- United Arab Emirates

- /

- Banks

- /

- DFM:AJMANBANK

Ajman Bank PJSC And 2 More Middle Eastern Penny Stocks To Watch

Reviewed by Simply Wall St

The Middle Eastern stock markets have recently shown resilience, with most Gulf bourses experiencing gains driven by positive corporate earnings and easing tariff concerns. For investors interested in smaller or newer companies, penny stocks — despite the term's somewhat outdated nature — still hold potential for value and growth. These stocks can offer a mix of affordability and potential upside when supported by solid financial foundations, making them worth watching in today's market landscape.

Top 10 Penny Stocks In The Middle East

| Name | Share Price | Market Cap | Rewards & Risks |

| Thob Al Aseel (SASE:4012) | SAR4.07 | SAR1.63B | ✅ 2 ⚠️ 1 View Analysis > |

| Keir International (SASE:9542) | SAR4.20 | SAR504M | ✅ 2 ⚠️ 3 View Analysis > |

| Dna Group (T.R.) (TASE:DNA) | ₪0.987 | ₪121.56M | ✅ 2 ⚠️ 4 View Analysis > |

| Alarum Technologies (TASE:ALAR) | ₪2.54 | ₪177.71M | ✅ 4 ⚠️ 2 View Analysis > |

| Oil Refineries (TASE:ORL) | ₪0.912 | ₪2.84B | ✅ 1 ⚠️ 2 View Analysis > |

| Tgi Infrastructures (TASE:TGI) | ₪2.13 | ₪158.35M | ✅ 2 ⚠️ 2 View Analysis > |

| Sharjah Cement and Industrial Development (PJSC) (ADX:SCIDC) | AED0.715 | AED425.78M | ✅ 2 ⚠️ 2 View Analysis > |

| Dubai National Insurance & Reinsurance (P.S.C.) (DFM:DNIR) | AED3.69 | AED426.19M | ✅ 2 ⚠️ 4 View Analysis > |

| Union Insurance Company P.J.S.C (ADX:UNION) | AED0.601 | AED198.89M | ✅ 2 ⚠️ 4 View Analysis > |

| Dubai Investments PJSC (DFM:DIC) | AED2.30 | AED9.78B | ✅ 3 ⚠️ 3 View Analysis > |

Click here to see the full list of 96 stocks from our Middle Eastern Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Ajman Bank PJSC (DFM:AJMANBANK)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Ajman Bank PJSC offers a range of banking products and services to individuals, businesses, and government institutions in the United Arab Emirates, with a market cap of AED4.06 billion.

Operations: The bank's revenue is primarily generated from its Treasury (AED113.94 million), Consumer Banking (AED266.56 million), and Wholesale Banking (AED454.45 million) segments in the United Arab Emirates.

Market Cap: AED4.06B

Ajman Bank PJSC, with a market cap of AED4.06 billion, has shown notable financial activity in the UAE banking sector. Despite having a low allowance for bad loans at 49% and a high level of non-performing loans at 10.8%, the bank maintains an appropriate Loans to Assets ratio of 57%. Its Price-To-Earnings ratio of 9.5x suggests good value compared to the AE market average. Recently, Ajman Bank reported an increase in net income for Q1 2025 to AED134.68 million from AED107.42 million last year, indicating improved profitability despite past earnings declines over five years by 1.6% annually.

- Click here to discover the nuances of Ajman Bank PJSC with our detailed analytical financial health report.

- Understand Ajman Bank PJSC's track record by examining our performance history report.

Escort Teknoloji Yatirim (IBSE:ESCOM)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Escort Teknoloji Yatirim A.S. offers technology-based products, solutions, and services both in Turkey and internationally, with a market cap of TRY1.78 billion.

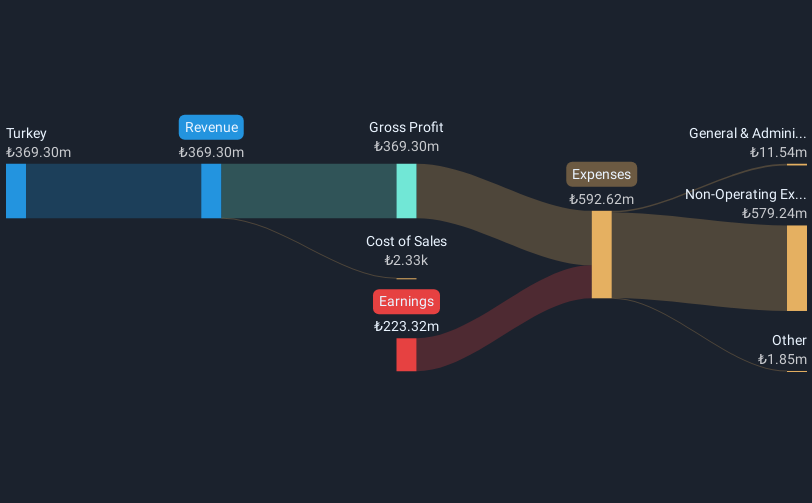

Operations: The company generates revenue primarily from its operations in Turkey, amounting to TRY369.30 million.

Market Cap: TRY1.78B

Escort Teknoloji Yatirim A.S., with a market cap of TRY1.78 billion, reported a significant decline in sales to TRY369.30 million for 2024 from TRY994.88 million the previous year, resulting in a net loss of TRY223.32 million compared to a net income last year. Despite being debt-free and not diluting shareholders recently, the company faces challenges with negative return on equity and insufficient short-term assets to cover liabilities. Although unprofitable, Escort has reduced its losses at an impressive rate over five years and maintains stable weekly volatility at 8%, offering some stability amidst financial challenges.

- Jump into the full analysis health report here for a deeper understanding of Escort Teknoloji Yatirim.

- Gain insights into Escort Teknoloji Yatirim's historical outcomes by reviewing our past performance report.

Mega Polietilen Köpük Sanayi ve Ticaret Anonim Sirketi (IBSE:MEGAP)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Mega Polietilen Köpük Sanayi ve Ticaret Anonim Sirketi, with a market cap of TRY778.25 million, specializes in the production and sale of foam sheets in Turkey.

Operations: The company generates revenue primarily through its Textile Operation, which accounts for TRY12.14 billion, and its Polyurethane Operations, contributing TRY31.24 million.

Market Cap: TRY778.25M

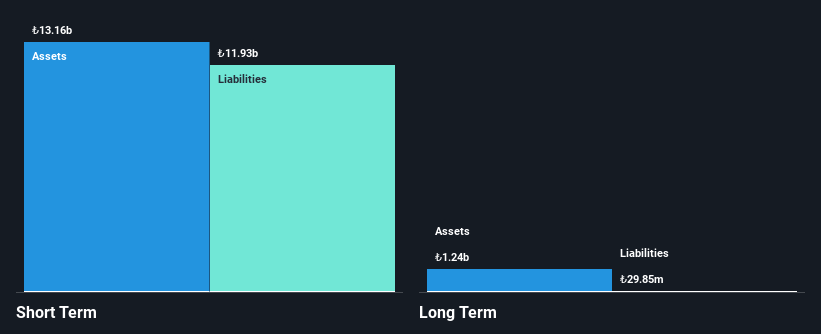

Mega Polietilen Köpük Sanayi ve Ticaret Anonim Sirketi demonstrates robust growth, with earnings rising by 36% over the past year and sales reaching TRY12.17 billion, doubling from the previous year. Despite a volatile share price and lower profit margins at 4%, its short-term assets of TRY13.2 billion comfortably cover both short- and long-term liabilities. While debt levels have increased, they remain satisfactory, with interest payments well-covered by earnings. The company's low price-to-earnings ratio of 1.6x suggests potential undervaluation compared to the broader market, although its high weekly volatility may pose risks for investors seeking stability in penny stocks.

- Click to explore a detailed breakdown of our findings in Mega Polietilen Köpük Sanayi ve Ticaret Anonim Sirketi's financial health report.

- Gain insights into Mega Polietilen Köpük Sanayi ve Ticaret Anonim Sirketi's past trends and performance with our report on the company's historical track record.

Seize The Opportunity

- Explore the 96 names from our Middle Eastern Penny Stocks screener here.

- Searching for a Fresh Perspective? Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About DFM:AJMANBANK

Ajman Bank PJSC

Provides various banking products and services for individuals, businesses, and government institutions in the United Arab Emirates.

Adequate balance sheet with questionable track record.

Market Insights

Community Narratives