As Middle Eastern markets experience a surge, buoyed by the Israel-Iran ceasefire and Dubai's stock index reaching a 17-year high, investors are increasingly turning their attention to the region's promising small-cap opportunities. In this vibrant landscape, identifying stocks with strong fundamentals and growth potential becomes crucial for those looking to capitalize on these favorable market conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Alf Meem Yaa for Medical Supplies and Equipment | NA | 17.03% | 18.37% | ★★★★★★ |

| Baazeem Trading | 8.48% | -2.02% | -2.70% | ★★★★★★ |

| Sure Global Tech | NA | 11.95% | 18.65% | ★★★★★★ |

| MOBI Industry | 6.50% | 5.60% | 24.00% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 2.07% | 16.18% | 21.11% | ★★★★★★ |

| Nofoth Food Products | NA | 15.75% | 27.63% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 14.55% | 29.05% | ★★★★★☆ |

| National Corporation for Tourism and Hotels | 19.25% | 0.67% | 4.89% | ★★★★☆☆ |

| Waja | 23.81% | 98.44% | 14.54% | ★★★★☆☆ |

| Saudi Chemical Holding | 79.49% | 16.57% | 44.01% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Gübre Fabrikalari Türk Anonim Sirketi (IBSE:GUBRF)

Simply Wall St Value Rating: ★★★★★★

Overview: Gübre Fabrikalari Türk Anonim Sirketi, along with its subsidiaries, is engaged in the production, sale, and marketing of chemical fertilizers in Turkey and has a market capitalization of TRY74.90 billion.

Operations: Gübre Fabrikalari Türk Anonim Sirketi generates revenue primarily from domestic fertilizer sales, amounting to TRY27.35 billion, and foreign fertilizer sales at TRY17.57 billion. The company's net profit margin is a key financial metric to consider when evaluating its profitability performance over time.

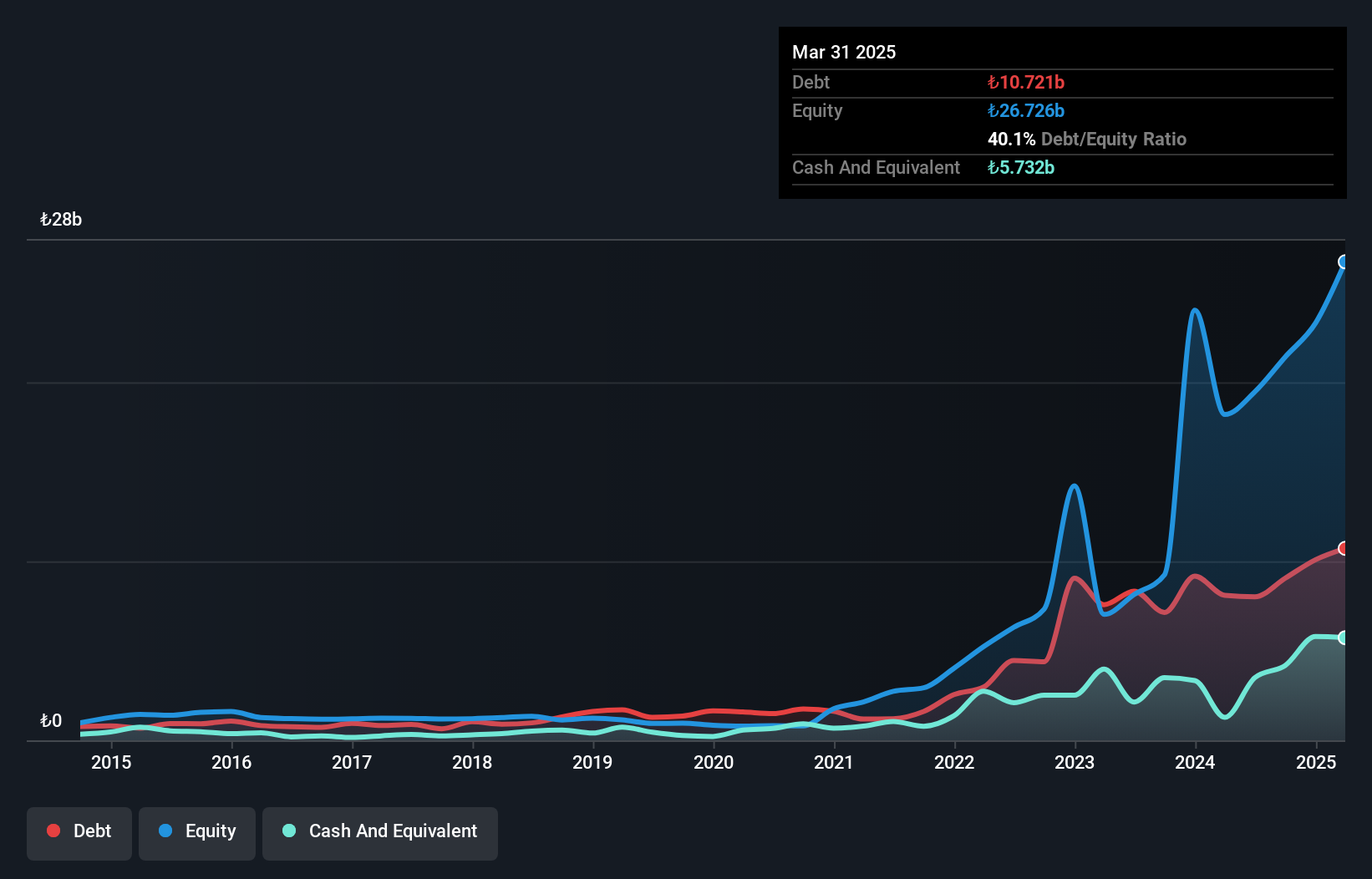

Gübre Fabrikalari Türk Anonim Sirketi, a notable player in the Middle East's chemicals sector, has shown significant financial improvement. Over the last five years, its debt to equity ratio impressively decreased from 198.5% to 40.1%, indicating better financial health. Recently turning profitable, GUBRF reported TRY 998 million net income for Q1 2025 compared to a TRY 1,719 million loss the previous year. Trading at a discount of about 7.7% below estimated fair value suggests potential upside for investors eyeing value opportunities in emerging markets like Turkey's chemical industry.

Odine Solutions Teknoloji Ticaret ve Sanayi (IBSE:ODINE)

Simply Wall St Value Rating: ★★★★★☆

Overview: Odine Solutions Teknoloji Ticaret ve Sanayi operates in the technology sector, focusing on internet software and services, with a market capitalization of TRY10.14 billion.

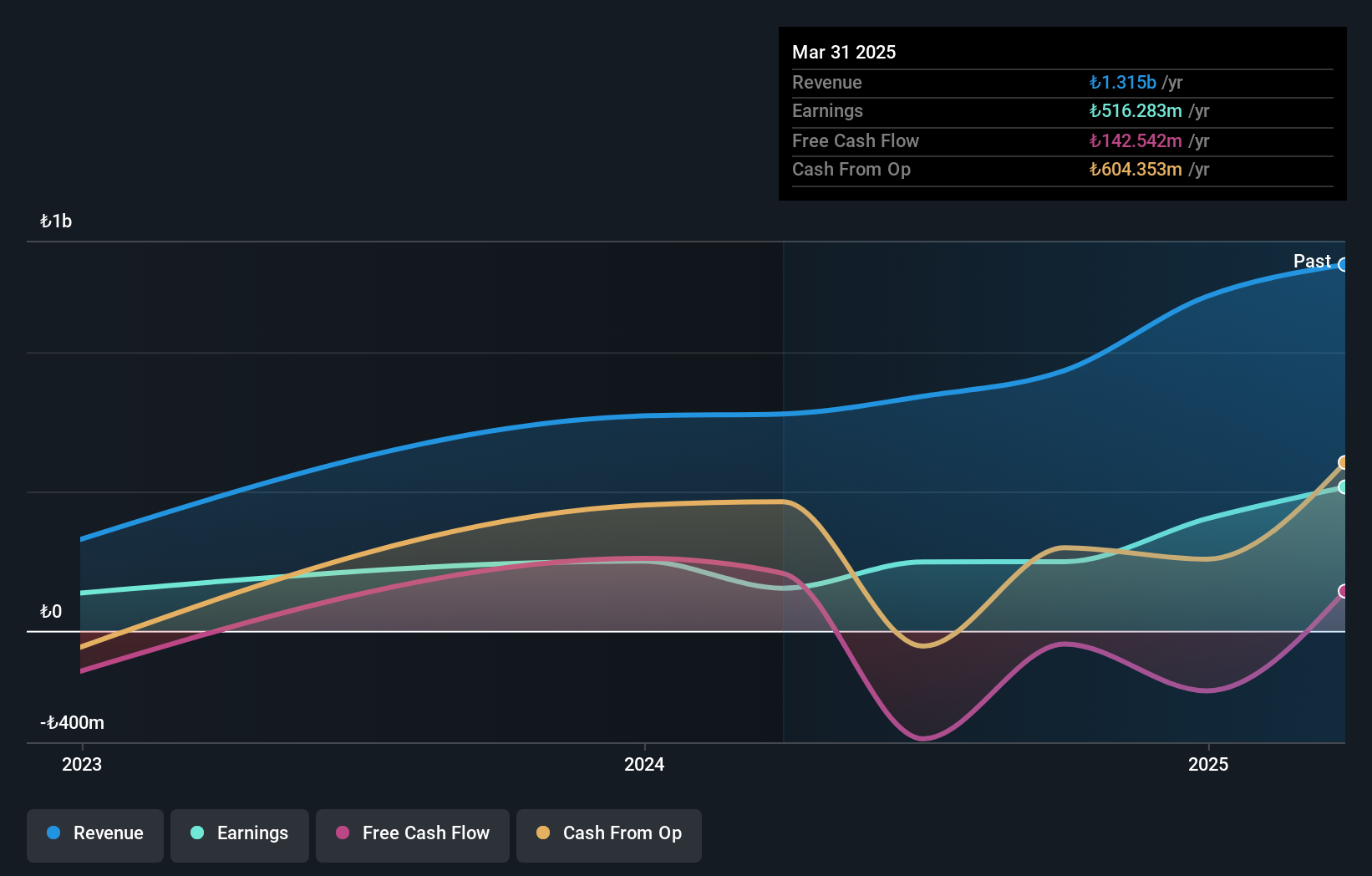

Operations: Odine Solutions generates revenue primarily from its internet software and services segment, amounting to TRY1.31 billion. The company's gross profit margin stands at 45%, reflecting its efficiency in managing production costs relative to sales.

Odine Solutions Teknoloji Ticaret ve Sanayi, a nimble player in the tech sector, showcases impressive growth with earnings surging 237.6% over the past year, surpassing industry norms. The price-to-earnings ratio of 19.6x indicates potential value compared to the IT industry's average of 22.8x. Despite recent share price volatility, Odine's financial health is robust with more cash than debt and positive free cash flow at TRY 142.54 million as of March 2025. Their innovative AI-powered semantic communication patent for future wireless systems highlights a commitment to cutting-edge R&D and positions them well for upcoming tech advancements in areas like IoT and smart cities.

- Click to explore a detailed breakdown of our findings in Odine Solutions Teknoloji Ticaret ve Sanayi's health report.

Understand Odine Solutions Teknoloji Ticaret ve Sanayi's track record by examining our Past report.

Qassim Cement (SASE:3040)

Simply Wall St Value Rating: ★★★★★★

Overview: Qassim Cement Company operates in the Kingdom of Saudi Arabia, focusing on the manufacture and sale of cement, with a market capitalization of SAR5.53 billion.

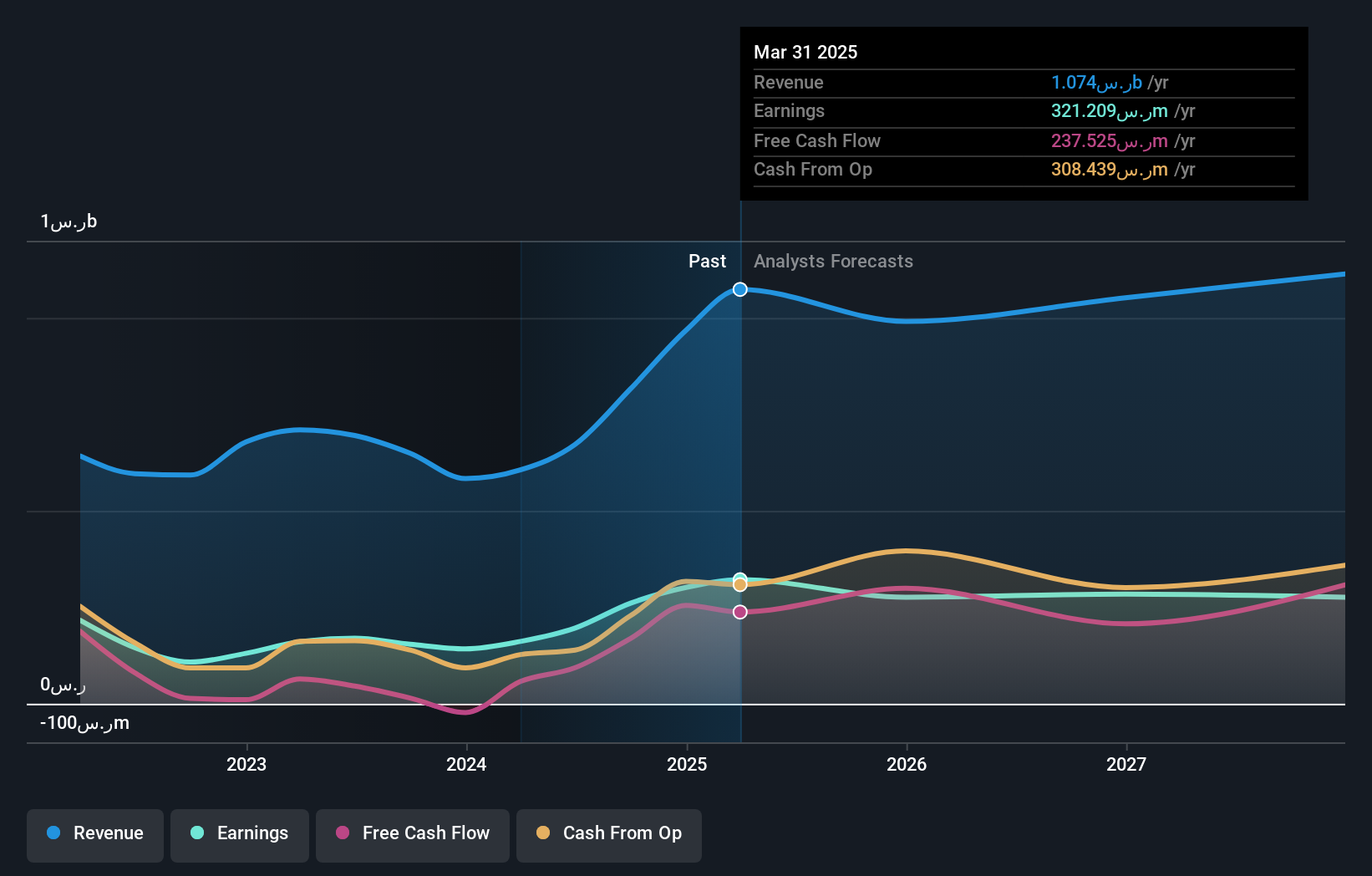

Operations: The company generates revenue primarily from the manufacturing and selling of cement, amounting to SAR1.07 billion.

Qassim Cement, a notable player in the Middle East's cement industry, has shown impressive growth with earnings surging by 99% over the past year, outpacing the Basic Materials industry's 29%. The company reported sales of SAR 302.68 million for Q1 2025 compared to SAR 196.42 million a year earlier, reflecting strong operational performance. With no debt on its books for five years and a price-to-earnings ratio of 17.3x below the SA market average of 21.2x, it presents an attractive valuation proposition. Recently declaring a quarterly dividend of SAR 0.80 per share, Qassim Cement continues to reward its shareholders actively.

- Take a closer look at Qassim Cement's potential here in our health report.

Gain insights into Qassim Cement's past trends and performance with our Past report.

Seize The Opportunity

- Dive into all 218 of the Middle Eastern Undiscovered Gems With Strong Fundamentals we have identified here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:ODINE

Odine Solutions Teknoloji Ticaret ve Sanayi

Odine Solutions Teknoloji Ticaret ve Sanayi A.S.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives