- Turkey

- /

- Retail REITs

- /

- IBSE:YGGYO

Top Dividend Stocks To Consider For Your Portfolio

Reviewed by Simply Wall St

In a week marked by economic reports and earnings data, global markets experienced fluctuations with major indices like the Nasdaq Composite and S&P MidCap 400 reaching highs before retreating. Amidst this backdrop of cautious optimism and economic uncertainty, dividend stocks continue to attract investors seeking steady income streams. As markets navigate these complex conditions, selecting dividend stocks with strong fundamentals can offer a measure of stability and potential growth for portfolios.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.31% | ★★★★★★ |

| Mitsubishi Shokuhin (TSE:7451) | 3.86% | ★★★★★★ |

| Globeride (TSE:7990) | 4.12% | ★★★★★★ |

| Intelligent Wave (TSE:4847) | 3.97% | ★★★★★★ |

| Innotech (TSE:9880) | 4.86% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.62% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 4.22% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.57% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.59% | ★★★★★★ |

| KurimotoLtd (TSE:5602) | 5.10% | ★★★★★★ |

Click here to see the full list of 2037 stocks from our Top Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

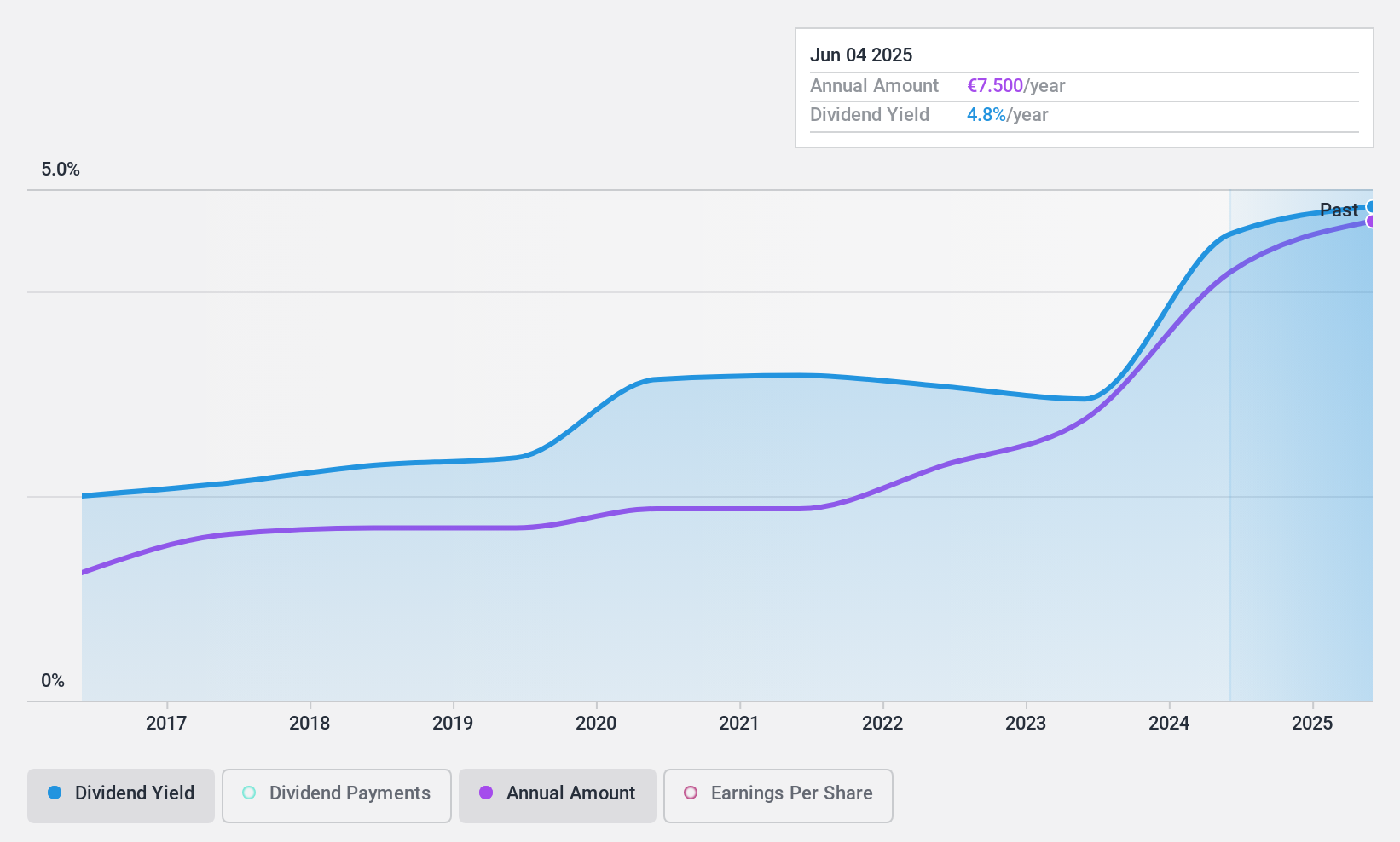

Exacompta Clairefontaine (ENXTPA:ALEXA)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Exacompta Clairefontaine S.A. is involved in the production, finishing, and formatting of papers across France, Europe, and internationally with a market cap of €159.54 million.

Operations: Exacompta Clairefontaine S.A.'s revenue segments include €354.56 million from Paper and €597.58 million from Conversion.

Dividend Yield: 4.8%

Exacompta Clairefontaine offers a reliable dividend yield of 4.75%, supported by stable and growing payments over the past decade. The dividend is well covered by earnings, with a payout ratio of 35.4%, and cash flows, with a cash payout ratio of 10.7%. However, its yield is lower than the top quartile in France (5.57%). Recent earnings showed decreased sales (€408.42M) and net income (€16.5M), potentially impacting future dividend sustainability.

- Take a closer look at Exacompta Clairefontaine's potential here in our dividend report.

- Our valuation report here indicates Exacompta Clairefontaine may be undervalued.

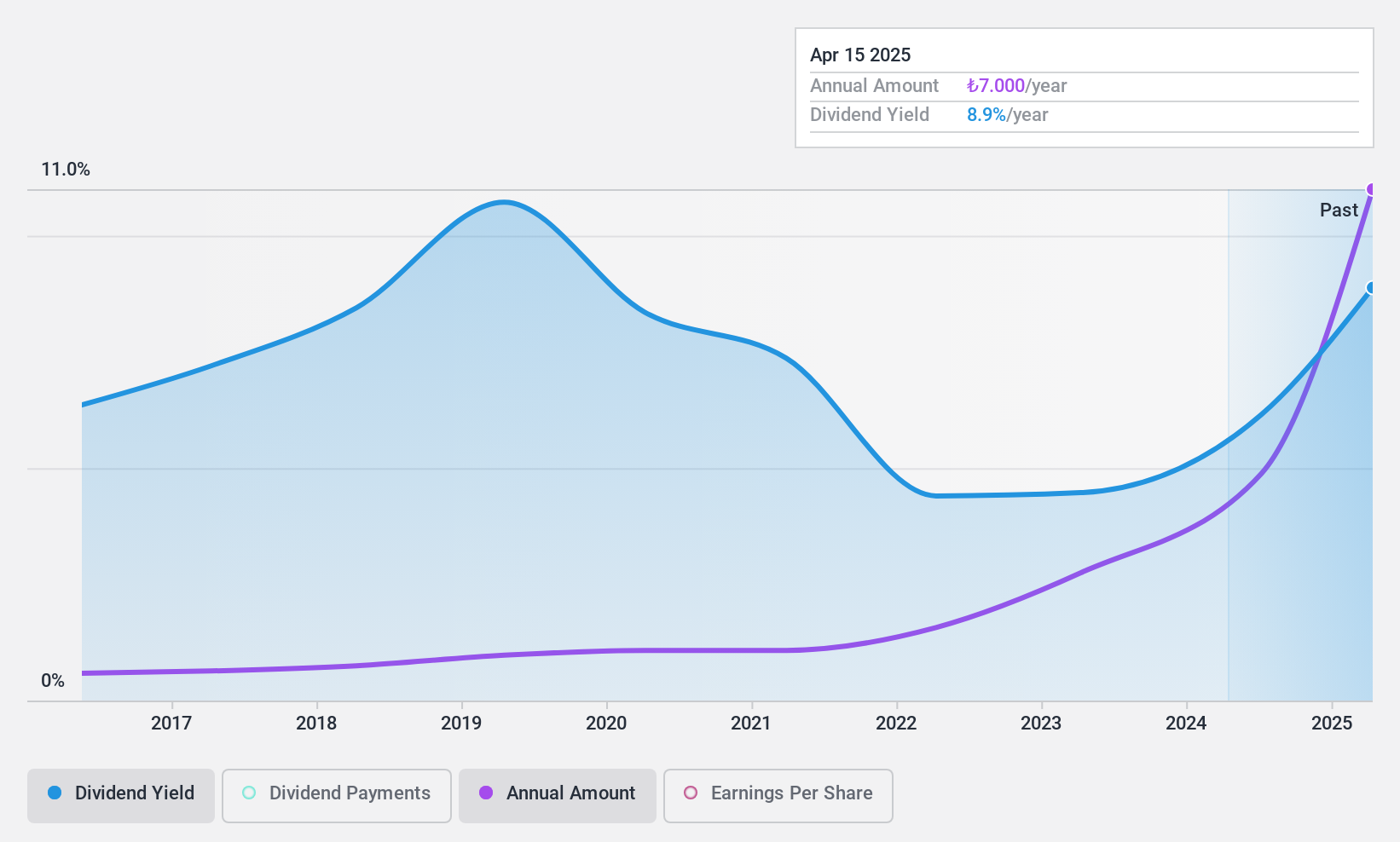

Yeni Gimat Gayrimenkul Yatirim Ortakligi (IBSE:YGGYO)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Yeni Gimat Gayrimenkul Yatirim Ortakligi A.S. operates in the real estate investment sector and has a market capitalization of TRY13.09 billion.

Operations: Yeni Gimat Gayrimenkul Yatirim Ortakligi A.S. generates its revenue primarily from Ankamall AVM with TRY1.33 billion and CP Ankara Hotel contributing TRY94.43 million.

Dividend Yield: 5.7%

Yeni Gimat Gayrimenkul Yatirim Ortakligi's dividend yield of 5.7% ranks in the top 25% in Turkey, supported by a low payout ratio of 12.7% and cash payout ratio of 11.9%, indicating strong coverage by earnings and cash flows. Despite an unstable dividend track record under a decade, recent earnings improvements with TRY 255.96 million net income for Q2 highlight potential growth prospects, though historical volatility remains a concern for stability-focused investors.

- Unlock comprehensive insights into our analysis of Yeni Gimat Gayrimenkul Yatirim Ortakligi stock in this dividend report.

- In light of our recent valuation report, it seems possible that Yeni Gimat Gayrimenkul Yatirim Ortakligi is trading behind its estimated value.

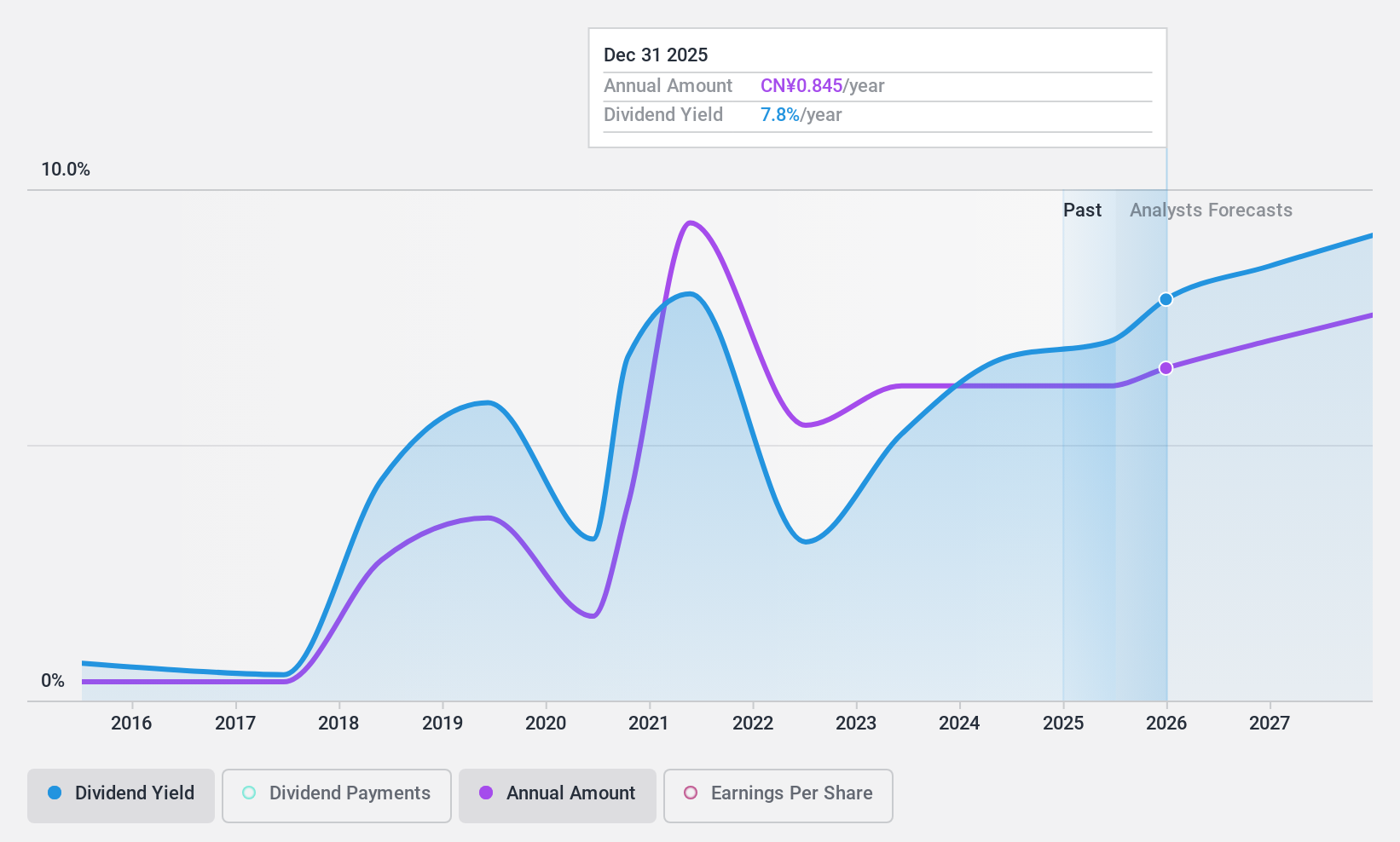

Luyang Energy-Saving Materials (SZSE:002088)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Luyang Energy-Saving Materials Co., Ltd. is involved in the research, development, production, and sale of energy-saving products such as ceramic fiber, alumina fiber, soluble fiber, basalt fiber, and insulating firebrick both in China and internationally with a market cap of CN¥6.30 billion.

Operations: Luyang Energy-Saving Materials Co., Ltd. generates revenue through its production and sale of energy-efficient products, including ceramic fiber, alumina fiber, soluble fiber, basalt fiber, and insulating firebrick across domestic and international markets.

Dividend Yield: 6.5%

Luyang Energy-Saving Materials offers a dividend yield of 6.5%, placing it in the top 25% in China, but with a high cash payout ratio of 129.7%, dividends are not well covered by cash flows. Although dividends have grown over the past decade, they have been volatile and not consistently reliable. The company's price-to-earnings ratio of 13.5x suggests good value compared to the market average, despite recent earnings declines with CNY 341.74 million net income for nine months ending September 2024.

- Get an in-depth perspective on Luyang Energy-Saving Materials' performance by reading our dividend report here.

- Our valuation report unveils the possibility Luyang Energy-Saving Materials' shares may be trading at a discount.

Where To Now?

- Discover the full array of 2037 Top Dividend Stocks right here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:YGGYO

Yeni Gimat Gayrimenkul Yatirim Ortakligi

Yeni Gimat Gayrimenkul Yatirim Ortakligi A.S.

Excellent balance sheet, good value and pays a dividend.

Market Insights

Community Narratives