- Philippines

- /

- Metals and Mining

- /

- PSE:MA

SRV Yhtiöt Oyj Leads The Pack Of 3 Promising Penny Stocks

Reviewed by Simply Wall St

As global markets edge closer to record highs, spurred by gains in major U.S. indices and a cautious approach to tariffs, investors are exploring diverse opportunities across various sectors. In this context, penny stocks—though an older term—remain a relevant area for those seeking potential growth at lower price points. These often smaller or newer companies can present unique investment opportunities when backed by strong balance sheets and solid fundamentals. This article highlights three promising penny stocks that stand out as hidden gems with the potential for impressive returns without many of the risks typically associated with this segment of the market.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.525 | MYR2.61B | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$3.85 | HK$44.2B | ★★★★★★ |

| Warpaint London (AIM:W7L) | £4.10 | £329.61M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.94 | £149.81M | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.33 | MYR918.11M | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.97 | £478.61M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.835 | MYR277.17M | ★★★★★★ |

| MGB Berhad (KLSE:MGB) | MYR0.70 | MYR414.16M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.79 | A$144.95M | ★★★★☆☆ |

| Next 15 Group (AIM:NFG) | £3.34 | £336.16M | ★★★★☆☆ |

Click here to see the full list of 5,670 stocks from our Penny Stocks screener.

We'll examine a selection from our screener results.

SRV Yhtiöt Oyj (HLSE:SRV1V)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: SRV Yhtiöt Oyj is a construction company involved in the development, construction, and commercialization of projects in Finland, Russia, and Estonia with a market cap of €78.76 million.

Operations: The company generates revenue from its Heavy Construction segment, which accounts for €745.8 million.

Market Cap: €78.76M

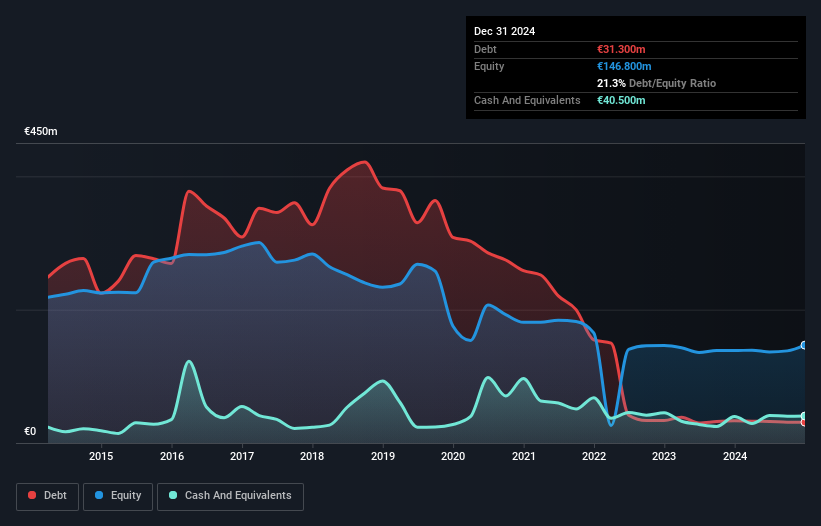

SRV Yhtiöt Oyj, with a market cap of €78.76 million, has shown a significant turnaround by becoming profitable in 2024, reporting net income of €5.3 million compared to a net loss the previous year. The company reduced its debt-to-equity ratio significantly over five years and has more cash than total debt, although its operating cash flow coverage is low at 3.5%. Revenue for 2025 is expected to decline but remain substantial at €630-710 million. Despite trading below estimated fair value and having stable volatility, challenges include low return on equity and an inexperienced board.

- Take a closer look at SRV Yhtiöt Oyj's potential here in our financial health report.

- Learn about SRV Yhtiöt Oyj's future growth trajectory here.

Sinpas Gayrimenkul Yatirim Ortakligi (IBSE:SNGYO)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Sinpas Gayrimenkul Yatirim Ortakligi, originally established as Sinpas Insaat Anonim Sirketi in 2006 with the goal of becoming a Real Estate Investment Trust, operates in the real estate sector and has a market capitalization of TRY11.72 billion.

Operations: The company's revenue is primarily derived from Residential Real Estate Developments, totaling TRY2.40 billion.

Market Cap: TRY11.72B

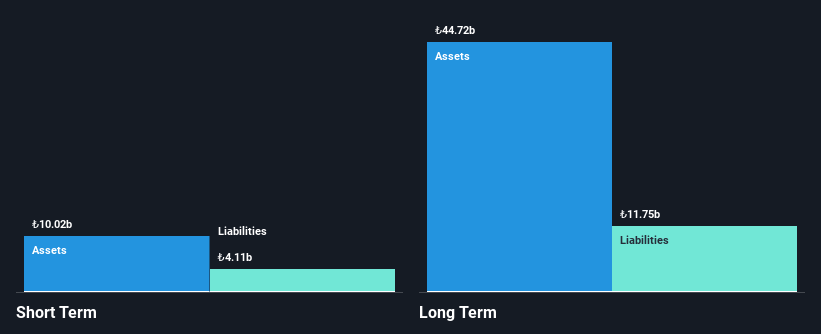

Sinpas Gayrimenkul Yatirim Ortakligi, with a market cap of TRY11.72 billion, trades at a favorable price-to-earnings ratio of 15.9x compared to the industry average. The seasoned management team has maintained stable weekly volatility and avoided shareholder dilution recently. However, the company faces challenges with low return on equity (1.2%) and negative earnings growth over the past year (-90.7%). While short-term assets exceed liabilities, long-term liabilities remain uncovered by these assets. Interest coverage is weak at 0.2x EBIT, though debt levels have significantly reduced over five years and are well covered by operating cash flow (22.8%).

- Click here to discover the nuances of Sinpas Gayrimenkul Yatirim Ortakligi with our detailed analytical financial health report.

- Review our historical performance report to gain insights into Sinpas Gayrimenkul Yatirim Ortakligi's track record.

Manila Mining (PSE:MA)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Manila Mining Corporation is involved in the mining and exploration of metals in the Philippines, with a market capitalization of approximately ₱1.30 billion.

Operations: There are no reported revenue segments for this company.

Market Cap: ₱1.3B

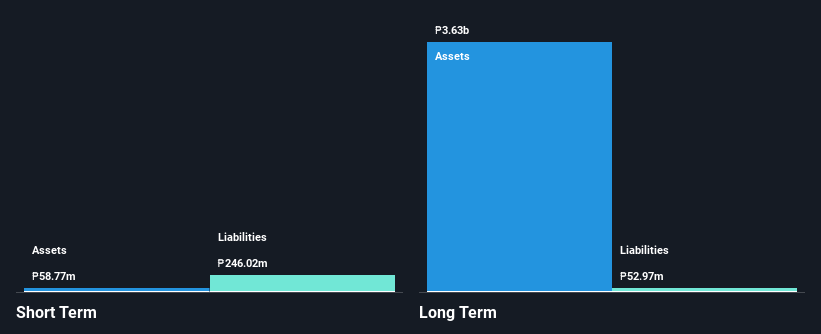

Manila Mining Corporation, with a market cap of ₱1.30 billion, is pre-revenue and debt-free, providing a stable cash runway for over three years despite being unprofitable. Recent exploration permits in Surigao del Sur may enhance future prospects. However, short-term liabilities significantly exceed assets (₱246 million vs. ₱58.8 million), posing financial challenges. The seasoned board and management team offer stability amidst high share price volatility and negative return on equity (-0.23%). Trading at 81% below estimated fair value suggests potential undervaluation, though the lack of meaningful revenue remains a concern for investors seeking immediate returns.

- Dive into the specifics of Manila Mining here with our thorough balance sheet health report.

- Gain insights into Manila Mining's historical outcomes by reviewing our past performance report.

Seize The Opportunity

- Embark on your investment journey to our 5,670 Penny Stocks selection here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About PSE:MA

Manila Mining

Engages in mining and exploration of metals in the Philippines.

Excellent balance sheet and good value.

Market Insights

Community Narratives