Exploring Abu Dhabi Ship Building PJSC And 2 Other Undiscovered Gems In The Middle East

Reviewed by Simply Wall St

As concerns over U.S. tariffs resurface, most Gulf markets have experienced declines, reflecting broader investor apprehension about economic stability and the potential impact on small-cap stocks in the region. Despite these challenges, opportunities for growth remain in the Middle East, where identifying promising companies like Abu Dhabi Ship Building PJSC can be crucial for investors seeking to navigate uncertain market conditions effectively.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Alf Meem Yaa for Medical Supplies and Equipment | NA | 17.03% | 18.37% | ★★★★★★ |

| MOBI Industry | 6.50% | 5.60% | 24.00% | ★★★★★★ |

| Baazeem Trading | 6.93% | -1.88% | -2.38% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 2.07% | 16.18% | 21.11% | ★★★★★★ |

| National Corporation for Tourism and Hotels | 15.77% | -3.48% | -12.95% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 13.40% | 30.21% | ★★★★★☆ |

| Union Coop | 3.73% | -4.15% | -13.19% | ★★★★★☆ |

| Keir International | 23.18% | 49.21% | -17.98% | ★★★★★☆ |

| Saudi Chemical Holding | 73.23% | 15.66% | 44.81% | ★★★★☆☆ |

| Waja | 23.81% | 98.44% | 14.54% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Abu Dhabi Ship Building PJSC (ADX:ADSB)

Simply Wall St Value Rating: ★★★★★☆

Overview: Abu Dhabi Ship Building PJSC is involved in the construction, maintenance, repair, and overhaul of commercial and military ships and vessels in the United Arab Emirates, with a market capitalization of AED1.26 billion.

Operations: ADSB's primary revenue streams include New Build and Engineering at AED1.25 billion and Military Repairs and Maintenance at AED148.77 million, with smaller contributions from Small Boats, Mission Systems, and Commercial Repairs and Maintenance.

Abu Dhabi Ship Building, a smaller player in the Aerospace & Defense sector, is making waves with impressive earnings growth of 91.5% over the past year, significantly outpacing the industry average of 19.1%. The company's debt-to-equity ratio has improved from 155.4% to 47.6% over five years, indicating better financial health and stability. With a price-to-earnings ratio of 16x, it appears undervalued compared to its peers' average of 50x. Recent executive appointments aim to bolster growth and operational excellence while a dividend increase signals confidence in future prospects despite lacking free cash flow positivity recently.

Bosch Fren Sistemleri Sanayi ve Ticaret (IBSE:BFREN)

Simply Wall St Value Rating: ★★★★★☆

Overview: Bosch Fren Sistemleri Sanayi ve Ticaret A.S. operates in the automotive components industry and has a market capitalization of TRY21.61 billion.

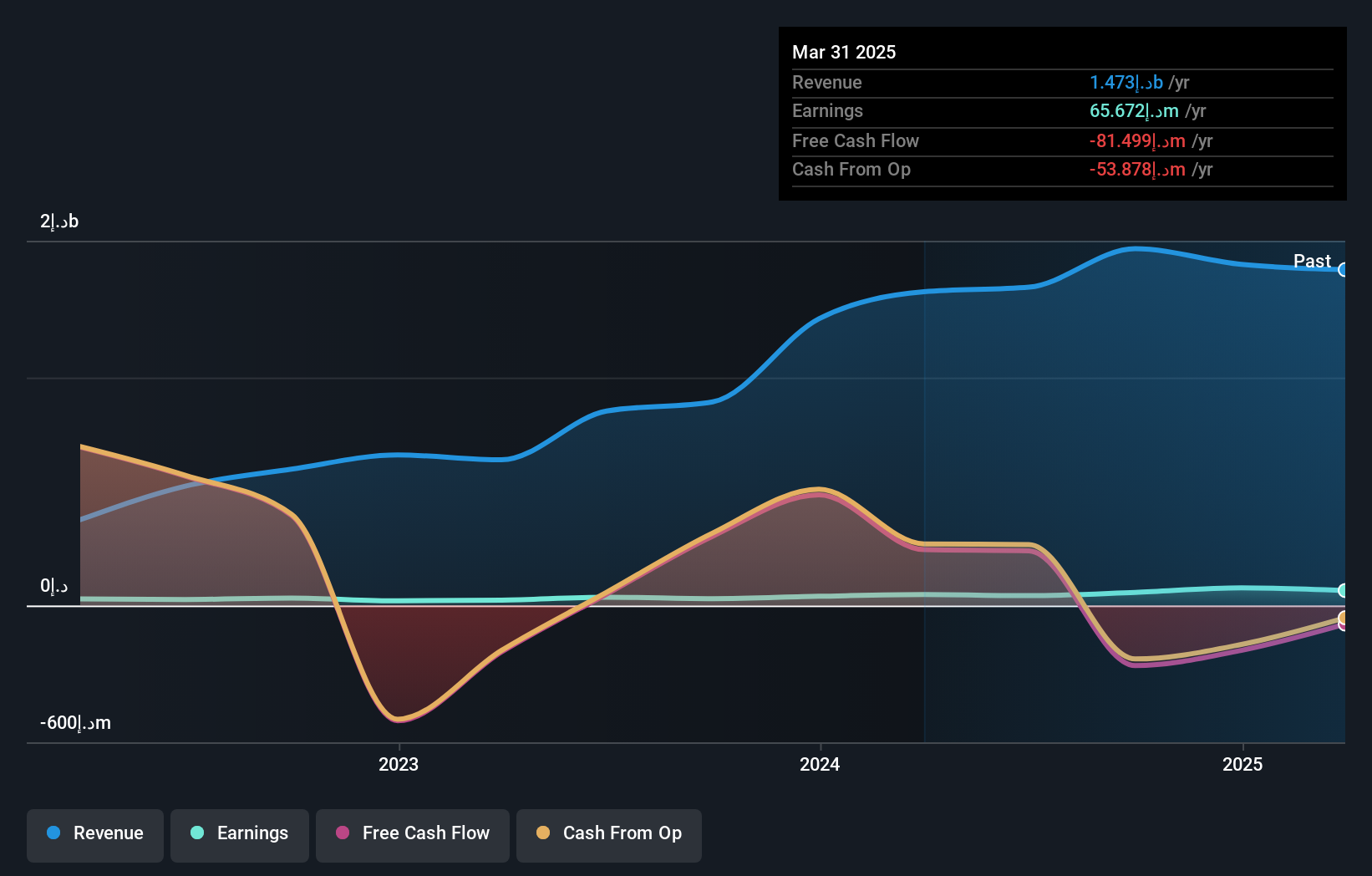

Operations: BFREN generates revenue of TRY2.07 billion from the automotive components sector. The company's financial performance can be further analyzed by examining its profit margins and cost structures, although specific details on these are not provided here.

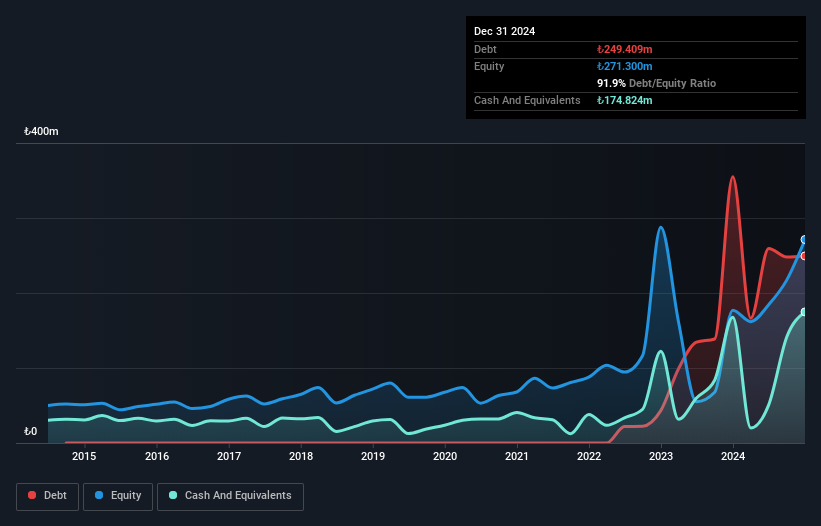

Bosch Fren Sistemleri, a smaller player in the auto components sector, has recently turned its financial fortunes around. The company reported TRY 2.07 billion in sales for 2024, up from TRY 1.75 billion the previous year, and achieved a net income of TRY 94.41 million compared to a loss of TRY 90.82 million previously. Its debt management appears prudent with a net debt to equity ratio at a satisfactory level of 27.5%, and interest payments are well covered by EBIT at 4.1 times coverage. Despite an increase in debt over five years, Bosch Fren's profitability now seems promising with high-quality earnings supporting its cash runway stability.

- Take a closer look at Bosch Fren Sistemleri Sanayi ve Ticaret's potential here in our health report.

Understand Bosch Fren Sistemleri Sanayi ve Ticaret's track record by examining our Past report.

Logo Yazilim Sanayi ve Ticaret (IBSE:LOGO)

Simply Wall St Value Rating: ★★★★★★

Overview: Logo Yazilim Sanayi ve Ticaret A.S. develops and markets software solutions in Turkey and internationally, with a market capitalization of TRY11.76 billion.

Operations: Logo Yazilim generates revenue primarily from the software industry, amounting to TRY4.08 billion.

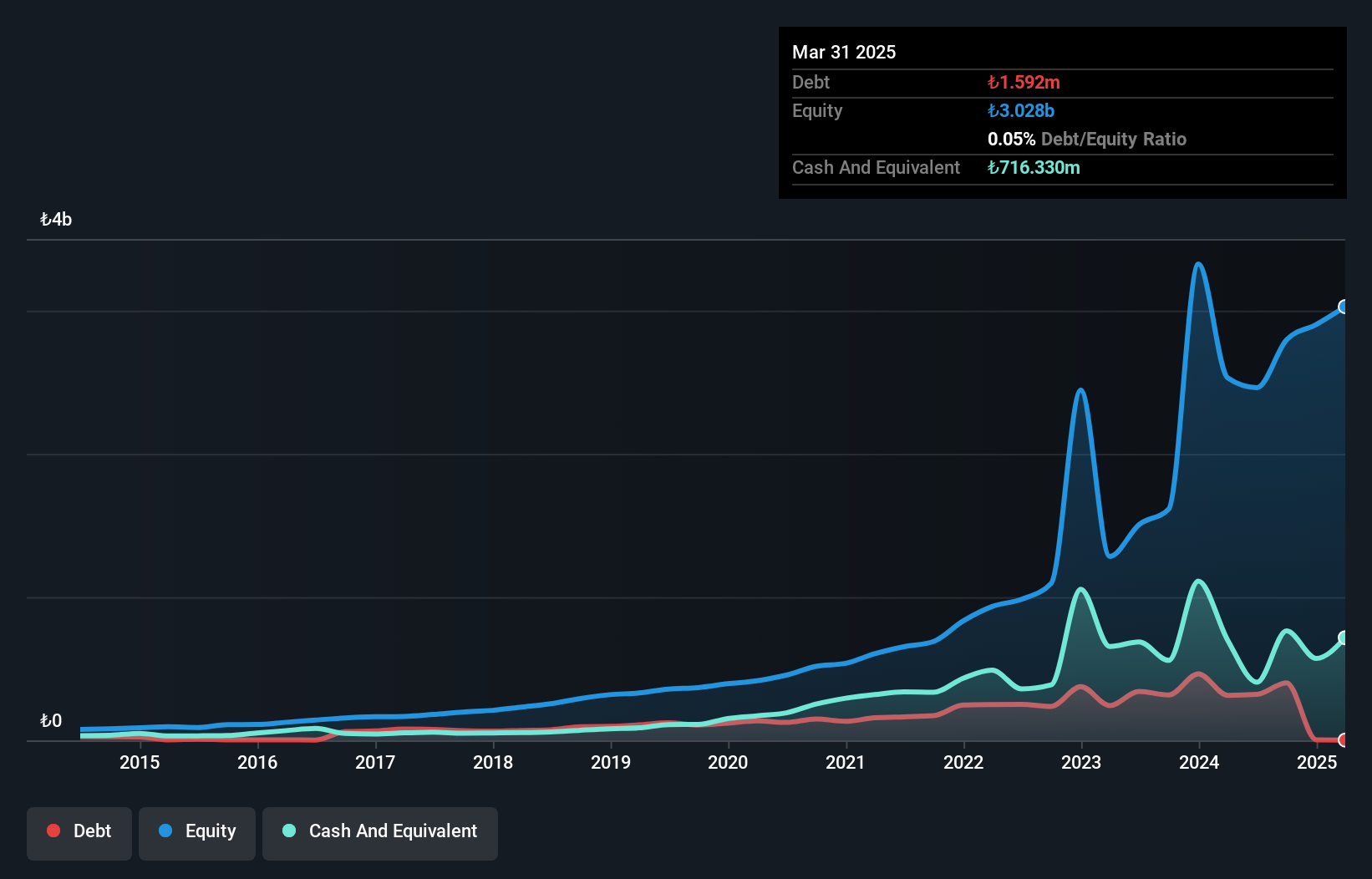

Over the past five years, Logo Yazilim's debt to equity ratio has impressively decreased from 30.3% to 0.1%, indicating a robust financial position. The company boasts high-quality earnings, with interest payments well covered by EBIT at 4.9 times, reflecting sound financial health. Despite an annual earnings growth of 13.1%, it trails behind the software industry's rapid pace of 143.8%. Recently, sales surged to TRY 4 billion from TRY 3 billion last year, and net income climbed to TRY 352 million from TRY 202 million previously, showcasing strong performance in its niche market segment within Turkey's dynamic tech landscape.

- Get an in-depth perspective on Logo Yazilim Sanayi ve Ticaret's performance by reading our health report here.

Learn about Logo Yazilim Sanayi ve Ticaret's historical performance.

Where To Now?

- Unlock our comprehensive list of 247 Middle Eastern Undiscovered Gems With Strong Fundamentals by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:LOGO

Logo Yazilim Sanayi ve Ticaret

Develops and markets software solutions in Turkey and internationally.

Outstanding track record with excellent balance sheet.

Market Insights

Community Narratives