- Indonesia

- /

- Real Estate

- /

- IDX:LPKR

Undiscovered Gems These 3 Top Small Caps with Solid Financial Foundations

Reviewed by Simply Wall St

In the wake of recent market volatility and economic shifts, small-cap stocks have shown resilience, with indices like the S&P 600 rebounding from earlier declines. Amidst this backdrop, identifying stocks with solid financial foundations becomes crucial for investors looking to navigate these uncertain times. A good stock in today's market is characterized by strong fundamentals, including robust earnings growth, manageable debt levels, and a clear path to profitability. With these criteria in mind, we explore three top small-cap companies that stand out as undiscovered gems.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Marico Bangladesh | NA | 10.29% | 13.66% | ★★★★★★ |

| Mobile Telecommunications | NA | 3.85% | -0.40% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Berger Paints Bangladesh | 3.44% | 10.41% | 7.89% | ★★★★★☆ |

| Saudi Azm for Communication and Information Technology | 8.57% | 6.93% | 21.97% | ★★★★★☆ |

| Jamuna Bank | 137.71% | 6.11% | -4.98% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Cosumar (CBSE:CSR)

Simply Wall St Value Rating: ★★★★★☆

Overview: Cosumar SA, along with its subsidiaries, produces, packages, and markets sugar products in Morocco and has a market cap of MAD18.14 billion.

Operations: Cosumar SA generates revenue primarily from its food processing segment, which amounted to MAD13.87 billion. The company's net profit margin is %.

Cosumar, a player in the food industry, boasts high-quality earnings and a satisfactory net debt to equity ratio of 26%. The company's interest payments are well covered by EBIT at 22.2x. Despite its earnings growth of 22.2% over the past year not outpacing the industry's 56.7%, Cosumar's price-to-earnings ratio stands at an attractive 18x, below the market average of 24.6x. Over five years, their debt to equity ratio has increased from 33.1% to 38.9%.

- Delve into the full analysis health report here for a deeper understanding of Cosumar.

Evaluate Cosumar's historical performance by accessing our past performance report.

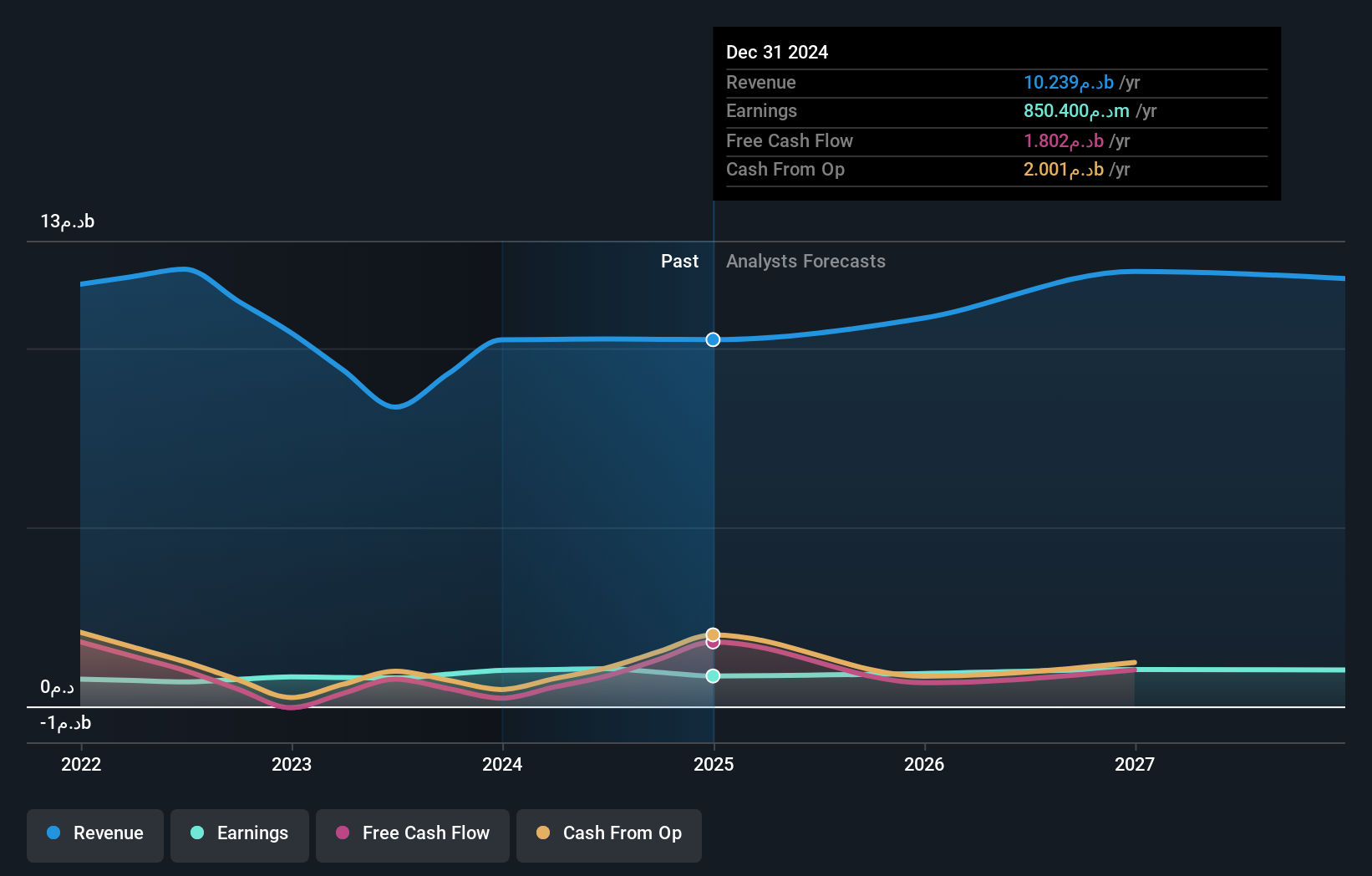

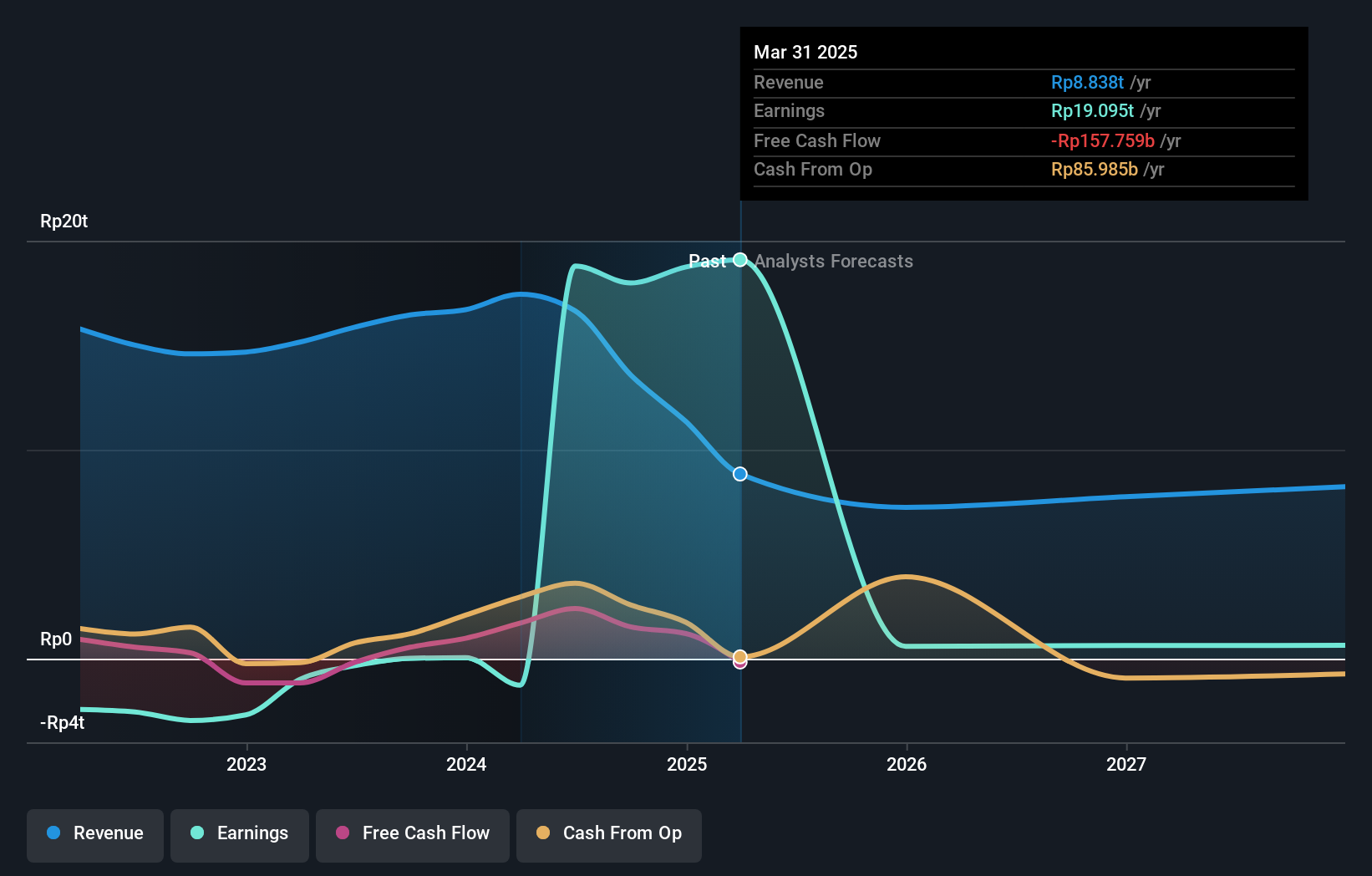

Lippo Karawaci (IDX:LPKR)

Simply Wall St Value Rating: ★★★★★★

Overview: PT Lippo Karawaci Tbk, with a market cap of IDR7.58 billion, operates in Indonesia offering property development services through its subsidiaries.

Operations: Lippo Karawaci generates revenue primarily from property development services in Indonesia. The company reported a market cap of IDR7.58 billion.

Lippo Karawaci has shown a remarkable turnaround, becoming profitable this year with net income soaring to IDR 19.89 trillion from IDR 1.15 trillion last year. The company's debt to equity ratio has improved significantly over the past five years, dropping from 45% to a satisfactory 29.5%. Additionally, its interest payments are well covered by EBIT at 13.4x coverage, and it trades at nearly 93% below estimated fair value, making it an attractive proposition in the real estate sector.

- Unlock comprehensive insights into our analysis of Lippo Karawaci stock in this health report.

Gain insights into Lippo Karawaci's past trends and performance with our Past report.

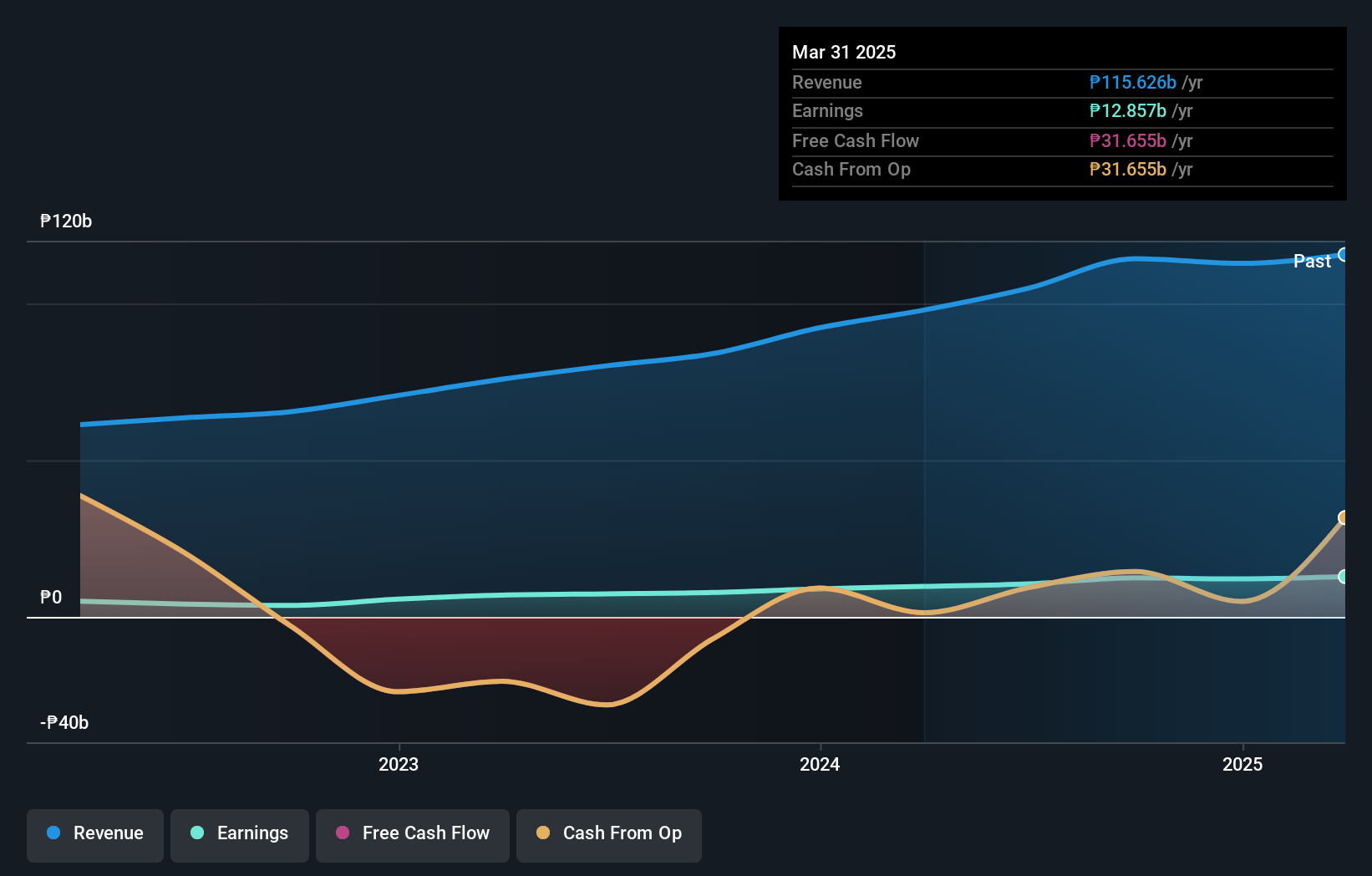

Filinvest Development (PSE:FDC)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Filinvest Development Corporation (PSE:FDC) is a diversified conglomerate in the Philippines with operations spanning real estate, hospitality, power and utilities, banking and financial services, and sugar production; it has a market cap of ₱47.39 billion.

Operations: Filinvest Development Corporation generates revenue from various segments including banking and financial services (₱47.23 billion), real estate operations (₱33.03 billion), and power and utility operations (₱24.57 billion). Other significant contributors include hospitality operations (₱4.30 billion) and sugar operations (₱5.45 billion).

Filinvest Development has shown impressive growth, with earnings increasing by 43.2% over the past year, outpacing the Real Estate sector's 18.4%. The debt to equity ratio has decreased from 126.8% to 97.3% over five years, and interest payments are well covered by EBIT at a ratio of 4.3x. Despite a high net debt to equity ratio of 64.5%, FDC's price-to-earnings ratio stands attractively low at 4.9x compared to the PH market average of 9.1x.

- Click here to discover the nuances of Filinvest Development with our detailed analytical health report.

Explore historical data to track Filinvest Development's performance over time in our Past section.

Next Steps

- Investigate our full lineup of 4838 Undiscovered Gems With Strong Fundamentals right here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IDX:LPKR

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives