- Japan

- /

- Specialty Stores

- /

- TSE:2726

Global Stocks Possibly Trading Below Fair Value Estimates In October 2025

Reviewed by Simply Wall St

In the midst of a volatile global market landscape, characterized by easing monetary policies and fluctuating trade tensions, investors are increasingly seeking opportunities in stocks that may be trading below their fair value estimates. Identifying undervalued stocks can be particularly appealing during such times, as they offer potential for growth when market conditions stabilize or improve.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Zhejiang Century Huatong GroupLtd (SZSE:002602) | CN¥19.10 | CN¥37.99 | 49.7% |

| Teikoku Sen-i (TSE:3302) | ¥3400.00 | ¥6729.43 | 49.5% |

| TaewoongLtd (KOSDAQ:A044490) | ₩31100.00 | ₩62162.91 | 50% |

| Pandora (CPSE:PNDORA) | DKK867.40 | DKK1734.70 | 50% |

| Noratis (XTRA:NUVA) | €0.78 | €1.56 | 49.9% |

| Kitron (OB:KIT) | NOK60.30 | NOK120.56 | 50% |

| Kinsus Interconnect Technology (TWSE:3189) | NT$145.00 | NT$287.04 | 49.5% |

| High Quality Food (BIT:HQF) | €0.614 | €1.22 | 49.7% |

| Atea (OB:ATEA) | NOK147.60 | NOK293.57 | 49.7% |

| Aecc Aero Science and TechnologyLtd (SHSE:600391) | CN¥27.07 | CN¥54.13 | 50% |

We'll examine a selection from our screener results.

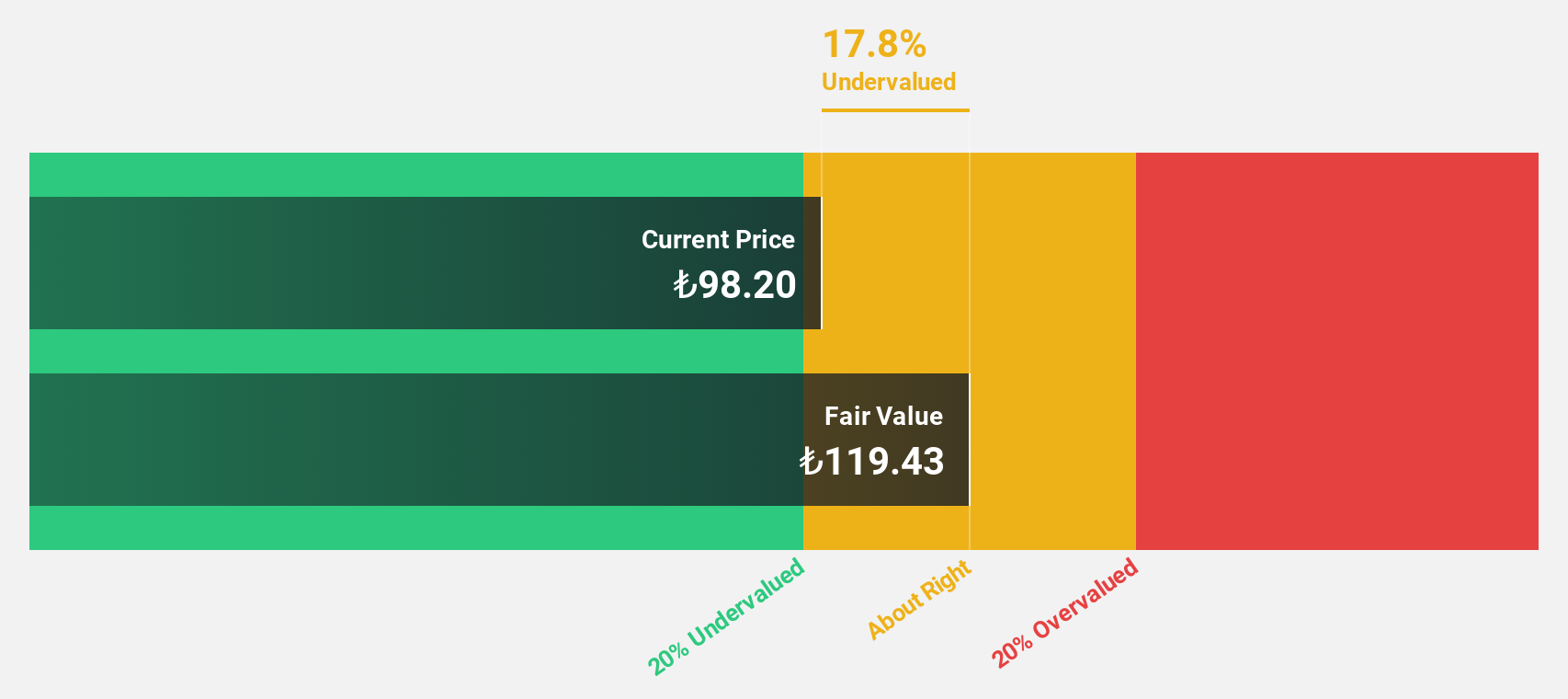

Turkcell Iletisim Hizmetleri (IBSE:TCELL)

Overview: Turkcell Iletisim Hizmetleri A.S., along with its subsidiaries, offers converged telecommunication and technology services in Turkey, Belarus, the Turkish Republic of Northern Cyprus, and the Netherlands, with a market cap of TRY210.88 billion.

Operations: The company's revenue segments include Turkcell Turkey, generating TRY153.66 billion, and Techfin, contributing TRY9.88 billion.

Estimated Discount To Fair Value: 20%

Turkcell Iletisim Hizmetleri is trading at TRY96.95, approximately 20% below its estimated fair value of TRY121.14, indicating it may be undervalued based on cash flows. Despite a forecasted low return on equity and reduced profit margins compared to the previous year, Turkcell's earnings are expected to grow significantly at 50.1% annually over the next three years, outpacing the Turkish market average. Recent investments in 5G spectrum enhance its technological capabilities and potential revenue growth.

- Our expertly prepared growth report on Turkcell Iletisim Hizmetleri implies its future financial outlook may be stronger than recent results.

- Click here to discover the nuances of Turkcell Iletisim Hizmetleri with our detailed financial health report.

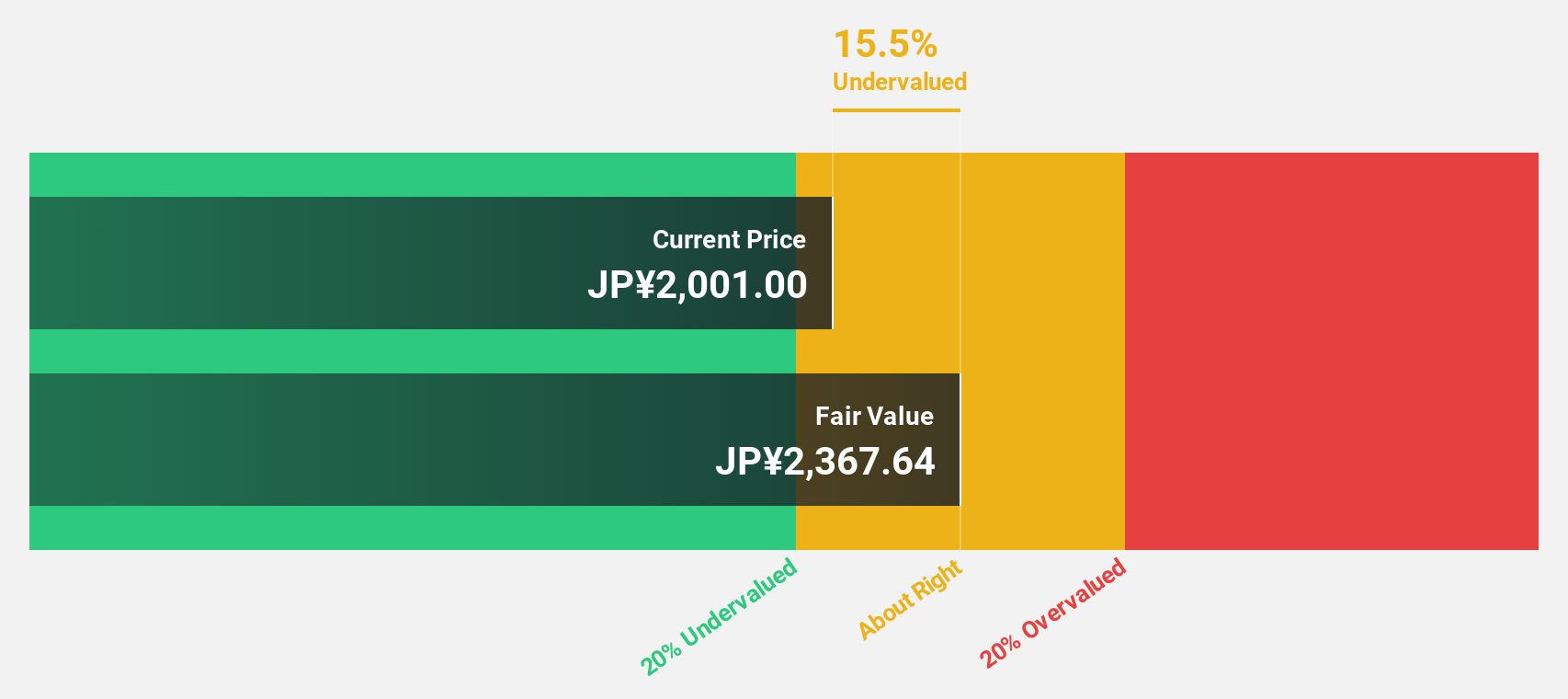

PAL GROUP Holdings (TSE:2726)

Overview: PAL GROUP Holdings CO., LTD. operates in Japan, focusing on the planning, manufacture, wholesale, and retail of men's and women's clothing and accessories, with a market cap of ¥349.38 billion.

Operations: The company's revenue is primarily derived from the Clothing Business, which accounts for ¥138.52 billion, and the Miscellaneous Goods Business, contributing ¥84.72 billion.

Estimated Discount To Fair Value: 11.6%

PAL GROUP Holdings is trading at ¥2,060, below its estimated fair value of ¥2,331.24, suggesting potential undervaluation based on cash flows. Recent earnings show a rise in net income to ¥9.19 billion for the half-year ending August 2025. While share price volatility persists, earnings are forecasted to grow at 15.8% annually, surpassing the Japanese market average of 8%. The company's return on equity is projected to be robust in three years at 21%.

- In light of our recent growth report, it seems possible that PAL GROUP Holdings' financial performance will exceed current levels.

- Get an in-depth perspective on PAL GROUP Holdings' balance sheet by reading our health report here.

Rakus (TSE:3923)

Overview: Rakus Co., Ltd. and its subsidiaries offer cloud services in Japan with a market cap of ¥455.96 billion.

Operations: Revenue Segments (in millions of ¥):

Estimated Discount To Fair Value: 12.6%

Rakus is trading at ¥1,276.5, below its fair value estimate of ¥1,460.73, hinting at potential undervaluation based on cash flows. Revenue growth is forecasted to outpace the Japanese market at 15.8% annually, while earnings are expected to grow significantly by 23.4% per year. Recent strategic alliances aim to enhance sales and customer satisfaction in the SaaS market, potentially boosting future cash flows despite a revised lower dividend following a stock split.

- Upon reviewing our latest growth report, Rakus' projected financial performance appears quite optimistic.

- Take a closer look at Rakus' balance sheet health here in our report.

Make It Happen

- Delve into our full catalog of 517 Undervalued Global Stocks Based On Cash Flows here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2726

PAL GROUP Holdings

Engages in the planning, manufacture, wholesale, and retail of clothing products, including men’s and women’s clothing and accessories in Japan.

Flawless balance sheet with reasonable growth potential and pays a dividend.

Market Insights

Community Narratives