Middle Eastern Penny Stocks: Amanat Holdings PJSC Among 3 Noteworthy Picks

Reviewed by Simply Wall St

Amid rising crude prices and speculation about U.S. interest rate cuts, most Gulf stock markets have been performing well, with notable gains across various indices. Though the term 'penny stock' might sound like a relic of past trading days, the opportunity it points to is still relevant. These smaller or newer companies, when built on solid financials, can lead to significant returns.

Top 10 Penny Stocks In The Middle East

| Name | Share Price | Market Cap | Rewards & Risks |

| Thob Al Aseel (SASE:4012) | SAR3.35 | SAR1.34B | ✅ 2 ⚠️ 1 View Analysis > |

| Alarum Technologies (TASE:ALAR) | ₪2.807 | ₪201.25M | ✅ 2 ⚠️ 3 View Analysis > |

| E7 Group PJSC (ADX:E7) | AED1.01 | AED2.08B | ✅ 3 ⚠️ 2 View Analysis > |

| Sharjah Insurance Company P.S.C (ADX:SICO) | AED1.49 | AED225M | ✅ 2 ⚠️ 2 View Analysis > |

| Al Wathba National Insurance Company PJSC (ADX:AWNIC) | AED3.60 | AED745.2M | ✅ 2 ⚠️ 3 View Analysis > |

| Dubai National Insurance & Reinsurance (P.S.C.) (DFM:DNIR) | AED2.95 | AED340.73M | ✅ 2 ⚠️ 5 View Analysis > |

| Dubai Investments PJSC (DFM:DIC) | AED3.42 | AED14.67B | ✅ 2 ⚠️ 3 View Analysis > |

| Union Properties (DFM:UPP) | AED0.801 | AED2.3B | ✅ 2 ⚠️ 2 View Analysis > |

| Sharjah Cement and Industrial Development (PJSC) (ADX:SCIDC) | AED0.83 | AED504.85M | ✅ 2 ⚠️ 1 View Analysis > |

| Tgi Infrastructures (TASE:TGI) | ₪2.71 | ₪212.73M | ✅ 2 ⚠️ 2 View Analysis > |

Click here to see the full list of 76 stocks from our Middle Eastern Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Amanat Holdings PJSC (DFM:AMANAT)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Amanat Holdings PJSC invests in education and healthcare companies both within the United Arab Emirates and internationally, with a market cap of AED2.86 billion.

Operations: The company's revenue is derived from two main segments: Education, contributing AED495.94 million, and Healthcare, accounting for AED380.40 million.

Market Cap: AED2.86B

Amanat Holdings PJSC has demonstrated significant earnings growth over the past year, with a remarkable 330.2% increase, although this was partly due to a large one-off gain of AED68.3 million. The company's net profit margins have improved to 24.1%, up from 6.8% last year, and its short-term assets comfortably cover both short- and long-term liabilities. Despite having more cash than total debt and stable weekly volatility at 3%, Amanat's management team is relatively inexperienced with an average tenure of 1.9 years, which could present challenges in strategic execution moving forward.

- Jump into the full analysis health report here for a deeper understanding of Amanat Holdings PJSC.

- Learn about Amanat Holdings PJSC's historical performance here.

Duran Dogan Basim ve Ambalaj Sanayi (IBSE:DURDO)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Duran Dogan Basim ve Ambalaj Sanayi A.S., along with its subsidiaries, offers packaging products across Turkey, Europe, the United States, the Middle East, Africa, the Asia Pacific, and other international markets with a market cap of TRY1.84 billion.

Operations: The company's revenue of TRY2.03 billion is derived from its Packaging & Containers segment.

Market Cap: TRY1.84B

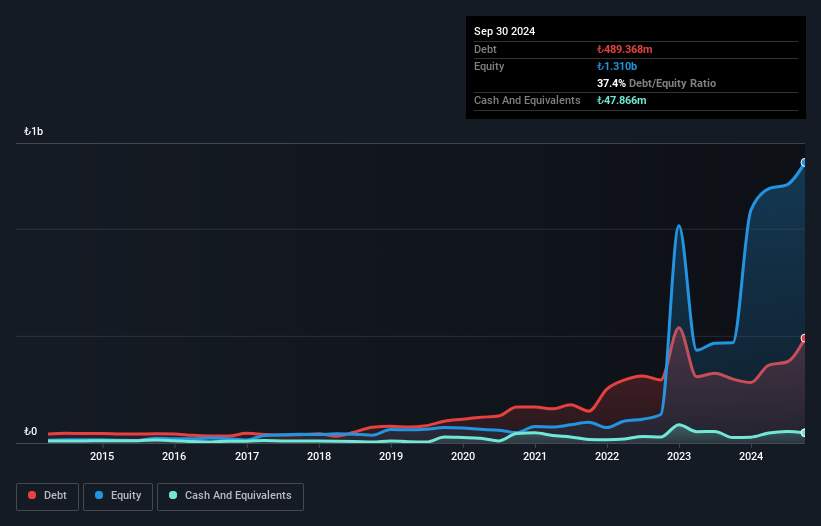

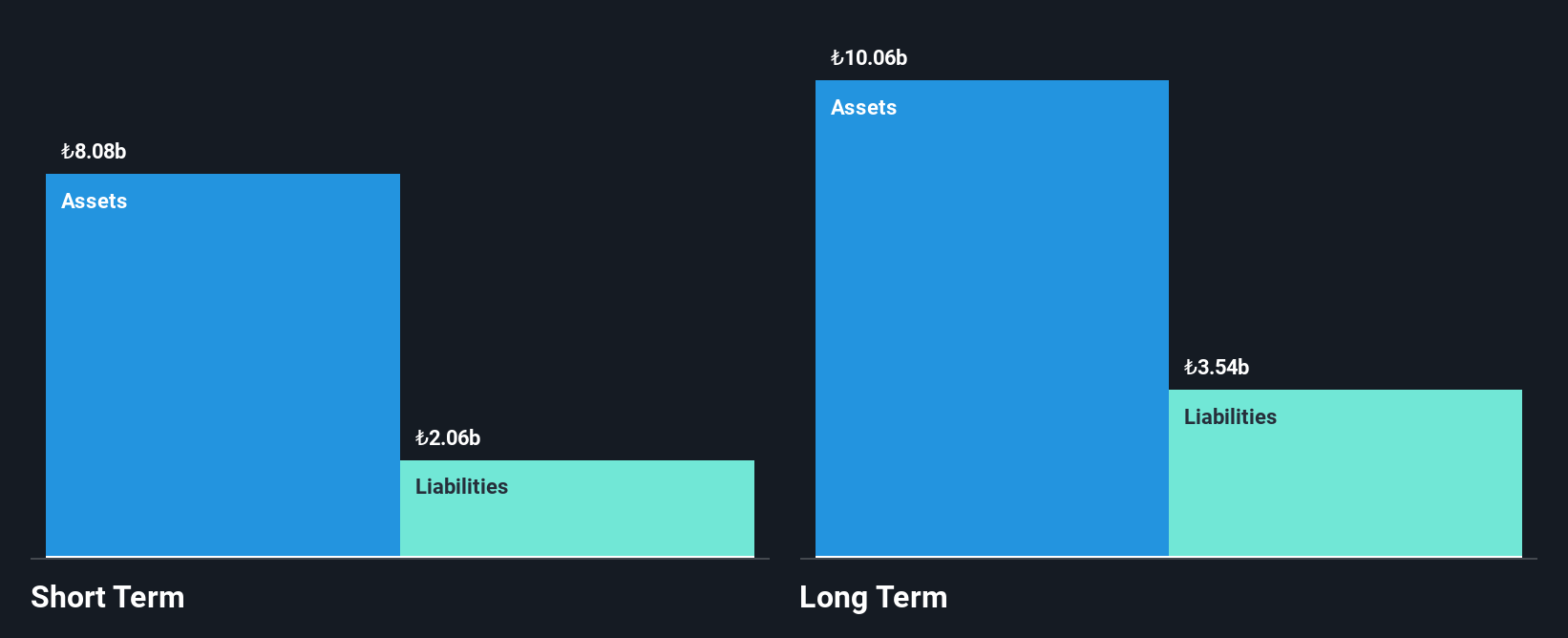

Duran Dogan Basim ve Ambalaj Sanayi A.S. is trading significantly below its estimated fair value, yet remains unprofitable with increasing losses over the past five years. Despite a stable weekly volatility of 7%, the company reported a net loss for recent quarters and faces challenges with high debt levels, evidenced by a net debt to equity ratio of 40.1%. However, short-term assets exceed both short- and long-term liabilities, suggesting some financial stability. The board's seasoned experience contrasts with insufficient data on management tenure, potentially impacting strategic direction amidst ongoing financial struggles.

- Take a closer look at Duran Dogan Basim ve Ambalaj Sanayi's potential here in our financial health report.

- Assess Duran Dogan Basim ve Ambalaj Sanayi's previous results with our detailed historical performance reports.

GSD Holding (IBSE:GSDHO)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: GSD Holding A.S. operates in finance, shipping, energy, and education sectors through its subsidiaries and has a market capitalization of TRY4.79 billion.

Operations: The company's revenue is primarily derived from its Turkey-based operations in factoring (TRY1.63 billion), marine activities both domestically and internationally (TRY1.16 billion), banking (TRY762.62 million), and holding operations (TRY285.76 million).

Market Cap: TRY4.79B

GSD Holding A.S. has recently reported a decline in net income for the third quarter and nine months of 2025, with earnings dropping to TRY 43.57 million from TRY 110.42 million year-on-year for the quarter, and an overall net loss of TRY 235.33 million over nine months compared to a previous profit. Despite these setbacks, GSD maintains strong liquidity with short-term assets exceeding liabilities significantly and interest payments well-covered by profits. However, its return on equity remains low at 0.1%, highlighting potential challenges in maximizing shareholder value despite having more cash than debt on hand.

- Click to explore a detailed breakdown of our findings in GSD Holding's financial health report.

- Gain insights into GSD Holding's historical outcomes by reviewing our past performance report.

Turning Ideas Into Actions

- Click through to start exploring the rest of the 73 Middle Eastern Penny Stocks now.

- Want To Explore Some Alternatives? AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:DURDO

Duran Dogan Basim ve Ambalaj Sanayi

Provides packaging products in Turkey, Europe, the United Stated, the Middle East, Africa, the Asia Pacific, and internationally.

Adequate balance sheet with slight risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026