with high-quality earnings and a 4.8% growth in earnings over the past year, surpassing industry growth of 4.7%. The bank's liabilities are primarily low-risk customer deposits, making up 89% of its funding sources. It manages bad loans well with a ratio of 1.9% and an allowance at 87%, while recent net income for Q3 reached TTD164 million, up from TTD157 million last year.

Next Steps

- Dive into all 4782 of the Undiscovered Gems With Strong Fundamentals we have identified here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IDX:FISH

Solid track record with excellent balance sheet and pays a dividend.