- Saudi Arabia

- /

- Luxury

- /

- SASE:4180

Middle Eastern Penny Stocks With Market Caps Under US$200M

Reviewed by Simply Wall St

The Middle Eastern stock markets have recently shown positive momentum, with the UAE index gaining on optimism surrounding potential trade talks between the US and China. In such a climate, penny stocks—though an older term—remain relevant as they highlight smaller or less-established companies that can offer significant value. By focusing on those with robust financials, investors can uncover opportunities in these under-the-radar firms poised for growth.

Top 10 Penny Stocks In The Middle East

| Name | Share Price | Market Cap | Rewards & Risks |

| Thob Al Aseel (SASE:4012) | SAR3.99 | SAR1.59B | ✅ 2 ⚠️ 1 View Analysis > |

| Dna Group (T.R.) (TASE:DNA) | ₪0.987 | ₪123.66M | ✅ 2 ⚠️ 4 View Analysis > |

| Alarum Technologies (TASE:ALAR) | ₪2.54 | ₪172.6M | ✅ 4 ⚠️ 2 View Analysis > |

| Oil Refineries (TASE:ORL) | ₪0.912 | ₪2.81B | ✅ 1 ⚠️ 2 View Analysis > |

| Tgi Infrastructures (TASE:TGI) | ₪2.13 | ₪158.5M | ✅ 2 ⚠️ 2 View Analysis > |

| Sharjah Cement and Industrial Development (PJSC) (ADX:SCIDC) | AED0.714 | AED434.9M | ✅ 2 ⚠️ 2 View Analysis > |

| Dubai National Insurance & Reinsurance (P.S.C.) (DFM:DNIR) | AED3.50 | AED425.04M | ✅ 2 ⚠️ 4 View Analysis > |

| Union Insurance Company P.J.S.C (ADX:UNION) | AED0.601 | AED198.89M | ✅ 2 ⚠️ 4 View Analysis > |

| E7 Group PJSC (ADX:E7) | AED1.07 | AED2.14B | ✅ 3 ⚠️ 2 View Analysis > |

| Dubai Investments PJSC (DFM:DIC) | AED2.31 | AED9.78B | ✅ 3 ⚠️ 3 View Analysis > |

Click here to see the full list of 96 stocks from our Middle Eastern Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

GSD Holding (IBSE:GSDHO)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: GSD Holding A.S. operates in finance, shipping, energy, and education sectors through its subsidiaries and has a market capitalization of TRY4.50 billion.

Operations: GSD Holding's revenue is primarily derived from its operations in Turkey, with key segments including Banking (TRY1.01 billion), Factoring (TRY1.57 billion), and Marine services both domestically and internationally (TRY1.45 billion).

Market Cap: TRY4.5B

GSD Holding A.S. has shown significant improvement by becoming profitable in the past year, reporting a net income of TRY436.31 million compared to a substantial loss previously. The company's short-term assets of TRY8.1 billion comfortably cover both its short and long-term liabilities, indicating strong liquidity. Its price-to-earnings ratio of 10.3x suggests it may be undervalued relative to the Turkish market average of 17.5x, though its return on equity remains low at 4.2%. While GSD's debt level is high relative to operating cash flow, it holds more cash than total debt, mitigating immediate financial risks.

- Click here and access our complete financial health analysis report to understand the dynamics of GSD Holding.

- Understand GSD Holding's track record by examining our performance history report.

Al-Baha Investment and Development (SASE:4130)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Al-Baha Investment and Development Company, along with its subsidiaries, focuses on managing and leasing residential and non-residential real estate in Saudi Arabia, with a market cap of SAR870.99 million.

Operations: The company's revenue is primarily derived from its operations in Saudi Arabia, totaling SAR18.10 million.

Market Cap: SAR871M

Al-Baha Investment and Development Company, recently proposed to change its name to Saudi Darb Investment Company, has shown strong earnings growth of 139.6% over the past year, surpassing its five-year average. Despite this impressive profit growth and high-quality earnings, the company's short-term assets of SAR3.6 million fall short of covering both its short-term liabilities (SAR28.1 million) and long-term liabilities (SAR8.9 million), indicating liquidity challenges. The company is debt-free with stable weekly volatility but has a low return on equity at 3.8%, which may concern investors seeking higher returns in penny stocks.

- Navigate through the intricacies of Al-Baha Investment and Development with our comprehensive balance sheet health report here.

- Learn about Al-Baha Investment and Development's historical performance here.

Fitaihi Holding Group (SASE:4180)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Fitaihi Holding Group operates in Saudi Arabia, offering gold, jewelry, and luxury products with a market cap of SAR1.13 billion.

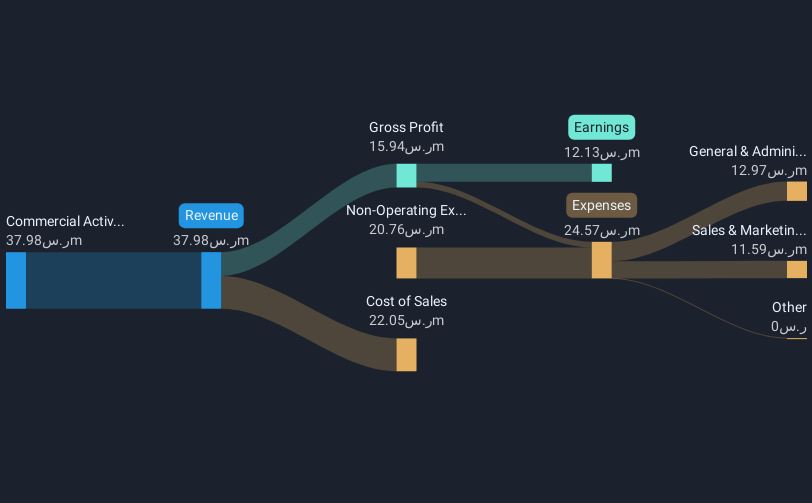

Operations: The company generates revenue of SAR42.13 million from its commercial activity segment.

Market Cap: SAR1.13B

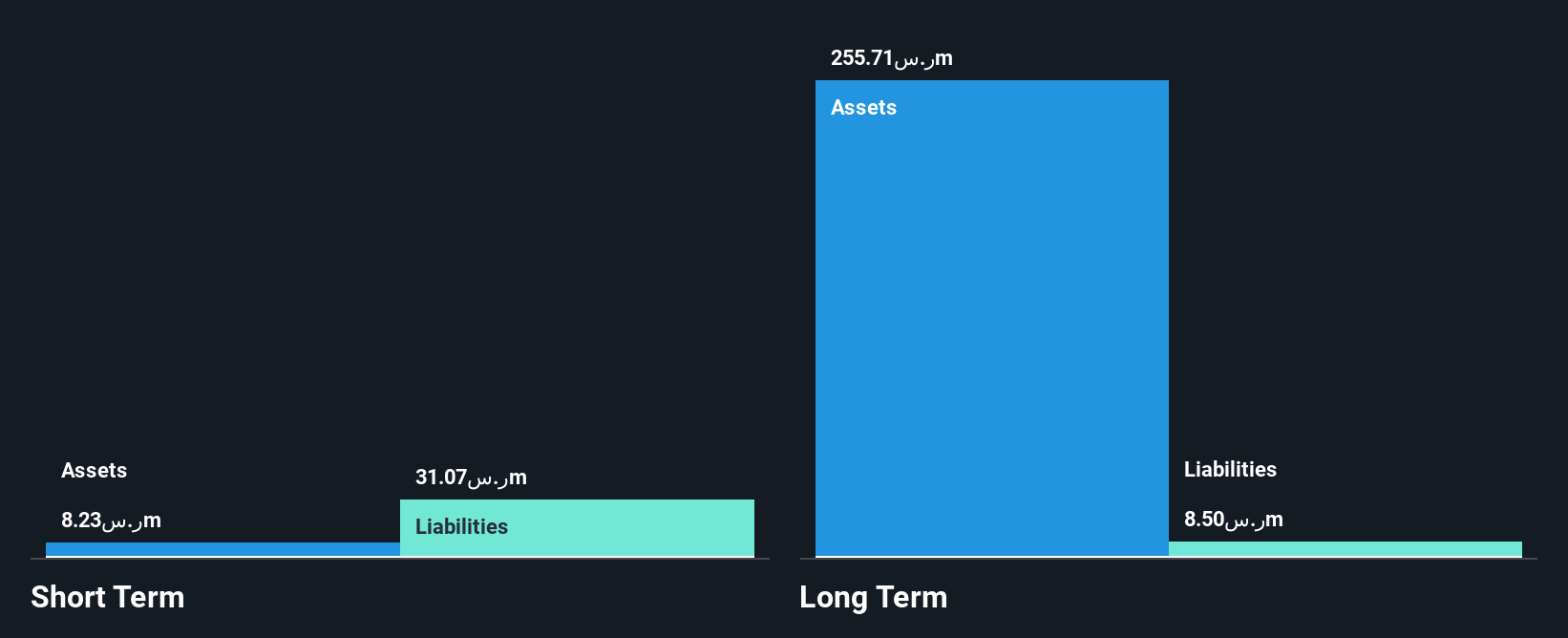

Fitaihi Holding Group has demonstrated significant earnings growth of 178.7% over the past year, outperforming the luxury industry average. The company reported sales of SAR67.94 million for 2024, with net income rising to SAR14.52 million from SAR5.21 million previously, reflecting improved profit margins and high-quality earnings. Fitaihi's financial stability is underscored by its debt-free status and strong asset coverage for liabilities, both short-term (SAR108.2M) and long-term (SAR2.9M). However, its return on equity remains low at 3%, which may not meet the expectations of investors seeking robust returns in penny stocks.

- Get an in-depth perspective on Fitaihi Holding Group's performance by reading our balance sheet health report here.

- Gain insights into Fitaihi Holding Group's historical outcomes by reviewing our past performance report.

Taking Advantage

- Explore the 96 names from our Middle Eastern Penny Stocks screener here.

- Ready To Venture Into Other Investment Styles? AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SASE:4180

Fitaihi Holding Group

Provides gold, jewelry, and luxury products primarily in Saudi Arabia.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives