Iveco Group And 2 Other Stocks That May Be Priced Below Their Estimated Value

Reviewed by Simply Wall St

Global markets have experienced a mixed performance recently, with major indices like the S&P 500 and Nasdaq Composite reaching record highs while others like the Russell 2000 faced declines. Amidst this divergence, growth stocks have notably outpaced value stocks, highlighting opportunities for investors to explore potentially undervalued assets in various sectors. In such an environment, identifying stocks that may be priced below their estimated value requires careful analysis of market trends and economic indicators, making it crucial for investors to consider factors such as sector performance and geopolitical influences.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Round One (TSE:4680) | ¥1266.00 | ¥2527.81 | 49.9% |

| NBT Bancorp (NasdaqGS:NBTB) | US$50.06 | US$99.93 | 49.9% |

| Proya CosmeticsLtd (SHSE:603605) | CN¥92.22 | CN¥184.30 | 50% |

| BMC Medical (SZSE:301367) | CN¥68.53 | CN¥136.81 | 49.9% |

| Acerinox (BME:ACX) | €9.98 | €19.93 | 49.9% |

| Grupo Traxión. de (BMV:TRAXION A) | MX$19.71 | MX$39.28 | 49.8% |

| North Electro-OpticLtd (SHSE:600184) | CN¥11.08 | CN¥22.00 | 49.6% |

| Sands China (SEHK:1928) | HK$20.20 | HK$40.33 | 49.9% |

| Equifax (NYSE:EFX) | US$266.82 | US$530.98 | 49.7% |

| iFLYTEKLTD (SZSE:002230) | CN¥51.82 | CN¥102.95 | 49.7% |

We're going to check out a few of the best picks from our screener tool.

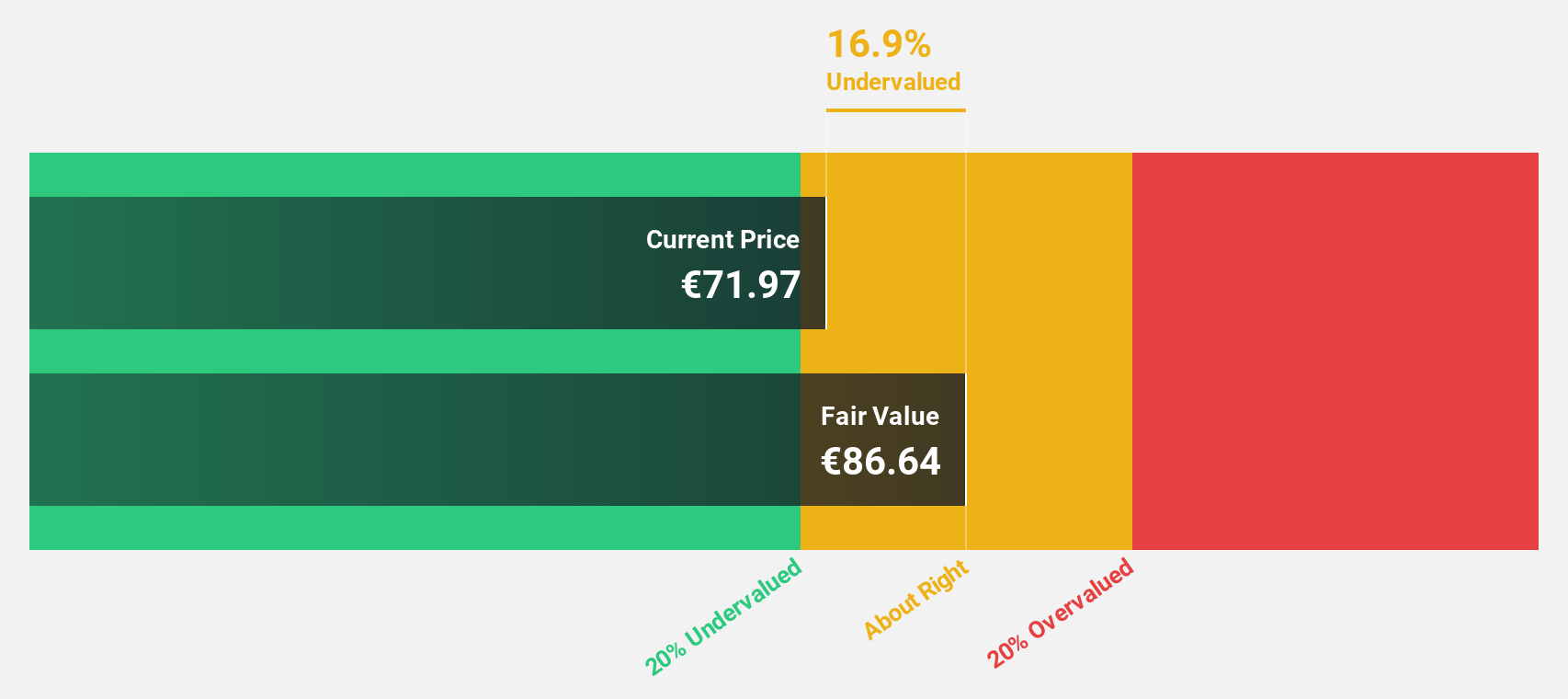

Iveco Group (BIT:IVG)

Overview: Iveco Group N.V. is involved in the design, production, marketing, sale, servicing, and financing of trucks, commercial vehicles, buses, and specialty vehicles for various applications globally with a market cap of €2.63 billion.

Operations: The company's revenue segments include Powertrain generating €3.75 billion and Financial Services contributing €570 million.

Estimated Discount To Fair Value: 24.5%

Iveco Group is trading at €9.95, significantly below its estimated fair value of €13.18, suggesting it may be undervalued based on discounted cash flow analysis. Despite a high level of debt and slower revenue growth than the Italian market, its earnings are forecast to grow significantly at 37.1% annually over the next three years. Recent strategic alliances and a completed share buyback program enhance its financial positioning and operational capabilities in Europe.

- Upon reviewing our latest growth report, Iveco Group's projected financial performance appears quite optimistic.

- Take a closer look at Iveco Group's balance sheet health here in our report.

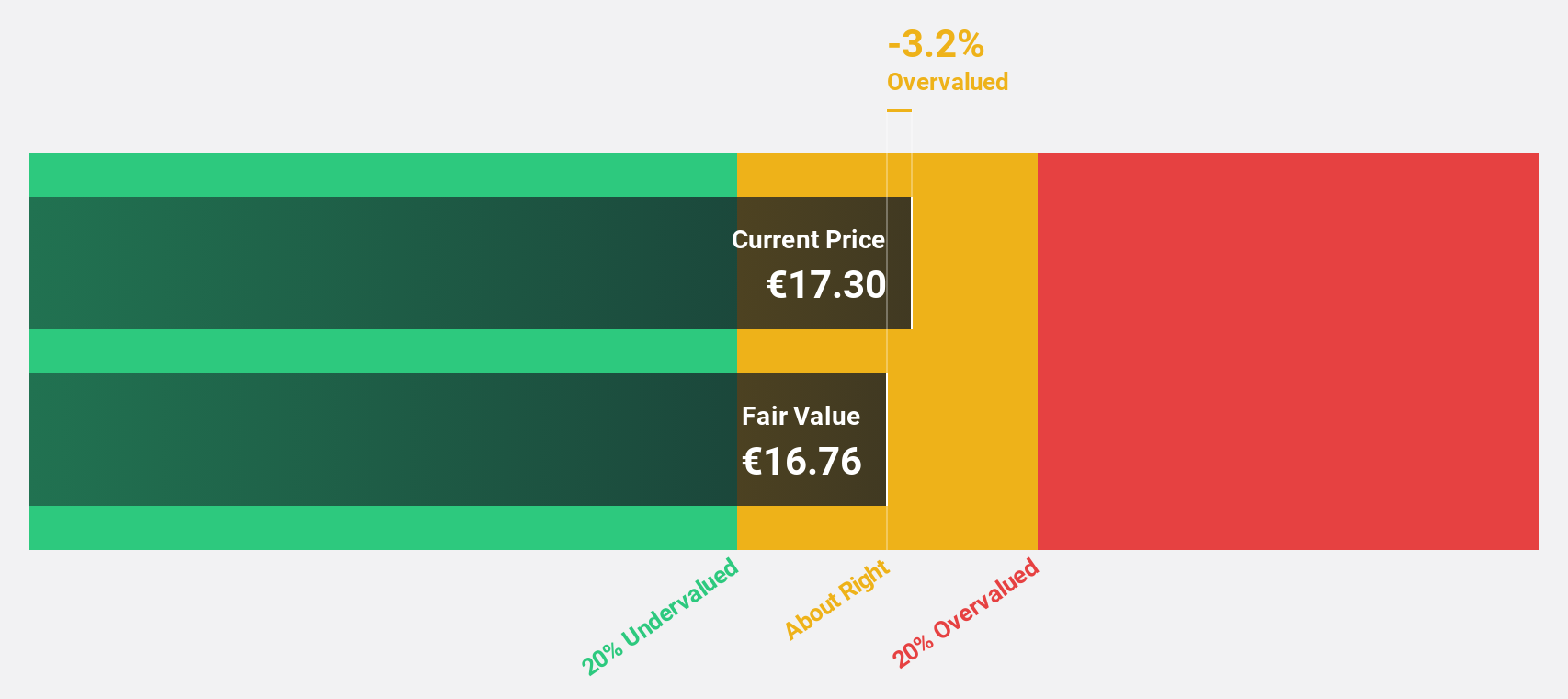

RENK Group (DB:R3NK)

Overview: RENK Group AG specializes in the design, engineering, production, testing, and servicing of customized drive systems both in Germany and internationally, with a market cap of €2.10 billion.

Operations: The company's revenue is derived from three main segments: €315.97 million from the M&I Segment, €631.93 million from the VMS Segment, and €119.59 million from the Slide Bearings Segment.

Estimated Discount To Fair Value: 40.8%

RENK Group, trading at €21.02, is significantly undervalued with an estimated fair value of €35.51 based on discounted cash flow analysis. Despite a drop in profit margins from 3.1% to 1.9% and earnings challenges, its earnings are expected to grow by over 50% annually, outpacing the German market's growth rate of 20.9%. The recent CEO transition could impact strategic direction as it prepares for revenue growth forecasted at €1.1 billion for 2024.

- In light of our recent growth report, it seems possible that RENK Group's financial performance will exceed current levels.

- Get an in-depth perspective on RENK Group's balance sheet by reading our health report here.

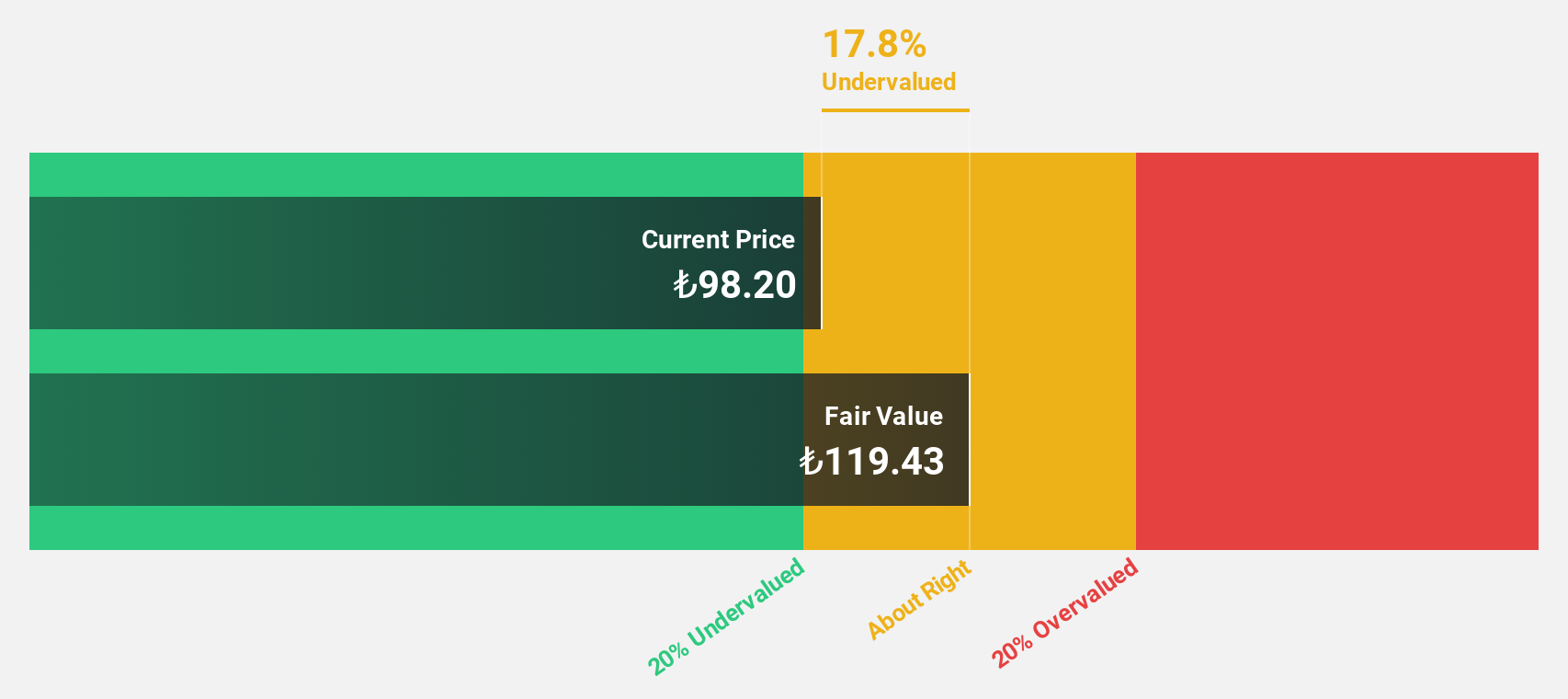

Turkcell Iletisim Hizmetleri (IBSE:TCELL)

Overview: Turkcell Iletisim Hizmetleri A.S. offers digital services in Turkey, Belarus, the Turkish Republic of Northern Cyprus, and the Netherlands with a market cap of TRY205.49 billion.

Operations: The company's revenue segments include Turkcell Turkey with TRY98.38 billion, Fintech contributing TRY5.98 billion, and Turkcell International at TRY2.83 billion.

Estimated Discount To Fair Value: 39.1%

Turkcell Iletisim Hizmetleri, trading at TRY 94.3, is undervalued with an estimated fair value of TRY 154.85 based on discounted cash flow analysis. Despite a recent upward revision in inflation forecasts affecting revenue growth targets to approximately 7% for 2024, the company has shown strong financial performance with a net income turnaround from loss to TRY 14.28 billion in Q3 and expected significant earnings growth over the next three years.

- According our earnings growth report, there's an indication that Turkcell Iletisim Hizmetleri might be ready to expand.

- Navigate through the intricacies of Turkcell Iletisim Hizmetleri with our comprehensive financial health report here.

Key Takeaways

- Investigate our full lineup of 884 Undervalued Stocks Based On Cash Flows right here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About DB:R3NK

RENK Group

Engages in the design, engineering, production, testing, and servicing of customized drive systems in Germany and internationally.

High growth potential and fair value.