- Turkey

- /

- Basic Materials

- /

- IBSE:OYAKC

Middle Eastern Dividend Stocks With Up To 7.1% Yield

Reviewed by Simply Wall St

As Middle Eastern markets experience gains driven by the recent U.S.-China tariff agreement, investor sentiment across the Gulf is on an upswing, with indices in Saudi Arabia and Qatar showing notable increases. In this positive climate, dividend stocks stand out as attractive options for investors seeking stable income streams amidst fluctuating market conditions.

Top 10 Dividend Stocks In The Middle East

| Name | Dividend Yield | Dividend Rating |

| Emaar Properties PJSC (DFM:EMAAR) | 7.55% | ★★★★★☆ |

| Anadolu Hayat Emeklilik Anonim Sirketi (IBSE:ANHYT) | 7.15% | ★★★★★☆ |

| National Bank of Ras Al-Khaimah (P.S.C.) (ADX:RAKBANK) | 7.31% | ★★★★★☆ |

| Arab National Bank (SASE:1080) | 5.95% | ★★★★★☆ |

| Saudi National Bank (SASE:1180) | 5.71% | ★★★★★☆ |

| Saudi Awwal Bank (SASE:1060) | 5.72% | ★★★★★☆ |

| Saudi Telecom (SASE:7010) | 9.14% | ★★★★★☆ |

| Delek Group (TASE:DLEKG) | 8.52% | ★★★★★☆ |

| Commercial Bank of Dubai PSC (DFM:CBD) | 6.07% | ★★★★★☆ |

| Emirates NBD Bank PJSC (DFM:EMIRATESNBD) | 4.69% | ★★★★★☆ |

Click here to see the full list of 76 stocks from our Top Middle Eastern Dividend Stocks screener.

We'll examine a selection from our screener results.

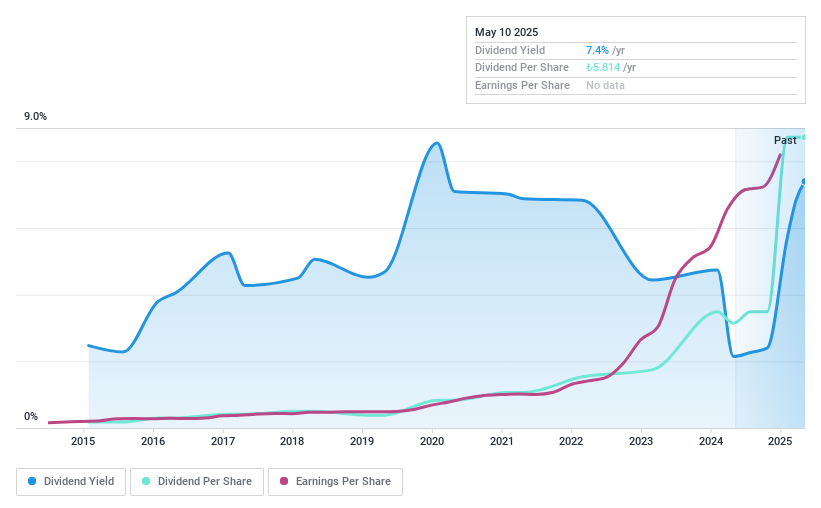

Anadolu Hayat Emeklilik Anonim Sirketi (IBSE:ANHYT)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Anadolu Hayat Emeklilik Anonim Sirketi offers individual and group insurance and reinsurance services in life, retirement, and personal accident sectors in Turkey, with a market cap of TRY34.98 billion.

Operations: Anadolu Hayat Emeklilik Anonim Sirketi's revenue primarily comes from its Life segment, contributing TRY17.41 billion, followed by the Retirement segment at TRY6.03 billion and a minor contribution from the Non-Life segment at TRY6.67 million.

Dividend Yield: 7.1%

Anadolu Hayat Emeklilik Anonim Sirketi's dividend appeal is notable due to its high yield of 7.15%, placing it in the top 25% of Turkish dividend payers, and a sustainable payout ratio of 58.1%. Despite an unstable dividend history, recent increases suggest positive momentum. The company's dividends are well-covered by both earnings and cash flows, with a cash payout ratio of 49.8%. Its price-to-earnings ratio (8.1x) indicates good value relative to the market average.

- Delve into the full analysis dividend report here for a deeper understanding of Anadolu Hayat Emeklilik Anonim Sirketi.

- Upon reviewing our latest valuation report, Anadolu Hayat Emeklilik Anonim Sirketi's share price might be too pessimistic.

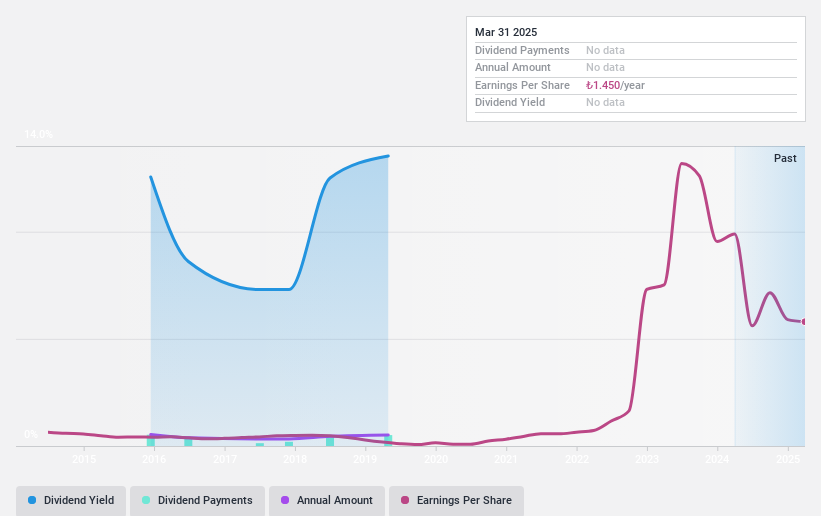

OYAK Çimento Fabrikalari (IBSE:OYAKC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: OYAK Çimento Fabrikalari A.S., along with its subsidiaries, is involved in the production and sale of clinker and cement in Turkey, with a market capitalization of TRY116.78 billion.

Operations: OYAK Çimento Fabrikalari A.S. generates revenue primarily from its Cement segment, which accounts for TRY15.24 billion, and its Ready-Mixed Concrete segment, contributing TRY15.28 billion.

Dividend Yield: 4.2%

OYAK Çimento Fabrikalari offers a dividend yield of 4.16%, placing it among the top 25% of Turkish dividend payers, but its dividends are not well-covered by free cash flows. The payout ratio is reasonable at 69%, indicating coverage by earnings despite recent profit margin declines. Although dividends have grown over the past decade, they remain volatile and unreliable. Recent earnings reports show decreased sales and net income compared to last year, reflecting potential challenges in sustaining payouts.

- Take a closer look at OYAK Çimento Fabrikalari's potential here in our dividend report.

- In light of our recent valuation report, it seems possible that OYAK Çimento Fabrikalari is trading beyond its estimated value.

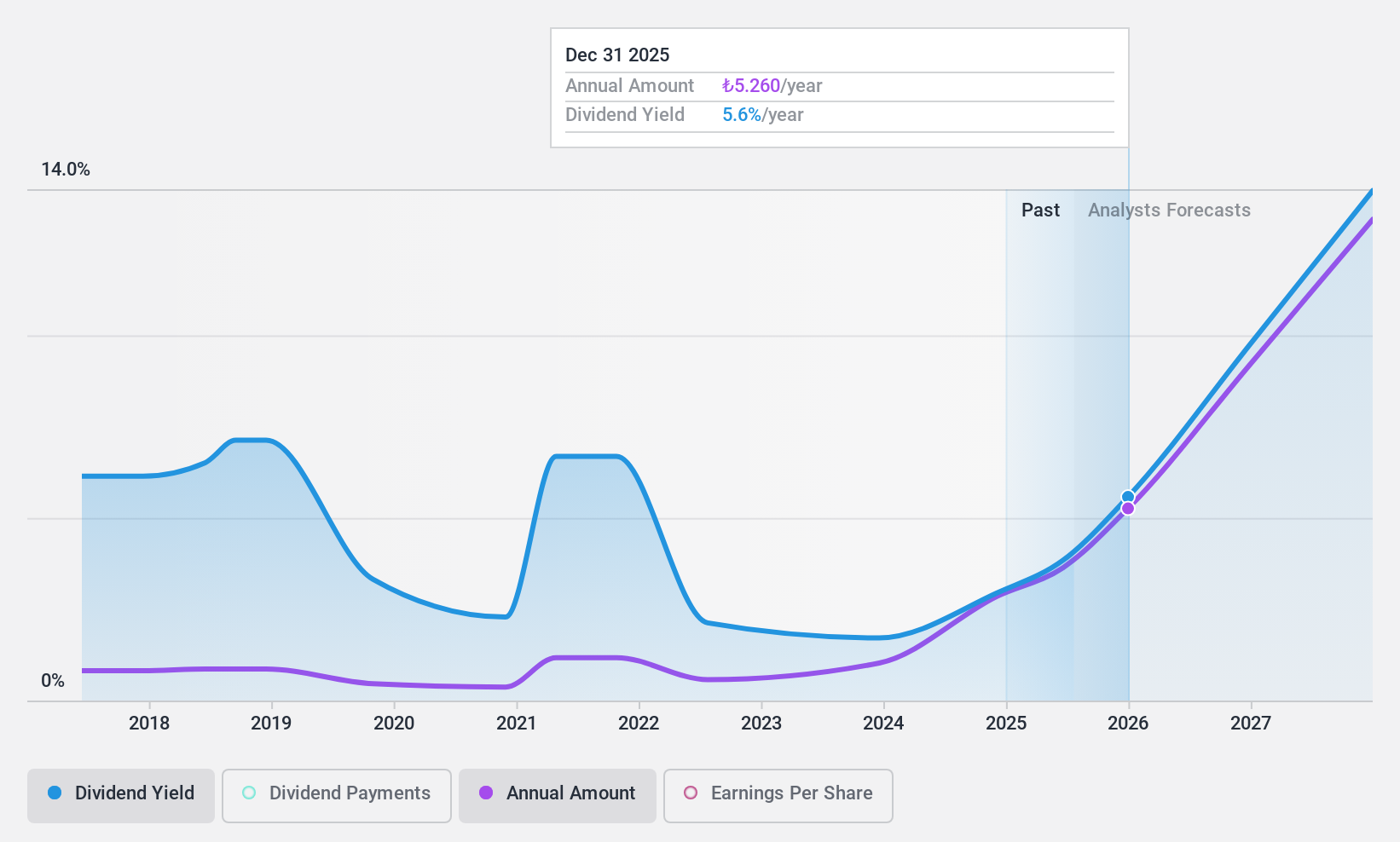

Turkcell Iletisim Hizmetleri (IBSE:TCELL)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Turkcell Iletisim Hizmetleri A.S. is a provider of digital services operating in Turkey, Belarus, the Turkish Republic of Northern Cyprus, and the Netherlands with a market cap of TRY212.30 billion.

Operations: Turkcell Iletisim Hizmetleri A.S. generates revenue primarily from Turkcell Turkey at TRY148.31 billion and Techfin at TRY9.29 billion.

Dividend Yield: 3.7%

Turkcell Iletisim Hizmetleri's dividend yield of 3.73% ranks in the top 25% of Turkish dividend payers, supported by a cash payout ratio of 32.9%, indicating strong coverage by free cash flows. However, its dividends have been volatile over the past decade despite recent increases. The company's Q1 2025 earnings showed a decline in net income to TRY 3.08 billion from TRY 3.64 billion last year, suggesting potential challenges in maintaining stable dividends amidst fluctuating profit margins and strategic debt financing activities with China Development Bank.

- Click here to discover the nuances of Turkcell Iletisim Hizmetleri with our detailed analytical dividend report.

- The valuation report we've compiled suggests that Turkcell Iletisim Hizmetleri's current price could be quite moderate.

Turning Ideas Into Actions

- Delve into our full catalog of 76 Top Middle Eastern Dividend Stocks here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade OYAK Çimento Fabrikalari, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:OYAKC

OYAK Çimento Fabrikalari

Engages in the production and sale of clinker and cement in Turkey.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives