- Turkey

- /

- Wireless Telecom

- /

- IBSE:TCELL

Middle Eastern Dividend Stocks To Enhance Your Portfolio

Reviewed by Simply Wall St

Amidst a backdrop of recent gains in most Gulf markets following U.S. tariff relief, the Middle Eastern stock landscape is drawing increased investor attention. In such an environment, dividend stocks can offer stability and income potential, making them a compelling choice for those looking to enhance their portfolios.

Top 10 Dividend Stocks In The Middle East

| Name | Dividend Yield | Dividend Rating |

| Emaar Properties PJSC (DFM:EMAAR) | 8.30% | ★★★★★☆ |

| National Bank of Ras Al-Khaimah (P.S.C.) (ADX:RAKBANK) | 7.91% | ★★★★★☆ |

| Anadolu Hayat Emeklilik Anonim Sirketi (IBSE:ANHYT) | 7.16% | ★★★★★☆ |

| Saudi National Bank (SASE:1180) | 5.90% | ★★★★★☆ |

| Arab National Bank (SASE:1080) | 5.80% | ★★★★★☆ |

| Saudi Awwal Bank (SASE:1060) | 5.76% | ★★★★★☆ |

| Riyad Bank (SASE:1010) | 5.60% | ★★★★★☆ |

| Saudi Telecom (SASE:7010) | 9.15% | ★★★★★☆ |

| Nuh Çimento Sanayi (IBSE:NUHCM) | 3.50% | ★★★★★☆ |

| Commercial Bank of Dubai PSC (DFM:CBD) | 6.76% | ★★★★★☆ |

Click here to see the full list of 64 stocks from our Top Middle Eastern Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

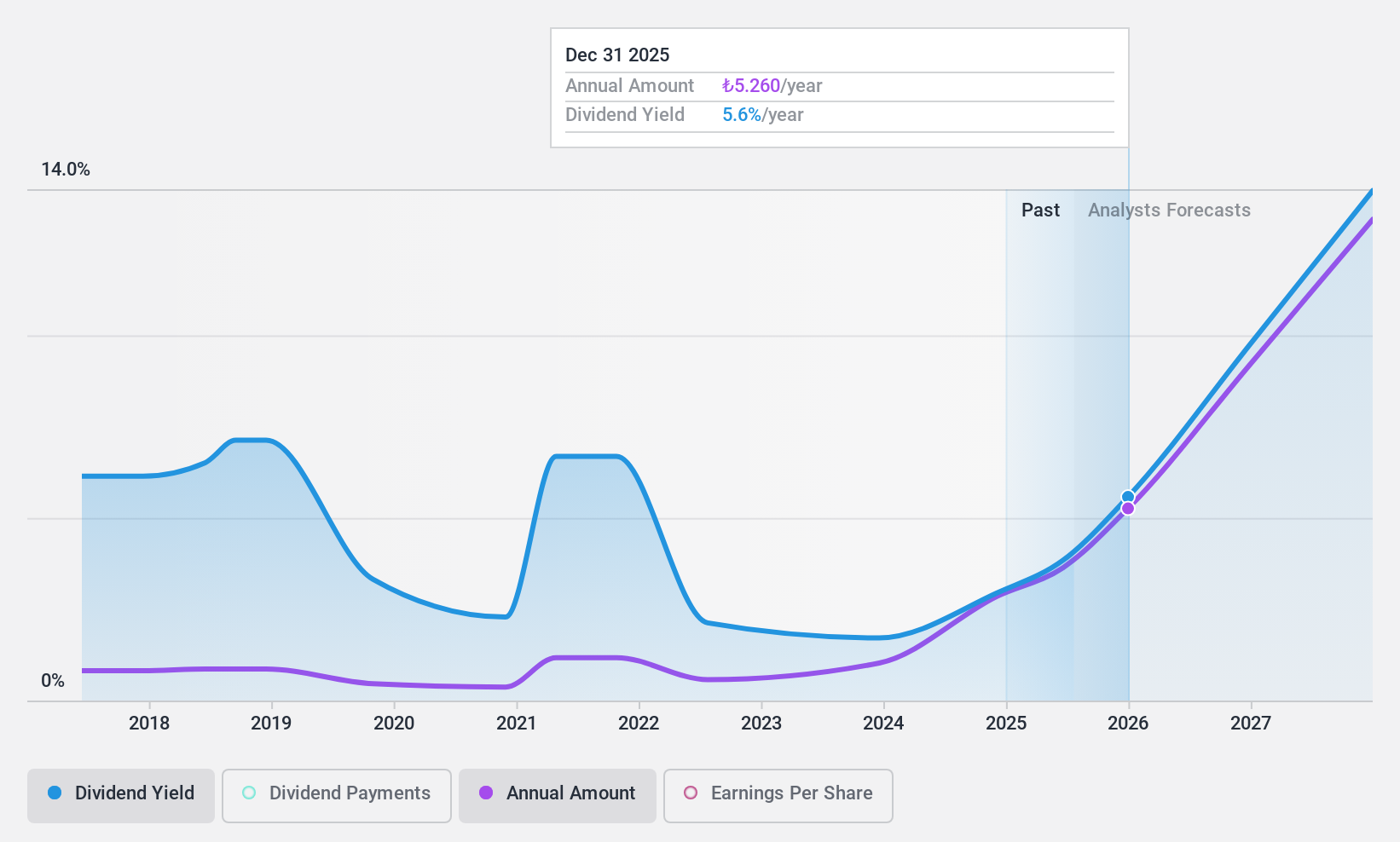

Turkcell Iletisim Hizmetleri (IBSE:TCELL)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Turkcell Iletisim Hizmetleri A.S. operates as a provider of digital services across Turkey, Belarus, the Turkish Republic of Northern Cyprus, and the Netherlands with a market cap of TRY197.59 billion.

Operations: Turkcell Iletisim Hizmetleri A.S. generates revenue primarily from its Turkcell Turkey segment at TRY143.77 billion, followed by Techfin at TRY8.63 billion and Turkcell International at TRY4.01 billion.

Dividend Yield: 3.1%

Turkcell Iletisim Hizmetleri's dividend strategy is supported by a low payout ratio of 23.9%, indicating strong coverage by earnings and cash flows, despite a historically unstable dividend track record. Recent board proposals suggest an increase in dividends, with TRY 8 billion to be distributed in 2025. However, the company's dividend yield is slightly below the top tier in Turkey's market. Strategic alliances and debt financing efforts could support future growth and stability for dividends.

- Dive into the specifics of Turkcell Iletisim Hizmetleri here with our thorough dividend report.

- The valuation report we've compiled suggests that Turkcell Iletisim Hizmetleri's current price could be quite moderate.

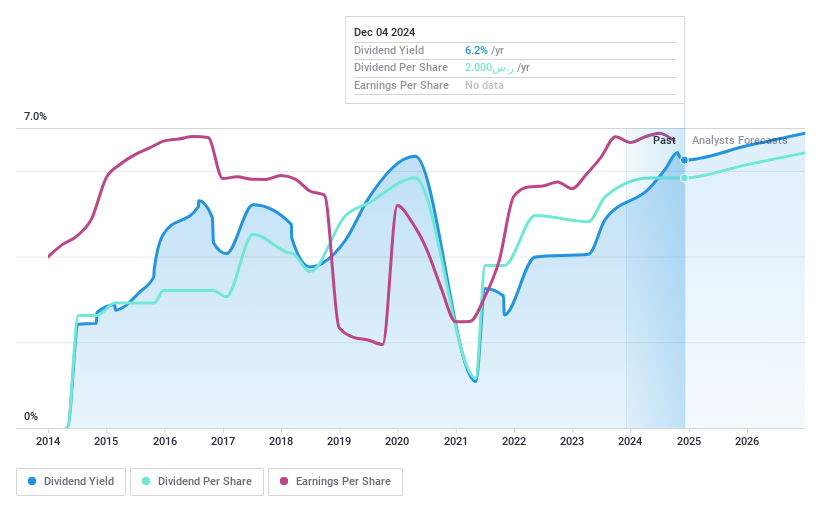

Banque Saudi Fransi (SASE:1050)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Banque Saudi Fransi offers banking and financial services to individuals and businesses both in the Kingdom of Saudi Arabia and internationally, with a market cap of SAR41.98 billion.

Operations: Banque Saudi Fransi's revenue is primarily derived from its Retail Banking segment at SAR6.98 billion, followed by Corporate Banking at SAR6.30 billion, and Investment Banking & Brokerage at SAR549.12 million.

Dividend Yield: 5.8%

Banque Saudi Fransi's dividends, though historically volatile, are currently well-covered by earnings with a payout ratio of 57.2%, and this is expected to improve to 54.2% in three years. The bank's dividend yield ranks in the top 25% of the Saudi Arabian market, supported by steady earnings growth—net income rose to SAR 4.54 billion for 2024 from SAR 4.22 billion in the previous year—indicating potential for sustained payouts despite past inconsistencies.

- Get an in-depth perspective on Banque Saudi Fransi's performance by reading our dividend report here.

- The analysis detailed in our Banque Saudi Fransi valuation report hints at an inflated share price compared to its estimated value.

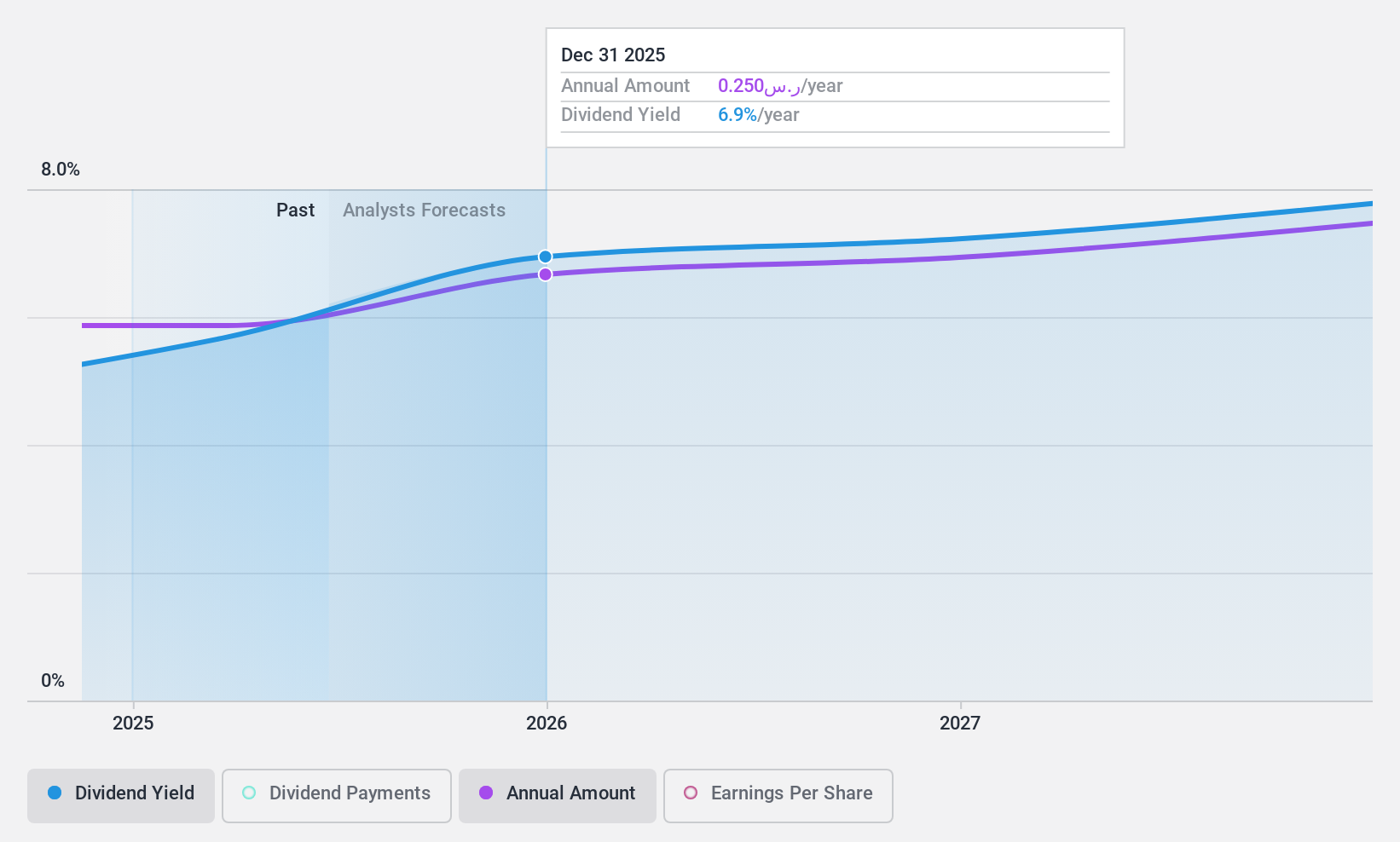

Fourth Milling (SASE:2286)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Fourth Milling Company operates in the Kingdom of Saudi Arabia, focusing on the production, packaging, and sale of flour and its byproducts, animal feed, and bran products with a market cap of SAR2.15 billion.

Operations: Fourth Milling Company's revenue is primarily derived from its food processing segment, which generated SAR629.03 million.

Dividend Yield: 5.5%

Fourth Milling Company recently joined the S&P Pan Arab Composite and S&P Global BMI Index, signaling increased visibility. The company's dividend yield ranks in the top 25% of Saudi Arabian payers. Although it's too early to assess dividend stability, payouts are well-supported by earnings with a 69.5% payout ratio and cash flows at 48.1%. Earnings grew by SAR 28.11 million last year, enhancing its ability to maintain dividends despite being new to regular distributions.

- Delve into the full analysis dividend report here for a deeper understanding of Fourth Milling.

- According our valuation report, there's an indication that Fourth Milling's share price might be on the cheaper side.

Turning Ideas Into Actions

- Dive into all 64 of the Top Middle Eastern Dividend Stocks we have identified here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Turkcell Iletisim Hizmetleri, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Turkcell Iletisim Hizmetleri might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:TCELL

Turkcell Iletisim Hizmetleri

Provides digital services in Turkey, Belarus, Turkish Republic of Northern Cyprus, and the Netherlands.

Exceptional growth potential with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives